申万宏源有色

2019年12月20日

欢迎交流:

徐若旭(13801890127)

王宏为(18801784277)

史霜霜(13120721885)

Solid as a rock——Hoshine Silicon Industry(603260)

Investment thesis

Hoshine Silicon is a leading manufacturer of silicon metal (industrial silicon) and organosilicon products. It enjoys strong cost advantage thanks to its in-house power generation capacity and the low coal price in Xinjiang. We believe its business model of leveraging the cost advantage to manufacture products with high added value is not replicable, hence ensuring its strong profitability. It is the world’s only silicon manufacturer with power generation capacity and self-supply ability of quartz (purchasing from the government at a fixed processing fee plus the cost) and graphite electrode. The integrated production lines along the silicon value chain further sharpen its cost advantage.

Rapid expansion backed by the cost advantage. The company currently operates 1mtpa of silicon metal capacity and 330ktpa of organosilicon capacity. It is also constructing a 200ktpa silicone monomer facility in Shanshan (Xijiang, scheduled to come on line in 3Q19) and a 400ktpa silicone monomer production line in Shihezi (Xinjiang, scheduled to complete in December 2020). For the next three years, the company will continue to capitalize on the low-cost resources in Xinjiang, and aim to reduce the manufacturing cost of new silicon products by Rmb1,500/t.

Potential rebound in prices. Silicon metal price remained sluggish in 1H19 due to weak exports and aluminum alloy demand, which resulted in massive production cuts. With the recovery in demand from the photovoltaic (PV) market, we expect silicon metal prices to climb in 4Q19. We forecast silicon metal 441 price of Rmb11,400/t in 19E, Rmb12,500/t in 20E and Rmb12,500/t in 21E. For the organosilicon market, we anticipate slight oversupply in the next three years due to substantial increase in capacity, However, as silicon price stood at the historical trough at present, we see limited downside, and expect silicon D4 price to fluctuate within Rmb18,000-23,000/t in the next three years.

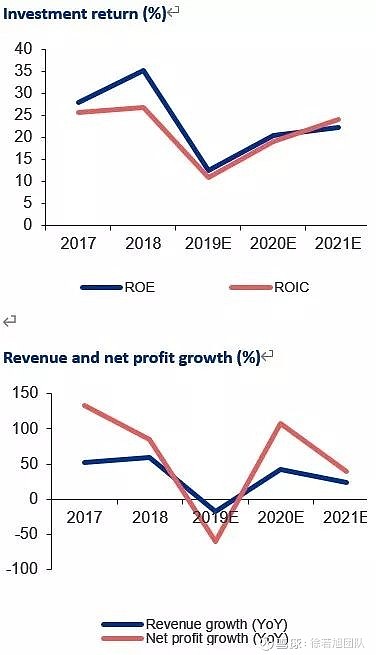

Maintain BUY. We cut our net profit forecast from Rmb1.2bn to Rmb1.1bn in 19E, maintain forecasts of Rmb2.3bn in 20E and Rmb3.3bn in 21E. The stock is trading at 25x 19E PE, 12x 20E PE and 8x 21E PE. Longer-term, we believe the company’s capacity expansion backed by cost advantages may continue to lift its profitability, and a potential surge in PV power demand, after grid parity is achieved, may substantially drive up silicon metal prices. We estimate every increase of Rmb1,000/t in silicon metal prices may raise Hoshine’s net profit by Rmb490m in 20E and Rmb570m in 21E. We maintain our BUY rating.

Risks: lower-than-expected demand from the PV market; the government’s additional charge on industrial companies’ power plants.

Investment Thesis

Earnings forecasts and valuation

We cut our net profit forecast from Rmb1.2bn to Rmb1.1bn in 19E, maintain forecasts of Rmb2.3bn in 20E and Rmb3.3bn in 21E. The stock is trading at 25x 19E PE, 12x 20E PE and 8x 21E PE. Longer-term, we believe the company’s capacity expansion backed by cost advantages may continue to lift its profitability, and a potential surge in PV power demand, after grid parity is achieved, may substantially drive up silicon metal prices. We estimate every increase of Rmb1,000/t in silicon metal prices may raise Hoshine’s net profit by Rmb490m in 20E and Rmb570m in 21E. We maintain our BUY rating.

Key assumptions

We expect Hoshine to sell 551kt of silicon metal at an average price of Rmb11,250/t in 19E, 718kt at Rmb12,350/t in 20E and 834kt at Rmb12,350/t in 21E. We forecast the sales volume of organosilicon products may reach 197kt in 19E, 301kt in 20E and 417kt in 21E, with cyclosiloxane prices of Rmb21,000/t in 19E, Rmb19,000/t in 20E and Rmb19,000/t in 21E on average.

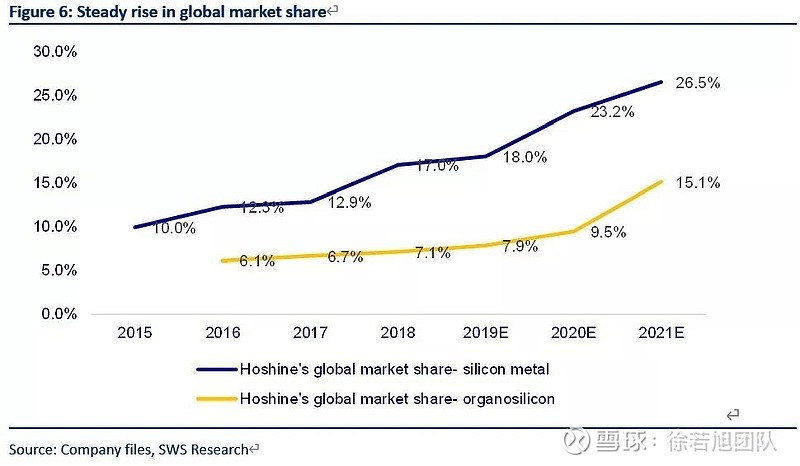

How we differ from consensus

The market has concerns on the sustainability of Hoshine’s profitability as the government may again allow industrial companies to construct power generation facilities for self-use, after several years’ of restriction. At present, Hoshine’s power plant can generate 11.5TWh of electricity per annum, sufficient for the power use by silicon metal production (c.900GWh). The new silicon capacity in Xinjiang plant will use steam of the power plant as energy, which will save cost by Rmb1,000/t. We estimate the steam from its power plant can support energy use for the next three to five years. We expect the company to claim 30%-plus market share for both silicon metal and organosilicon, enabling it to further enhance pricing power and hence the profitability.

