Tycoons of the Chao-Shan(潮汕)region in eastern Guangdong Province took up two places in the top ten of the Hurun Global Real Estate Rich List 2019, again demonstrating the economic prowess of the Chao-Shan entrepreneurs, a group we have discussed in our earlier “They're Called Jews of China, Attaining Entrepreneurial Success for Five Centuries ...”.

Li Ka-shing(李嘉诚), 91, took the second spot with riches of RMB 200 bn (US$29 bn), which went down in value from that of the previous year by three per cent. Li was preceded by Xu Jiayin (许家印), who has a personal fortune of RMB 250 bn, which decreased by 10 percent year-on-year (yoy).

Li Ka-shing announced his retirement last year.

Li first made his big break with real estate in Hong Kong, and then expanded into the Chinese mainland in the early 1980s. However, in the past six years, Li has been selling down his real estate assets in China and diversifying into other sectors such as infrastructure, retail, energy and telecommunications, and into Europe, of which UK attracted his most overseas investment.

Only in February, his Cheung Kong Infrastructure Holdings announced to bid for a British power supply company for two bn pounds. During the first half of last year, two of his main public companies completed sales of RMB 260. He announced his retirement last year, passing his baton to his son Victor Li.

Joseph Lau Luen Hung(刘銮雄)took the place of No. 10, with assets of RMB 110 bn (US$16 bn), down by 11 per cent on an annual basis. The RMB 110 bn was based on his 75% stake of HK-based Chinese Estates(华人置业), which operates mainly in Hong Kong, but has also some presence in Beijing and London. Lau has been increasing his shareholding in Evergrande, run by Xu Jiayin (许家印), the world’s leading real estate billionaire, and today has nine per cent of its equity. For five months ending January this year, the company had also bought more than RMB 11 bn worth of Evergrand’s corporate bonds.

It is noteworthy that immediately following the Top 10 is Yao Zhenhua (姚振华), owner of Bao Neng (宝能), who is also a native of the region. With a real estate asset of RMB 95 bn, Yao, long remaining in oblivion, erupted into the public's attention with his aggressive acquisition plans targeting one company after another since late 2015.

The sub-list of the Hurun Global Rich List series Rupert Hoogewerf and his team released on 26 February 2019, also includes six others from the Chao-Shan Region, which includes the fourth biggest real estate tycoon of the Chao-Shan Region, Ji Haipeng (纪海鹏), who ranked No. 30 with assets of RMB 44 bn (USD 6.5 bn), and Zhu Mengyi (朱孟依), who ranked No 50 with assets of RMB 28.5 bn (USD 4.2 bn). Joseph Lau Luen Hung(刘銮雄)'s younger brother, Thomas Lau Luen-hung (刘銮鸿), ranked the 159th with assets of RMB 11 bn (USD 1.6 bn).

The author notices that the billionaires' assets are quite similar to their companies' market capitalization if they are listed on stock exchanges. With the last few billionaires' fortunes being estimated at RMB 6.8 bn in the List, the author suspects that the list may have missed out around eight real estate billionaires from the Chao-Shan Region, which include the founder of Kaisa Group (佳兆业) and the founder of China South City (华南城).

Cantonese hold up half of the sky in the top ten

A closer look at the Top 10 reveals that apart from the two people who were descendants of the Chao-Shan region, three more people were not of this region but also hail from Guangdong Province. They are:

Lee Shau Kee (李兆基), 91, ranked No. 3 with an asset of RMB 180 bn (US$27 bn). He owns the HK-based Henderson Development. Lee was born in Shunde (顺德) , now a district of the expanded Foshan City in the southern part of Guangdong Province, in 1928. Last year Henderson Development’s share prices dropped nearly 20 per cent with its market capitalization dipping below RMB 180 bn.

Lee Shau Kee (middle) announced his resignation on 20 March 2019, passing the helmanship to his two sons (left and right). He will remain as a member of the board of directors in his company.

