五一假期的第一天,避开外出高峰,速读了滴滴22年年报。

We are a leading technology platform for shared mobility, with operations in China and 15 other countries through our platforms or our partnerships across the world. 业务覆盖中国和其他15个国家。 We had 587 million annual active users and 23 million annual active drivers worldwide for the twelve months ended March 31, 2023. 年活跃用户5.87亿,年活跃司机2300万。关键经营指标定义如下:

Transactions. The number of completed rides for our China Mobility segment, completed rides or food deliveries for our International segment, and completed bike and e-bike sharing, energy and vehicle services, intra-city freight and financial services transactions. Transactions are counted by the number of orders completed, so a carpooling ride with two paying consumers represents two transactions, even if both consumers start and end their ride at the same place, whereas two passengers on the same ride hailing transaction count as one transaction.

GTV. The total dollar value, including any applicable taxes, tolls and fees, of completed Transactions without any adjustment for consumer incentives or for earnings and incentives paid to drivers for mobility services, merchant or delivery partners for food delivery services, or service partners for other initiatives.

Platform Sales(关键指标): We define Platform Sales as GTV less all of the earnings and incentives paid to drivers and partners, tolls, fees, taxes and others. Platform Sales enables us to compare the performance of our China Mobility and International segments on a like-for-like basis

