盘前最重要的五件事

PCE day

US stock futures are edging higher, Treasuries are pretty calm and the dollar is sitting near to an eight-month high, with attention focused around the PCE inflation data coming later. The Federal Reserve’s preferred inflation gauge comes after a batch of data that reinforced the view the central bank will be able to cut rates this year, including slowing personal spending and signs of weakness in the jobs market.

Yen risks

Yen traders’ sights will be trained on the PCE data with the Japanese currency breaking through levels against the dollar not seen since 1986. The persistent strength in the greenback has raised wagers of Japan intervening in the market. Meanwhile, the country’s Topix stock index touched the highest level since 1990, boosted by improving shareholder returns and with the weak yen helping exporters.

Debate concerns

President Joe Biden struggled in the campaign’s first presidential debate against Donald Trump, fanning worries about his age and raising questions among Democrats on whether they should replace him as their candidate. Biden misspoke numerous times, repeated himself and froze at the end of one answer. Trump, meanwhile, delivered responses filled with falsehoods and exaggerations, and refused to commit to accepting the outcome of November’s election. The view that Trump won the night also gave a small lift to the dollar.

Nike slides

Shares in Nike have been slammed after the sportswear giant’s sales outlook fell short of expectations, reinforcing investor concerns about waning demand for its brands and that it is losing ground to rival Adidas. Nike said it expects revenue to fall in its current financial year, against analyst expectations for a rise. It has struggled to roll out new products to replace top sellers like Air Force 1 and Dunk sneakers, while its Converse unit saw quarterly revenue slump by 18%.

French hedging

Investors are preparing for the first round of French elections this weekend following the rout in bonds and stocks that has followed the snap vote being called. Traders are betting that bond yields will go higher, while hedging potential losses in stocks and piling into derivatives to protect against a drop in the euro. The far-right National Rally has solidified its polling lead ahead of election day and here’s a guide to how it will all work.

债券市场摘要

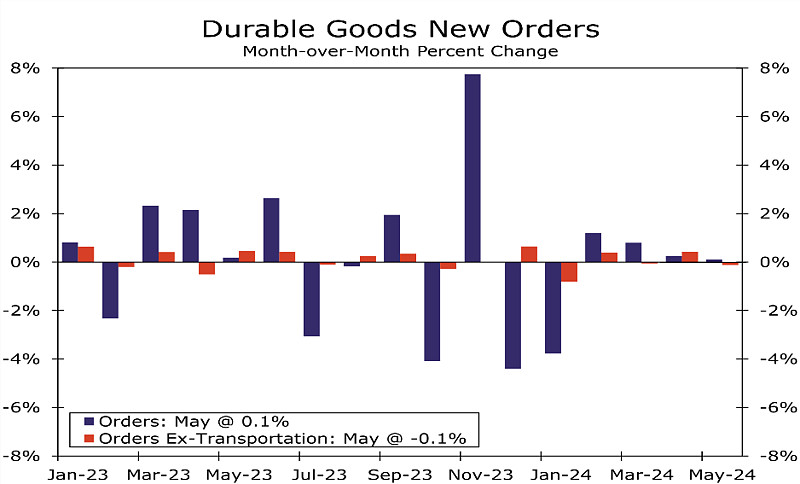

US Treasury yields edged lower by 2-3bp. The third and final reading for US Q1 GDP came at 1.4%, in-line with expectations but higher than the second estimate of 1.3%. While personal consumption was revised downwards to 1.5% from 2.0%, the price and core price indices were revised upwards to 3.1% and 3.7%, respectively. The preliminary Durable Goods Orders rose 0.1% MoM in May, higher than the surveyed -0.5%, while the prior month's print was revised higher to 0.2% from 0.1%. However, the Capital Goods Orders fell 0.6% in May vs. expectations of a 0.1% pick-up. Separately, Fed Governor, Michelle Bowman reiterated her views earlier this week, saying that she is still not ready to support a rate cut until inflation moves sustainably towards 2%. Looking at equity markets, S&P and Nasdaq were up 0.1% and 0.3%, respectively. US IG spreads were 0.7bp tighter while HY CDS spreads tightened by 1.7bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were wider by 0.3bp and 2.9bp respectively. Turkey's central bank kept rates steady at 50%, with a hawkish stance despite the surge in the latest inflation reading to over 75%. Asian equity indices have opened weaker this morning. Asia ex-Japan CDS spreads were 2bp tighter.

