IN THIS ISSUE

Macro Strategy - Big Slowdown In Developed Markets Behind The Worsening Profits Recession: As positive economic surprises boosted the outlook to start the year, the dichotomy between weakening leading indicators of economic activity and buoyant growth/stronger equity markets widened.

In our view, these conflicting signals are reconciled by the leads and lags between changes in monetary policy and changes in economic conditions, with the recent improvements in employment and spending likely to be one-offs that will fade in the months ahead. In fact, U.S. and eurozone growth is expected to be significantly weaker this year than last, a negative for the corporate revenue and profits outlook.

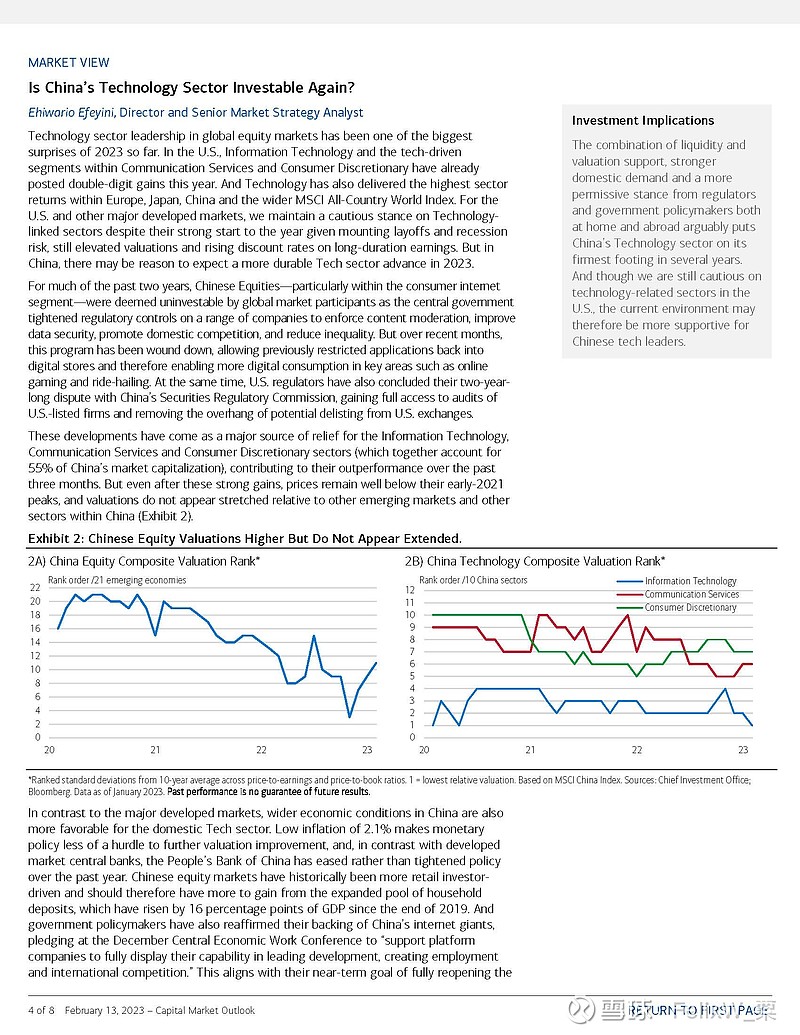

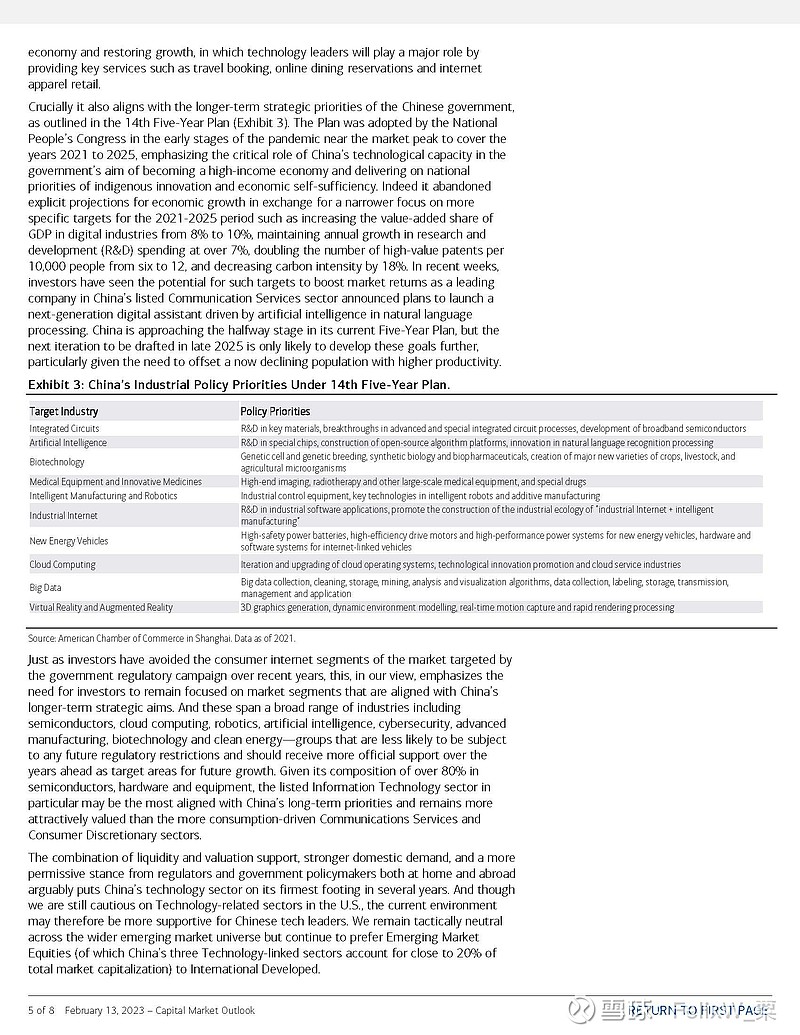

Market View - Is China’s Technology Sector Investable Again?: Technology sector leadership in global equity markets has been one of the biggest surprises of 2023 so far, including in the U.S., Europe, Japan, China and the wider MSCI All-Country World Index.

