NQ – where are your users?

For a $1B market cap consumer Internet company that derived >50%of its revenue (2012) from China with an estimated ~60% market share, NQ’susers in China are highly elusive. Basedon two rounds of consumer surveys and retail store checks, we weren’t able tofind a single user of NQ security in China.

Our two surveys on 188 consumers were done in the past two years China, covering Beijing, Shanghai, Tianjin (1st tiercities), four rich provincial capitals/equivalents (2nd tier cities), two poor provincial capitals (3rd tier cities), and two 4th tier cities. We also visited5 carrier stores, 6 consumer gadget retailers, and 9 prepaid card vendors in two rich provincial capitals, one tier 1 city, and two tier 4 cities.

First, of the 11 retail outlets (carrier stores, gadgetstores), we found one case of NQ pre-installation. Of the 9 card vendors, none of them soldmobile security top-up cards, nor did the vendors show awareness of such aproduct as a sale item. The answers wereceived upon inquiry for mobile security product were either “there’s no needfor mobile security” (50% of the cases), or “you should download 360 (Qihoo)and Kingsoft, free of charge” (50%).

Of the total 188 consumers, when asked which securitysoftware they use on their mobile phone, 103 mentioned 360 Qihoo, 6 mentioned Kingsoft,10 mentioned QQ, 14 mentioned other security product, zero mentioned NQ, and 60mentioned “unknown/none”. The numbersadd up to more than 188, due to some users carrying two products on theirphones.

In short, of the 188 consumers we surveyed across China frommid-2012 to mid-2013, there were zero mentions of NQ security, but plenty ofother security product users, contradicting the ~60% market share that NQ cited. Furthermore, of the users who installed anymobile security product, none of them had intention to pay for it. The reason is quite simple –Qihoo 360, thedominant mobile security provider in China, offers the service for free.

NQ’s China consumer revenue in 2012 was reported as $43M(total revenue less overseas revenue less NationSky revenue), or RMB 266M. At RMB 2 per month per user, this boils downto 11M monthly paying users (RMB 266M /12 months / RMB 2 = 11M). To put thisinto perspective, SINA Weibo, the ubiquitous Twitter-like service in China, hadan monthly active user (MAU) of 81M, and it includes MAUs from the desktop PCs,as well as mobile phones. Therefore, anMAU of 11M on mobile phone alone should definitely be observable, which is notwhat we found in our survey.

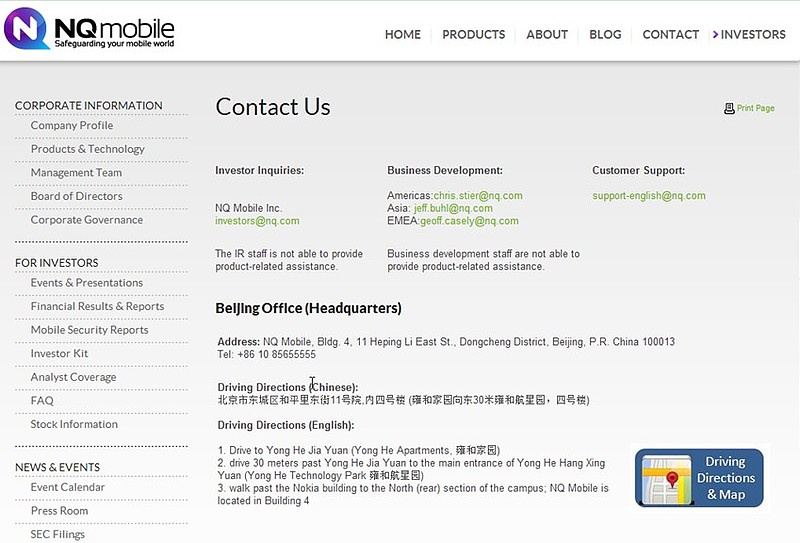

In light of the fact that mobile billing agent Yidatongaccounted for 22% of 2012 revenue, or $20.3M, or 47% of the above mentioned $43MNQ China security revenue, we dug into this company. Yidatong’s founder was described by NQ’s managementas a consultant, and Yidatong was characterized as an independent third party. However, Yidatong website (which took us awhile to find) shows that it has the exact same address as NQ, and the Websitelooks like it has not been maintained for years, hardly the sign of a companytrying to court a variety of customers. Here is the contact page of Yidatong’s dust-gathering Website, circa2009. For the rest of the pages from Yidatong’s simple Web site, refer to theappendix, the last page of which shows NQ’s address, exactly the same as Yidatong.

Speaking of consultants, besides Yidatong’s founder, NQ hasa lot of non-employee consultants, whom it incentivizes with stockoptions. NQ had 378 and 387 employees atyear end 2010 and 2011, but there were at least 69 and 70 non-employeeconsultants during 2010 and 2011, respectively, amounting to 18% of employees. As shown by this disclosure:

A one-product software tool company using outside consultantsequaling 18% of its own workforce? That’s a little unusual, to say the least. The number of options given to theconsultants is not trivial either:

NQ had cash and cash equivalent balance of $127M at year end2012. It clearly could afford to pay those70 non-employee consultants in cash in 2012. Instead, it paid them equity on Jul 10, 2012, when share price wasdeemed by management as “unacceptably” low at ~$8. The only explanation is that NQ wanted theseconsultants to have a vested interest in NQ’s shares.

SinoMR, a market research firm, gave NQ a mobile securitymarket share north of 60% in China in one of its reports, which stands in starkcontrast to our survey and the feedback from many observers of Chinese mobilesecurity market. Is the author of theSinoMR report one of those consultants receiving NQ stock options? We don’t know for sure, but it will notsurprise us if he/she is.