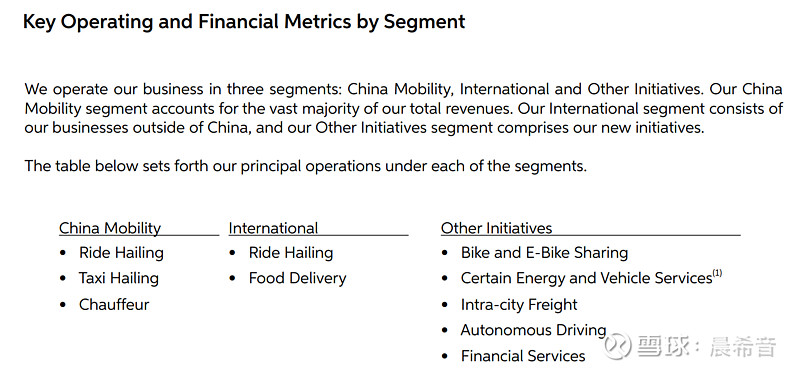

图1:滴滴财报的三大业务版块划分

国内出行版块:网约车、出租车、代驾。

国际版块:网约车、外卖。

其他版块:单车、货运、自动驾驶、金融、能源和车辆服务。

图2:滴滴国内、国际提供的服务类别

国内共享出行:花小猪、出租车、代驾、顺风车、企业级、拼车、快车、专车、豪华车。

国内能源&车辆服务:租车、后市场维保、加油。

国内电车:造车、充电网络建设。

国内其他:单车、货运、金融。

国际:网约车、外卖、金融。

图3:国内共享出行提供的多样化价格、服务、车型的选择

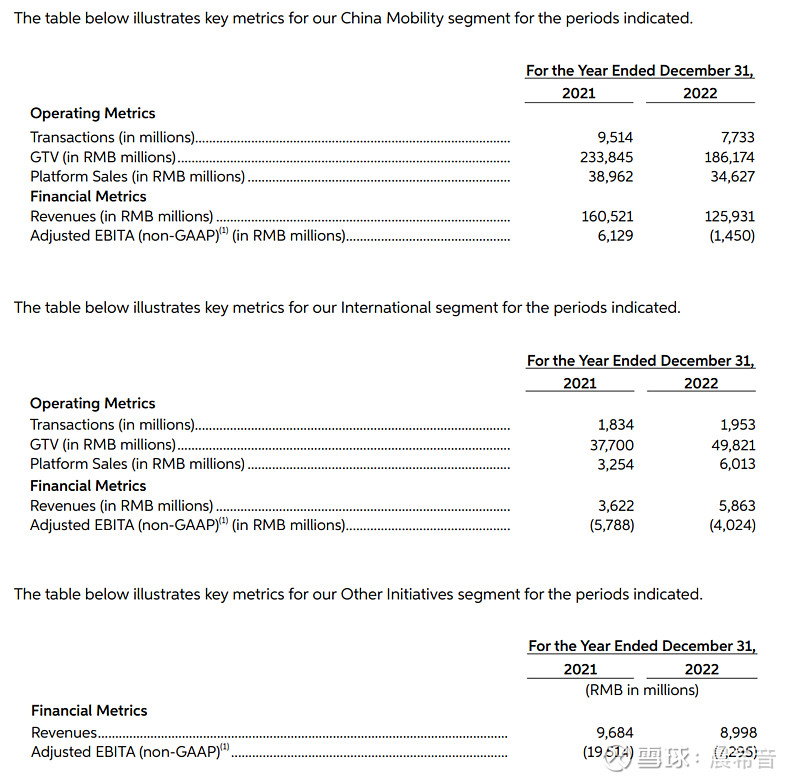

图4:国内出行版块经营指标

所有指标顾名思义,其中Revenue口径在不同业务版块口径不同,财报中做了单独说明:For each of our service offerings, we recognize revenues differently depending on who the customer is and whether we are the principal or agent in providing the service. We recognize revenues (i) on a gross basis(before subtracting driver earnings and incentives) when we are the principal in providing the service and (ii) on a net basis (after subtracting driver and partner earnings and incentives) when we are the agent in providing the service. Specifically, we recognize revenues for our ride hailing service in China on a gross basis as we consider ourselves as the ride service provider in accordance with the service agreements and the regulations in China.

翻译:根据公司在不同国家不同业务中的 whether we are the principal or agent in providing the service,来决定收入口径是gross basis(包含司机分成和司机激励) 还是 net basis(不包含司机和合作伙伴分成&激励)。从财报数据看,国内业务是gross basis口径,国际业务是net口径(国际Revenue和Platform Sales几乎相同)。

21年,国内出行版块GTV 2338亿RMB,调整后EBITA已达61.3亿RMB,22年EBITA亏损14.5亿,包括了当年80.26亿罚款(The Adjusted EBITA of our China Mobility segment went from a gain of RMB6.1 billion 2021 to a loss of RMB1.5 billion in 2022. The Adjusted EBITA loss in 2022 included an administrative fine imposed for the violation of the Cybersecurity Law, Data Security Law and Personal Information Protection Law)。

22年,国际版块GTV 498亿RMB,营收58亿,商业化佣金率11.8%(revenue/GTV),比21年9.6%提升2.2pp,国际化还在投入期,22年EBITA亏损40亿RMB。