Rating Changes

网页链接{Fitch Upgrades Ulker to 'BB-'; Outlook Positive; Rates Planned Notes 'BB-(EXP)'}

网页链接{Turkish Confectionary Manufacturer Ulker Biskuvi Upgraded To 'BB' On Profitable Business Expansion; Outlook Stable}

网页链接{Moody's Ratings upgrades Alpha Bank S.A.'s long- and short-term deposit ratings to Baa3/P-3 from Ba1/NP, outlook on the long-term deposit ratings remains positive}

网页链接{Fitch Downgrades Hudson Pacific Properties' IDR to 'BB-' from 'BBB-'; Outlook Negative}

网页链接{Moody's Ratings changes Colombia's outlook to negative from stable; affirms Baa2 ratings}

宏观交易员观点节选

雅登:又一个疲软期(来自昨天还表示今年不太可能降息的人)

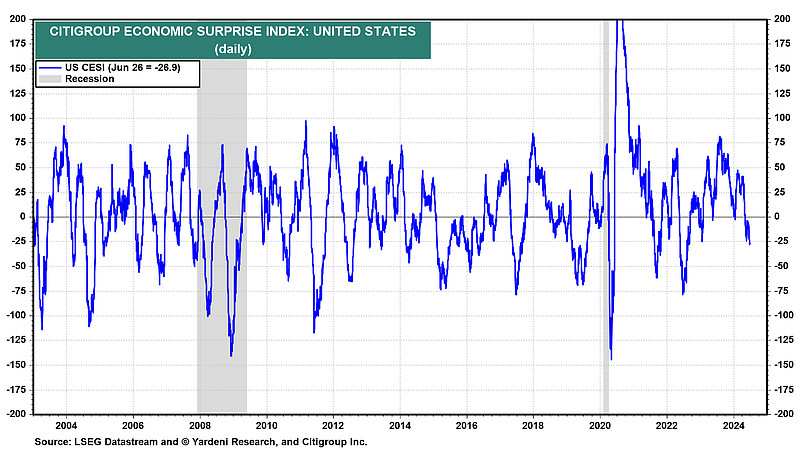

自2022年3月美联储开始收紧货币政策以来,经济既没有实现硬着陆,也没有实现软着陆。它在住房和零售等行业经历了几次滚动式衰退,这些衰退刺激了整体经济增长的疲软期。正如花旗集团经济惊喜指数自5月3日以来一直适度为负所显示的,经济可能正在经历另一个疲软期。

在今天一系列疲软的经济指标之后,亚特兰大联邦储备银行的GDPNow追踪模型将第二季度的实际GDP预测从3.0%(年化季率)修正为2.7%。这仍然相对强劲。债券市场和股票市场对今天的数字都没有太大反应。

让我们来看看今天的指标,这些指标可能给坚定的硬着陆者带来了一些(短暂的)欢乐:

(1) 失业救济申请。在截至6月22日的一周内,每周失业救济申请人数下降了6,000,至233,000(季节性调整后),保持在历史低位(图表)。从持续申请人数中可以发现劳动力市场的一些疲软,截至6月15日的一周内,持续申请人数增加了18,000,至183.9万——这是自2021年11月以来的最高水平。

然而,正如路透社今天指出的,持续申请人数的增加是由去年明尼苏达州的一项规则变化推动的,该变化允许非教师教育工作人员在夏季月份申请失业救济。明尼苏达州是本周持续申请人数的最大贡献者,增加了8,834(未季调)。

