译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Distressed in Distressing Times

by Kevin Horan

Jeff Gundlach has been recently quoted as asking, “the Fed can buy up corporate bond ETFs and thereby prop up prices of corporate bonds, but what happens when there are defaults and the artificial Fed price is replaced by the recovery value?”

据传债王JeffGundlach最近问了这么一个问题,“联储可以把专门投资美国公司债的交易所交易基金全买光,这样就可以推高公司债的报价水平,但是如果公司债市场出现违约并且联储明显偏离市场水平的报价被回收价值取而代之会发生什么?”

回收价值是指在公司债发行人违约的情况下,投资者能通过破产清算收回的本金,一般以百分比表示。

We have already seen how the S&P U.S. Corporate Investment Grade Corporate Bond Index, an index of 7,000+ bonds whose constituents’ option-adjusted spread (OAS) topped out at 568 at the beginning of March 2020, now contains 99 bonds with an OAS greater than 1,000. Though not all are Energy sector bonds, 51 of the 99 are as the virus and the currently low price of oil take their toll on the economy and energy industry.

标准普尔美国投资级公司债指数中7,000多只成分券的经期权调整后的信用利差在3月初触及到568个基点的高位,其中有99只成分券的经期权调整后的信用利差超过了1,000个基点。尽管这些债券的发行人并非全部来自能源行业,但其中有51只券来自因受到新冠疫情和当前正在走低的油价影响而损失惨重的能源行业。

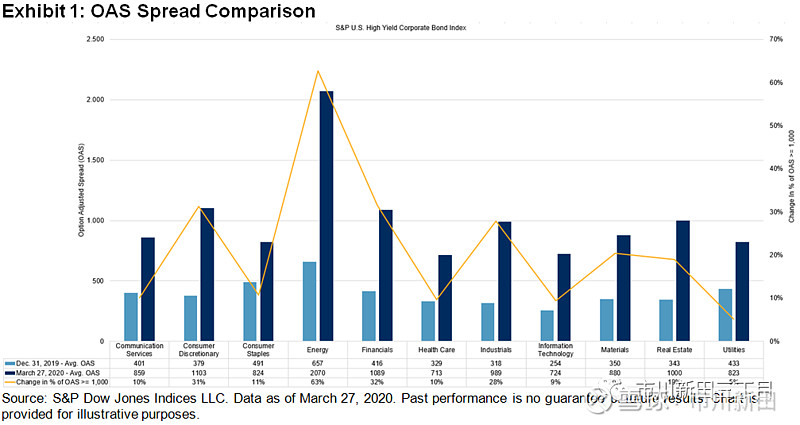

Moving down the credit scale and looking at more speculative-grade securities, the effects are even greater. Year to date, the S&P U.S. High Yield Corporate Bond Index has seen a fair amount of spread widening, as seen in Exhibit 1. In addition to the movement in OAS spreads, the amount of debt per sector that is at or above an OAS of 1,000 (distressed) has also increased since the beginning of the year. Distressed bonds will be an early indicator of issuers that may end up in default.

再看看评级更低、投机色彩更浓的公司债的情况就会发现,这些债券受到的影响更大。年初至今,标准普尔美国高收益债指数成分券的经期权调整后的信用利差在大幅走阔,见图1。

图中浅蓝色线柱代表的是2019年12月31日的信用利差水平,深蓝色线柱代表的是2020年3月27日的信用利差水平

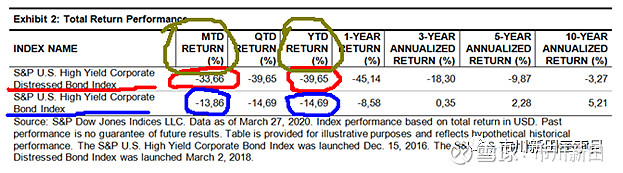

The S&P U.S. High Yield Corporate Distressed Bond Index is a sub-index of the S&P U.S. High Yield Corporate Bond Index, which focuses on bonds whose OAS are 1,000 or greater. The negative effects of the current market can be seen in its performance as the index is down more than twice as much as its parent index on both a month-to-date and year-to-date basis.

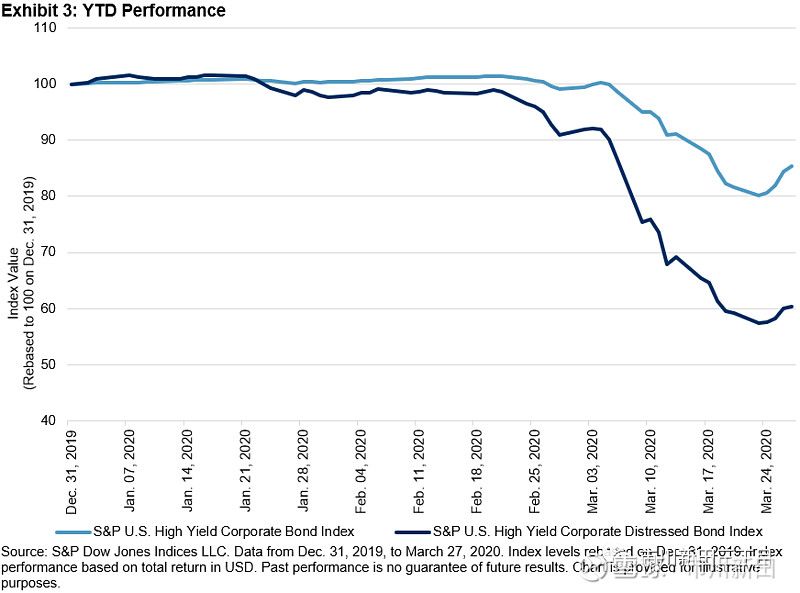

标准普尔美国不良债务级高收益债指数是标准普尔美国高收益债指数的一个细分指数,跟踪的是经期权调整后的信用利差水平大于等于1000个基点的公司债的走势。当前市场动荡带来的负面影响通过该指数的走势可以看得很清楚,因该指数年初至今以及本月至今的跌幅均超过了标准普尔美国高收益债指数的跌幅,见下图。

