$维罗纳制药(VRNA)$ 今天开谜底,要买趁手!

Verona Pharma: Next Week's PDUFA Date Ought To Provide An Upside Catalyst

网页链接{Edmund Ingham}

网页链接{Investing Group Leader}

Following5

ShareSave

Comments(15)Summary

Verona Pharma plc's ensifentrine has a PDUFA date on June 26th for COPD treatment, with promising Phase 3 study results suggesting the drug will secure commercial approval.Potential competition from Sanofi / Regeneron's Dupixent poses a threat, but Verona may have a head start in the market thanks to a delay in the PDUFA for Dupixent.Verona's market cap undervalues its potential success, with potential for significant growth and M&A interest.Incumbents in the COPD space include GSK's advair and AstraZeneca's symbicort - this makes the commercial launch of ensifentrine potentially tricky.Nevertheless, the strong safety and efficacy profile and its differentiated MoA mark it out as a potential "blockbuster" drug, which makes a relatively persuasive bull case for Verona stock.Rainer Puster

Investment Overview - Approval Catalyst One Week Away In Large, Underserved COPD Market

London, United Kingdom-based Verona Pharma plc (NASDAQ:VRNA) has a Prescription Drug User Fee Act ("PDUFA") date upcoming for its lead and only drug candidate, ensifentrine, on June 26th - in less than a week - in the indication of Chronic Obstructive Pulmonary Disease ("COPD").

A PDUFA date is the date by which the FDA must decide whether to formally approve a drug for commercial use, or outline its reasons for rejecting it in a Complete Response Letter ("CRL"). Verona submitted its New Drug Application ("NDA") for ensifentrine to the FDA in August last year.

The Mayo Clinic defines COPD as follows:

a chronic inflammatory lung disease that causes obstructed airflow from the lungs. Symptoms include breathing difficulty, cough, mucus (sputum) production and wheezing.

It's typically caused by long-term exposure to irritating gases or particulate matter, most often from cigarette smoke. People with COPD are at increased risk of developing heart disease, lung cancer and a variety of other conditions.

Verona's research (shared in a recent investor presentation) suggests 8.6m patients per annum are treated for COPD in the US, with ~$10bn per annum in maintenance COPD sales. In China, there are ~100m patients, and in Europe, ~70m patients, albeit drug sales are a fraction of the size of the US - ~$1bn, and ~$2bn respectively.

In Verona's 2023 annual report / 网页链接{10K submission} the company reports:

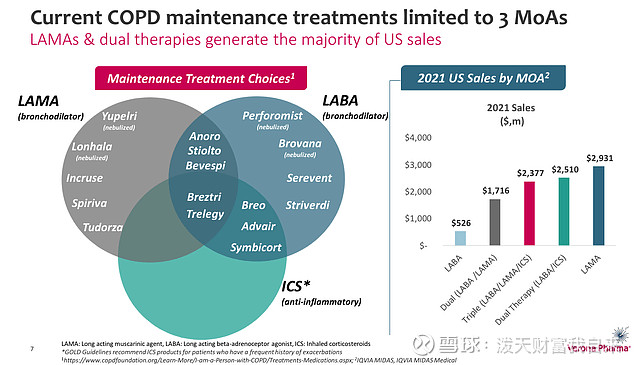

For approximately 40 years, the treatment of COPD has been dominated by three classes of inhaled therapies approved for use by the FDA and the European Commission based on the European Medicines Agency’s (“EMA”) opinion: anti-muscarinics, beta-agonists and inhaled corticosteroids (“ICSs”).

COPD patients are frequently treated with bronchodilators, including long-acting muscarinic antagonists ("LAMAs") and long-acting beta-agonists (“LABAs”), to relieve airway constriction and make it easier to breathe. In addition, patients at risk for exacerbations may be prescribed ICSs to prevent them.

The Case For Approval Of Ensifentrine

In Verona's 10K, the company states:

Ensifentrine is an investigational, first-in-class, inhaled, small molecule and selective, dual PDE3 and PDE4 inhibitor. This dual inhibition enables it to act as a bronchodilator and a non-steroidal anti-inflammatory agent in a single compound.

The company says the "reduction in macrophage activation" caused by ensifentrine "impacts cellular adhesion, chemotaxis, and survival of neutrophils and eosinophils," and emphasizes that it is:

not aware of any other single compound in clinical development in the U.S. or Europe or approved by the FDA nor the European Commission for the treatment of respiratory diseases that acts both as a bronchodilator and anti-inflammatory agent

As such, Verona is confident that its product would successfully find a niche within an admittedly crowded, but double-digit billion revenue market, and its data, led by its two pivotal Phase 3 ENHANCE studies, would seem to support the case for a positive outcome when the PDUFA arrives next week.

