各位球友周末好。今天推荐塞斯·卡拉曼(Seth Klarman)的一篇名作——《安全边际》第五章《定义你的投资目标》。

我很喜欢这一篇文章,诚意推荐给对价值投资有兴趣的朋友。

《安全边际》是卡拉曼35岁时的作品(1991年出版),是价值投资领域的经典著作——我个人认为,仅凭这本书就足以在价值投资的理论大厦留下他的名字。

在这一篇文章中,卡拉曼的观点直接、鲜明且锐利。

卡拉曼认为,投资者为收益率设定目标的做法是错误的,设定此目标并不会对实现目标提供任何帮助。假设你宣称希望获得每年15%的收益率,但这一目标并没有告诉,你该如何实现它。

投资收益率与你工作时间多长、工作多么努力或赚钱的愿望有多么强烈无关。挖沟的工人可以通过加班1小时而额外报酬,但投资者无法通过更努力的工作或思考来实现更高的报酬——投资收益不是工作时长的直接函数、不是努力程度的直接函数、不是赚钱意愿的直接函数。

投资者所能做的一切就是遵从一种受到纪律约束的严格方法, 而随着时间的推移,最终获得回报,为投资收益率设定目标会导致投资者只关注上涨潜力而忽视下跌风险。

因而,投资者的首要目标应该是回避亏损(avoiding loss should be the primary goal of every investor)——这就是价值投资的核心观点,也即霍华德马克斯说的价值投资是“防御性投资”。

这一观点论证过程非常精彩,绝对值得抽时间细看,最好是直接阅读英文。

另外值得一提的是,《安全边际》这本书早已经绝版,英文版一书难求(网络拍卖贼贵),中文版更是从未出版过。

因此,读者今天能买到的中文版《安全边际》一书,均为多年前某个读者自行翻译的影印版,而非正式出版物。该译本多少存在一些问题,较为影响阅读体验。

不过,技术发展日新月异,机器翻译已经能做出很不错的效果,有时其质量甚至超越个别不负责任的出版社和译者。因此,不习惯阅读英文的读者,不妨参考阅读机器翻译的“作品”——这或许是新时代赋予的阅读新选项。

我将卡拉曼的文章做了机器翻译(DeepL为主),个别语句做了人工修改,附在英文下下方。如有语义分歧请以英文为准,中文仅供参考。

阅读愉快。

第五章 Defining Your Investment Goals

定义你的投资目标

Warren Buffett likes to say that the first rule of investing is “Don’t lose money”, and the second rule is, “Never forget the first rule”. I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather “don’t lose money” means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

沃伦-巴菲特喜欢说,投资的第一条规则是 "不要亏损",第二条规则是,"永远不要忘记第一条规则"。我也相信,避免损失应该是每个投资者的首要目标。这并不意味着投资者根本就不应该承担任何损失的风险。相反,"不要亏损 "是指在几年内,投资组合不应面临本金的明显损失。

While no one wishes to incur losses, you couldn’t prove it from an examination of the behavior of most investors and speculators. The speculative urge that lies within most of us is strong; the prospect of a free lunch can be compelling, especially when others have already seemingly partaken. It can be hard to concentrate on potential losses while others are greedily reaching for gains and your broker is on the phone offering shares in the latest “hot” initial public offering. Yet the avoidance of loss is the surest way to ensure a profitable outcome.

虽然没有人希望招致损失,但从大多数投资者和投机者的行为来看,你无法证明这一点。我们大多数人内心的投机冲动是强烈的;免费午餐的前景可能是令人信服的,特别是当其他人似乎已经吃过了。当别人在贪婪地获取收益,而你的经纪人在电话中提供最新的 "热门 "首次公开募股的股票时,你可能很难专注于潜在的损失。然而,避免损失是确保盈利的最可靠方法。

A loss-avoidance strategy is at odds with recent conventional market wisdom.Today many people believe that risk comes, not from owning stocks, but from not owning them.Stocks as a group, this line of thinking goes, will outperform bonds or cash equivalents over time, just as they have in the past. Indexing is one manifestation of this view. The tendency of most institutional investors to be fully invested at all times is another.