In all, NQ paid out nearly 27% of its revenue in stock basedcompensation in 2011, 2012, and first half of 2013. We don’t know of any other public companythat can match this level of stock based compensation. Do you?

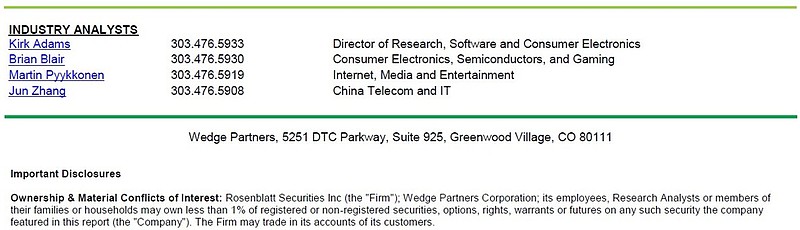

Wedge Partners, not to be confused with the old WedgePartners that was one of the earliest to doubt Longtop (LFT)’s financialintegrity (that part of the Wedge Partners went on to form J Capital, who isrecommending its client to short NQ), is one of the most bullish broker onNQ. But bear in mind it may own NQshares in its asset management arm (and definitely owned NQ in the past). See below (taken from a Wedge report datedSep 2013):

MattMathison, the VP of Capital Markets for NQ, was most recently a portfoliomanager at Wedge Partner asset management. Bloomberg shows him as continue to be affiliated with Wedge PartnerAsset Management, from his e-mail address below. This potential conflict of interest betweenWedge Partners and NQ should be front and center for any investor readingWedge’s reports.

Whatabout NQ’s foreign mobile security markets? NQ reported $18M and $36M in revenue from consumer security fromoverseas markets in 2011 and 2012. Weknow it’s not Western Europe or North America, and NQ affirmed that its overseas markets areindeed developing markets such as BRIC. Sincethe 2013 America Movil partnership marked NQ’s entry into Latin America, we know thislist of countries can only be North Asia, Southeast Asia, South Asia, MiddleEast, Eastern Europe, and Africa. We canfurther rule out Japan, Korea, and India as meaningful contributors to thoserevenue lines, since in June 2012, NQ just started to enter them, based onthese statements

While we don’t have on the ground checks to go by, intuitiontells us that due to the small population of Eastern Europe, NQ’s overseasusers must be primarily residing in third-world countries. It’s hard to imagine this group as morewilling to pay for mobile security than the Chinese consumers.

Q-tel, the national carrier in Qatar, told us that NQ wasonce in Qatar as a Symbian security provider, but had been largely phased out, as of mid-2012.

Having probed into the money-making ability of NQ consumersecurity, it’s not any surprise that NQ added scant cash to its balance sheetin 2011 and 2012. If we exclude cashraised from IPO and pre-IPO financing totaling $81M, the most recent net cashand cash equivalent balance was $47M as of Q2 2013, only $18M higher than the $29Mas of Q4 2010. Accounts receivables ateinto cash flow, and acquisitions and investments also added to the burn.

Using end of quarter accounts receivable balance andquarterly revenue, we calculated NQ’s DSO to be 144, 149, 146, 153, 145, 149,143, 167, 173, 157 the past ten quarters. So it’s in the 150-170 range, and not easing up as of late. NQ said the long DSO was caused by overseasmarkets, where this metric can run above 200. Let’s exercise some common sense as an investor, if a revenue dollartakes over 200 days to collect, it undoubtedly shows the customer (telcos orprepaid card distributors in those foreign countries) has tremendous poweragainst the supplier (NQ), which reflects on the highly discretionary nature ofthe product NQ offers. At some point,investor has to draw the line and decide whether this revenue is collectible,or even grimmer, whether this revenue was made up in the first place. The only difference between an extremely hardto collect revenue dollar and a made-up revenue dollar is investor faith.

Curiously, there is no A/R aging disclosure in NQ’s filings.

Oh, and CFO just got replaced. If he was let go, why? After all, the stock tripled in the last two monthsof his oversight? If he leftvoluntarily, why?

2013 saw NQ entering the US and Latin American markets. Can NQ land major carrier wins in theUS? Lookout Mobile, an Accel portfoliocompany, already locked in T-Mobile (together with MetroPCS), Deutsche Telekom,Sprint, and AT&T at the carrier level. Verizon currently white labels Juniper. While NQ has won some independent Verizon dealers, it won’t be easycompeting with Lookout on its home turf for a major carrier level win. The only carrier deals NQ has got are 1%market share holder Leap (being acquired by AT&T, so a potential switchoverto LookOut) and 1% market share holder US Wireless. With the US carriers’ boycott of Huaweiequipment on national security grounds, we wonder how promising NQ will be as asecurity provider for millions of US consumers.

Can NQ’s partnership with America Movil lead to significantrevenue? The deal was announced inMarch, and the first market, Mexico, was said to have launched in June. Latin America is a predominantly prepaidmarket, which means carriers mostly do not subsidize phones, and therefore don’tcontrol apps pre-installation on phones. And like China and other developingcountries, the per capita income is low. The lack of new announcements from Latin America over the past sevenmonths is uncharacteristic of NQ, which has been issuing press releases every three days or so. We shall see how this pans out. But what if a substantial portion of revenuein 2012 were indeed bad debt? Will anypotential success in Latin America even matter?

Up to now, we focused on the consumer securitycompany NQ, the part of NQ that did all the heavy lifting in “revenue andprofit” generation. 2013 has been a yearthat NQ declares itself to be a “platform” company able to make money from mobilegaming, advertising, and search. Can NQsuccessfully “pivot” from a questionable past (at best) to mobile rock stardom? In the next chapter, we shall examine everyone of those new initiatives.

Appendix:

The rest of Yidatong’s Website: