$维罗纳制药(VRNA)$ 转发外网文章,学习

Verona Pharma Is Launching Ohtuvayre, Although There Will Be Competition

Jun. 30, 2024 9:00 AM ET网页链接{Verona Pharma plc (VRNA) Stock}REGN, SNY, SNYNF

7.99K Followers

Following5

ShareSave

Play(9min)

Comments(16)Summary

VRNA received FDA approval for ensifentrine (Ohtuvayre) for the maintenance treatment of COPD on June 26.SNY/REGN's Dupixent represents a potential competitor. As do other drugs in development from SNY/REGN and GSK.Verona has the potential for further growth beyond the current approval, although in the near-term, initial sales seem likely to be a major determinant of the stock's direction.Alones Creative

When I 网页链接{wrote about} Verona Pharma plc (NASDAQ:VRNA) in February, the company was awaiting FDA approval of its drug ensifentrine for chronic obstructive pulmonary disease (COPD). I rated VRNA a hold then, noting there didn't seem to be much of a run up into approval underway, and there was room to fall if there was a delay in approval or outright rejection. June 26 came with news the FDA had indeed approved ensifentrine (Ohtuvayre) for the maintenance treatment of COPD, meaning a potential delay or rejection is now off the cards. This article looks at where VRNA stands now, and why I now rate the name a buy.

Approval has come late in Q2'24

Approval of VRNA's Ohtuvayre has failed to provide a sustained rally in the name, although a run up in early June might have meant success was built in somewhat. Further, since the approval of Ohtuvayre has come in late Q2'24, the opportunity to get in a month or two of sales before quarter-end isn't in play. As such when VRNA reports Q2'24 earnings, perhaps in late July or August, investors will be reliant on updates on sales subsequent to the end of the quarter, or perhaps script numbers, to gauge the success of the initial launch. VRNA may be aware that investors will want some concrete numbers and it may give some preliminary sales numbers at some point to satisfy investors.

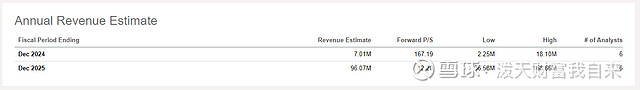

I do note that current revenue estimates for VRNA for 2024 average just $7M, albeit from just six analysts. That doesn't sound like a particularly high bar to clear in the first six months of the launch.

Seeking Alpha earnings tab.

Of course those estimates could be revised upwards, and pale in comparison to a 2029 sales estimate of $1.05B GlobalData. Nonetheless is doesn't seem like a rapid launch is predicted, especially when we consider Ohtuvayre is priced at $35.4K annually.

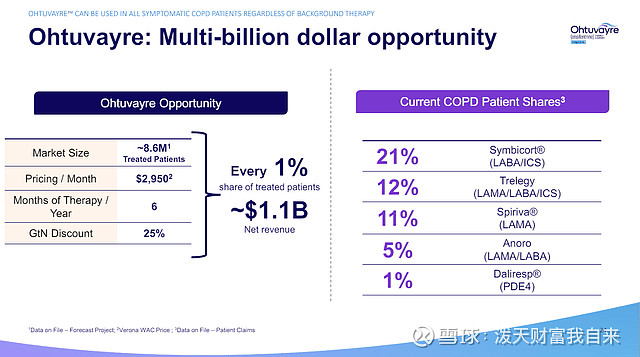

VRNA presentation, June 2024.

The company notes 8.6M COPD patients are treated chronically in the US, meaning even a 1% share (86,000 patients) treated for six months a year and with a 25% gross-to-net discount would yield $1.14B in revenue a year.

Competitor developments will be significant

There is renewed progress in the COPD space, meaning beyond existing approved COPD competitors, VRNA could face further competition.

Firstly, Regeneron Pharmaceuticals (REGN) and Sanofi (SNY) produced positive data in two trials of Dupixent (dupilumab, an injected monoclonal antibody) in COPD in 2023. SNY/REGN have also filed a supplemental Biologics License Application (sBLA) with the US FDA for approval of Dupixent in certain COPD patients. The companies have also filed for marketing approval of Dupixent in COPD elsewhere in the world.

It should be noted that the FDA 网页链接{has extended} the target review date for REGN/SNY's Dupixent for COPD sBLA. While approval could have originally come around June 27, 2024, the target date is now September 27, 2024. That does provide VRNA an opportunity to launch Ohtuvayre in the US while Dupixent isn't approved for COPD.

That being said, Dupixent is already approved in other indications and so could end up being prescribed off label prior to approval in COPD. Further, Dupixent already has an approval in certain asthma patients, meaning pulmonologists are familiar with the drug. VRNA rallied following the news of the FDA delay on the Dupixent sBLA, which REGN announced on May 31. I don't know how significant a three month delay in approval of a competitor is for VRNA, unless there is a hiccup in approval of Dupixent for COPD. REGN's comments in the May 31, 2024, press release seem to suggest there is no cause for concern, but we'll have to wait and see.

Beyond Dupixent, REGN and SNY are also developing itepekimab, an anti-IL-33 antibody, 网页链接{for COPD}, which previously demonstrated a reduction in COPD exacerbations in former smokers in a phase 2 study. That 网页链接{phase 2a result} was a pre-specified subgroup analysis, it should be noted. The effect on exacerbations wasn't statistically significant in the study population overall (current and former smokers). Two large phase 3 studies (AERIFY-1 and -2) are underway. I note that the AERIFY-1 and AERIFY-2 studies both have estimated primary completion dates in mid-2025, although both are still recruiting, so delays are possible.

Outside of REGN and SNY, those following the COPD space should look out for results from GSK plc's (GSK) MATINEE 网页链接{trial of} Nucala (mepolizumab) in COPD. That study has an estimated primary completion date in August 2024, and GSK has previously suggested an anticipated readout in H2'24. Nucala, an IL-5 antagonist monoclonal antibody is already approved in other indications including asthma, and brought in £1.7B pounds for GSK in 2023. Similar to Dupixent then, although not approved yet for COPD in the US, Nucala represents a key potential competitor.

Financial overview

VRNA had $254.9M in cash and cash equivalents as of March 31, 2024, which, along with the $650M available from its financing facility (set up subsequent to the end of Q1'24), VRNA believes will fund the company beyond 2026. R&D expenses were $6.8M in Q1'24 and SG&A expenses were $20.4M in the same quarter. Net loss was $25.8M in Q1'24 and net cash used in operating activities was $13.6M for the quarter. Of course cash burn is going to pick up now with a drug launch underway, not to mention VRNA planning to run further clinical studies. Nonetheless, I'm not expecting VRNA to raise cash via a dilutive method in the near-term, especially given the new financing facility. Initial revenues will also greatly impact predictions on how soon VRNA might move towards profitability and avoid having to dilute.

VRNA had 648,654,174 ordinary shares outstanding, although it trades as American Depository Shares (8 ordinary shares for one ADS), meaning there could be up to 81,081,772 ADS. VRNA thus has a market cap of $1.17B ($14.46 per ADS) and trades at 12 times 2025 revenues (estimate $96M).

Conclusions, rating and risks

VRNA is actually a little more attractive now relative to when I wrote about it in February, rating it a hold, given a number of factors. Firstly, the stock is down 13.6% since I wrote that article, but the risk of a delay in approval is now gone. Secondly, a delay in approval of REGN/SNY's Dupixent for the treatment of certain COPD patients could provide some advantage. Further the company's new financing facility comes with better terms than the previous one.

With the financing announced this morning, we are pleased to have further strengthened our balance sheet and enhanced our financial flexibility as we prepare for the potential launch of ensifentrine with access to up to $650 million in addition to our existing cash of $255 million. We refinanced our $400 million debt facility to one with a lower overall cost of capital and favorable financial covenants.

David Zaccardelli, President and CEO of VRNA, May 9, 2024.

I also note that revenue estimates for VRNA are particularly soft right now in 2024, making it easy to beat those estimates. I expect upwards revisions but the recent downside in the stock, the potential to beat estimates for now, a delay in competitor approval and improved funding situation, allow me to rate VRNA a buy.

There are several risks to a long trade, a few of which I'll note here. The first major risk of any long in VRNA would be that initial sales might disappoint. Even though I think current estimates look beatable, others might expect more on launch given the eventual peak revenue estimates, for example.

Secondly, if VRNA experiences delays in its other clinical work, such as developing ensifentrine in other indications, the stock could tumble.

Lastly, if VRNA announces an EU deal for commercialization rights to ensifentrine, but the market doesn't like the terms, the stock could fall. Any business development needs to be on terms the market perceives as favorable to VRNA to provide a rally or avoid any sell off.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by