避免损失的策略与最近的传统市场智慧相抵触。今天许多人认为,风险不是来自拥有股票,而是来自不拥有股票。这种思路认为,股票作为一个群体,随着时间的推移,其表现将超过债券或现金等价物,就像它们在过去一样。指数化是这种观点的一种表现形式。大多数机构投资者在任何时候都充分投资的倾向是另一种观点。

There is an element of truth to this notion; stocks do figure to outperform bonds and cash over the years. Being junior in a company’s capital structure and lacking contractual cash flows and maturity dates, equities are inherently riskier than debt instruments. In a corporate liquidation, for example, the equity only receives the residual after all liabilities are satisfied. To persuade investors to venture into equities rather than safer debt instruments, they must be enticed by the prospect of higher returns.

However, as discussed at greater length in chapter 7, the actual risk of a particular investment cannot be determined from historical data. It depends on the price paid. If enough investors believe the argument that equities will offer the best long-term returns, they may pour money into stocks, bidding prices up to levels at which they no longer offer the superior returns. The risk of loss stemming from equity’s place in the capital structure is exacerbated by paying a higher price.

这种观点有一定的道理;多年来,股票的表现确实优于债券和现金。股票在公司的资本结构中处于次要地位,没有合同规定的现金流和到期日,因此,股票在本质上比债务工具风险更大。例如,在公司清算中,股权只有在所有债务得到满足后才能获得剩余的资金。为了说服投资者冒险进入股票而不是更安全的债务工具,他们必须被更高的回报前景所吸引。

然而,正如第七章中详细讨论的那样,某项投资的实际风险不能由历史数据确定,它取决于支付的价格。如果有足够多的投资者相信股票将提供最好的长期回报的说法,他们可能会把钱投入到股票中,把价格抬高到不再提供卓越回报的水平。因股票在资本结构中的地位而产生的损失风险会因支付更高的价格而加剧。

Another common belief is that risk avoidance is incompatible with investment success. This view holds that high return is attainable only by incurring high risk and that long-term investment success is attainable only by seeking out and bearing, rather than avoiding, risk. Why do I believe, conversely, that risk avoidance is the single most important element of an investment program?

If you had $1,000, would you be willing to wager it, double or nothing, on a fair coin toss? Probably not. Would you risk your entire net worth on such a gamble? Of course not. Would you risk the loss of, say, 30% of your net worth for an equivalent gain? Not many people would because the loss of a substantial amount of money could impair their standard of living while a comparable gain might not improve it commensurately.

If you are one of the vast majority of investors who are risk averse, then loss avoidance must be the cornerstone of your investment philosophy.

另一个常见的信念是,规避风险与投资成功是不相容的。这种观点认为,只有承担高风险才能获得高回报,只有寻求和承担而不是回避风险,才能获得长期的投资成功。相反,为什么我认为规避风险是一个投资计划中最重要的因素呢?

如果你有1,000美元,你愿意把它作为赌注,不管是双倍还是零,都押在一个公平的抛硬币上吗?可能不会。你会把你的全部净资产放在这种赌博上吗?当然不会。你会冒着损失30%的净资产的风险来换取同等的收益吗?没有多少人会这么做,因为损失大量的钱可能会损害他们的生活水平,而类似的收益可能不会相应地提高他们的生活水平。