For the U.S. and other major developed markets, we maintain a cautious stance on technology-linked sectors. But in China, there may be reason to expect a more durable tech sector advance in 2023.

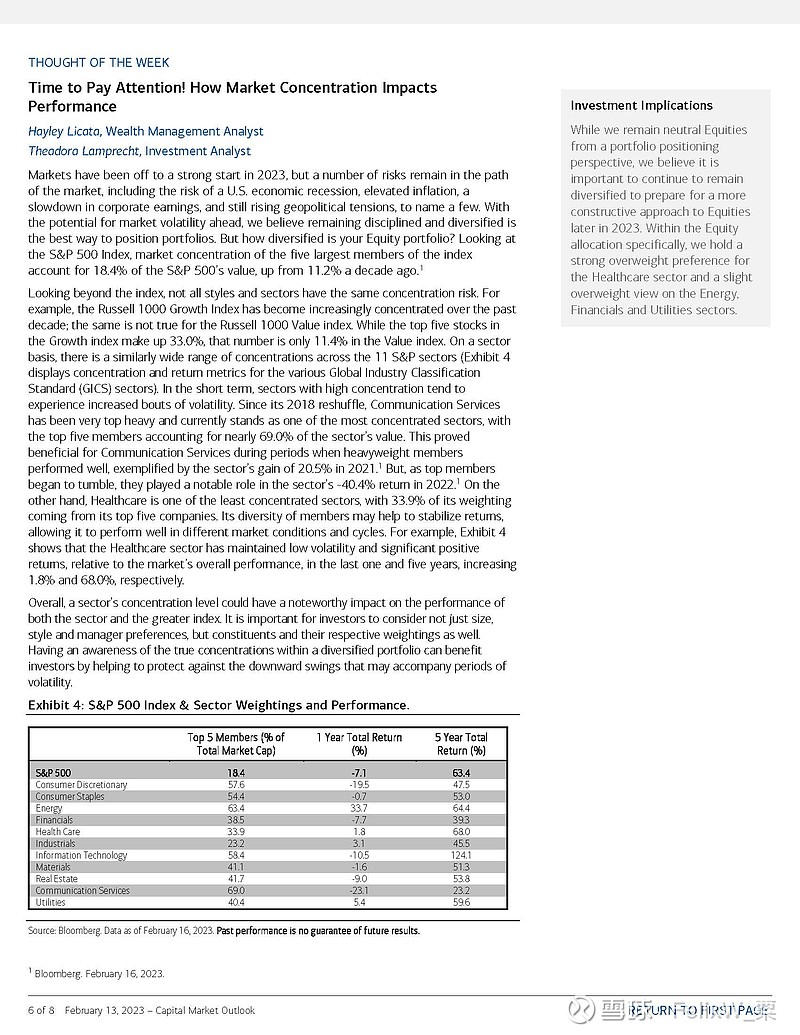

Thought of the Week - Time to Pay Attention! How Market Concentration Impacts Performance: With the potential for market volatility ahead, we believe remaining disciplined and diversified is the best way to position portfolios. But how diversified is your Equity portfolio?

It is important for investors to consider not just size, style and manager preferences, but constituents and their respective weightings as well. Having an awareness of the true concentrations within a diversified portfolio can benefit investors by helping to protect against the downward swings that may accompany periods of volatility.