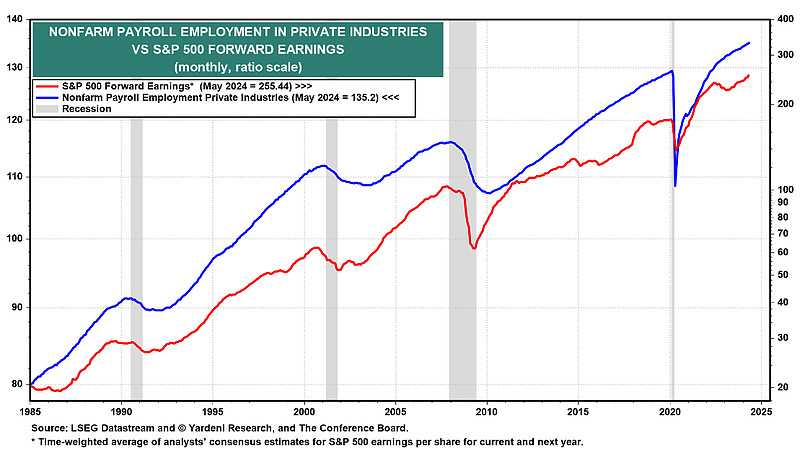

似乎每个人都在寻找劳动力市场疲软的迹象,包括几位美联储官员。我们不担心的一个重要原因是,私人工资就业是由利润驱动的,标准普尔500指数的预期收益继续上升到历史新高(图表)。盈利的公司倾向于扩大他们的员工人数!

加州海滩评论家:货币状况正在恢复正常

……

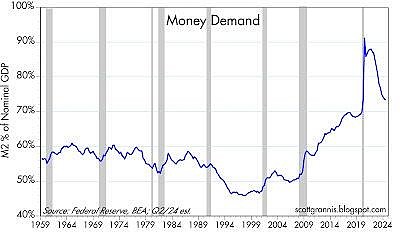

第3张图表是另一种衡量货币需求的方法,即通过将M2除以名义GDP。这是人们愿意持有的流动性量的代理,以他们年收入的百分比表示。在这里,我们也看到事情正在恢复到可能被认为是“正常”的,或者是疫情前的水平。

总结来说,货币状况在很大程度上已经恢复正常。这强烈支持了这样一种信念:美联储基本上已经成功地再次驯服了通胀。未来利率很可能会下降,唯一的问题是时机。与此同时,如果经济出现蹒跚,美联储有很多“干火药”可以释放(以降低利率的形式)。

经济现在面临的最大障碍是财政政策,这在很大程度上将取决于11月选举的结果。尽管我非常不喜欢特朗普的个性和他对中国征收关税的偏好,但我坚信他的政策(例如,降低税率、减少监管、缩小政府规模)会带来比拜登连任更强劲的经济。

大行观点节选

巴克莱资本:第一季度GDP第三次估算:状况还不错(团队降息可能会说,‘这样还好’)

第一季度GDP增长的第三次估算上调了0.1个百分点,达到1.4%的环比年化增长率,反映了对企业固定资产投资、库存和净出口的上调,这部分被消费者支出估计的下降所抵消。最终销售给国内私人购买者增长了2.6%,表明国内需求仍然稳固。

巴克莱资本6月就业预测:逐渐放缓(早到还是只是我这么觉得?)