如果你是绝大多数厌恶风险的投资者之一,那么避免损失必须是你投资理念的基石。

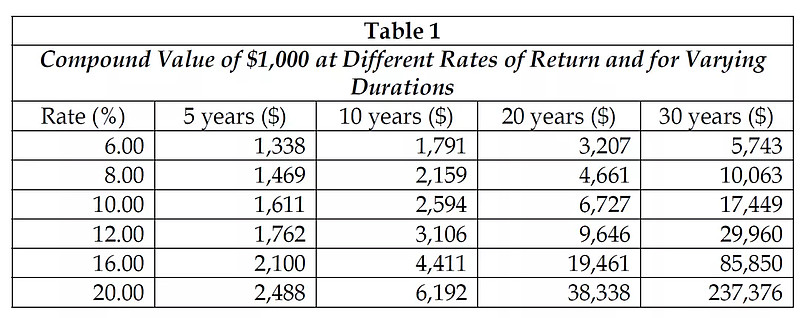

Greedy, short-term-oriented investors may lose sight of a sound mathematical reason for avoiding loss: the effects of compounding even moderate returns over many years are compelling, if not downright mind boggling. Table 1 shows the delightful effects of compounding even relatively small amounts.

贪婪的、以短期为导向的投资者可能会忽视避免损失的一个合理的数学理由:即使是多年的适度回报,复利的效果也是令人信服的,甚至是完全令人难以置信的。表1显示了即使是相对较小金额的复利也会产生令人愉快的效果。

As the table illustrates, perseverance at even relatively modest rates of return is of the utmost importance in compounding your net worth.A corollary to the importance of compounding is that it is very difficult to recover from even one large loss, which could literally destroy all at once the beneficial effects of many years of investment success.

正如该表所示,即使是相对较低的回报率,坚持不懈对你的净资产复利也是最重要的。复利的重要性的一个推论是,即使只出现过一次巨额亏损也很难让你恢复过来,这简直可以一下子摧毁多年来投资成功的有利影响。

In other words, an investor is more likely to do well by achieving consistently good returns with limited downside risk than by achieving volatile and sometimes even spectacular gains but with considerable risk of principal.

换句话说,一个投资者更有可能在有限的下跌风险下获得持续良好的回报,而不是获得不稳定的、有时甚至是惊人的收益,但却有相当大的本金风险。

An investor who earns 16% annual returns over a decade, for example, will, perhaps surprisingly, end up with more money than an investor who earns 20% a year for nine years and then loses 15% the tenth year.

例如,一个在十年内获得16%年收益的投资者,也许令人惊讶的是,他最终会比一个在九年内获得20%年收益,然后在第十年损失15%的投资者拥有更多的钱。

(CxEric注:这个例子非常精彩。连续十年16%,最终净值4.411;前9年20%、最后一年亏15%,最终净值4.386)

There is an understandable, albeit uneconomic, appeal to the latter pattern of returns, however. The second investor will outperform the former nine years out of ten, gaining considerable psychic income from this apparently superior performance. If both investors are money management professionals, the latter may also have a happier clientele (90% of the time, they will be doing better) and thus a more successful company. This may help to explain why risk avoidance is not the primary focus of most institutional investors.

然而,后一种回报模式的吸引力是可以理解的,尽管不经济。第二个投资者在10年中有9年的表现会优于前者,从这种明显的优异表现中获得相当大的心理收入。如果两个投资者都是资金管理专家,那么后者也可能有一个更快乐的客户(90%的时候,他们会做得更好),从而使公司更加成功。这可能有助于解释为什么风险规避不是大多数机构投资者的主要焦点。

One of the recurrent themes of this book is that the future is unpredictable. No one knows whether the economy will shrink or grow (or how fast), what the rate of inflation will be, and whether interest rates and share prices will rise or fall. Investors intent on avoiding loss consequently must position themselves to survive and even prosper under any circumstances.

Bad luck can befall you; mistakes happen. The river may overflow its banks only once or twice in a century, but you still buy flood insurance on your house each year. Similarly we may only have one or two economic depressions or financial panics in a century and hyperinflation may never ruin the U.S. economy, but the prudent, farsighted investor manages his or her portfolio with the knowledge that financial catastrophes can and do occur. Investors must be willing to forego some near-term return, if necessary, as an insurance premium against unexpected and unpredictable adversity.

