译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

US GDP Rose by $850 Billion in 2019 as US National Debt Surged by $1.2 Trillion. Debt-to-GDP Ratio Hit 108%

by Wolf Richter

Dream of 3% economic growth remained a dream despite surge in government borrowing and spending.

让美国经济实现3%的年增长仍只是一场梦而已,尽管美国政府的借贷和开支大幅飙升

The dreams of 3%-plus economic growth in the US remained dreams in 2019, despite tax cuts and ballooning federal government spending, which are a stimulus. But the resulting budget deficit caused the gross national debt to balloon far faster than GDP grew.

尽管有降税和加大财政开支等举措的加持,2019年美国经济增长3%以上的梦想却仍是一场空,但由此增加的预算赤字却导致美国政府债务总量的速超过了美国GDP的增速。

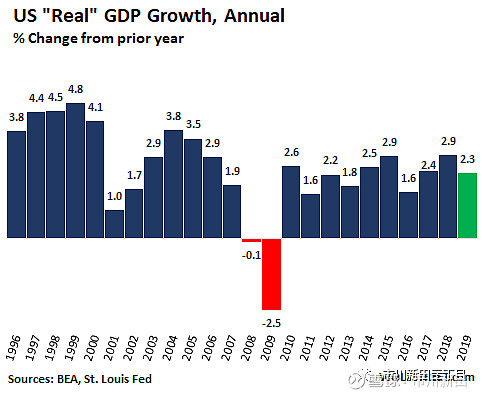

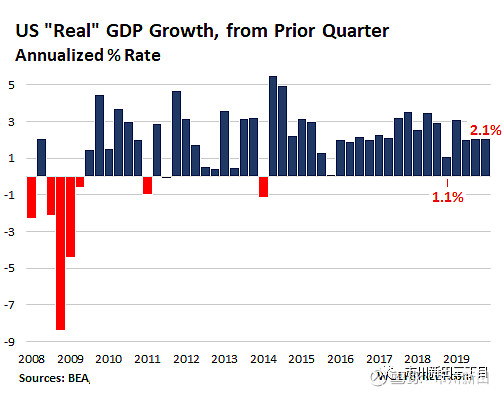

In the fourth quarter, the economy as measured by inflation-adjusted “real” GDP grew at an annual rate of 2.1% from the third quarter. This brought the total growth of real GDP for all of 2019 to 2.3%, which is the average annual GDP growth since 2012:

2019年四季度,经通胀调整后的美国GDP的季度环比实际年化增速为2.1%,受此影响,2019年全年的美国GDP增速为2.3%,为自2012年以来历年GDP年增长率的平均水平。

This is according to the first estimate by the Bureau of Economic Analysis, released today, based on incomplete data. As more data accumulates, the BEA revises the estimates. The next revision will be released on February 27. These revisions are often minor, but sometimes they’re whoppers, completely changing the economic picture, as they did for Q4 2018, when the initial estimate of GDP growth was a hot 3.1%, which was subsequently crushed down to a frigid .

该数据为美国经济分析局于今天公布的初值,基于不完全的统计,随着统计数据的完善,美国经济分析局将于2月27日公布修正后的数据。通常情况下数据修正的幅度比较小,但有的情况下也很大,大到足以改变对整个经济形势的判断,就像2018年4季度的美国GDP增速的初值高达3.1%,但经修正后猛降至1.1%。

In Q4 2019, the “real” GDP growth rate of 2.1% was essentially the same as over the prior two quarters, and below the average growth rate since 2012 of 2.3%:

2019年4季度美国GDP的实际增速为2.1%,与前两个季度的增速基本一致,低于2012年以来2.3%的年度增速均值。

On the positive side in Q4, imports of goods and services fell 8.7%, with goods imports alone dropping 11.6% (a decline in imports adds to GDP). But exports ticked up only 1.4% (an increase in exports adds to GDP).

好的一面是,2019年4季度美国进口货物和服务业进口的总值减少了8.7%,仅进口货值这一项就减少了11.6%,但出口额却仅增加了1.4%。

Also pushing up GDP in a big way: federal government expenditures in Q4 rose at an annual rate of 3.6%. This brought the increase in federal government spending for the entire year 2019 to 3.5%. Defense spending surged 4.9% in 2019. Nondefense spending inched up only 1.6%. We’ll get to the debt that this federal government spending produced in a moment.

还有一个大项对美国GDP的总量影响很大:2019年四季度美国联邦政府开支的年化增速为3.6%,受此影响2019年全年美国联邦政府开支的年化增速为3.5%。2019年美国的防务开支大增4.9%,非防务开支仅增加了1.6%,后面将谈到联邦政府的开支对美国债务总量增加所产生的影响。

Growth was dragged down in Q4 by the sharp decline in gross private domestic investment of 6.1%, including a 10.1% drop in investment in structures and a 2.9% drop in investments in equipment.