我们预计6月非农就业人数将增加20万,低于5月的27.2万增幅,平均小时收入环比增长0.3%(同比增长3.9%)。在家庭方面,我们预计失业率将升至4.0%。

巴克莱资本:最新数据保持第二季度GDP预期不变

5月贸易逆差扩大至1006亿美元,而耐用品订单环比仅小幅增长0.1%。这些数据与2024年第一季度GDP第三次估算的结合,导致了我们2024年第二季度GDP追踪器的成分变化,但我们的追踪估计保持在2.1%的环比年化增长率不变。

彭博BNP美国6月就业预测:避免Sahm规则

6月就业增长预计放缓至17.5万人(之前为27.2万人),将反映出失业救济申请的小幅上升和空缺的最近下降。这些数据仍将符合美联储对劳动力市场“再平衡”的定义。

我们预计失业率在连续两次上升后将保持在4.0%不变,因为年轻成年人失业率的飙升已经消退。要触及Sahm规则,失业率需要升至4.2%。

小时工资的增长更为温和(0.3%,之前为0.4%),将使同比增长率降至3.9%,这是自大流行以来的最低水平。大约3.0%的增长更符合美联储2%的通胀目标。

瑞银:冷酷的现实

美国总统辩论后的民意调查显示,前总统特朗普被宣布为赢家。虽然现任总统通常在辩论中“失利”,但据报道,美国总统拜登以较大差距落败。这引发了投资者对特朗普政策的增加审查,特别是在贸易方面。关税的经济后果相对明显,但关于多少竞选承诺会转化为政策行动存在不确定性。

冷酷的经济现实提供了美国5月的消费支出和收入数据,以及价格平减指数。虽然价格数据是焦点,但消费支出数字跟随第一季度GDP的负面修正。消费支出平减指数的月度变化应该是良性的,经济学家对美国通胀的主要担忧是,为什么美联储主席鲍威尔似乎没有注意到实际利率的上升……

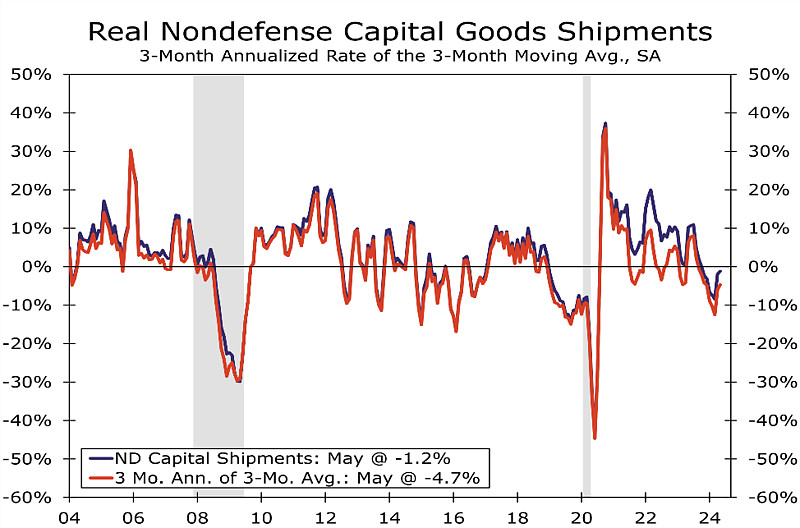

富国银行:耐用品订单继续显示疲软的资本支出需求

摘要 5月耐用品订单再次上升,但数据仍与一个仍在努力找到立足点的行业一致。我们对月度波动的解读是,工业领域正在稳定,并且距离真正的复苏还有一段时间。

财经媒体评论精选

美国经济在高利率下进一步显示出放缓迹象

Comerica Bank首席经济学家比尔·亚当斯(Bill Adams): “在2023年下半年超趋势增长之后,2024年上半年经济运行在低速档……第二季度零售销售和房屋活动持续疲软。”

欧洲央行今年可能只再降息一次 - 管理委员会成员,彼得·卡兹米尔(Peter Kazimir)

“我认为,我们可以预期今年再降息一次……存在显著的通胀上升风险,这可能不完全符合我们的预期……等到9月份的预测发布是恰当的。”

如果欧洲央行采取行动降低法国债券收益率,德国可能会反对

德国财政部长克里斯蒂安·林德纳(Christian Lindner): “欧洲央行的强烈干预可能会引发一些经济和宪法问题。”