Finding Value Among the “Lows”: The Walter J.Schloss Approach

By Cara Scatizzi

To the average investor, the name Walter J.Schloss does not ring any investment bells.

But as a Benjamin Graham disciple, he learned his lessons well. During the 1956 to 2000 period, Schloss’ investment fund earned a compounded annual rate of return of 15.7%, compared to the market’s return of 11.2% annually over the same period.

Warren Buffett has called him a “Super investor.”

Philosophy & Style

Walter Schloss got his start doing clerical work at a financial firm and never went to college. He was encouraged by company management to read Ben Graham’s famous “Security Analysis”book and to enroll in two investment courses taught by Graham.

Schloss later worked under Ben Graham and eventually started his own fund in 1955. Schloss’son Edwin joined the fund in 1973.

In 2001, Edwin determined that he could not find any cheap stocks to buy, so the two closed the fund. Deciding the market was overvalued would prove to be a prudent move. While Walter Schloss is now retired, much can be learned from his investing philosophy and style.

Warren Buffett highlighted Schloss’ investing style in an article called “The Superinvestors of Graham-and-Doddsville.” Buffett said that Schloss “doesn’t worry about whether it’s January… Whether it’s Monday… Whether it’s an election year.He simply says if a business is worth a dollar and I can buy it for 40 cents, something good may happen.”

Adam Smith also wrote about Schloss in his 1972 book “Supermoney” and said, “He has no connections or access to useful information… He looks up the munbers in the manuals and sends for the annual reports.” Schloss and his son analyzed stocks themselves, mainly using reports from the investment service Value Line.

Criteria

A disciple of Graham and his value investing technique, Schloss looked for stocks that were hitting new lows and those trading at a price lower than their book value per share.

1.Finding Value Companies

Schloss used the ratio of price to book value per share to determine if a stock was underpriced or fairly priced. Book value is the fair value of a company’s assets that, theoretically, shareholders would receive if the company were liquidated (meaning it sold all of its assets and paid all of its debt).

To calculate book value, simply subtract a company’s liabilities from its assets. Dividing the resulting number by the number of shares outstanding will give the book value per share. Schloss looked for companies whose current stock price was below its book value per share.

Another important criterion to Schloss is the proximity of the current stock price to its 52-week low. Schloss would not buy a stock simply because it hit a new low, but he did use this in conjunction with other factors to find potentially undervalued stocks.

He believed that a stock’s price could fall to a new low for a number of reasons:

First,the company may not be managed properly and its actual value has declined;

Second,a stock could be “on sale” and selling for a lower price than its actual value due to market conditions or an overall industry decline; or The company might be having temporaty problems.

If Schloss viewed a stock as being “on sale” or believed a company hit a temporary rough patch, but would emerge stronger, he considered buying it.

2.Campbell Soup Companies

Schloss invested in what he called Campbell Soup Companies, meaning those with a long history and that he considered stable and well known. He preferred to invest in businesses he understood, and ,in the same vein, he avoided new industries he knew little about and foreign stocks as well. He felt the financial statements and valuation ratios of foreign firms were hard to compare with companies in the U.S. because many used different reporting and accounting techniques. As a measure of financial strength, Schloss also avoided companies with debt.

3.Company Management

Finally, Schloss liked managers to have a stake in the company. He felt that their interests were better aligned with investors if they had money on the line. He also never spoke with company manangers because he felt that it clouded his judgment and that management was not always truthful when talking with investors. He preferred to make decisions based on his own analysis of a company’s reported financial statements.

Making the Investments

1.How to Buy

In general, Schloss preferred stocks to bonds because of their growth potential. He also limited his holding of one stock to no more than 20% of his entire portfolio. However, at any given time, he might hold up to 100 different stocks in his portfolio. Schloss weighted the holdings based on their perceived values, putting less money in positions he was less sure about. Schloss used limit orders to purchase stocks, deciding on the price he was willing to pay.

2.When to Sell

Schloss admitted that deciding when to sell a stock was difficult. A general rule of thumb he used was to try for a 50% profit from any holding before selling. This meant that he sometimes watched stocks continue to rise after he sold them, but he tried to keep emotions out of the decisions by using and implementing simple rules to make all of the sell decisions. If a stock’s price was falling and the company’s fundamentals were sound, Schloss would buy more.

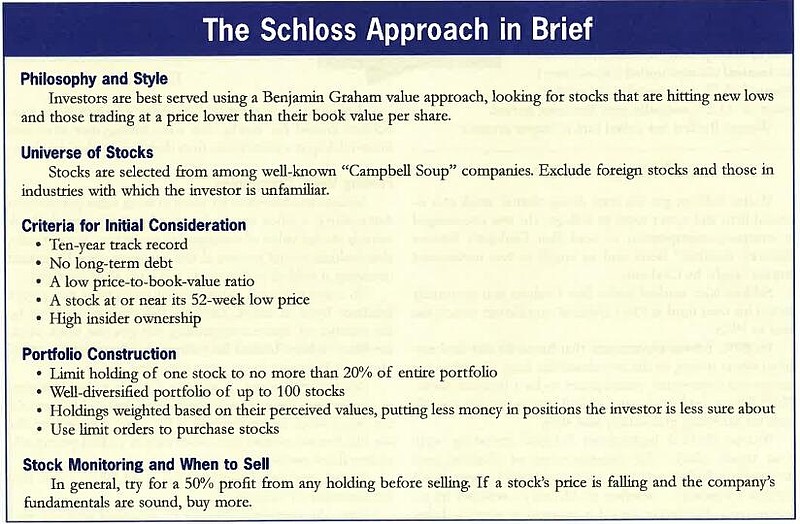

The Schloss Approach in Brief

1.Philosophy and Style

Investors are best served using a Benjamin Graham value approach, looking for stocks that are hitting new lows and those trading at a price lower than their book value per share.

2.Universe of Stocks

Stocks are selected from among well-known “Campbell Soup”companies. Exclude foreign stocks and those in industries with which the investor is unfamiliar.

3.Criteria ofr Initial Consideration

1)Ten-year track record

2)No long-term debt

3)A low price-to-book-value ratio

4)A stock at or near its 52-week low price

5)High insider ownership

4.Portfolio Construction

1)Limit holding of one stock to no more than 20% of entire potfolio

2)Well-diversified portfolio of up to 100 stocks

3)Holdings weighted based on their perceived values, putting less money in positions the investor is less sure about

4)Use limit orders to purchase stocks

5.Stock Monitoring and When to Sell

In general, try for a 50% profit from any holding before selling. If a stock’s price is falling and the company’s fundamentals are sound, buy more.