Recently, several “China Short Sellers” have developed a scheme to make themselves rich. First, short a US-listed China stock. Then, write a negative report on that company. After the stock drops, cover the short, and pocket a huge profit. This practice itself is already questionable, but what is despicable is how these short sellers take advantage of the information asymmetry between China and the US, and write reports full of holes and lies, knowing that their American readers have no way of verifying them. This paper dissects one such example, Short Seller Citron Research’s report “Qihoo's entry into search puts SOHU in play” (August 24). This paper will show that Citron lacks even the most basic understanding of the Chinese Internet/Search market, yet it fabricates and distorts information to deceive investors. It is not my intention to support or challenge Citron’s recommendations, but only to expose Citron’s ignorance and deception, and raise the question whether any investor should ever trust them.

Citron lacks basic understanding of search

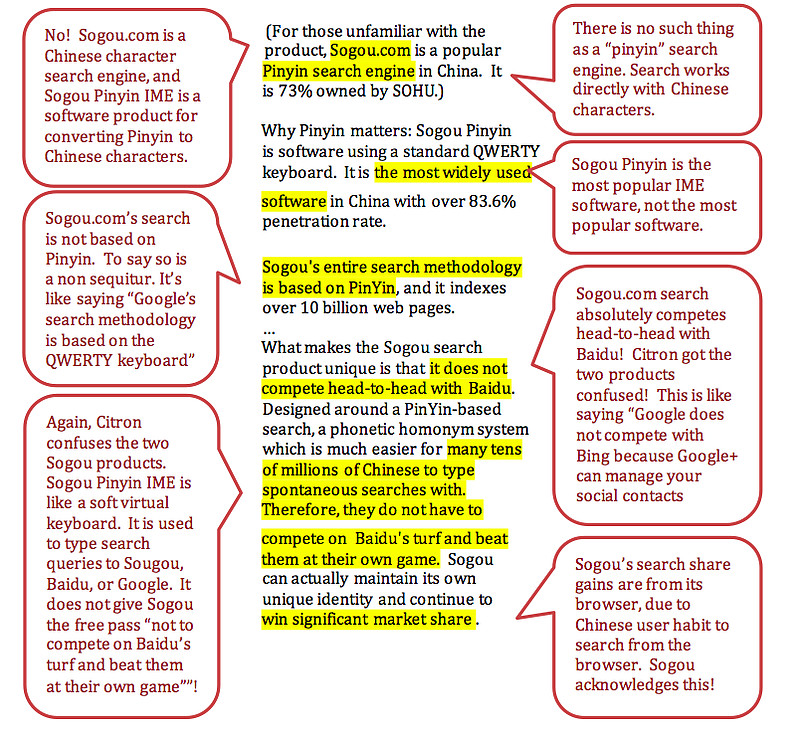

The most ludicrous part of Citron’s report is its faulty analysis of search engines and basic misunderstanding search engine Sogou’s strategy and products.

First, some background for those unfamiliar with the Chinese market:

1.Sogou is a company majority owned by Sohu, and produces three products:

1)Sogou.com search, comparable to Google.com search.

2)Sogou browser, comparable to IE or Chrome browser.

3)Sogou Pinyin IME (input method editor). An IME is a “soft keyboard” that converts typed roman character input (like “beijing”) into Chinese characters (like “北京”). IMEs are installed in Windows/Mac and are general purpose text-entry tools (not just for search).

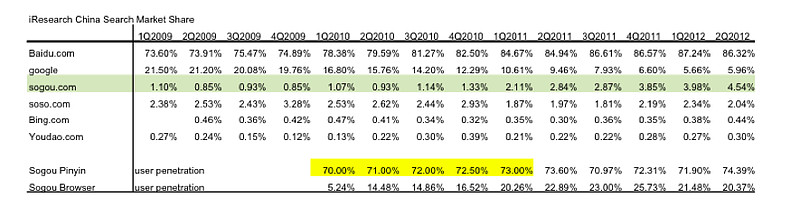

2.Sogou IME is the leading IME in China, with about 74% penetration.

3.Sogou browser is an emerging browser that has increased its user penetration from 5% in 2010 to over 20% recently.

4.Sogou search has had about 1% market share until Sogou Browser became successful. As Sogou Browser increased its penetration to over 20%, Sogou search also increased its share to 3-4.5%.

5.Browser market share can increase search market share, because many Chinese users have a habit of searching from the browser directly. Only about half of the search queries are entered on a search engine’s webpage.

6.Pinyin IME is a software product basically detached from search, and has no direct relationship with search engines. (Note that a few IMEs including Sogou have experimented with a feature to encourage users to search directly from the IME, with disappointing results, as it is not natural.) Empirically, search market share and IME market share can be shown to be virtually uncorrelated.