2019年4季度美国经济的增速受到全美私营部门投资大降6.1%的拖累,其中基建方面的开支下降10.1%,设备投资下降 2.9%。

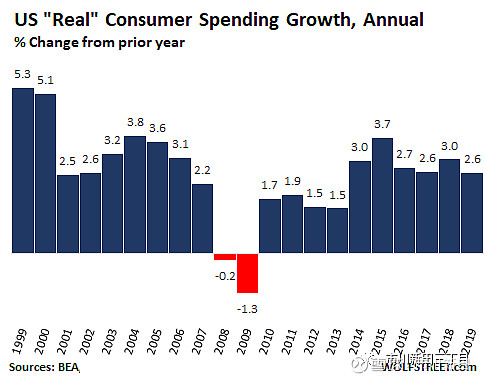

Consumer spending (“personal consumption expenditures” adjusted for inflation), which accounts for 68% of GDP, grew at an annual rate of 1.8% in Q4. While this growth rate was down from Q3 (3.1%) and Q2 (4.6%), it was higher than in Q1 (1.1%) and in Q4 2018 (1.4%). For the year 2019, consumer spending, on this inflation-adjusted basis grew 2.6%, at the low end of the range of the past six years:

在美国GDP总量中占比达68%的经通胀调整后的个人消费开支2019年四季度的年化增速为1.8%,低于三季度3.1%和二季度4.6%的增速,但高于一季度1.1%和2018年四季度1.4%的增速,2019年全年的经通胀调整后的个人消费开支增长了2.6%,为该指标过去六年波动区间的下轨。

GDP measures the economy in terms of the dollars that are spent or invested by consumers, businesses, and governments in a given time period. Illegal spending and investing – prostitution, retail sales of controlled substances, etc. – are not included in the US, though there are discussions under way about including it.

GDP这个指标通过统计消费者、商界和政府在某一特定的期间内支出或投资的金额以反映整体经济的运行情况,在美国,非法经济活动的开支或投资额,比如黄赌毒等,是不被纳入GDP的统计中的,尽管有观点认为应该把这部分的数据也纳入进来。

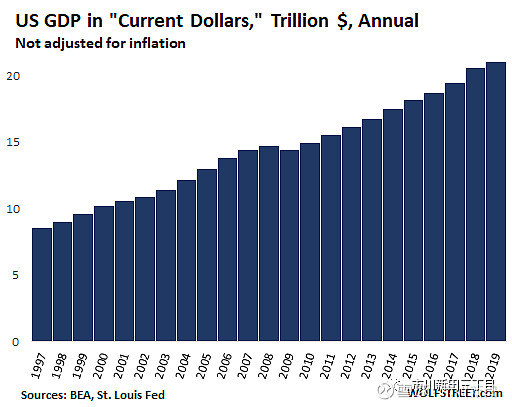

Nominal GDP, which is measured in current dollars and is not adjusted for inflation, increased by 4.1% in 2019, or by $849 billion from a year earlier, to $21.4 trillion:

2019年以当前的美元币值计算的、未对通胀率调整的GDP名义增速为 4.1%,同比上一年增加了8490亿美元,总量达21.4万亿美元。

Where do these dollars in GDP growth come from?

GDP的增长从何而来?

GDP measures the flow of dollars at a certain point. It does not include where the dollars came from that were invested or spent. In other words, GDP ignores the increase in debt.

GDP这个经济指标衡量的是某一个时点的资金流动情况,不包括投资额或资金的开支,换句话说,GDP没有反映债务的增长状况。

Most of what the federal, state, and local governments spend in the US and invest in the US enters into GDP either directly or indirectly. Much of what the federal government spent came from tax revenues, fees, and other receipts. The remainder was funded by new debt.

美国联邦政府、地方政府在美国开支和投资中的大部分直接或间接地体现在GDP中,美国联邦政府开支的资金来源大多来自于税收、收费和其他收入,不足部分来自于美国联邦政府的发债。

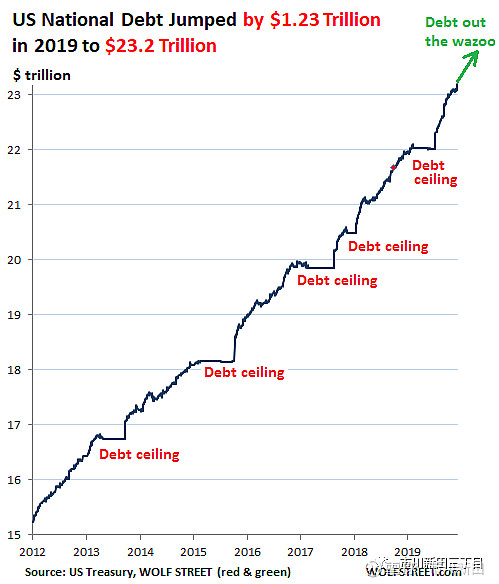

In the calendar year 2019, the federal government’s spending that made it directly into GDP calculations, released today, grew by 3.5%, with defense spending surging 4.9%, and nondefense spending ticking up 1.6%. Federal government deficit spending ballooned the US gross national debt by $1.23 trillion in the calendar year 2019, to $23.2 trillion.