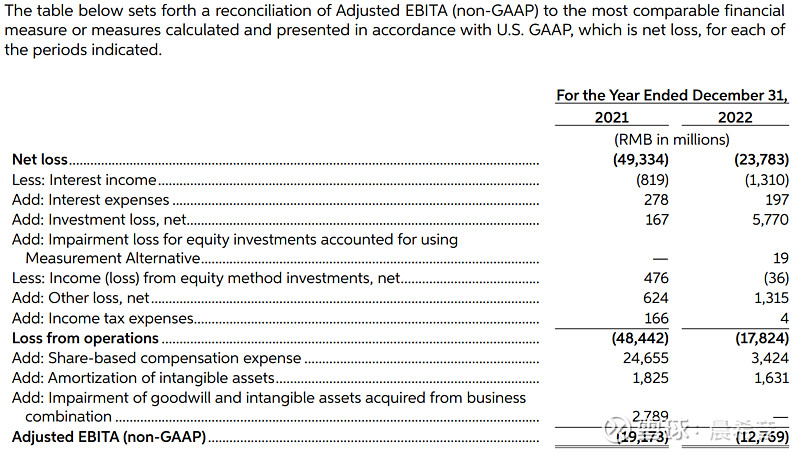

图5:滴滴调整EBITA使用的具体口径

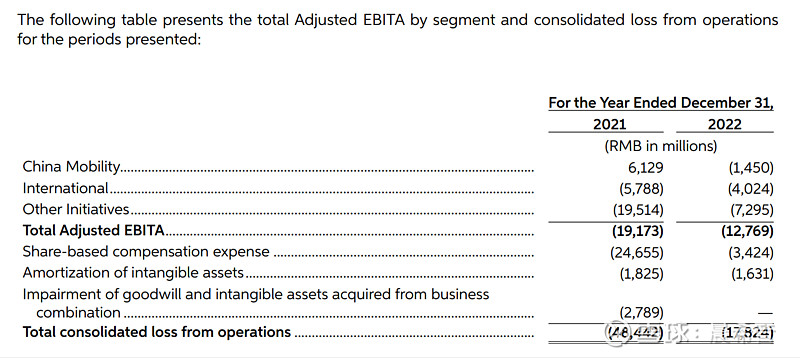

图6:三大业务版块的EBITA

图7:21年与22年各版块经营结果对比

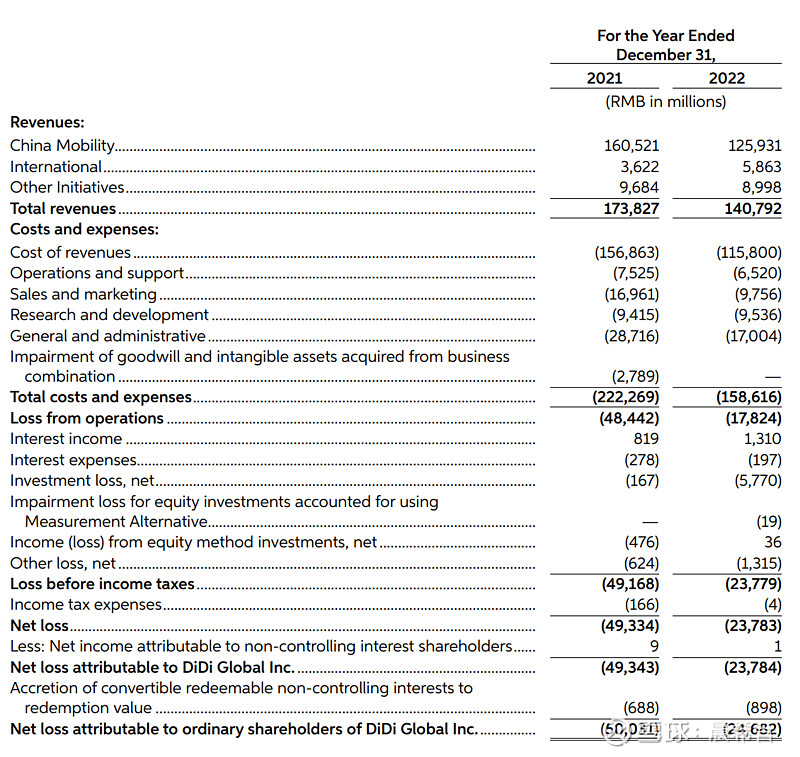

Revenues decreased by 19.0% from RMB173.8 billion in 2021 to RMB140.8 billion in 2022. This decrease was primarily due to the decrease of GTV in our China Mobility segment due to the effects of COVID-19 pandemic outbreaks in the second and fourth quarter of 2022. The total segment revenues of our China Mobility segment decreased by 21.5% from RMB160.5 billion in 2021 to RMB125.9 billion in 2022. GTV in our China Mobility segment decreased by 20.4% from RMB233.8 billion in 2021 to RMB186.2 billion in 2022. 22年受疫情影响,国内营收YoY -19%。

The total segment revenues of our International segment increased by 61.9% from RMB3.6 billion in 2021 to RMB5.9 billion in 2022. The increase in International segment revenue was primarily due to the growth of GTV and improved incentives efficiencies with our customers. GTV in our International segment increased by 32.2% from RMB37.7 billion in 2021 to RMB49.8 billion in 2022. Total segment revenues of our Other Initiatives segment decreased by 7.1% from RMB9.7 billion in 2021 to RMB9.0 billion in 2022, primarily due to an 8.0% decrease of our bike and e-bike sharing business revenues, as COVID-19 pandemic resurged in 2022. 22年国际化版块,GTV YoY+32%,营收YoY +61.9%。

Operations and Support Expenses. Our operations and support expenses decreased by 13.4% from RMB7.5 billion in 2021 to RMB6.5 billion in 2022. This decrease was primarily due to a decrease of RMB0.8 billion in personnel-related compensation expenses, including share-based compensation(新业务缩减&YH HC&优化成本), mainly due to the reduction in headcount in our new initiatives, and a decrease of RMB0.2 billion in other third-party operations support fees in line with the decrease of our bike and e-bike sharing business.