Catalysts

Faster-than-expected increase in silicon metal and organosilicon prices。

Risks

Lower-than-expected demand from the PV industry; the Xinjiang government charges additional fee on industrial companies’ power plants.。

Contents

1. A silicon leader with strong cost advantage

2. Silicon metal prices likely to rise driven by PV demand

2.1 PV demand to significantly recover

2.2 Silicone demand growing steadily

2.3 Weak demand for silicon alloys

2.4 Silicon metal supply: Output slumps due to sector-wide losses

2.5 Prices at the bottom, depending on PV power demand and environmental protection campaigns

3. Organosilicon: weak prices due to a slight oversupply

3.1 Supply: Hoshine accounts for the largest part of new capacity

3.2 Stable organosilicon demand

3.3 Weak prices due to a slight oversupply

4. Earnings forecasts

Charts & Tables

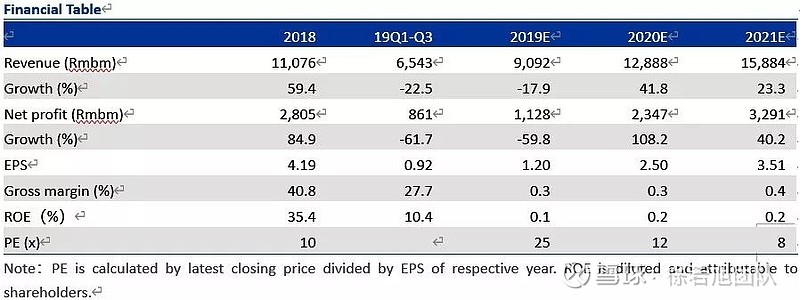

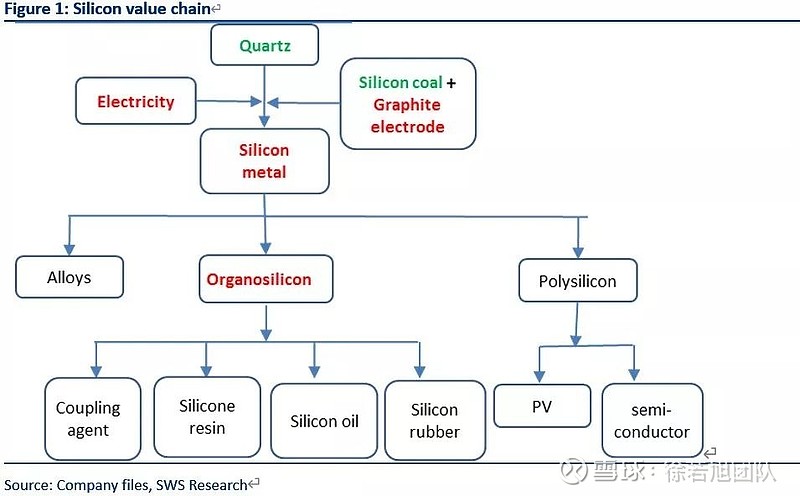

Figure 1: Silicon value chain.

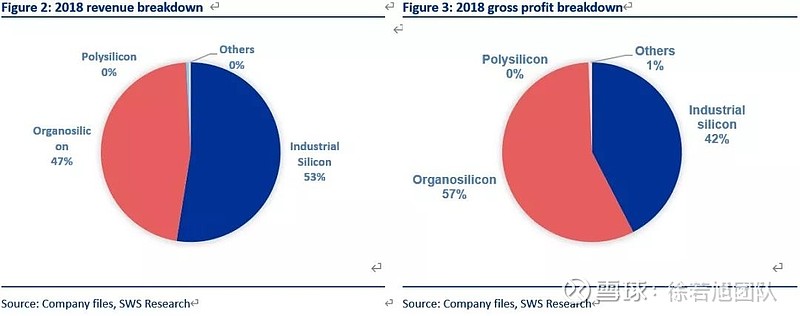

Figure 2: 2018 revenue breakdown.

Figure 3: 2018 gross profit breakdown.

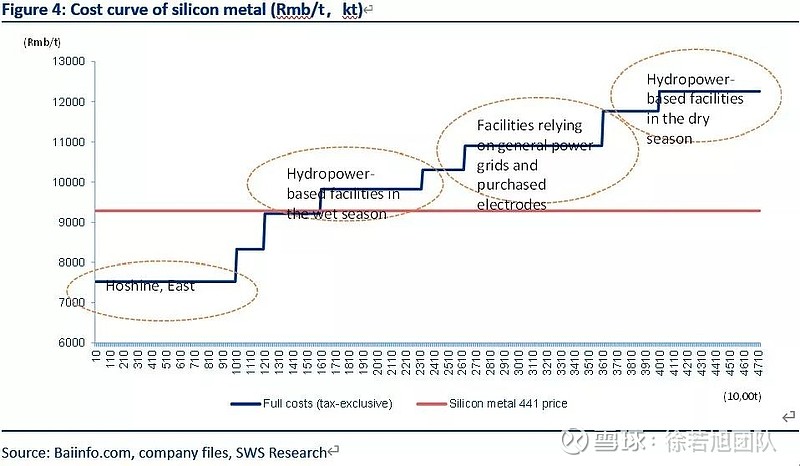

Figure 4: Cost curve of silicon metal (Rmb/t,kt)

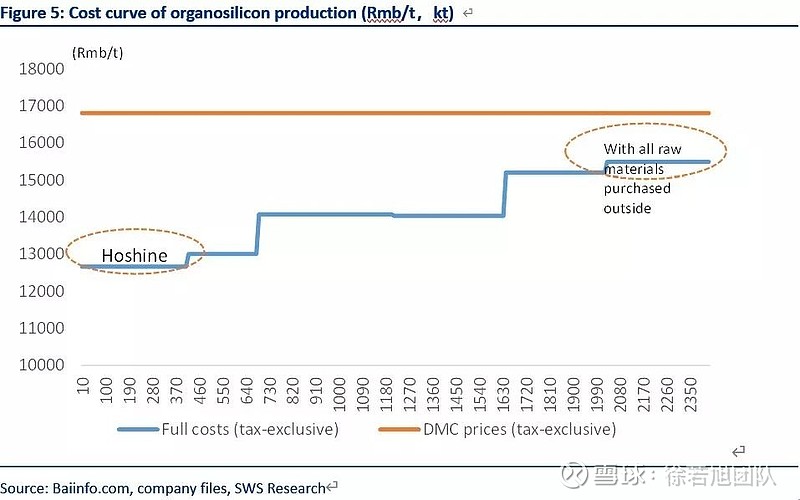

Figure 5: Cost curve of organosilicon production (Rmb/t,kt)

Figure 6: Steady rise in global market share.

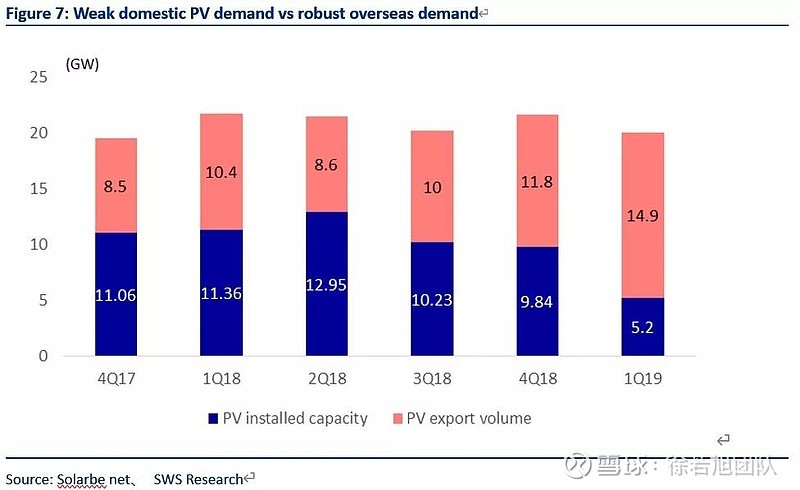

Figure 7: Weak domestic PV demand vs robust overseas demand.

