STAA系列文章一:Refractive Error is a Global Epidemic 网页链接

STAA系列文章二:为什么说ICL是近视手术的天花板 网页链接

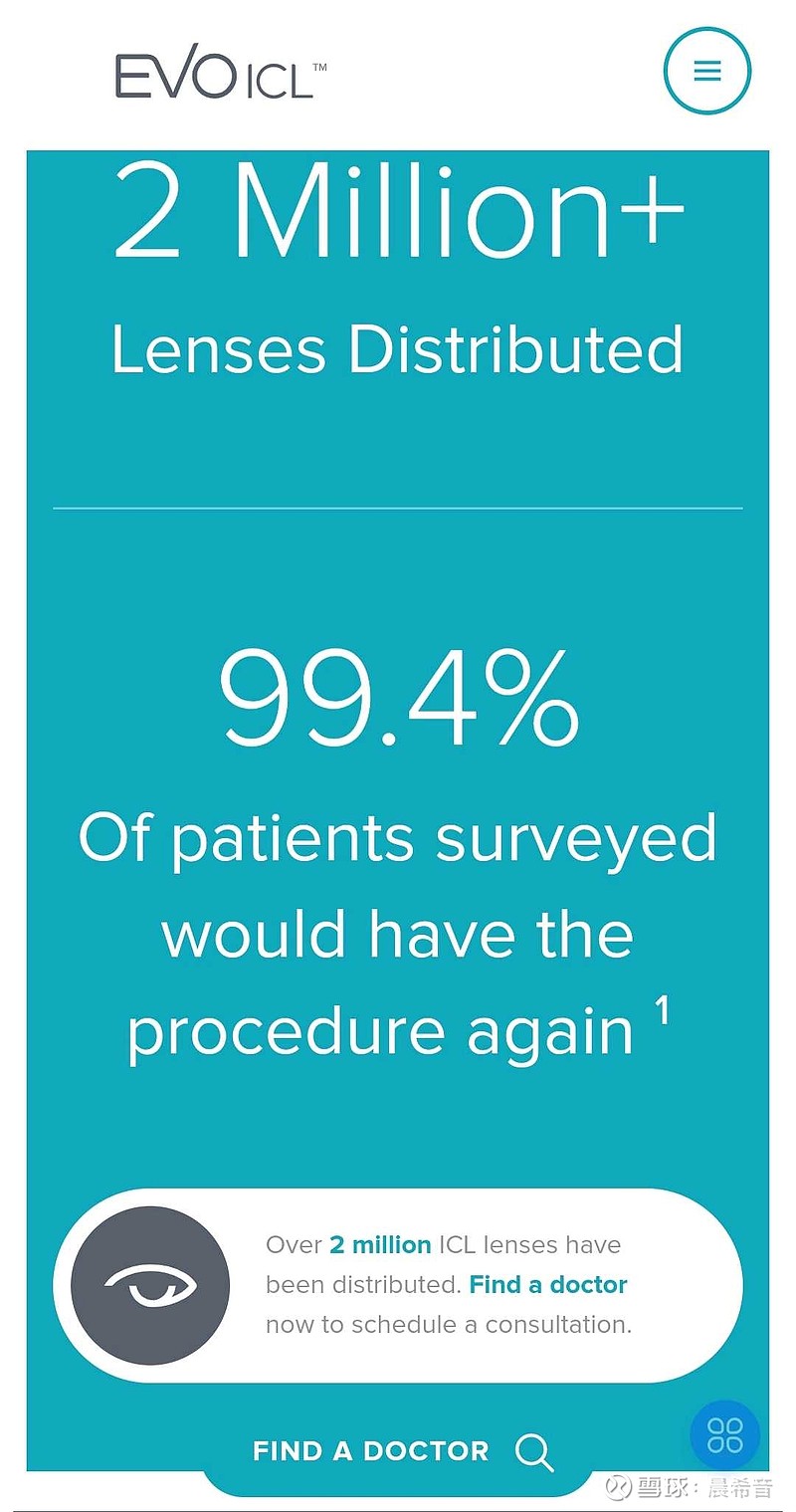

STAA系列文章三:ICL晶体植入量全球突破200万 网页链接

Third Quarter 2022 Overview

However, due to tighter COVID restrictions in China resulting in expected delayed demand in the fourth quarter, ongoing headwinds in Europe, weakness in the Yen and Euro, and lower Other Products sales, we now anticipate total net sales will be approximately $285 million for fiscal 2022, which represents $300 million adjusted for constant currency.

