Summary:

~ JOYY Inc. (YY) just announced a great Q3 2021 with both revenue and profits beating analyst estimates.

~ The company announced a huge $1 billion stock repurchase program, on top of its existing $200 million stock buyback program.

~ A fear of fraud and the Chinese crackdown on internet companies creates a great buying opportunity.

Cheaply Valued

In the expensive US stock market, JOYY is one of those “strange” companies that trade below cash on its balance sheet. With a total of 78 million shares outstanding, JOYY’s market capitalization is about $4.4 billion, while according to the recent Q3 quarterly report, it has $4.8 billion cash on the balance sheet.

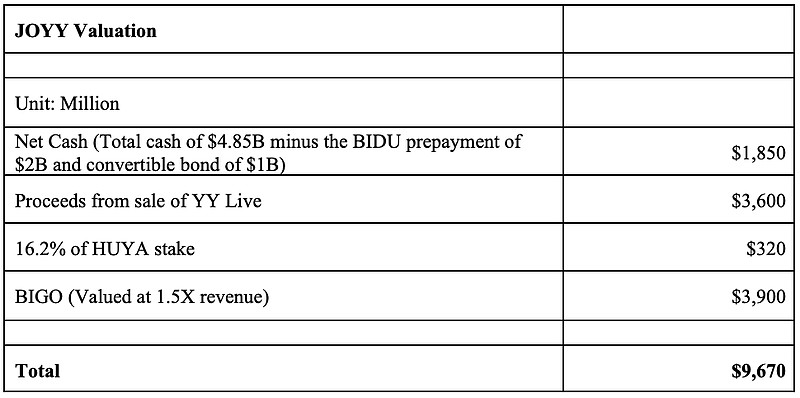

If we use the sum of the parts method to value the company, JOYY should trade at $9.6 billion, more than double its current market cap. In addition to the cash on JOYY’s balance sheet, its main business, BIGO, generates an annualized revenue of more than $2.6 billion and is growing in the 15-20% range. It also owns a 16.2% stake of HUYA, another US-listed company.

JOYY Valuation

On November 17, JOYY announced a great third quarter with both revenue and profits beating analyst estimates. Revenue grew by 21.7% reaching $651 million, and the Non-GAAP net income was $35 million, compared to a loss of $27 million in the corresponding period of 2020. After JOYY agreed to sell YY Live to BIDU and excluded YY Live from its financial reports starting Q4 2020, Q3 2021 is the first time that JOYY has achieved profitability on the corporate level.

On top of the great earnings report, JOYY also announced a massive $1 billion share repurchase program. Since JOYY already initiated a $200 million buyback program two months ago, this additional buyback announcement came as a nice surprise.

However, many investors were not impressed. Excellent quarterly results and the buyback news did not bring “joy” to JOYY stock. Its share price barely moved.

Why couldn’t JOYY’s impressive announcements move its stock price? It seems Investors have put JOYY in the penalty box for two reasons: the fear of fraud, and the risk from China’s internet company crackdown.

Is JOYY a Fraud?

In November last year, Muddy Waters, a famous short seller, issued a short report on JOYY. In its 71-page report, Muddy Waters claimed that 90% of JOYY’s revenue was fabricated. You can read the detailed report here.

JOYY categorically denied the accusations. In response, JOYY said Muddy Waters’ report demonstrated its lack of a basic understanding of the live streaming industry in China. JOYY further stated that the operating metrics disclosed by JOYY are commonly used and have been publicized by its industry peers.

So who should we believe, Muddy Waters or JOYY management? After thorough analysis, I sided with JOYY management. Even though some of JOYY’s operating metrics may be inflated, JOYY is most likely not a fraud. JOYY’s financials, especially its profit numbers, seem to be authentic. I’ve studied a myriad of evidence from different sources and discussed it with several well-informed people in the live streaming industry before coming to this conclusion. The following few points are things I have considered:

~ BIDU announced to buy YY Live for $3.6 billion before Muddy Waters’ short report. After the accusation, BIDU executed a thorough investigation before going ahead with the deal, concluding that YY Live was not a fraud. BIDU’s detailed examination speaks louder than Muddy Waters’ accusation.

~ In April 2020, Tencent bought the controlling ownership of HUYA, JOYY’s major subsidiary, and began to consolidate HUYA into its financial reports. Tencent has not found any financial irregularity in HUYA’s numbers after its 18-month of ownership. If JOYY’s major subsidiary is not a fraud, it’s hard to believe JOYY itself is a fraud. After all, both JOYY and HUYA are in the same business of live streaming.