本书的一个反复出现的主题是,未来是不可预测的。没有人知道经济是收缩还是增长(或多快),通货膨胀率是多少,以及利率和股票价格是上升还是下降。因此,有意避免损失的投资者必须为自己定位,以便在任何情况下都能生存,甚至繁荣。

坏运气可能降临到你身上;错误会发生。河流在一个世纪内可能只溢出河岸一两次,但你仍然每年为你的房子购买洪水保险。同样,我们可能在一个世纪里只发生一两次经济萧条或金融恐慌,恶性通货膨胀可能永远不会毁掉美国经济,但谨慎的、有远见的投资者在管理他或她的投资组合时,知道金融灾难可能而且确实发生。如果有必要,投资者必须愿意放弃一些近期的回报,作为对意外和不可预测的逆境的保险费。

Choosing to avoid loss is not a complete investment strategy; it says nothing about what to buy and sell, about which risks are acceptable and which are not. A loss-avoidance strategy does not mean that investors should hold all or even half of their portfolios in U.S. Treasury bills or own sizable caches of gold bullion. Rather, investors must be aware that the world can change unexpectedly and sometimes dramatically; the future may be very different from the present or recent past. Investors must be prepared for any eventuality.

选择避免损失并不是一个完整的投资策略;它没有说要买什么和卖什么,没有说哪些风险是可以接受的,哪些是不可以的。避免损失的策略并不意味着投资者应该持有全部或甚至一半的投资组合的美国国库券,或拥有大量的金条。相反,投资者必须意识到,世界可能会发生意想不到的变化,有时甚至是巨大的变化;未来可能会与现在或最近的过去大不相同。投资者必须为任何可能发生的情况做好准备。

Many investors mistakenly establish an investment goal of achieving a specific rate of return. Setting a goal, unfortunately, does not make that return achievable. Indeed, no matter what the goal, it may be out of reach. Stating that you want to earn, say, 15% a year, does not tell you a thing about how to achieve it.

许多投资者错误地建立了一个实现特定回报率的投资目标。不幸的是,设定一个目标并不能使该回报率得以实现。事实上,不管是什么目标,都可能是遥不可及的。宣称你想赚取,比如说,每年15%的收益,并没有告诉你如何实现它。

Investment returns are not a direct function of how long or hard you work or how much you wish to earn. A ditch digger can work an hour of overtime for extra pay, and a piece worker earns more the more he or she produces. An investor cannot decide to think harder or put in overtime in order to achieve a higher return.

投资回报并不是你工作多长时间或多努力的直接函数,也不是你希望赚多少钱的直接函数。一个挖沟的人可以加班一小时以获得额外的报酬,一个计件工人生产得越多,他或她的收入就越多。投资者不能决定为了获得更高的回报而更加努力地思考或加班工作。

All an investor can do is follow a consistently disciplined and rigorous approach; over time the returns will come.

投资者所能做的就是遵循一贯的纪律和严格的方法;随着时间的推移,回报会到来。

Targeting investment returns leads investors to focus on upside potential rather than on downside risk. Depending on the level of security prices, investors may have to incur considerable downside risk to have a chance of meeting predetermined return objectives. If Treasury bills yield 6%, more cannot be achieved from owning them. If thirty-year government bonds yield 8%, it is possible, for a while, to achieve a 15% annual return through capital appreciation resulting from a decline in interest rates. If the bonds are held to maturity, however, the return will be 8%.