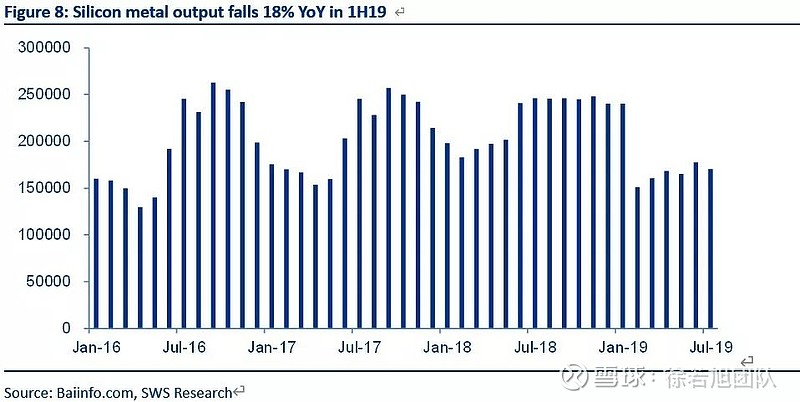

Figure 8: Silicon metal output falls 18% YoY in 1H19(t)

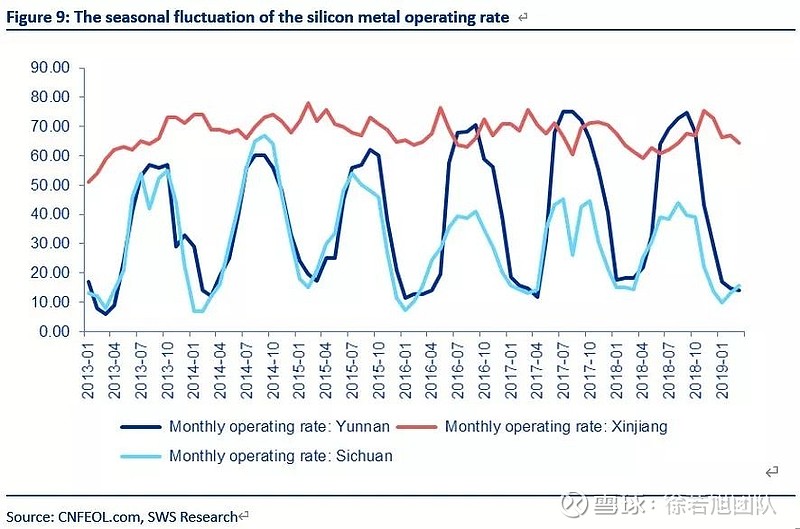

Figure 9: The seasonal fluctuation of the silicon metal operating rate.

Figure 10: The historical trend of silicon metal prices.

Figure 11: The gross profit of silicon metal fell to historical lows.

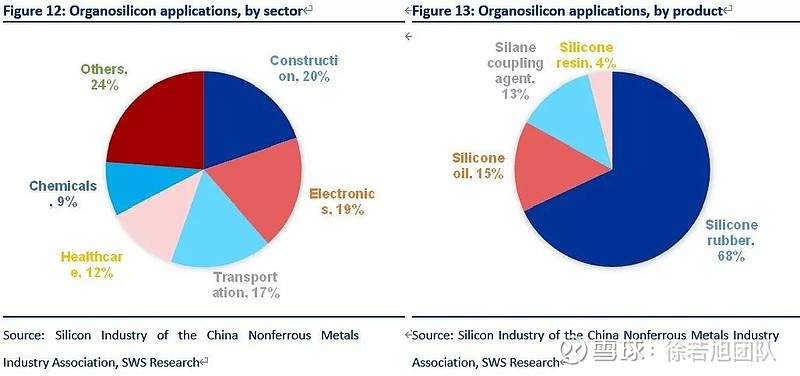

Figure 12: Organosilicon applications, by sector

Figure 13: Organosilicon applications, by product

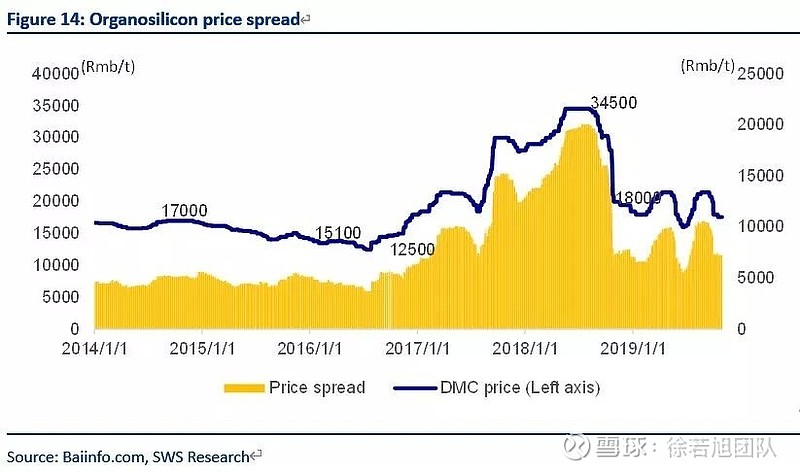

Figure 14: Organosilicon price spread.

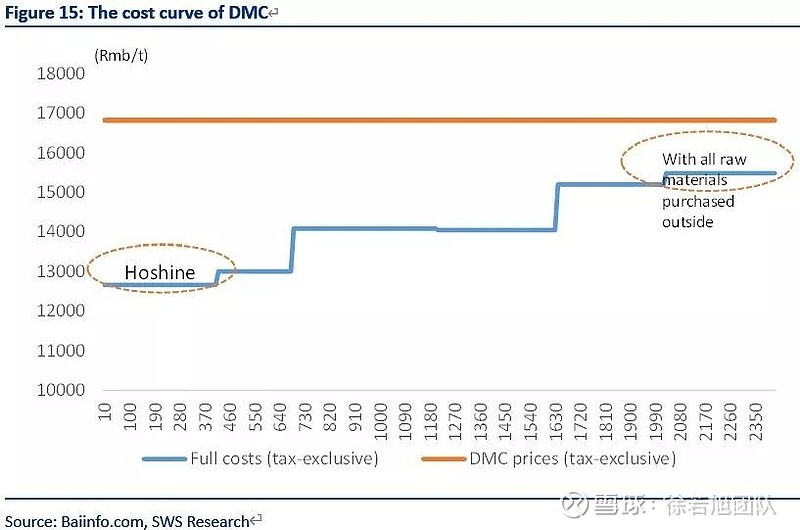

Figure 15: The cost curve of DMC(RMB/t,Kt)

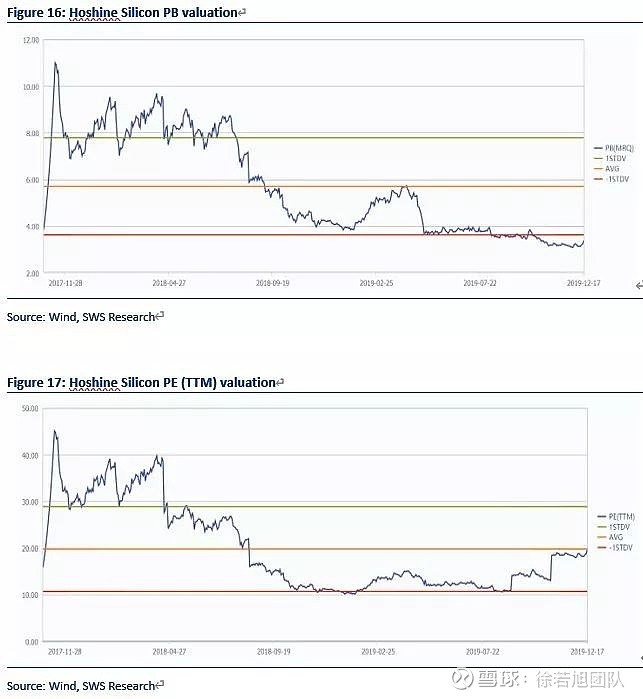

Figure 16: Hoshine Silicon PB valuation.