根据今天公布的数据,在2019年里,直接体现在GDP总量中的美国联邦政府开支额增长了3.5%,国防开支增长了4.9%,非国防开支增长了1.6%。美国联邦政府的预算赤字大幅增长导致2019年度的美国联邦政府债务总量达到23.2万亿美元,增量为1.23万亿美元。

But despite the surge in federal government spending, causing additional federal borrowing of $1.23 trillion in 2019, growth in nominal GDP totaled only $849 billion.

但是尽管美国联邦政府的开支大幅增长导致美国联邦政府的债务总量在2019年里增加了1.23万亿美元,而美国名义GDP的总量缺却只增加了8490亿美元。

Let that stew for a moment: What would the economy have done with a more moderate increase, or no increase, in federal borrowing and spending?

思考一下这个问题:如果美国联邦政府的借贷和开支增加得没那么快或者没有增加,美国经济会怎样?

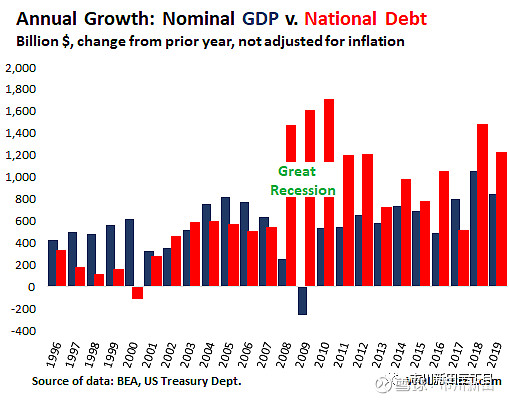

The chart below shows annual increases in nominal GDP in billion dollars (blue) and the annual increases in the gross national debt in billion dollars (red). Neither are adjusted for inflation. Note the special effects just before, during, and right after the Great Recession: Nominal GDP growth plunged in 2008 and went negative in 2009. During that time, unemployment skyrocketed, companies collapsed, federal tax receipts plunged, federal expenditures surged (unemployment insurance, etc.), and the deficit and the gross national debt exploded.

下图显示的是历年来美国名义GDP的增量(下图中的蓝色线柱,单位为10亿美元)和美国联邦政府债务增量(下图中的红色线柱,单位为10亿美元)的对比情况,这两个数据均未对通胀率进行调整。注意图中经济大衰退前夕,衰退期间和衰退期刚过这三个时点年份的情况:美国名义GDP的增量在2008年出现大跌,2009年转为负值,当时美国失业率一飞冲天,企业纷纷破产关门,联邦税收猛降,联邦政府的开支猛增(失业保险金的开支等项目),预算赤字和政府债务总量猛增。

But instead of going back to the prior arrangements, where in good times, nominal GDP grew faster than the national debt, the national debt continued to outgrow nominal GDP. The only exception was 2017, when the debt-ceiling fight dragged a portion of the debt-increase into 2018 (average out 2017 and 2018 for a more accurate picture):

但经济危机过后,一切都与以前不一样了,日子好过的时候美国名义GDP的增速均大于政府债务的增速,但最近十年中的大部分年份里政府债务的增速持续超过名义GDP的增速。惟一例外是2017年,当时围绕着美国联邦政府债务总量的争斗导致新增债务的一部分被推迟到2018年才体现出来,把2017年和2018年的债务增量平均一下才能更准确地反映当时的情况。

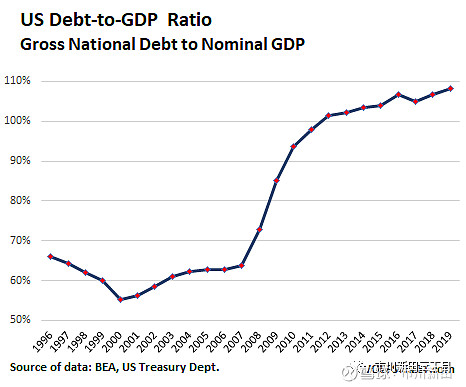

The year 2019 was also another milestone: The ratio of the US gross national debt to GDP jumped to 108%, up from 63% in 2006 on the eve of the Financial Crisis as all heck was already breaking loose:

2019年还有另一个重大事件:美国政府债务总量与GDP之间的比率升至108%,大幅高于2006年即金融危机爆发前的比率63%,一切都失控了:

And I will leave you with a chart of this issue that no one in Washington pays attention to anymore, other than the Fed, which pays lip-service to it by occasionally calling the federal debt-growth “unsustainable,” when challenged in a press conference. In terms of our elected officials in Washington, the rule is that debt doesn’t matter. Former fiscal hawks have been converted. And debt truly doesn’t matter until it suddenly does:

除了美联储在华盛顿没人会注意到下图所反应出来的问题,但联储只会在记者招待会上被问到的时候过过嘴瘾,偶尔唠叨一句联邦政府的债务增速是“不可持续的”。在华盛顿那帮被美国老百姓选上台的大人物看来,债务增加就不是个事。以前主张加强预算纪律的人已经改弦更张了,美国的债务问题真的没人当回事,直到有一天维持不下去了为止。