The above points are validated by the following table, showing search market share (from iResearch), as well as Sogou Pinyin and Sogou Browser market penetration (from Sohu):

Now, let’s analyze the following text, taken verbatim from the Citron report:

The above analysis shows that Citron lacks even basic understanding of “Pinyin”, “IME”, “search engine”, and confuses the two Sogou products. Citron appears to have mentally fabricated a merged product that would not compete with Baidu and “beat [Baidu] at their own game”, from which Citron built the primary investment thesis of this report! Also, Citron cannot comprehend the critical role of a browser in China’s search market. Chinese users have a habit of entering search queries to a browser, so the success of Sogou’s (and Qihoo’s) browser has been directly responsible for their search share gains. This fact would further invalidate Citron’s conclusion that Sogou is better placed than Qihoo, because Sogou’s browser share is significantly lower than Qihoo’s. Perhaps that is why they don’t acknowledge it.

Citron distorts data and compares apples to oranges

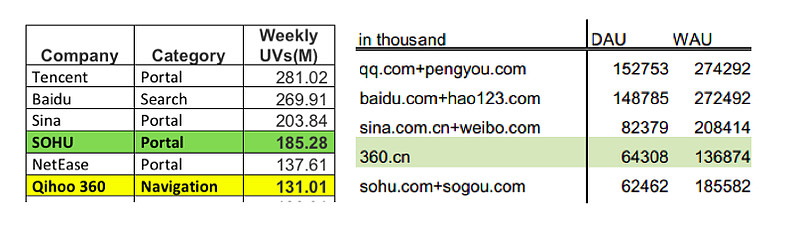

Citron demonstrates Sohu’s superior position by asserting that Sohu has 40% more web traffic than Qihoo, and cites the statistics below (left table below) to illustrate this point.

But this comparison is misleading in three ways:

1.For this comparison, Citron conveniently summed Sohu and Sogou numbers (see right-most column of right chart), even though Sohu is a portal site and only Sogou is comparable to Qihoo.

2.Citron conveniently chose to keep weekly UV (WAU) and removed daily UV (DAU column) from the chart (using DAU would put Qihoo ahead of Sohu+sogou).

3.While Sogou is similar to Qihoo, Sohu is a portal site and entirely different. What is the purpose of comparing web traffic of two companies in different categories? This is like comparing Yahoo portal to Google search. The value of a click or link on a portal site is dramatically lower than that on a search/navigation site.

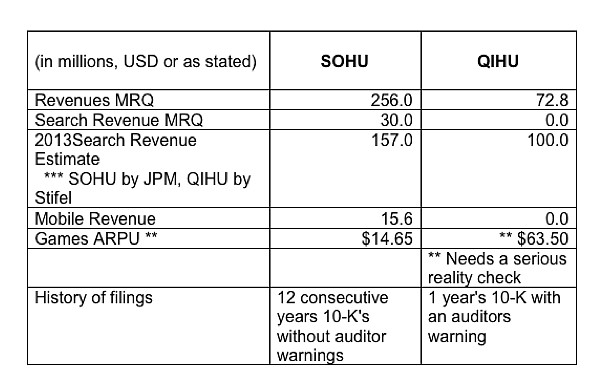

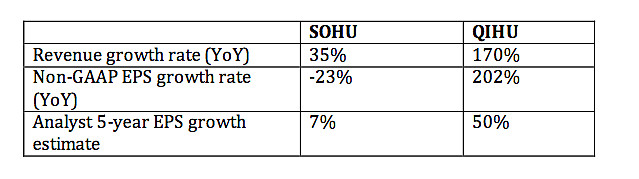

In a second fascinating comparison between Sohu and Qihoo financials, Citron uses the following table to show why Sohu is far superior:

But as any investment novice would question: What about revenue growth and earnings growth for current year and next five years? Growth high-tech stock prices are much more driven by these growth numbers than the numbers Citron chose to cite. Below are the numbers that really matter:

In the two examples above, it is clear that Citron picks “convenient” numbers even if they are of minimal value, and that Citron obscures “inconvenient” numbers, even if they are of critical importance.

Citron does not understand search monetization

In this report, Citron mentions many times that search engines are difficult to monetize using ads, requiring substantial and costly infrastructure that takes years to build. While building a full ad monetization structure is indeed not easy, Citron clearly does not understand the options available to a search engine. The obvious option is to simply use Google’s AdWords as a partner site. The search engine site would provide the search results, but the search term would trigger Google AdWords ads (for those advertisers that permit this), with a revenue share that greatly favors the search engine site. Many search engines have worked with Google using this approach, including AOL, Ask.com, and Tecent’s Soso. In some cases, Google also provided search, but in other cases just AdWords. Yahoo is also working this way with Bing. It takes about one quarter to connect a search engine to Google AdWords. This is basic search industry knowledge.

Qihoo has already been Google’s partner by sending traffic from 360.cn to Google, and getting a Google ad revenue share for the traffic referral. As Qihoo launches its own search engine, is it hard to imagine that Qihoo would find a slightly different way to work with its partner Google? Note that these were the same phases Tencent Soso went through with Google: 1) rely on Google for ads+search, 2) launch own search but uses Google ads, 3) launch own ads.