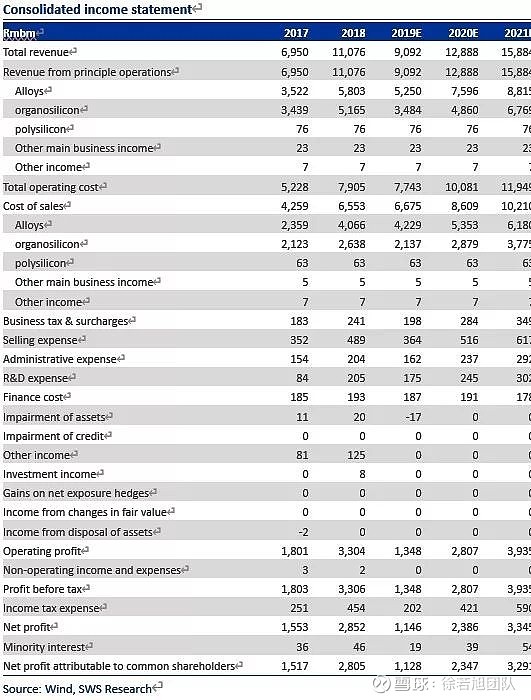

Figure 17: Hoshine Silicon PE (TTM) valuation.

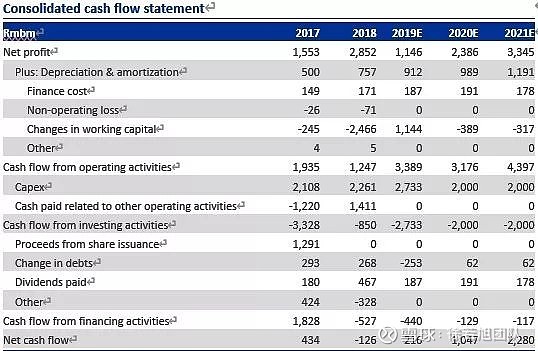

Table 1: Output and sales volume forecasts (‘000 tonnes)

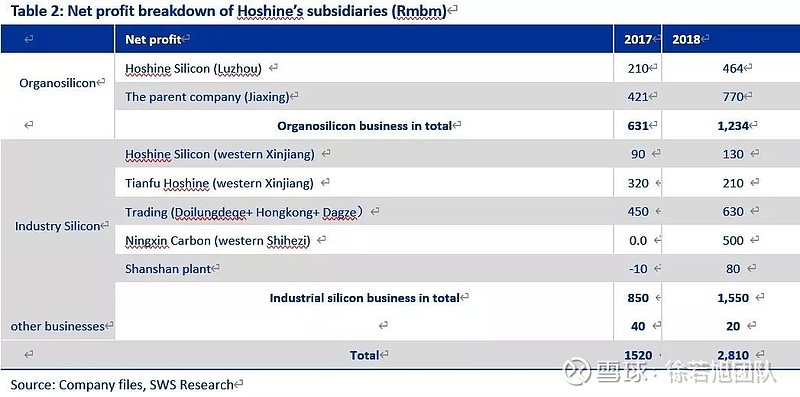

Table 2: Net profit breakdown of Hoshine’s subsidiaries (‘100 million yuan)

Table 3: Silicon metal export volume (‘000t)

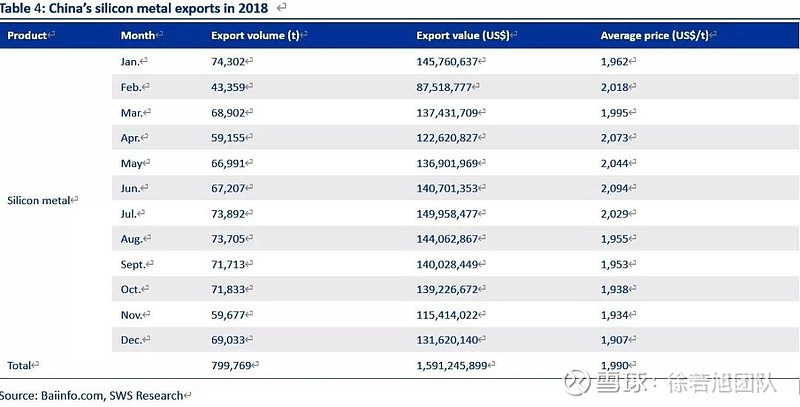

Table 4: China’s silicon metal exports in 2018.

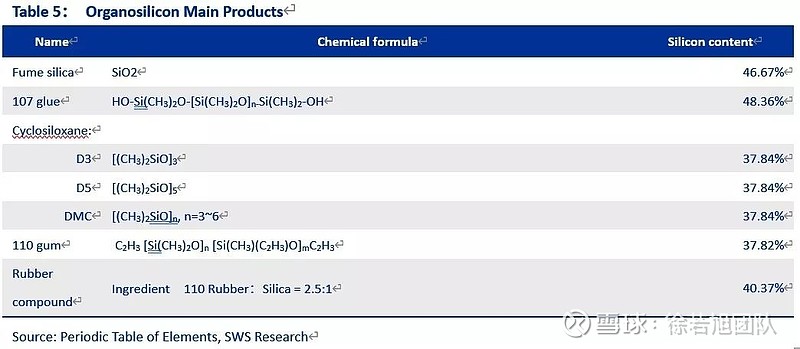

Table 5: Organosilicon Main Products.

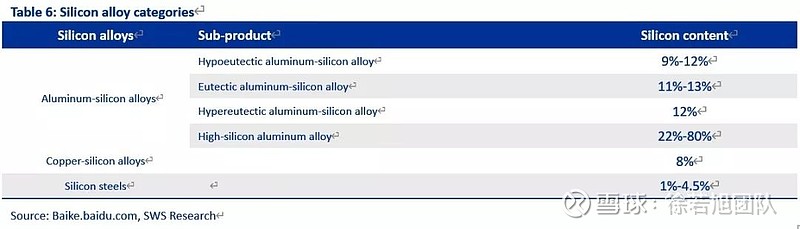

Table 6: Silicon alloy categories.

Table 7: Silicon metal capacity additions in China.

Table 8:Silicon Metal Supply,China(kt)

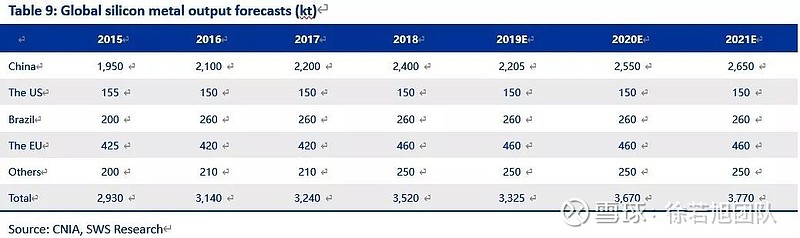

Table 9: Global silicon metal output forecasts (kt)

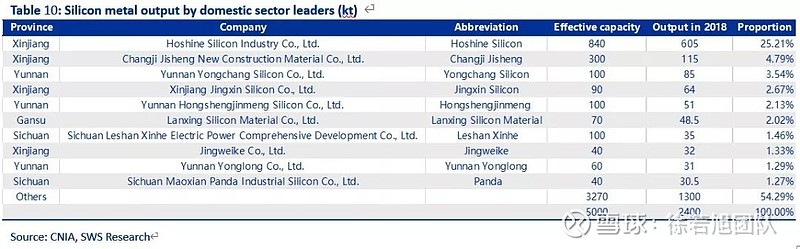

Table 10: Silicon metal output by domestic sector leaders (kt)

