巴菲特致股东的信原文精读Day376:

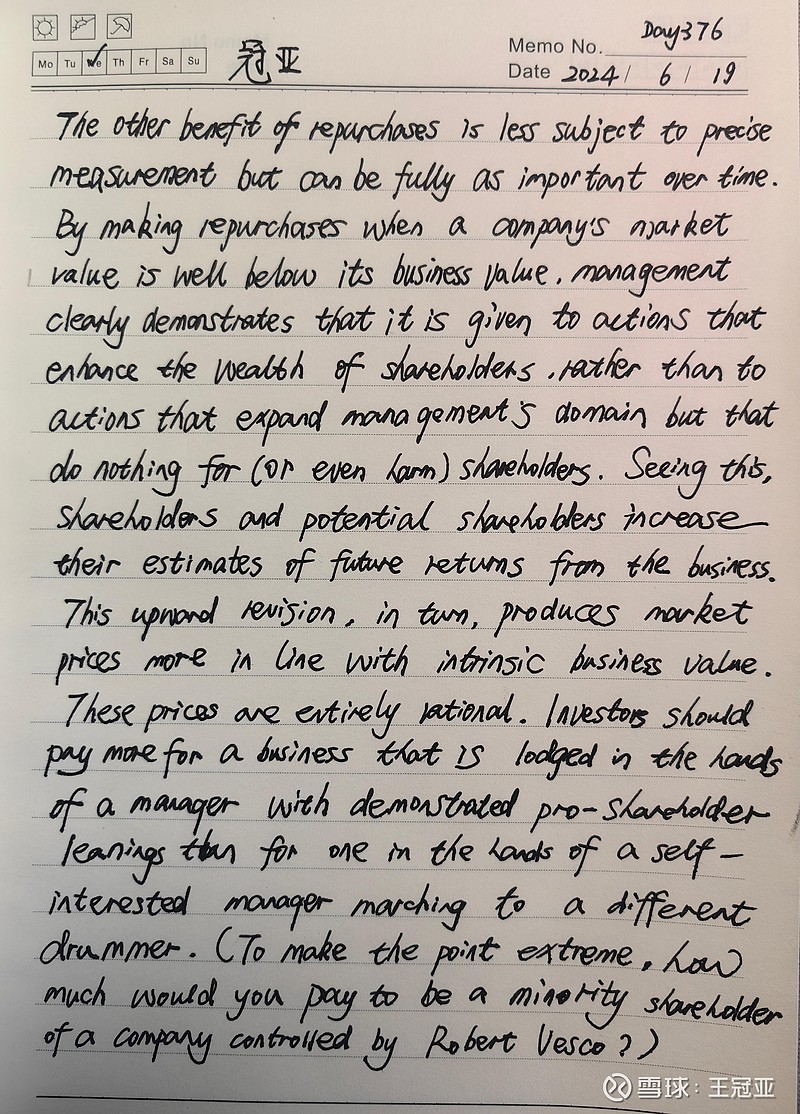

原文:The other benefit of repurchases is less subject to precise measurement but can be fully as important over time. By making repurchases when a company’s market value is well below its business value, management clearly demonstrates that it is given to actions that enhance the wealth of shareholders, rather than to actions that expand management’s domain but that do nothing for (or even harm) shareholders. Seeing this, shareholders and potential shareholders increase their estimates of future returns from the business. This upward revision, in turn, produces market prices more in line with intrinsic business value. These prices are entirely rational. Investors should pay more for a business that is lodged in the hands of a manager with demonstrated pro-shareholder leanings than for one in the hands of a self-interested manager marching to a different drummer. (To make the point extreme, how much would you pay to be a minority shareholder of a company controlled by Robert Vesco?)(1984)

释义:1.“domain”意为“领域”、“势力范围”;

2.“revision”意为“修正”;“in line with”意为“符合……”;

3.“in the hands of”意为“由……控制”;“leanings”意为“倾向”;“drummer”意为“鼓手”。

精译:回购的另一大好处不太容易精确衡量,但随着时间的推移,它可能同样重要。在公司市值远低于其商业价值时进行回购,管理层清楚地表明了自己的立场,他们采取的是增加股东财富的行动,而不是扩大管理版图但对股东没有任何好处(甚至伤害)的行动。看到这一点,股东和潜在股东会调高对未来业务回报的估值。这种向上修正反过来又产生了更符合商业内在价值的市场价格。这些价格是完全合理的。相比于一家由自私自利的管理层掌控的公司,另一家由处处为股东利益着想的管理层运营的公司,投资者理应支付更高的价格。(说得极端一点,如果是罗伯特·威斯科控制的公司,你作为小股东愿意花多少钱?)(1984年)

心得:回购的显性好处是可以有效地增厚股东权益,隐性好处则涉及到管理层的价值观。有能力且以股东利益为导向的管理层,自然会让股东和潜在股东平添很多信心,从而增强对未来的乐观预期,进而推升股价至合理水平。巴菲特提到的罗伯特·威斯科,是美国金融史上著名的诈骗犯,假如与这样的人为伍,你能夜夜安眠么?

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。