~ When compared JOYY’s key financial metrics (revenue, ARPU, profit margin, etc.) with other live streaming companies, all of these metrics seem legitimate, and are comparable to its competitors in China’s live streaming industry.

~ In the case that JOYY was a fraud, it would be unwise to sell the company, as the fraud would be quickly discovered by the buyer. Rather, JOYY management would try to maintain control of the company as long as it can to conceal their fraud.

~ In the sales agreement between JOYY and BIDU, JOYY agreed to compensate BIDU if the operating income of YY Live fell below RMB3.7 billion ($580 million) in 2021 or 2022. If YY Live was fraudulent, it would be very unlikely that JOYY management would offer such a guarantee.

~ JOYY has initiated massive stock buyback programs. Immediately after completing a $300 million stock buyback program, JOYY announced a new $200 million repurchase program in September. Furthermore, during the Q3 2021 earnings call, JOYY announced an additional $1 billion stock buyback program.

~ JOYY offers a generous dividend. After Muddy Waters’ accusation, JOYY announced it would increase the quarterly dividend to $0.51 per ADR for three years. This is around a 3.6% dividend yield at the current stock price.

In summary, while Muddy Waters’ short report does expose some questionable tactics commonly used in the live streaming industry in China, these tactics do not diminish the fact that live streaming is extremely profitable in China. JOYY is the market leader and its financials are most likely real.

The Chinese Crackdown

Over the last couple of months, the Chinese government began to put its internet companies under increasing regulatory scrutiny. Companies were heavily fined whenever any violations were identified. The crackdown sent Chinese stocks into a tailspin; Alibaba, one of China’s internet juggernauts, saw its stock price go down by more than 50%. There has been tremendous pessimism bordering on panic about China and its internet companies nowadays.

However, investors may be overly pessimistic about China. Unfamiliarity with China’s political system allows many to misinterpret the aim of the Chinese government. Although the fines are big, they are sensible and proportional to the size of the companies affected. The Chinese government’s goal is to exert some control over its internet companies, not to destroy them.

On the surface, JOYY is a Chinese internet company listed in the US market, so the pessimistic sentiment toward Chinese internet companies also affects its stock price. But after drilling deeper into JOYY’s financials, you would notice that the majority of JOYY’s revenues are from markets outside China.

JOYY sold the majority ownership of HUYA to Tencent in April 2020. Earlier this year, it agreed to sell YY Live to BIDU for $3.6 billion. Once the YY Live deal concludes, JOYY will no longer have any major business unit in China. Its remaining subsidiary is BIGO, which is headquartered in Singapore.

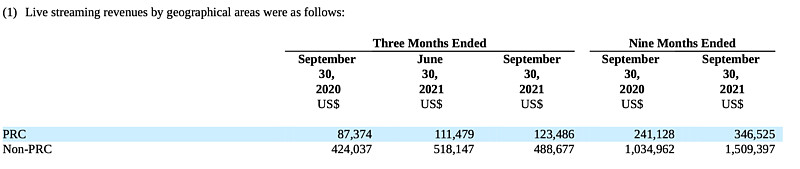

The table below is from JOYY’s most recent quarterly report. It shows that in Q3 2021, less than 20% of JOYY’s revenue was from China, while more than 80% of revenue was from markets outside China.

Source: JOYY Q3 2021 Quarterly Report

Catalyst: Massive Stock Buyback Program

Out of the 78 million shares outstanding, JOYY insiders currently own about 25 million shares, 32% of the total. This means roughly 53 million shares are floating in the market. Also, the current short interest on JOYY is about 5.2 million.

If JOYY management carries out its massive $1.2 billion share buyback program, at the current price, more than 40% of the 53 million floating shares will be bought out. This share buyback would be significant enough to move JOYY stock higher. In addition, the buyback program may trigger short covering, further propelling JOYY’s stock price.

Conclusion

JOYY is trading at less than 50% of its fair valuation in an expensive market. Based on evidence from thorough research on the topic and conversations with knowledgeable people in China’s live streaming industry, I have concluded that JOYY is likely not a fraud. Once the deal to sell YY Live to BIDU concludes, JOYY will have very little exposure to China, with the majority of its revenue coming from markets outside China.

The recent strong quarter confirms that JOYY’s business has a promising future and its stock is not a value trap. The newly announced $1 billion stock buyback program should provide the catalyst to drive JOYY stock higher. Now is a great time to buy JOYY.