以投资回报为目标引导投资者关注上升的潜力,而不是下降的风险。根据证券价格的水平,投资者可能必须承担相当大的下行风险才有机会达到预定的回报目标。如果国库券的收益率为6%,则不能通过拥有国库券来实现更多的收益。如果30年的政府债券收益率为8%,那么在一段时间内,通过利率下降带来的资本增值,有可能实现15%的年收益。然而,如果债券被持有至到期,回报率将是8%。

Stocks do not have the firm mathematical tether afforded by the contractual nature of the cash flows of a high-grade bond. Stocks, for example, have no maturity date or price. Moreover, while the value of a stock is ultimately tied to the performance of the underlying business, the potential profit from owning a stock is much more ambiguous. Specifically, the owner of a stock does not receive the cash flows from a business; he or she profits from appreciation in the share price, presumably as the market incorporates fundamental business developments into that price.

Investors thus tend to predict their returns from investing in equities by predicting future stock prices. Since stock prices do not appreciate in a predictable fashion but fluctuate unevenly over time, almost any forecast can be made and justified. It is thus possible to predict the achievement of any desired level of return simply by fiddling with one’s estimate of future share prices.

股票没有高等级债券的现金流的合同性质所提供的坚实的数学束缚。例如,股票没有到期日或价格。此外,虽然股票的价值最终与相关企业的业绩挂钩,但拥有股票的潜在利润要模糊得多。具体来说,股票的拥有者并没有得到企业的现金流;他或她从股价的升值中获利,大概是市场将基本的业务发展纳入了该价格。

因此,投资者倾向于通过预测未来的股票价格来预测他们在股票上的投资回报。由于股票价格不会以可预测的方式升值,而是随着时间的推移而不均匀地波动,因此几乎任何预测都是可以做出并证明其合理性的。因此,仅仅通过摆弄自己对未来股价的估算,就有可能预测出任何期望的回报水平。

In the long run, however, stock prices are also tethered, albeit more loosely than bonds, to the performance of the underlying businesses. If the prevailing stock price is not warranted by underlying value, it will eventually fall. Those who bought in at a price that itself reflected overly optimistic assumptions will incur losses.

然而,从长远来看,股票价格也与相关企业的业绩联系在一起(尽管比债券要松散)。如果当时的股票价格没有内在价值的保证,它最终会下跌。那些以反映过于乐观假设的价格买入的人将会遭受损失。

Rather than targeting a desired rate of return, even an eminently reasonable one, investors should target risk. Treasury bills are the closest thing to a risk-less investment; hence the interest rate on Treasury bills is considered the risk-free rate. Since investors always have the option of holding all of their money in T-bills, investments that involve risk should only be made if they hold the promise of considerably higher returns than those available without risk. This does not express an investment preference for T-bills; to the contrary, you would rather be fully invested in superior alternatives. But alternatives with some risk attached are superior only if the return more than fully compensates for the risk.

投资者应该以风险为目标,而不是以理想的回报率为目标,即使是一个非常合理的回报率。国库券是最接近无风险的投资;因此国库券的利率被认为是无风险利率。由于投资者总是可以选择将所有的钱都持有国库券,所以只有当涉及风险的投资承诺比没有风险的投资有更高的回报时,才应该进行投资。这并不表示对国库券的投资偏好;恰恰相反,你宁可完全投资于优越的替代品。但是,只有当收益超过了对风险的完全补偿时,附带一些风险的替代品才是优越的。

Most investment approaches do not focus on loss avoidance or on an assessment of the real risks of an investment compared with its return. Only one that I know does: value investing. Chapter 6 describes value investing; chapter 7 elaborates on three of its central underpinnings. Both chapters expand on the theme of loss avoidance and consider various means of achieving this objective.

大多数投资方法都不注重避免损失,也不注重评估一项投资的实际风险与收益的比较。据我所知,只有一种是这样的:价值投资。第6章描述了价值投资;第7章阐述了它的三个核心支撑点。这两章都对避免损失这一主题进行了扩展,并考虑了实现这一目标的各种手段。

$格力电器(SZ000651)$ $福耀玻璃(SH600660)$ $上证指数(SH000001)$

P.S.

本文先发于个人公众号,那里的排版会好一些。

有兴趣的朋友可以前往关注。

公众号:CxEric的读书与投资笔记(cxericreading)