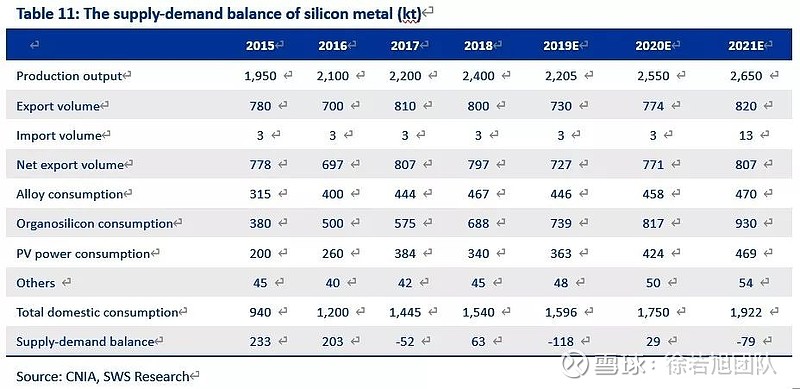

Table 11: The supply-demand balance of silicon metal (kt)

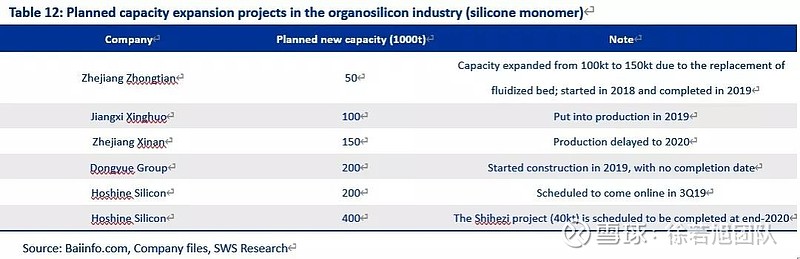

Table 12: Planned capacity expansion projects in the organosilicon industry (silicone monomer)

Table 13: Domestic organosilicon monomer output (1,000t)

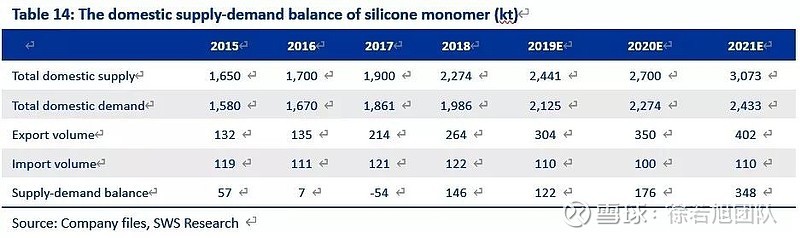

Table 14: The domestic supply-demand balance of silicone monomer (kt)

Table 15: Net profit sensitivity analysis in 2020.

Table 16: Net profit sensitivity analysis in 2021.

Table 17: Comparable peer valuation.

Text

1.A silicon leader with strong cost advantage

Hoshine Silicon is a leading manufacturer of silicon metal (industrial silicon) and organosilicon products. It is the world’s only silicon manufacturer with power generation capacity and self-supply ability of quartz (purchasing from the government at a fixed processing fee plus the cost) and graphite.

The company achieved 18A sales of Rmb11.1bn (+59% YoY) and net profit of Rmb2.8bn (+85% YoY). The organosilicons segment accounted for 47% of the revenue and 44% of net profit, while the industrial silicon business contribute 53% of sales and 55% of earnings.

On the back of the power generation capacity and integrated production lines, Hoshine enjoys the lowest silicon production cost in the industry.

The coal cost of Hoshine’s power generation units in Xinjiang stands at Rmb160-200/t, significantly lower than the coal price in the central and eastern regions. Meanwhile, the capacity utilization rate reached c.8,000 hours in 2018, compared to an average of 5,000 hours of the State Grid. The total power generation cost of Hoshine is Rmb0.17-0.18/kWh, lower than hydropower generation cost (Rmb0.26-0.6/kWh) in Yunnan and Sichuan provinces and local coal-fired power tariff (Rmb0.3-0.4/kWh). The power consumption of its industrial silicon plants totaled 12,500-13,000kWh/t.

The government prohibited industrial companies from building power generation capacity from 2H17, and the projects already received approval were not allowed to construct. We believe this will significantly restrict silicon metal capacity addition in coming years, ensuring the cost advantage of existing producers, particularly those in Xinjiang where power cost is low.

Unlike the aluminum industry which is dominated by state-owned enterprises, almost all silicon metal producers are private-invested companies and no players can grab market share through policy advantage. This enables Hoshine to maintain its competitive edge. In 2018, the company’s cost of goods sold stood at Rmb7,521/t, the lowest in the industry.

For organosilicon segment, Hoshine also enjoys the lowest cost in the industry. The company achieved self-sufficiency of methyl chloride, a major raw material of silicon production, in addition to silicon metal. Moreover, thanks to the advanced production process, it uses low-grade silicon (silicon 5 series) instead of commonly used silicon 421, which offers further cost advantage to the firm. The gross margin of Hoshine’s organosilicon production is higher than peers such as Zhejiang Xinan Chemical Industrial Group (600596:CH – N-R). Excluding the impact from silicon metal self-supply, Hoshine’s organosilicon segment reached c.10%.

On the back of the strong cost advantage, Hoshine is able to rapidly expand its capacity. The company currently operates 1mtpa of silicon metal capacity and 330ktpa of silicone monomer capacity. It is also constructing a 200ktpa silicone monomer facility in Shanshan (Xijiang, scheduled to come on line in 3Q19) and a 400ktpa silicone monomer production line in Shihezi (Xinjiang, scheduled to complete in December 2020).

We expect the firm’s industrial silicon sales volume to reach 551kt in 19E, 718kt in 20E and 834kt in 21E, and forecast organosilicon sales volume of 197kt in 19E, 301kt in 20E and 417kt in 21E.

Based on our analysis of its subsidiaries’ net profit, we noted that the firm generated earnings of Rmb1.23bn from the organosilicon business and Rmb1.55bn from the silicon metal business. All its subsidiaries are wholly-owned companies. In order to minimize tax payment, the firm locate the majority of silicon metal profit in the graphite electrode subsidiary (which enjoys a favourable tax rate of 15% due to the high-tech nature) and silicon trading company in Tibet (with a favourable tax rate of 12%). Its silicon metal subsidiary and the power plant, are subject to a tax rate of 20%.

2. Silicon metal prices likely to rise driven by PV demand

2.1 PV demand to significantly recover

According to China Photovoltaic Industry Association (CPIA), China’s PV installed capacity totaled 5.2GW and export volume amounted to 14.9GW in 1Q19, pointing to soft domestic demand and booming overseas demand. Following the execution of the new PV industry policy on 30 May, we expect domestic PV demand to significantly pick up. The country’s silicon metal used in PV solar cells stood at 340,000t in 2018, as per data from Silicon Industry of China Nonferrous Metals Industry Association (CNIA). Given declining PV product prices and PV power generation costs in China, we believe PV companies’ reliance on government subsidies will dramatically decrease in the future, and expect PV installed capacity to regain growth momentum this year. Moreover, we expect overseas PV demand to rapidly rise bolstered by a faster grid connection of PV power, as traditional power generation means are costly. Provided domestic PV capacity growth remains flattish YoY in 2019 and export growth exceeds 20% YoY, we estimate silicon metal demand from domestic PV companies will grow 10% YoY in 19E before accelerating to 20% YoY in 20E as domestic demand bounces back, translating into silicon metal used in PV solar cells of 370,000t in 19E and 450,000t in 20E.