Sogou has chosen not to use Google AdWords, and instead to develop its own ads product and sales team. There were historical reasons for that, but it is naïve to think this is the only approach. In fact, it is an unlikely and irresponsible approach for Qihoo, because this approach explicitly forfeits significant revenue.

Now, how much revenue might come from a Qihoo-Google AdWords partnership? According to JP Morgan report on Tencent, Tencent Soso's monetization from Google AdWords partnership was $13.6M during its last full year working with Google (Q4 2008 to Q3 2009), and Soso's market share for those four quarters was about 2.45%. From 2009 to 2011, the China search query volume has increased about 41%. Let’s assume another 25% increase from 2011 to 2013, for a total of 76% for 4 years. Then, if Qihoo has a 10% search market share in 2013 in a market that is 76% larger than 2009, and uses Google AdWords, Qihoo can deliver search revenue of $98M in 2013 ($13.6M * (10% / 2.45%) * 176%). This is at the top of the range of current analyst estimates of $50 – 100M, and much larger than Citron’s assumption of $0.

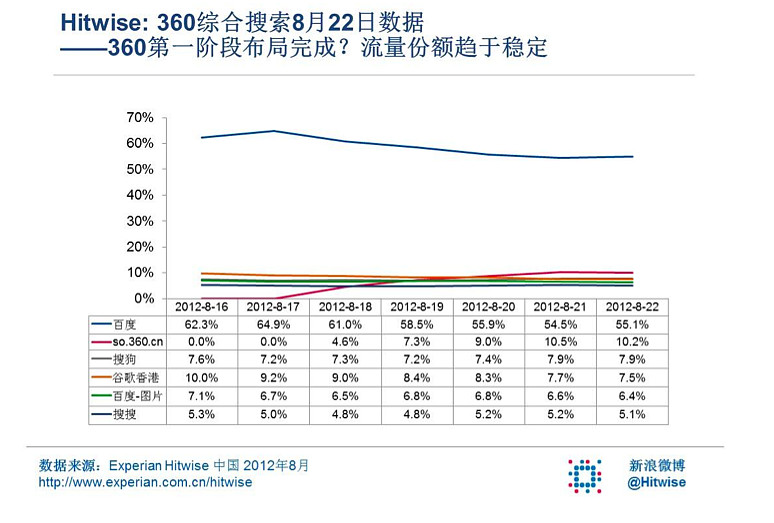

Can Qihoo get a 10% market share? The chart below from Hitwise shows Qihoo already at 10.2% market share as of August 22, 2012:

Citron hand-waves comparisons with misleading analysis

Citron often makes sweeping generalizations and comparisons to justify its recommendation. In this report, Citron made a comparison that Sohu video should have comparable value to Tudou’s valuation when Tudou was merged with Youku. However, they ignore many inconvenient but major problems:

1.There are many second-tier video websites comparable to Sohu (LeTV, Qiyi, Sina, Tencent, Xunlei, etc.), especially if one considers metrics ignored by Citron. In a market where one company leads many others by far, the leader will command an even higher premium valuation.

2.The price Youku paid for Tudou includes a sizable premium for creating the single market leader. It cannot be extrapolated to second-tier players.

3.When a market #1 buys #2, #3’s value shrinks rather than increases.

4.Youku and Tudou project much higher revenue growth than Sohu video.

Another broad generalization was to take Qihoo’s market capitalization gains in four days and simply adding it to Sogou. This is ridiculous, as Qihoo has gained 10% market share in these four days, while Sogou has only maintained its share.

The undisciplined and wild copy-pasting of numbers discredits Citron’s analysis.

Conclusion

This paper has shown that Citron is an amateur in the Chinese Internet market, lacking even basic understanding of Chinese text entry (IME), Chinese language (the relationship between Pinyin and Chinese characters), search product features, search monetization, and Chinese user habits (searching in browser).

Citron’s primary investment thesis in this report is based on a combined product (Sogou.com + Sogou Pinyin IME) that could bypass Baidu and win share from it. The only problem is that combined product does not exist, and was a figment of Citron’s imagination, based on Citron’s misunderstanding of the Chinese market.

Citron takes advantage of the fact that most readers of its reports are unfamiliar with the Chinese Internet, and do not read Chinese. This asymmetry emboldens Citron to compare apples and oranges, emphasize irrelevant but convenient data, obscure inconvenient but important data, quote questionable “experts”, cite unreadable or irrelevant sources, and wildly copy-paste key financial figures.

Leveraging this information asymmetry and general concerns about Chinese companies, Citron has successfully deceived investors to invest based on Citron’s recommendations. Since Citron has already made big bets on these recommendations before their reports are published, Citron doesn’t have to be qualified; Citron’s recommendation doesn’t have to be right; Citron just needs to mislead their readers to follow their recommendations!

So, will you ever trust, follow or read Citron’s reports again? Are Citron and other similar China short sellers exposing fraud, or practicing fraud?

Qihoo's entry into search puts SOHU in play 网页链接

(文章首发雪球xueqiu.com,转载请注明出处)