CASH: We believe that our cash from operations, existing cash, cash equivalents and short-term investments are sufficient to fund our operating activities, capital expenditures and other obligations for the next 12 months. We may decide to enhance our liquidity position or increase our cash reserve through additional capital and finance funding. The issuance and sale of additional equity would result in further dilution to our shareholders. The incurrence of indebtedness would result in increased fixed obligations and could result in operating covenants that would restrict our operations. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all。截至2021和2022年12月31日,现金、现金等价物、限制性现金分别为609亿和488亿。我们认为,我们的经营现金、现有现金、现金等价物和短期投资,足以为我们未来12个月的经营活动、资本支出和其他义务提供资金。我们可能会决定新的融资。额外股权的发行和出售将导致进一步稀释我们的股东。

Operating Activities:Net cash used in operating activities in 2022 was RMB9.6 billion, as compared to a net loss of RMB23.8 billion for the same period. The difference was due to RMB16.2 billion for non-cash or non-operating adjustments, partially offset by RMB2.0 billion for changes in our working capital accounts. Non-cash or non-operating adjustments consisted primarily of interest income and investment loss (income), net of RMB5.5 billion, depreciation and amortization expenses of RMB5.1 billion, share-based compensation of RMB3.4 billion, foreign exchange loss (gain), net of RMB1.4 billion, and allowances for credit losses of RMB1.1 billion. Changes in our working capital accounts consisted primarily of a decrease of RMB1.2 billion in accounts and notes payable, and a decrease of RMB1.0 billion in accrued expenses and other current liabilities, partially offset by an increase of RMB0.4 billion in other non-current assets.2022年用于经营活动的净现金为96亿元人民币,而净亏损为238元人民币亿美元。差额是由于162亿元人民币用于非现金或非经营调整,部分被我们营运资本账户的20亿元人民币变动所抵消。非现金或营业外调整主要包括利息收入和投资损失(收入),扣除55亿元,折旧和摊销费用51亿元,股份补偿人民币34亿元,外汇损失(收益),净额人民币14亿元,信贷损失准备金11亿元人民币。我们营运资本账户的变化主要包括减少12亿元人民币应付账款和应付票据,应计费用和其他流动费用减少10亿元负债,部分被其他非流动资产增加的4亿元人民币所抵消。

Investing Activities:Net cash used in investing activities in 2022 was RMB11.0 billion, primarily as a result of the purchase of short-term investments of RMB25.7 billion, loan receivable originated from third parties of RMB14.7 billion, the purchase of long-term time deposits and debt investments stated at amortized cost of RMB7.8 billion, the purchase of property and equipment and intangible assets of RMB2.6 billion, and the purchase of other investment securities of RMB2.1 billion, partially offset by the proceeds from maturities of short-term investments of RMB25.2 billion, cash received from loan repayments of third parties of RMB13.6 billion, the cash proceeds from distribution of Chengxin of RMB1.8 billion, and the proceeds from disposal of property and equipment and intangible assets of RMB0.7 billion.2022年用于投资活动的净现金为110亿元人民币,主要是由于购买短期投资人民币257亿元,应收第三方贷款人民币147亿元,购买长期定期存款和债务投资,摊销成本为78亿元人民币,购买26亿元人民币的房地产、设备和无形资产,以及购买其他投资证券21亿元,部分被短期到期收益抵消投资252亿元,第三方偿还贷款收到的现金136亿元分销诚信所得现金18亿元,以及处置财产所得以及7亿元人民币的设备和无形资产。

Financing Activities:2022年用于融资活动的净现金为35亿元人民币,主要是由于偿还70亿元的短期借款和长期借款,部分被38亿元的长期借款和短期借款的收益所抵消。

23年经营:the demand for commuting通勤, consumer travel旅游, and travel to or from airports, train stations场站 and other major transportation hubs大型枢纽 in China has rapidly recovered快速复苏, driving our China Mobility segment to return to growth国内出行版块增长. In March 2023, we completed an average of 28.2 million daily transactions for our China Mobility segment, representing a 42% increase from March 2022.

3月,国内出行版块,日均交易订单YoY+42%,为2820万单;国际化版块,日均交易660万单;其他版块,日均1020万单(including bike and e-bike sharing, certain energy and vehicle services, intra-city freight, and financial services)。三大版块,3月日均共4500万单。

估值:出行和旅游/住宿类似,属于可选消费,这些行业对经济和人均支配收入变化较敏感。21~22年疫情下国内出行版块60~70亿EBITA,按23年增速40%算,EBITA在80~100亿的范围。单看国内版块,给10倍PE,估值区间在120~150亿美金。国际化版块、其他版块、造车和自动驾驶,这些财报披露信息太少,暂不考虑。