The China-US trade war dampens domestic silicon metal exports, which may recover driven by overseas demand. China exported 800,000t of silicon metal in 2018, which we think will decrease this year due to the impact of the China-US trade dispute. However, as overseas demand for silicone and silicon alloys steadily rises on the back of accelerating growth in PV demand, in the absence of large capacity ramp-ups by foreign silicon metal producers, we expect China’s silicon metal exports to surge thanks to competitive prices. We estimate domestic silicon metal export volume to reach 727kt in 19E, 771kt in 20E, and 807kt in 21E.

2.2Silicone demand growing steadily

The varieties of silicone products mainly include room temperature vulcanized silicone rubber (RTV-107/OH polymer), 110 methyl vinyl silicone gum, silicone rubber compound, and cyclosiloxane, which are primarily applied in downstream silicone rubber and silicone fluid fields. With the rising energy shortage around the globe, the necessity of silicone and its modified materials used as a substitute for petroleum-based products is gradually increasing. Among that, the technology of replacing synthetic rubber with silicone rubber have been relatively mature and cost-effective at present. We expect the apparent consumption of synthetic rubber in China to surpass 7.7mt in 2020. Provided 10% of the volume is replaced by silicone rubber, the market demand will increase by c.770kt per annum. In addition, following a potentially sharp drop in prices in the near term, silicone products will be applied in a wider range of areas, implying a 10%-plus Cagr in silicone demand in the next three years.

China’s silicon metal used in silicone production totaled 690kt in 2018, according to Silicon Industry of CNIA. We expect the volume to reach 740kt in 19E, 822kt in 20E, and 930kt in 21E, as downstream applications expand and lower prices stimulate demand.

2.3 Weak demand for silicon alloys

In terms of alloys, silicon metal can be used to produce silicon-aluminum alloys, copper-silicon alloys, and silicon steels (mostly made from ferrosilicon). High-silicon aluminum alloy, as a binary alloy composed of silicon and aluminum, is a metal-based thermal management material. Increasing the silicon content can significantly reduce the density and thermal expansion coefficient of the alloy material. Meanwhile, high-silicon aluminum alloy has outstanding thermal conductivity, high strength and rigidity, and good coating performance with gold, silver, copper, and nickel, and can be welded with substrates and processed through precision equipment. It serves as an electronic packaging material with a wide range of applications, especially in high-tech fields such as aerospace, space technology, and portable electronics. For silicon steel, the material enjoys high magnetic permeability, low coercive force, and large resistivity. With small hysteresis and eddy-current losses, it is mainly used as a magnetic material in motors, transformers, electrical appliances, and electrical instruments.

Domestic silicon metal used in alloys stood at 470,000t in 2018, according to data from Silicon Industry of CNIA. Given weak demand for silicon-aluminum alloys and stable demand for silicon steel and silicon-copper alloys, we project the demand for silicon metal used in alloys to reach 470,000t in 19E, 480,000t in 20E, and 510,000t in 21E.

2.4 Silicon metal supply: Output slumps due to sector-wide losses

The ex-plant price of domestic 441-grade silicon metal sat at Rmb11,100/t on 26 August after dropping to a new low of Rmb10,633/t in June, vs its historical range of Rmb10,300-15,800/t. The weak price has led to a continued industry-wide losses and a sharp drop in output, which slid 18% YoY in 1H19.

On 28 July 2017, the Government of Xinjiang Uygur Autonomous Region issued a circular on promoting the development of silicon-based new materials, requiring silicon metal capacity to be controlled within 2mt in the region, along with higher in-house conversion rate of silicon metal products and stricter entry barriers. The local authority banned approvals of additional silicon metal capacity under any name or by any means, and required capacity elimination and upgrades to be carried out only in Zhundong and Shanshan production bases, with outdated capacity to be removed being equivalent to or larger than the capacity to be upgraded.

On 8 December 2017, the Yunnan provincial government released a guideline on promoting the development of the integrated hydropower silicon materials processing industry, urging silicon metal capacity to be controlled below 1.3mt by 2020, in addition to aggressive development of downstream silicon industries. Meanwhile, the local government required a thorough elimination of outdated silicon metal capacity.For capacity expansion and upgrade projects, they should be carried out with the removal of outdated capacity that is larger than the designed capacity of the projects.

We note only Hoshine’s 400,000tpa capacity has commenced operation in Shanshan since early 2018, while GCL-Poly Energy’s (3800:HK - Hold) 200,000tpa capacity and Yunnan Yongchang Silicon Industry’s 100,000tpa capacity are still in the pipeline. Among that, Yongchang has low motivation to put the planned capacity into operation, as weak silicon metal prices make it difficult to profit from hydropower projects in Yunnan. In addition, Xinajing Keyu Technology is constructing a 150,000tpa silicon metal capacity with on-stream time unknown, and other silicon metal projects in Xinjiang have basically halted construction, involving a combined capacity of 1.5mtpa.

Silicon metal capacity expansion mainly takes place in low-cost Xinjiang. Electricity tariffs generally account for the largest proportion of 30-40% of silicon metal production costs. At present, electricity costs in the silicon metal industry mostly consist of three tiers. In particular, the first tier refers to silicon metal producers with in-house power plants in Xinjiang which enable them to enjoy the lowest power generation costs of Rmb0.15-0.17/kWh thanks to low coal prices, followed by those using public power networks in Yunnan, Sichuan and certain Xinjiang cities with a electricity tariff of Rmb0.26-0.3/kWh, and those in central and western regions with a electricity tariff above Rmb0.3/kWh.

Graphite electrode constitutes c.15% of silicon metal production costs, vs 10% from silica and 15% from silicon coal (reductive agent). Whether those products can be self-supplied can affect the actual silicon metal production costs as well.

Stricter environmental regulations propel supply-side reforms in the silicon metal industry, along with stringent restrictions on capacity additions and removal of outdated capacity. The ongoing environmental protection inspections since 2017 has sparked a sector-wide elimination of outdated silicon metal capacity, resulting in halts or delayed construction of a large number of coal-silicon integration projects in Xinjiang and accelerated capacity removals in Sichuan and Guizhou provinces. Statistics show that a total of 180,000t of outdated silicon metal capacity, mainly located in high-cost central and western China, were swept out in 2018.

More small- and medium-sized silicon metal plants may be forced out following government calls for the deployment of desulfurization and denitrification equipment. The local government of Yunnan province has started the desulfurization and denitrification equipment installation pilot since 2018 and will force the shutdown of silicon metal firms that fail to install desulfurization and denitrification equipment before end-2019 in certain cities. Xinjiang launched a similar pilot program in 2019, with official announcement on the deployment of desulfurization and denitrification equipment likely to be introduced in the future. We believe increasingly strict environmental regulations will force smaller players to exit the market at a faster pace, and leading players will gain more market share amid an increased industry consolidation.

According to Silicon Industry of CNIA, Xinjiang operated 1.7mt of silicon metal capacity in 2018, the highest among Chinese regions, while Yunnan and Sichuan possessed 1.2mt and 700,000t of capacity, respectively, owing to ample hydropower resources. China’s silicon metal capacity amounted to 5mt in end2018, representing an increase of 200,000t from the preceding year.

China’s silicon metal output totaled 2.4mt in 2018, increasing 200,000t from 2017. Xinjiang remained the largest contributor, producing 1mt of silicon metal last year (+270,000t YoY), while production in Sichuan, Fujian and other regions decreased.

