巴菲特致股东的信原文精读Day363:

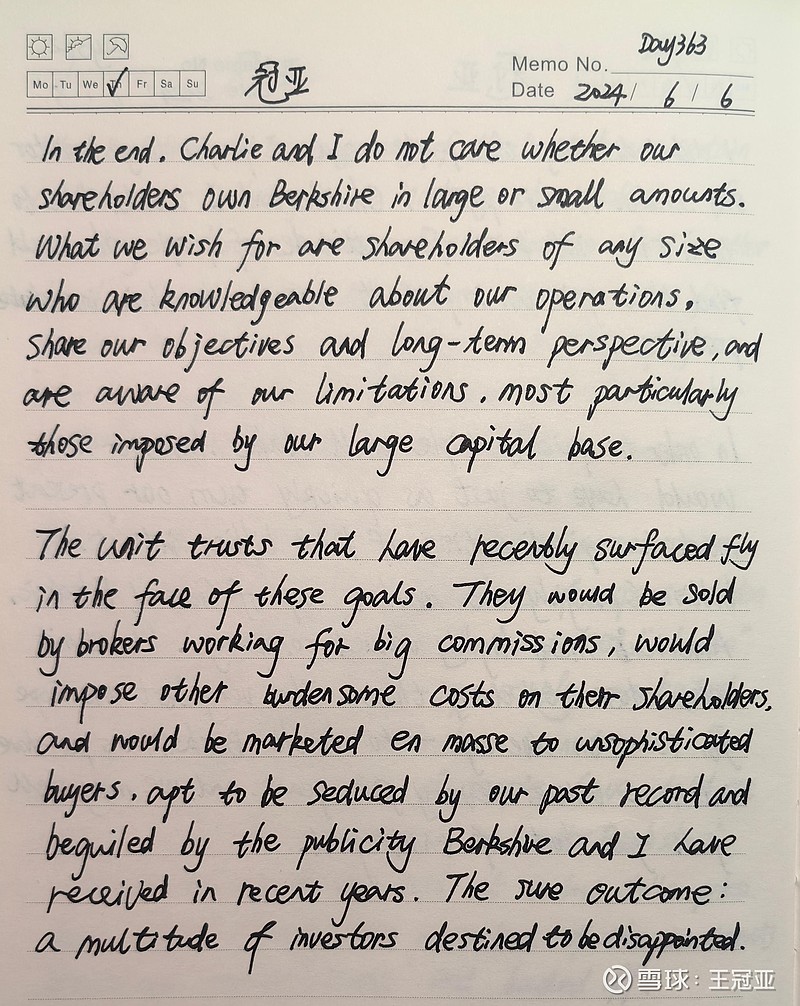

原文:In the end, Charlie and I do not care whether our shareholders own Berkshire in large or small amounts. What we wish for are shareholders of any size who are knowledgeable about our operations, share our objectives and long-term perspective, and are aware of our limitations, most particularly those imposed by our large capital base.

The unit trusts that have recently surfaced fly in the face of these goals. They would be sold by brokers working for big commissions, would impose other burdensome costs on their shareholders, and would be marketed en masse to unsophisticated buyers, apt to be seduced by our past record and beguiled by the publicity Berkshire and I have received in recent years. The sure outcome: a multitude of investors destined to be disappointed.(1995)

释义:1.“imposed by”意为“由……施加的”;

2.“fly in the face of”意为“与……背道而驰”;

3.“burdensome”意为“负担沉重的”;“en masse”意为“全体”;“unsophisticated”意为“涉世未深的”;“seduced by”意为“被……引诱”;“beguiled by”意为“被……所迷住”。

精译:总而言之,我和芒格并不在乎股东持有伯克希尔股票是多是少。我们希望的是,无论股东是大是小,他们都能熟知我们的运营情况,分享我们的目标和长期愿景,并意识到我们的局限性,尤其是我们庞大的资本规模所造成的局限性。

最近出现的单位信托基金与这些目标背道而驰。经纪商会兜售它们,以赚取高额佣金,这会给股东们带来其他沉重的成本;经纪商还会大肆推销给懵懂的买家,他们容易被我们过去的业绩记录所吸引,被近年来伯克希尔和我所获得的公开宣传所诱惑。结果可想而知:众多投资者注定会大失所望。(1995年)

心得:为什么要发行B类股票?巴菲特已经说得非常直白了:自己在伯克希尔苦心经营多年,一直珍视声誉,然而现在的经纪商却想打着“100%复制伯克希尔”的旗号大发横财,其实质是透支巴菲特的声誉以满足一己之私,这自然是巴菲特所不能容忍的。

手抄:

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。