摘要:

上周,美国CPI数据公布前后,Sprott Physical Uranium Trust再度出现在市场上。

- SPUT重回市场。

- 核能在埃及的COP27峰会上被广泛讨论。

- 澳洲阿德莱德正在举办全球天然铀峰会。

- 全球核电业主积极为2023年长贸订单工作做准备。

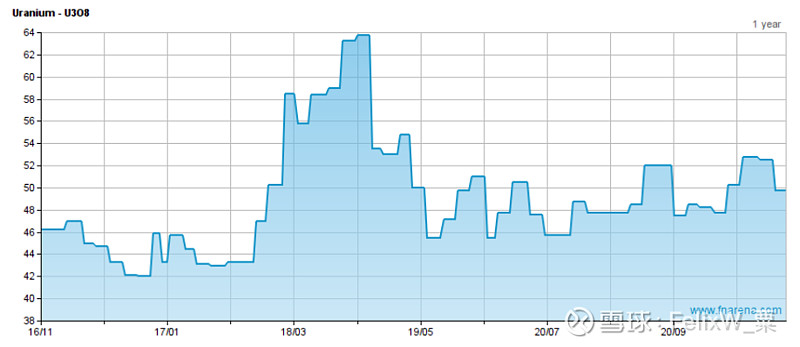

The spot uranium market was again quiet last week, likely awaiting the US October CPI result, given the market is now highly correlated to general financial market volatility. Only three transactions were reported, but two of them featured buying from the Sprott Physical Uranium Trust.

After being almost solely responsible for pushing the spot uranium price up from the depths this past couple of years, the SPUT has been quiet in 2022 as it has suffered through financial market volatility. The trust still manages to find new investors with each fresh release of units, but for the bulk of the year to date has traded on the Toronto exchange at a discount to net asset value.

Net asset value is pretty unequivocal – U3O8 is the only asset.

SPUT reappeared in the market last week to buy 100,000lbs U3O8 ahead of the US CPI result, and came back for another 100,000lbs after the result, industry consultant TradeTech reports. On CPI excitement, SPUT has now swung to a premium to net asset value.

The CPI also drove the sharpest fall in the US dollar index since 2009, which provided a boost for all commodities. Yet, despite the inflation relief evident in stock and bond markets, TradeTech’s weekly uranium spot market indicator rose only US25c to US$50.00/lb.

The 2022 price average is 42% above the 2021 average.

Cop That

The long-term operation of existing nuclear power plants is the "unsung hero of the fight against global warming," one delegate told those gathered for COP27 in Egypt last week.

But it’s what we might expect the International Atomic Energy Agency Director General to say.

Raphael Grossi and other industry members stressed the important role nuclear must play in efforts to cut carbon emissions and to tackle climate change. He noted the fact there was a pavilion at COP27 for nuclear was "a first and a reflection of how things are changing."

Meanwhile, uranium industry members also gathered in Adelaide, Australia this week for the Global Uranium Conference 2022. South Australia's Minister for Energy & Mining, Infrastructure & Transport opened the conference with comments regarding the state's long-term commitment to mining and more recent support for nuclear power.

While Australia has no nuclear power facilities today, the nation's notable reliance on coal and any future carbon constraints on electricity generation make it a possibility, the minister suggested.

A very, very slim possibility. Australia remains the world's third largest producer of uranium, which is exported for foreign global nuclear power programs. Uranium exploration continues across the country, with many companies working to develop new mines that are in various stages of development and permitting.

Slight hurdle: uranium mining is banned in all states bar South Australia and the Northern Territory. One exception is Western Australia, where four mines already under development were exempted from the ban reimposed by a new state government.

Not Spot, Not Term

The war in U* and subsequent shift away from Russian uranium has prompted energy utilities to secure supply out to longer delivery dates, due to geopolitical uncertainty. Hence the long-term market has proven busier this year than the mid-term market.

But so keen to stay out of the volatile and unrepresentative spot market of 2022 are utilities, they have taken to sourcing supply for 2023, as well as longer term out to a decade.

Not quite spot, but as good as.

TradeTech’s term market price indicators remain at US$53.00/lb for both the mid and long-term.

#今日话题# #核电概念股# #碳中和# $铀矿ETF-Global X(URA)$ $中广核矿业(01164)$ $Cameco Corp(CCJ)$