Environmental protection inspections in May and June has dampened silica plants’ operation in Xinjiang. Mines in Wucai Bay and Shanshan halted production temporally, hitting capacity utilization of local plants, such as Hoshine’s Shanshan plant. In the meantime, operating rate of silicon metal capacity in central and western regions slumped from a year earlier as businesses suffered losses. As such, we forecast domestic silicon metal production at 2.2mt in 19E (-195,000t YoY), 2.6mt in 20E, and 2.7mt in 21E.

Largest silicon metal producer. As the largest silicon metal producer globally, China produced 2.4mt of silicon metal in 2018, accounting for 68% of the world’s total. Overseas silicon metal output amounted to 1.12mt last year, including 150kt from the US, 260kt from Brazil, 460kt from Europe and 250kt from other regions. Moreover, most new silicon metal capacity are concentrated in China. We expect global silicon output to reach 3.33mt in 19E, 3.67mt in 20E and 3.77mt in 21E.

We note the supply of domestic silicon metal varies seasonally, while its prices show no clear sign of seasonal fluctuations. Given expensive hydropower tariffs during the dry season (December to May), hydropower-based silicon metal companies in Yunnan, Sichuan and Guizhou provinces halt operations due to higher production costs, and resume operations in the wet season (June to November), when hydropower tariffs retreat to the normal level. In January 2019, the domestic capacity utilization ratio and output of silicon metal declined notably YoY and MoM, primarily due to sluggish silicon metal prices, which forced high-cost production facilities to reduce output.

Given limited additional capacity, the elimination of outdated capacity, and the long-time suspension of high-cost production facilities with a gloomy outlook of production resumption due to poor endowment of resources (especially for coal costs, in-house electricity costs and hydropower tariffs), we expect the silicon metal sector to further consolidate, and greater economies of scale may further save costs and boost sector leaders’ competitiveness.

According to the Silicon Industry of the China Nonferrous Metals Industry Association, the domestic top-10 players, which controlled 35% of total capacity, held an aggregate market share of 54.3% in 2018. Specifically, Hoshine produced 605kt of silicon metal, claiming a market share of 25.2%, followed by Changji Jisheng New Construction Material (115kt, 4.8%), Yunnan Yongchang Silicon (85kt, 3.5%), and Xinjiang Jingxin Silicon (64kt, 2.7%).

2.5 Prices at the bottom, depending on PV power demand and environmental protection campaigns

Driven by robust photovoltaic (PV) power demand and the export market, we anticipate a tight balance or even a supply shortage of silicon metal in 2019-21E.

On 26 August, the ex-factory tax-inclusive price of silicon metal 441 in Sichuan stood at Rmb11,100/t, vs a historical price range of Rmb10,300-15,800/t. Against this backdrop, only a few Xinjiang-based companies with in-house power generation facilities, such as Hoshine and East Hope Non-ferrous Metal, remained profitable, while other companies incurred losses, and high-cost producers in Fujian and Hunan even recorded negative cash flows.

The current ex-factory tax-inclusive price of silicon metal 441 (Rmb11,100/t) is equivalent to a tax-exclusive price of Rmb10353/t, which we expect to continue to pick up along with recovering PV power demand in the future. Coupled with massive production cuts due to unprofitable prices, we expect silicon metal prices to climb in 4Q19. In our view, the production costs of hydropower-based silicon metal in the dry season will serve as a ceiling on silicon metal prices, which is c.Rmb15,000/t (tax-inclusive), based on the tax-exclusive operating costs of c.Rmb12,200/t, and taxes and operating expenses of Rmb1,000/t, while we consider the production costs in the wet season, which stands at Rmb10,300/t, as a floor for silicon metal prices. As such, silicon metal prices may range between Rmb10,300/t and Rmb15,000/t in the future. We expect the average price of silicon metal 441 to reach Rmb11,400/t in 19E, Rmb12,500/t in 20E and Rmb12,500/t in 21E.

3. Organosilicon: weak prices due to a slight oversupply

3.1Supply: Hoshine accounts for the largest part of new capacity

We expect large amounts of organosilicon capacity to come online over the next three years, totaling 1.1mt of silicone monomer, equivalent to a 50% rise in the domestic silicone monomer output in 2018, of which Hoshine accounts for 600kt. Given weakening organosilicon prices, Zhejiang Xinan Chemical Industrial Group (600596:CH – N-R) has delayed the completion of its 150kt capacity to 2020. Except Hoshine’s 600kt capacity, we believe other companies may delay or suspend the construction of new organosilicon projects. However, the overall supply of organosilicon will remain at a high level.

We note the domestic silicone monomer supply arrived at 2.27mt in 2018, and expect it to reach 2.44mt in 19E, 2.7mt in 20E and 3.07mt in 21E.

3.2 Stable organosilicon demand

Organosilicon products consist of 110 methyl vinyl silicone rubber, 107 silicone rubber, rubber compound and cyclosiloxane, and are mainly used in silicone oil and silicone rubber. Given the increasingly tight energy supply across the globe, we highlight the growing importance of organosilicon and modified materials as a substitute for oil-based products. Currently, replacing synthetic rubber with silicone rubber boasts relatively mature technologies and cost advantages. We expect the domestic apparent consumption of synthetic rubber to top 7.7mt in 20E. Assuming a replacement rate of 10%, we forecast a potential silicone rubber market size of c.770kt per year. Meanwhile, following significant declines in organosilicon prices recently, we note a substantial improvement in the cost-effectiveness of various downstream sectors. As a result, we forecast an organosilicon demand Cagr of 10%-plus over the next three years.

3.3 Weak prices due to a slight oversupply

We expect a slight oversupply of silicone monomer in 2019-21, reaching 122kt in 19E, 176kt in 20E and 348kt in 21E.

On 26 August, domestic tax-inclusive dimethylcyclosiloxane (DMC) price reached Rmb19000/t. We note the domestic DMC supply contracted in June, following continuous slumps in DMC prices in 1H19, enabling DMC prices to rebound from a low level of Rmb16,000/t on 20 February to Rmb21,500/t. We believe healthy supply-demand dynamics may lift DMC prices to above its break-even point in the long-term.

Based on the organosilicon cost curve, organosilicon companies are loss-making when tax-exclusive DMC prices fall to Rmb16,000/t (equivalent to tax-inclusive prices of Rmb18,000/t). There are just 13 organosilicon producers in China, all of which record relatively small depreciation costs, meaning that cash costs are close to full production costs. Hence, we expect high-cost DMC capacity to be suspended as DMC prices drop to c.Rmb18,000/t, and consider it as a lower limit for DMC prices in the future. We expect octamethylcyclotetrasiloxane (D4) prices to average Rmb20,500/t in 19E, and Rmb19,000/t in 2020-21E.

4. Earnings forecast

Maintain BUY. We expect Hoshine to sell 551kt (vs. previous forecast of 545kt) of silicon metal at an average price of Rmb11,250/t in 19E, 718kt at Rmb12,350/t in 20E and 834kt at Rmb12,350/t in 21E. We forecast the sales volume of organosilicon products may reach 197kt (vs. previous forecast of 217kt) in 19E, 301kt in 20E and 417kt in 21E, with cyclosiloxane prices of Rmb21,000/t in 19E, Rmb19,000/t in 20E and Rmb19,000/t in 21E on average. As such, we cut our net profit forecast from Rmb1.2bn to Rmb1.1bn in 19E, maintain forecasts of Rmb2.3bn in 20E and Rmb3.3bn in 21E. The stock is trading at 25x 19E PE, 12x 20E PE and 8x 21E PE. Longer-term, we believe the company’s capacity expansion backed by cost advantages may continue to lift its profitability, and a potential surge in PV power demand, after grid parity is achieved, may substantially drive up silicon metal prices. We estimate every increase of Rmb1,000/t in silicon metal prices may raise Hoshine’s net profit by Rmb490m in 20E and Rmb570m in 21E. We maintain our BUY rating.

