$香港医思医疗集团(02138)$ Union Medical Healthcare Ltd | 2138.HK

Enjoy rising medical tourism in the long run

信达国际 23 Oct 2019

The largest non-hospital medical services provider in HK

Union Medical Healthcare (UMH) was established in 2005 and listed

on the Hong Kong Stock Exchange in 2016. It is the largest provider

of medical beauty services in Hong Kong. Its main businesses

include medical services, quasi-medical services, traditional beauty

services and skin care and beauty products. UMH had 51 clinics and

service centers with 87 registered practitioners in FY19. UMH’s total

weighted average GFA increased by 28.7% CAGR in FY16-FY19 to

221,708 sqm. Total customer grew by 23.5% YoY to 99,524 in FY19

with 45.9% CAGR in FY16-FY19, of which 74.9% were women.

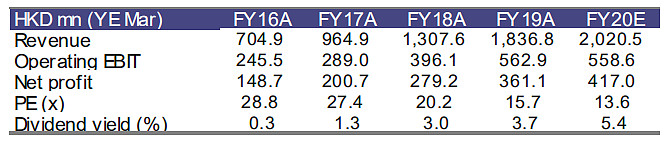

Bright performance

UMH achieved 37.6% CAGR in FY16-FY19 and reached HK$1,837

mn in FY19, up 40.5% YoY. This was mainly due to the significant

increase of the number of active clients and their spending in

medical services. HK$18,456 of average revenue per customer

contributed in FY19, up 13.7% YoY. Medical services/quasi-medical

services/traditional beauty services, skin care and beauty products

accounted for 28%/46%/26% of revenue, up 76.8%/46.8%/8.1%

YoY respectively. In FY16-FY19, net profit grew 37.1% CAGR and

reached to HK$361 mn in FY19. The group recently announced that

revenue came at ≥ HK$1 bn in 1H20, up at least 17.6% YoY

growth. Medical services sales growth is at ≥ 50% YoY. Sales

recorded a decline of no more than 9% during Golden Week in Oct

1- Oct 10 (vs decrease of 55.8% YoY in the amount of passengers

visiting HK from China in Oct 1- Oct 7), which is less affected by

ongoing HK protests.

A beneficiary of medical tourism

In FY16-FY19, the revenue contributed by customers from China

has achieved 103.8% CAGR and reached HK$689 mn in FY19 and

accounted for 38.0% of the total revenue (vs 35.4% in FY18). With

the improvement of transportation convenience between Hong Kong

and China, the rising of medical beauty tourism, well-known brand

name and recognized medical services, we think medical services

will drive UMH earnings growth.

Trading at discount; Ongoing social unrest remains a near-term

overhang

UMH is currently trading at 13.6x/10.6x FY20E/FY21E PE,

compared with average 23.0x P/E since its IPO. However, we advise

investors continue to pay attention to ongoing protests in HK, which

may influence UMH's business in the short term. We believe that

UMH’s long-term development is positive and worth tracking.

Sources: Bloomberg