Yang Huiyan (杨惠妍), 38, ranked No. 4 with RMB 160 bn (US$23 bn). She runs the Foshan-based Country Garden, founded by her father Yang Guoqiang(杨国强), Yang is the only woman in the Top 10, inheriting her wealth from her father Yang Guoqiang, who still runs the business. Country Garden last year was the largest real estate developer in the world with sales exceeding RMB 700 bn (US$100 bn), up 30 per cent yoy.

Henry Cheng Kar-shun (郑家纯), 71, ranked No. 6 together with China’s Wang Jianlin(王健林), and Donald Bren from the U.S., and Hugh Grosvenor (godfather to Prince George) of the UK. Cheng had a fortune of RMB 115 bn (US$17 bn), down 11 per cent from the previous year.

Cheng inherited the Hong Kong-based New World(新世界)from by his late father Cheng Yu-Tung (郑裕彤), Cheng also controls jewellery brand Chow Tai Foo. At the end of 2018, New World announced the US$2.7 bn acquisition of FTLife Insurance.

One more person should have been counted as a Chao-Shan billionaire as historically Guangdong Province had included the current Hainan Province, an island only next in size to Taiwan until 1988. That person is Tos Chirathivat, 54, from Central Group of Thailand (尚泰), who ranked No. 9 with RMB 130 bn (US$19 bn). Chirathivat owns 33 shopping malls, seven office buildings, two hotels and one residential property project, among others, across Thailand. Central Group was founded by his grandfather a century ago, and recently invested US$200 mn in Singaporean ride-hailing and food-delivery platform Grab. His grandfather left his hometown in Hainan Island in 1924 for Thailand and started a humble grocery store there some 17 years later.

Nearly three out of five real estate billionaires live in China

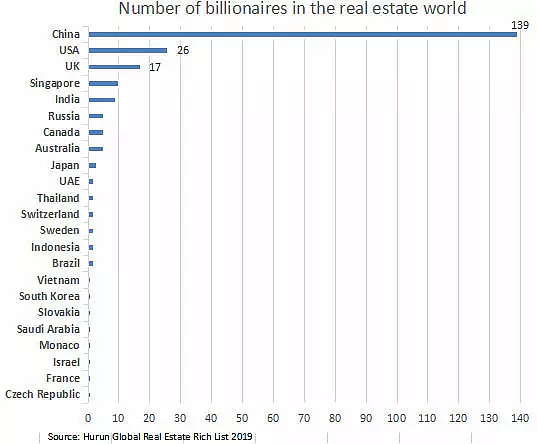

The list altogether has 239 persons, of which 139 billionaires are from China (which includes seven people from Taiwan), Of the entire list, around 67 are based in from Guangdong Province and Hong Kong. Hong Kong had been administered by Guangdong before it was ceded to UK in 1842.

Trailing behind China are 26 from the USA and 17 from UK. Donald Trump came in at the 82nd place with US$3 bn, mainly on the back of his New York real estate and golf courses.

Rupert Hoogewerf, Chairman and Chief Researcher of Hurun Report, said in its report, “The urbanization mega trend in China has driven the biggest wealth explosion in the history of world, with the result that most of the world’s largest real estate developers today come from China.” ###

[About the authors]

Benny Pei is a scholar on the evolution of business practices and philosophies of entrepreneurs from the Chaozhou and Shantou region in southeastern Guangdong Province. He is also a mentor in the MBA Centre and the Veritas College of Shantou University. Prior to this he was a member of the board of directors and senior managers in a few Shenzhen-listed Chao-Shan companies spanning more than a decade.

Sam Gao, a food industry analyst and writer based in Shanghai, started researching the phenomenon of Cantonese tycoons in early 2018 and is an advisor for a public company based in Shantou. He once worked for Euromonitor, Global Data (Canadean), Mintel and Rabobank’s research department. He was a journalist at nhua in the 1990s.