Extremely bearish scenario. Hoshine’s in-house power plants can generate 11.5TWh of electricity in 2020E when running at full capacity, at production costs of Rmb0.18/KWh (including grid transmission fees, and government funds and surcharges). Assuming an ASP of Rmb0.33/KWh, and that the company’s silicon metal, organosilicon and graphite electrode segments make no profit, we estimate annual net profit of Rmb1.22bn for Hoshine in 2020E. The risk and space of stock price falling is small.

The stock is trading at 3.38x PB and 19.6x PE (TTM) on 17 December, both at the lower end of its historical range since its listing.

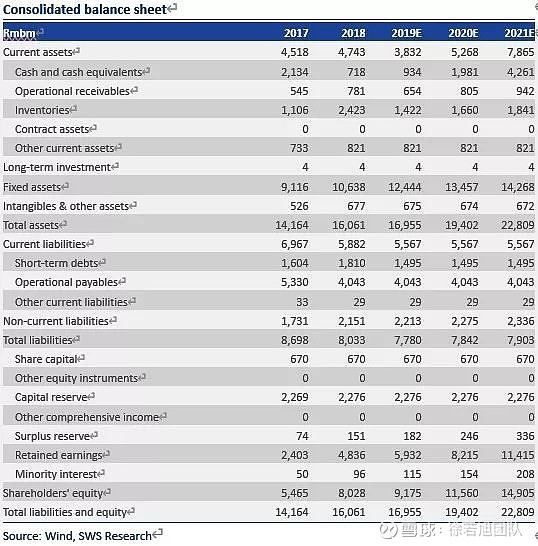

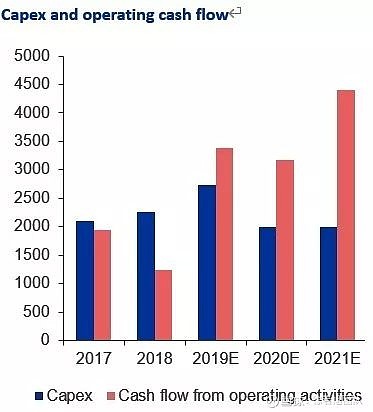

Company financials

信息披露

证券分析师承诺

本报告署名分析师具有中国证券业协会授予的证券投资咨询执业资格并注册为证券分析师,以勤勉的职业态度、专业审慎的研究方法,使用合法合规的信息,独立、客观地出具本报告,并对本报告的内容和观点负责。本人不曾因,不因,也将不会因本报告中的具体推荐意见或观点而直接或间接收到任何形式的补偿。

与公司有关的信息披露

本公司隶属于申万宏源证券有限公司。本公司经中国证券监督管理委员会核准,取得证券投资咨询业务许可,资格证书编号为:ZX0065。本公司关联机构在法律许可情况下可能持有或交易本报告提到的投资标的,还可能为或争取为这些标的提供投资银行服务。本公司在知晓范围内依法合规地履行披露义务。客户可通过compliance@swsresearch.com索取有关披露资料或登录网页链接信息披露栏目查询从业人员资质情况、静默期安排及其他有关的信息披露。

机构销售团队联系人

华东 陈陶 021-23297221 13816876958 chentao1@swhysc.com

华北 李丹 010-66500631 13681212498 lidan4@swhysc.com

华南 谢文霓 021-23297211 18930809211 xiewenni@swhysc.com

海外 胡馨文 021-23297753 18321619247 huxinwen@swhysc.com

股票投资评级说明

证券的投资评级:

以报告日后的6个月内,证券相对于市场基准指数的涨跌幅为标准,定义如下:

买入(Buy):相对强于市场表现20%以上;

增持(Outperform):相对强于市场表现5%~20%;

中性 (Neutral):相对市场表现在-5%~+5%之间波动;

减持 (Underperform):相对弱于市场表现5%以下。

行业的投资评级:以报告日后的6个月内,行业相对于市场基准指数的涨跌幅为标准,定义如下:

看好(Overweight):行业超越整体市场表现;

中性 (Neutral):行业与整体市场表现基本持平;

看淡 (Underweight):行业弱于整体市场表现。

我们在此提醒您,不同证券研究机构采用不同的评级术语及评级标准。我们采用的是相对评级体系,表示投资的相对比重建议;投资者买入或者卖出证券的决定取决于个人的实际情况,比如当前的持仓结构以及其他需要考虑的因素。投资者应阅读整篇报告,以获取比较完整的观点与信息,不应仅仅依靠投资评级来推断结论。申银万国使用自己的行业分类体系,如果您对我们的行业分类有兴趣,可以向我们的销售员索取。

本报告采用的基准指数:沪深300指数

法律声明

本报告仅供上海申银万国证券研究所有限公司(以下简称“本公司”)的客户使用。本公司不会因接收人收到本报告而视其为客户。客户应当认识到有关本报告的短信提示、电话推荐等只是研究观点的简要沟通,需以本公司网页链接网站刊载的完整报告为准,本公司并接受客户的后续问询。本报告首页列示的联系人,除非另有说明,仅作为本公司就本报告与客户的联络人,承担联络工作,不从事任何证券投资咨询服务业务。

本报告是基于已公开信息撰写,但本公司不保证该等信息的准确性或完整性。本报告所载的资料、工具、意见及推测只提供给客户作参考之用,并非作为或被视为出售或购买证券或其他投资标的的邀请或向人作出邀请。本报告所载的资料、意见及推测仅反映本公司于发布本报告当日的判断,本报告所指的证券或投资标的的价格、价值及投资收入可能会波动。在不同时期,本公司可发出与本报告所载资料、意见及推测不一致的报告。

客户应当考虑到本公司可能存在可能影响本报告客观性的利益冲突,不应视本报告为作出投资决策的惟一因素。客户应自主作出投资决策并自行承担投资风险。本公司特别提示,本公司不会与任何客户以任何形式分享证券投资收益或分担证券投资损失,任何形式的分享证券投资收益或者分担证券投资损失的书面或口头承诺均为无效。本报告中所指的投资及服务可能不适合个别客户,不构成客户私人咨询建议。本公司未确保本报告充分考虑到个别客户特殊的投资目标、财务状况或需要。本公司建议客户应考虑本报告的任何意见或建议是否符合其特定状况,以及(若有必要)咨询独立投资顾问。在任何情况下,本报告中的信息或所表述的意见并不构成对任何人的投资建议。在任何情况下,本公司不对任何人因使用本报告中的任何内容所引致的任何损失负任何责任。市场有风险,投资需谨慎。若本报告的接收人非本公司的客户,应在基于本报告作出任何投资决定或就本报告要求任何解释前咨询独立投资顾问。

本报告的版权归本公司所有,属于非公开资料。本公司对本报告保留一切权利。除非另有书面显示,否则本报告中的所有材料的版权均属本公司。未经本公司事先书面授权,本报告的任何部分均不得以任何方式制作任何形式的拷贝、复印件或复制品,或再次分发给任何其他人,或以任何侵犯本公司版权的其他方式使用。所有本报告中使用的商标、服务标记及标记均为本公司的商标、服务标记及标记。

研究团队

徐若旭(13801890127)

王宏为(18801784277)

史霜霜(13120721885)

关注申万宏源,开启投资新时代!