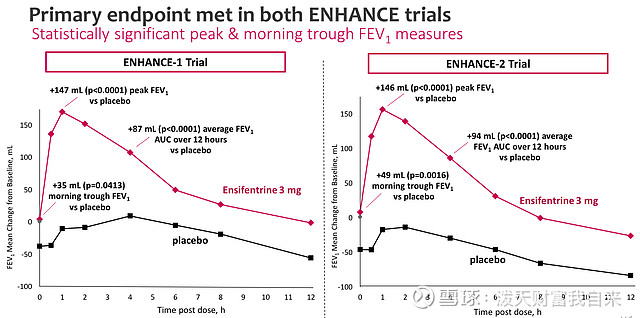

The drug met its primary endpoint in each of the two ~800 patient studies, demonstrating "statistically significant and clinically meaningful improvements in measures of lung function," and also meeting several key secondary endpoints.

The lung function in question is Forced expiratory volume (FEV1), which calculates the amount of air that a person can force out of their lungs in 1 second - as we can see below, ensifentrine comfortably outperformed placebo in the ENHANCE studies, with the effect most pronounced immediately following administration, but continuing to outperform placebo after a 12-hour period.

ENHANCE study results - primary endpoint (presentation)

Not only that, but ensifentrine also reduced disease exacerbation rates in both studies, by, respectively, 36% and 43%, making the results clinically meaningful. Time to first exacerbation was also "significantly" delayed, with a 41% risk reduction in time to first exacerbation. In the ENHANCE 1 study, quality of life was observed to improve by a clinically significant amount.

From a safety perspective, 46% of patients taking ensifentrine 3mg dose experienced at least one treatment related adverse event ("TRAE"), compared to 40% of patients taking placebo. The most common adverse events were hypertension - back pain, and worsening of COPD, although none of these occurred in >3% of patients.

In summary, the pivotal study data seems impressive, and perhaps significantly, the FDA has not requested to convene an advisory committee ("AdComm") i.e., a panel of experts in the field, to discuss the data and vote or advise on whether to approve the drug (the FDA is not obliged to follow its AdComm's advice, but tends to do so). That may imply that the agency is satisfied with the safety and efficacy profile and is ready to approve the drug.

The Potential Fly In Verona's Ointment - Dupixent Poses A Mega-Blockbuster Threat

In its Q1 2024 earnings release, Verona reported a net loss of $(25.8m), up from $(16.7m) in the prior year period, against a cash position of $255m. To help fund a potential commercial launch of ensifentrine, however, the company has agreed a financing deal with Oaktree Capital and OMERS Life Sciences for up to $650m in funding, including a debt facility of $400m, which replaces a former facility, for a "lower overall cost of capital," Verona says.

The Institute for Clinical Economic Review (ICER) has speculated that, if approved, Verona will price its drug in the region of $7.5k - $12.7k per annum, while analysts have been touting the drug's "blockbuster" (revenues >$1bn per annum) potential.

With a market cap of just $1.3bn at the time of writing, and share price trading at $15 per share, down from its all-time peak of ~$26, achieved shortly after the ENHANCE study results were shared last December, investors may be wondering what the catch is - surely, a valuation closer to $3bn, or 3x peak revenue potential, may be more appropriate?

Ensifentrine, if approved, may face a rival of major significance - above and beyond the existing standards of care it must compete with - if the Pharma giants Sanofi (SNY) and Regeneron (REGN) secure approval for their mega-blockbuster Dupixent in the COPD indication, however.

Dupixent drove >$11bn of revenues in 2023, across indications including atopic dermatitis, asthma, rhinosinusitis and prurigo nodularis. The interleukin-4 receptor alpha antagonist has established itself as a first-in-class therapy across multiple disease indications and is expected to hit ~$15bn in peak annual sales. COPD would seem to be an obvious label expansion opportunity for the drug - in its twin clinical studies in the disease, BOREAS and NOTUS, Regeneron reports that:

The primary endpoint was met in both trials, showing Dupixent significantly reduced annualized moderate or severe acute COPD exacerbations by up to 34%, compared to placebo. Dupixent rapidly and significantly improved lung function compared to placebo, with improvements sustained at 52 weeks.

Although not quite as impressive as ensifentrine's data, these results mark out Dupixent as a potential fly in Verona's ointment in the commercial setting, although luckily for Verona, the PDUFA date originally set by the FDA for Dupixent in COPD of June 27th, the day after ensifentrine's PDUFA, has been pushed back by 3 months, as the FDA has "requested additional analyses on the efficacy of Dupixent in the BOREAS and NOTUS pivotal trials," Regeneron reports.

That gives ensifentrine a potential 3-month head-start in the commercial markets, which is a significant positive for the company, even if, eventually, Regeneron and Sanofi's sales and marketing infrastructure may pose a significant threat to ensifentrine's ability to capture market share.

Another advantage ensifentrine has over dupixent is that it is available in nebulizer form, which is the standard form of therapy that COPD patients are used to. Dupixent, a biologic drug, comes as an injectable. Furthermore, Verona management believes Dupixent will address a niche segment of the COPD market, as CEO David Zaccardelli told analysts on the 网页链接{Q1 2024 earnings call}:

Dupixent data supports its use in a subset of patients, those with higher eosinophil count, which I think has been estimated in the U.S. to involve around 300,000 patients that are currently treated. That's of the 8.6 million that are under maintenance treatment in the U.S. So it does look like it's targeted at a fairly small portion of the overall patient population.

Risks To Be Aware Of

Besides the - now-delayed - threat of Dupixent, there are multiple other competitors for Verona to be concerned about, as we can see below:

current COPD maintenance therapies (presentation)

AstraZeneca's (AZN) symbicort earned $2.36bn of revenues last year, while GSK plc's (GSK) Advair earned $1.14bn of revenues. These incumbents will not be easy for Verona to displace, although Verona believes its drug may be used as an add-on therapy, alongside LAMA / LABA / ICS drugs, due to the fact, its research indicates that patients continue to "frequently suffer from persistent symptoms" despite use of these therapies. Verona's research suggests that ~56% of patients are dissatisfied with their current therapy.

Whether insurers will want to bundle two expensive therapies together for one patient is questionable, and it should also be noted that, despite ensifentrine's impressive study data, there are multiple different measures of efficacy around the treatment of COPD, and not every physician will be convinced that this new drug, if approved, is superior to current standards of care, even with its dual mechanism.

Verona has limited experience in the commercial markets, and it is up against some of the world's largest and most influential Pharmas, with established blockbuster products in this indication. Therefore it may take time to establish a foothold in the market, resulting in heavy losses in its first years on the market. Verona does have funding in place, although in the Q! 2024 earnings call management stated that draws under its new debt facility "bear interest at 11%," which seems a high figure and may further impact finances.

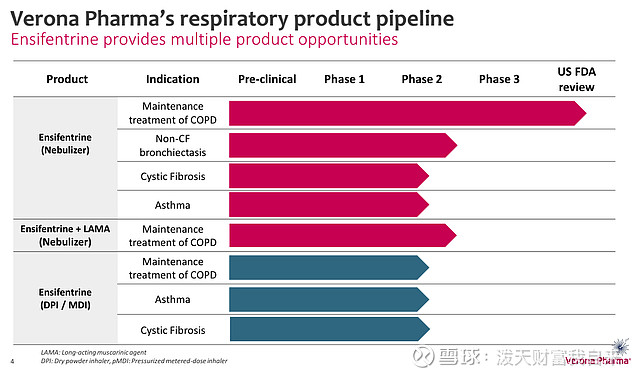

Finally, Verona has no other assets in development besides ensifentrine, a drug it has been solely focused on for the best part of 20 years. If, for any reason, the FDA did decline to approve the drug next week, the company's share price would undoubtedly suffer devastating losses, and potentially impact the other disease targets Verona is pursuing, as shown below:

Veron pipeline (presentation)

Concluding Thoughts - I Make Verona A Buy Ahead Of Its PDUFA, Whilst Acknowledging Some Risks

Occasionally, the stars seem to align for a company, and in Verona's case, the delay to the PDUFA date for Dupixent in COPD is a major boost for the company ahead of the most critical week in its history.

Based on the data shared by the company, the unmet need, and the FDA's decision not to convene an AdComm, I would rate the chances of ensifentrine winning approval next week as high, and based on the market opportunity - 390m patients worldwide, >$10bn in sales, low level of patient satisfaction with current therapies, I'd expect to see Verona's share price rise in response to an approval next week.

Recently, I have noticed a trend of biotech stocks not quite spiking as high as expected upon securing a commercial drug approval, I suspect because a PDUFA date is common knowledge, and therefore the prospect of a successful approval is already baked into the share price, with investor looking to profit in the short term.

Nevertheless, in Verona's case, I'd argue the current market cap undervalues the company substantially, based on the opportunity, although I'd be slightly concerned about the commercial launch - how many physicians and patients will the company be able to reach, and how quickly, and how will rival Pharmas react to the newly launched drug?

Personally, I would have preferred to see Verona raise money via the capital markets rather than through debt, as I do suspect losses may be heavy in the first few years post-launch, in the triple-digit millions.

Nevertheless, the bull case is simply too compelling to ignore - a potential best-in-class drug in a double-digit billion market ought to succeed, and the company that markets and sells the drug deserves a multi-billion dollar valuation, I'd argue. I would also expect Verona to attract some M&A interest also, and would envisage a price tag of >$2.5bn.

Verona Pharma plc stock is not a risk-less investment opportunity by any means, but on balance it is one that may pay off for investors.

This article was written by

网页链接{Edmund Ingham}

11.74K Followers

FollowingEdmund Ingham is a biotech consultant. He has been covering biotech, healthcare, and pharma for over 5 years, and has put together detailed reports of over 1,000 companies. He leads the investing group 网页链接{Haggerston BioHealth}.

The group is for both novice and experienced biotech investors. It provides catalysts to look out for and buy and sell ratings. It also provides product sales and forecasts for all the Big Pharmas, forecasting, integrated financial statements, discounted cash flow analysis and market by market analysis. 网页链接{Learn more}.