Our fiscal 2022 outlook includes ICL sales of approximately $272 million, representing approximately 28% year over year growth, and Other Products sales of approximately $13 million.(Q4增长预计放缓)

Today it is vital that STAAR focus on the significant growth opportunities we have with our premium EVO products. (ICL高端晶体产品的巨大增长机遇)

At the same time, our low margin Other Products business, which represents approximately 5% of sales and consists of cataract IOLs, IOL injectors and injector parts, has faced increasing supply chain challenges. As a result of third-party materials and supply chain challenges that only affect our Other Products business, we will no longer be able to support Other Products as we have historically. We will continue to support customers of Other Products through the end of 2023. (除ICL外,其他低毛利产品,疫情下受到三方原材料供应和供应链影响,Q4起将暂停Support,预计2023年底恢复。这部分低毛利产品,只占约5%销售额)

As we look to fiscal 2023, despite the aforementioned challenges, we expect to achieve approximately 30% ICL sales growth, year over year, to approximately $355 million in total company net sales which contemplates limited sales from Other Products. (2023高端ICL晶体,给出了30% YoY的稳定增长指引)

We see significant growth potential for our EVO family of lenses globally and look forward to continuing our focus, efforts and resources on especially large growth opportunities in the U.S. and Asia in 2023.

Financial Overview – Q3 2022

Net sales were $76.0 million for the third quarter of 2022, up 30% compared to $58.4 million reported in the prior year quarter. The sales increase was driven by ICL sales and unit growth of 33% and 40%, respectively, as compared to the prior year period. Other Product sales decreased 3% compared to the prior year quarter. ICL sales were 95% of total net sales for the third quarter of 2022. Changes in currency, primarily in the Japanese Yen as well as the Euro, negatively impacted reported total net sales by $4.0 million for the third quarter of 2022.

Gross profit margin for the third quarter of 2022 was 79.5% compared to the prior year quarter of 77.6%. Factors impacting gross margin in the third quarter of 2022, as compared to the prior year quarter, due mainly to product and geographic mix, partially offset by increased period costs associated with manufacturing projects.

Operating expenses for the third quarter of 2022 were $46.8 million compared to the prior year quarter of $37.5 million. General and administrative expenses were $14.0 million compared to the prior year quarter of $11.0 million. The increase in general and administrative expenses was due to compensation related expenses, increased facilities costs and outside services. Selling and marketing expenses were $23.1 million compared to the prior year quarter of $18.2 million. The increase in selling and marketing expenses is due to increased trade shows and sales meetings, advertising and promotional activities, travel expenses and compensation related expenses. Research and development expenses were $9.6 million compared to the prior year quarter of $8.3 million due to increased compensation related expenses.

Net income for the third quarter of 2022 was $10.3 million or $0.21 per diluted share compared with net income of $6.0 million or $0.12 per diluted share for the prior year quarter. The year over year increase is attributable to higher sales and gross profit and, as a percentage of sales, lower operating expenses. Adjusted Net Income for the third quarter of 2022 was $18.1 million or $0.37 per diluted share compared to $10.3 million or $0.21 per diluted share for the prior year quarter. The reconciliation between GAAP and non-GAAP financial information is provided in the financial tables included with this release.

Cash, cash equivalents and investments available for sale at September 30, 2022 totaled $224.7 million compared to $199.7 million at December 31, 2021.

About STAAR Surgical

STAAR, which has been dedicated solely to ophthalmic surgery for over 40 years, designs, develops, manufactures and markets implantable lenses for the eye with companion delivery systems. These lenses are intended to provide visual freedom for patients, lessening or eliminating the reliance on glasses or contact lenses. All of these lenses are foldable, which permits the surgeon to insert them through a small incision.

STAAR’s lens used in refractive surgery is called an Implantable Collamer® Lens or “ICL”, which includes the EVO ICL™ product line. More than 2,000,000 ICLs have been sold to date and STAAR markets these lenses in over 75 countries. To learn more about the ICL go to: EVOICL.com.