作者:大唐炼金师

链接:网页链接

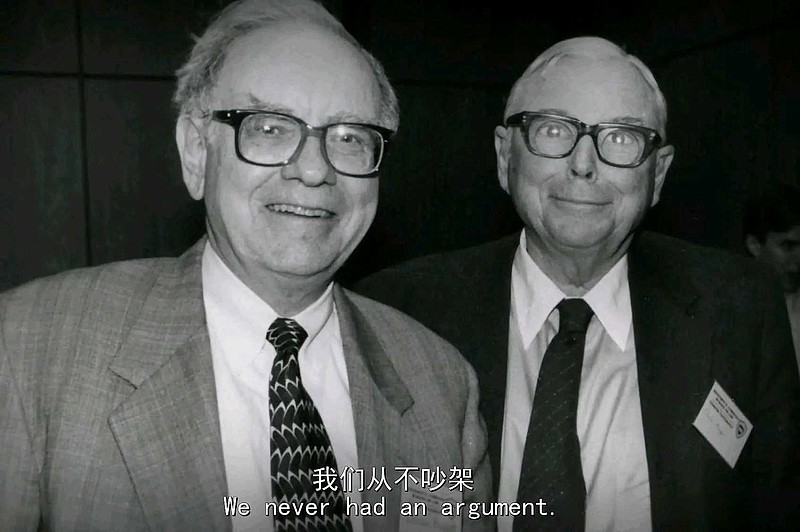

巴菲特在今年初致股东的信中摘录了的芒格经典语录,可以作为查理在伯克希尔的谢幕词,不仅是因为查理的文字也是充满智慧,更包含着这段几十年友情的珍贵。

Nothing Beats Having a Great Partner

拥有一个好搭档比什么都好

Charlie and I think pretty much alike. But what it takes me a page to explain, he sums up in a sentence.

查理和我想法很相似。但我花了一页纸解释的东西,他用一句话就概括了。

His version, moreover, is always more clearly reasoned and also more artfully – some might add bluntly – stated.

此外,他的版本总是逻辑更清晰也更巧妙,有些可能更直言不讳。

Here are a few of his thoughts, many lifted from a very recent podcast:

以下是他的一些想法,很多摘自最近的播客:

1、The world is full of foolish gamblers, and they will not do as well as the patient investor.

世界上到处都是愚蠢的赌徒,他们不会做得像耐心的投资者那样好。

2、If you don’t see the world the way it is, it’s like judging something through a distorted lens.

如果你看世界的方式不是实事求是,那就像是通过扭曲的镜头来判断事物。

3、All I want to know is where I’m going to die, so I’ll never go there. And a related thought: Early on, write your desired obituary – and then behave accordingly.

我只想知道我会死在哪里,这样我就永远不会去那里了。还有一个相关的想法:尽早写下你想要的讣告,然后照着行事。

4、If you don’t care whether you are rational or not, you won’t work on it. Then you will stay irrational and get lousy results.

如果你不在乎自己是否理性,就不会为此付出努力,那么你将一直非理性行事,并因此得到讨厌的结果。

5、Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.

耐心是可以学会的。注意力持续时间长,能够长时间专注于一件事是一个巨大的优势。

6、You can learn a lot from dead people. Read of the deceased you admire and detest.

你可以从历史人物身上学到很多东西,读那些你钦佩或厌恶的人的故事。

7、Don’t bail away in a sinking boat if you can swim to one that is seaworthy.

如果你能游到一艘适航的船上,就不要继续呆在正在下沉的船。

8、A great company keeps working after you are not; a mediocre company won’t do that.

一家伟大的公司会在你不在后保持强劲,而平庸的公司做不到。

9、Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.

沃伦和我不关注市场的泡沫,我们寻找好的长期投资目标,并固执地长期持有。

10、Ben Graham said, “Day to day, the stock market is a voting machine; in the long term it’s a weighing machine.”

If you keep making something more valuable, then some wise person is going to notice it and start buying.

本•格雷厄姆说过:“每天来看,股市都是一台投票机,从长远来看,它就是一台称重机。”

如果你不断创造更有价值的东西,那么一些明智的人就会注意到它,并开始购买。

11、There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.

投资时没有100%确定的事。因此,使用杠杆是危险的(前段时间芒格在阿里上使用杠杆,载了个跟头,这再次告诉我们远离杠杆,以及自省要一天三次),再奇妙的数字乘以0也总是等于0,不要指望能富两次。

12、You don’t, however, need to own a lot of things in order to get rich.

然而,你想要致富并不需要拥有很多东西。

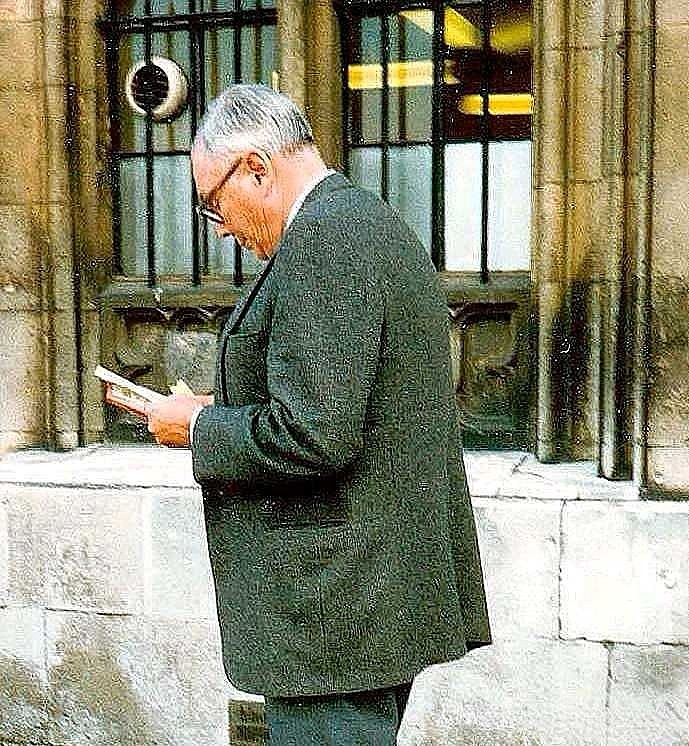

13、You have to keep learning if you want to become a great investor. When the world changes,you must change

如果你想成为一名伟大的投资者,你必须不断学习。当世界发生变化,你必须改变。

14、Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.

数十年来想,沃伦和我一直讨厌铁路股,但世界变了,最终美国有了四条对美国经济至关重要的大型铁路,我们迟迟没有意识到这种变化,但迟到总比不到好。

15、Finally, Iwill add two short sentences by Charlie that have been his decision-clinchers for decades: “Warren, think more about it. You’re smart and I’m right.”

最后,我要加上查理的两句话,这两句话几十年来一直是他做决定的关键:“沃伦,你再想想,你很聪明,我是对的。”

And so it goes. I never have a phone call with Charlie without learning something. And, while he makes me think, he also makes me laugh.

事情就这样,每次和查理通话,我都会有所收获,而且,当他让我思考时,他也让我快乐。

* * * * * * * * * * * *

I will add to Charlie’s list a rule of my own: Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says.

我将在查理的清单上加上我自己的一条规则;找一个非常聪明的高级搭档,最好比你稍大一点,然后非常仔细地听他说什么。

出自2023年巴菲特致股东的信,大唐炼金师2023年2月26日翻译的。