年初至今,标准普尔美国不良债务级高收益债指数(深蓝线)和标准普尔美国高收益债指数(浅蓝线)的走势对比

The S&P U.S. High Yield Corporate Distressed Bond Index, when measured on a market-weighted basis, accounts for 3.8% of its benchmark index, though since its first value date on Jan. 31, 2000, it has averaged 9.6% and was as high as 77% on Dec. 31, 2008.

标准普尔美国不良债务级高收益债指数中各成分券的市值在整个美国高收益债市场总量中的占比为3.8%,该指数自2000年1月31日推出以来这个占比的均值为9.6%, 在2008年12月31日则高达77%。

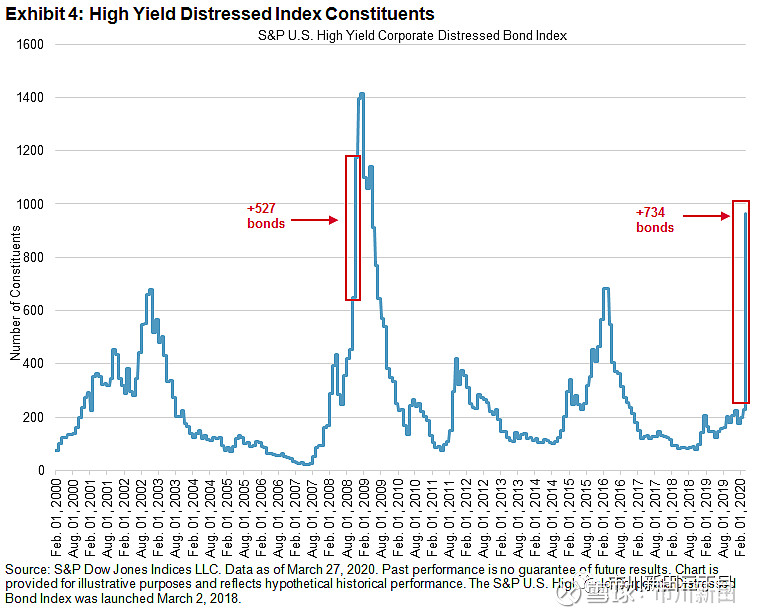

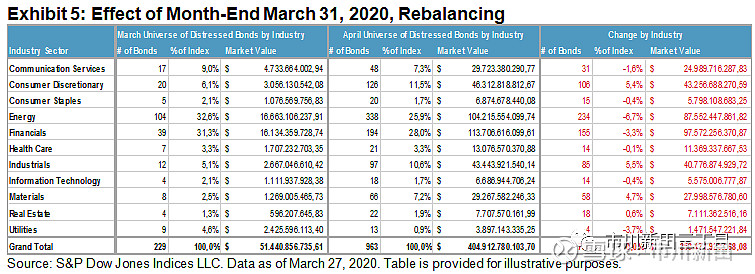

As can be seen in Exhibit 4, the index is going to jump from its current 229 bonds to 963 bonds at the March 31, 2020, rebalancing. This will be the largest number of bonds entering the index at a rebalancing since the Oct. 31, 2008, rebalancing. The percent of distress within high yield will be 30% of market value, or 963 bonds out of the high yield April universe of 2,314 (42%).

如下图4所示,在预定于2020年3月31日进行的调整完成后,标准普尔美国不良债务级高收益债指数的成分券数量将从目前的229只增至963只,这将是自2008年10月31日该指数的定期调整过后新加入成分券的数量最多的一次,本次调整过后,不良债务级高收益公司债的市值在整个美国高收益债市场中的占比将达到30%,成分券的数量占比为42%。

As the market scenario plays out after the sudden stop of economic activity due to the COVID-19 pandemic, distressed and defaulted debt will likely continue to be an ongoing concern.

新冠疫情导致的经济活动突然暂停后的市场走势显示,不良债务级高收益债以及违约级高收益债有可能会继续成为市场担忧的对象,如下图5所示。

图5:债券指数中成分券的发行人在各行业的分布情况

The S&P U.S. High Yield Corporate Distressed Bond Index gives a window into credits that are struggling and the issuers that may eventually end up in default.

标准普尔美国不良债务级高收益债指数给评判经营状况不佳以及最终将违约的美国公司债发行人的信用状况提供了一个很好的渠道。

S&P Global Ratings said the default rate for high-yield, or junk, bonds is heading to 10% over the next 12 months, more than triple the rate of 3.1% that closed out 2019.

标准普尔全球评级公司认为,未来12个月美国高收益债也就是垃圾债的违约率将冲到10%,比2019年底的3.1%高两倍以上。

“The current recession in the U.S. this year is coming at a time when the speculative-grade market is historically vulnerable to a liquidity freeze or an earnings drop,” Nick Kraemer, head of S&P Global Ratings Performance Analytics, said in a statement.

标准普尔全球评级公司的信用分析师Nick Kraemer表示,“当前正在到来的美国经济衰退正值美国投机级债券市场对市场流动性以及发行人经营收益下降的敏感程度达到历史最高水平的时点。”