译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

Politics and Asset Prices

by Kevin Muir

The other day a reader was kind enough to send me a video of a terrific interaction between two hedge fund legends. Last month, Ray Dalio and Paul Tudor Jones sat down at the Greenwich Economic Forum to discuss a variety of topics.

某日有一位好心的读者给我发来一个视频,内容是桥水公司的Ray Dalio 和Tudor投资公司的Paul Tudor Jones之间精彩的对话,这两位对冲基金行业的风云人物上个月在格林威治经济论坛上围绕着一系列话题展开了讨论。

There are so many aspects of this video to explore, but I want to drill down on one particularly interesting comment that Jones made.

关于这番对话网上有太多的视频资料,但是我想着重谈谈Jones发表的一番非常有意思的言论。

“我们内部搞了个测验,是关于如果民主党总统候选人伊丽莎白-沃伦或拜登, Buttigieg, Kobalchar这几位候选人当选下届美国总统,标准普尔500指数会怎么走,我们用了市场对这几个人当选概率的下注结果作为投票的依据。投票结果显示,如果伊丽莎白-沃伦当选下届美国总统,标准普尔500指数的点位会到2,250左右,当前在3,050。但是我只是想说的她的政策主张可能带来的结果就是这样。”

如果用Buttigieg和拜登当选下届美国总统的当选概率算一下,标准普尔500指数可能会到2,700,原因是他们会加税,这会导致美国经济出现一定幅度的下行,这个结果意味着如果是特朗普连任,那么标准普尔500指数可能会到3,600。

This is a fascinating intellectual exercise that the folks at Tudor did. Let's take a moment to understand their thinking, and then examine what it might mean for markets going forward.

Tudor投资公司里的这帮人搞的这个小测试非常有意思,咱们先花点时间搞清楚他们到底是咋想的,然后再琢磨一下对未来的市场走势意味着什么。

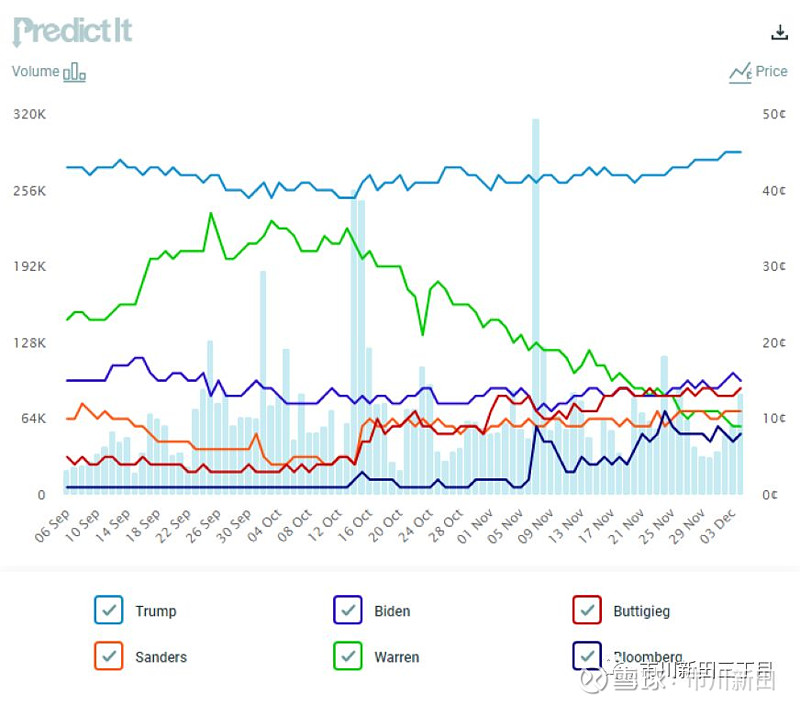

This interview was conducted at the beginning of November 2019. I am unsure which election market Paul was using, but let's go with PredictIt:

这个对话的时点是在2019年11月初,我不知道Paul他们在预测股价走势的时候用的是哪个选举行情调查机构的数据,我们姑且以PredictIt网站的数据为准吧。

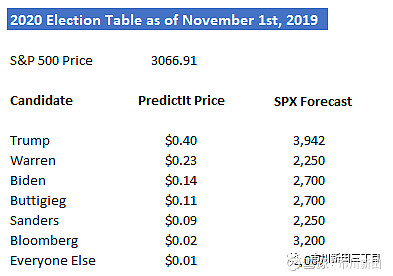

On November 1st, the price breakdown of the leading contenders was Trump $0.40, Warren $0.23, Biden $0.14, Buttigieg $0.11 and Sanders $0.09.

11月1日在PredictIt网站上几位民调领先的总统候选人的赔率(即赌该人当选需要下注的金额)分别是:特朗普0.40美元,沃伦0.23美元,拜登0.14美元,Buttigieg 0.11美元,桑德斯0.09美元。

Let's plug these into a spreadsheet and see if we can get the same numbers as Tudor.

把以上这些数字代入上面这张表格中,看看结果是不是与Tudor预测的一致。

I used Tudor's SPX forecasts for Warren, Biden, Buttigieg and Sanders. I assumed a Michael Bloomberg Presidency might be mildly positive, and for everyone else, unchanged.

在预测沃伦,拜登, Buttigieg and桑德斯当选后标准普尔500指数可能会到的点位时,我用的是Tudor预测的结果。至于迈克尔·布隆伯格,我认为他当总统应该会对股市构成一定程度的利好,如果是除此之外的其他人当选,我认为标准普尔500指数不会有啥变动。

When I put those numbers into my model, to make it balance, I actually need a Trump value of 3,942 - which contrasts Tudor's 3,600 call.

当用我的预测模型把以上这些要素跑一遍,为了让盈亏结果持平,特朗普再次胜选后标准普尔500指数需要涨到3,942才行,这跟Tudor预测的3,600点并不一致。

Now I am not sure whether I have different market election odds than Tudor, or if Paul was using extreme forecasts for effect in his chat. It doesn't really matter. The point is that the market is a discounting mechanism, and if the performance of the S&P 500 will truly be that catastrophic under an extreme-left Democratic candidate win, then it might mean that a Trump win needs to be euphoric to balance it out.

我拿不准结果不一致的原因是不是因为我用的候选人的赔率与Tudor用的不是一个来源,或者Paul在谈话中用的是比较极端的预测结果来给听众加深印象。这些其实都无关紧要,关键之处在于金融市场的任务是对未来进行贴现,如果极左翼的民主党候选人当选确实导致标准普尔500指数出现灾难性的后果,那么这就意味着如果是特朗普连任标准普尔500指数需要来个暴涨才能保证赔率平衡。

Here is my pushback to this model. Too often the market is not a good discounting mechanism. How many times have you seen a risk staring everyone straight in the face, yet the market ignores it? And then when that risk comes to be, everyone freaks out. I have spent the last 25 years trading against the market, and if it was so perfect, there wouldn't be those individuals (like Tudor) who have consistently beat it. So my complaint with this analysis is that it assumes participants are properly discounting the market risk if the far-left Democratic candidates win.

以下是我对这个分析模型质疑的地方。金融市场的贴现机制在很多情况下并没有充分地发挥作用。风险都到眼皮子底下了但市场却熟视无睹的情况发生过多少次了?最后当风险真正来临的时候,每个人都被吓得屁滚尿流。过去25年里我一直在与市场反着做,如果市场贴现功能完美无缺的话,像Tudor这样能持续跑赢市场的人就不会存在了。因此我之所以对这个该预测模型不满意是因为其前提假设是如果极左翼的民主党候选人当选,市场参与者会在定价中充分地考虑由此给市场带来的风险。

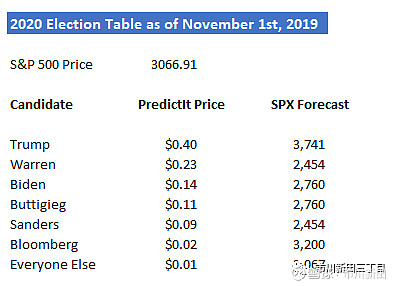

Another possibility? Maybe the 2,250 forecast for Sanders and Warren is too pessimistic. If we change the decline to a 20% bear market (2,454) and move Biden and Buttigieg to a 10% correction (2,760), we get a 3,741 balancing figure for Trump which is approaching more reasonable levels.

有没有其他的可能性?也许对桑德斯和沃伦胜选后标准普尔500指数会跌到2,250点的预测过于悲观了。如果把桑德斯和沃伦胜选后标准普尔500指数的跌幅缩小到20%,也就是跌到2,454(3,067*0.8=2,453.60),将拜登和Buttigieg胜选后标准普尔500指数的跌幅调整为10%,也就是跌到2,760(3,067*0.9=2,760.30),那么特朗普再次当选后标准普尔500指数的点位就成了3,741点,这个结果要更贴近Tudor的预测结果。

I think these assumptions are more realistic, so let's dig into this model a little more.

我认为以上这些预测结果更符合实际情况,因此我想对这个模型进一步分析一下。

Since Tudor made this presentation, Michael Bloomberg has jumped into the race and both far-left candidates' odds have sunk. Could this be why the stock market has rallied?

自从Tudor作出这番预测后,迈克尔·布隆伯格开始加入选战,然后两位极左派候选人的胜选概率下跌了。美股近期大涨是因为这个原因吗?

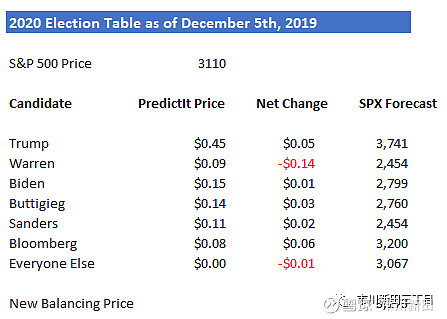

Let's keep our stock market forecasts unchanged and see how much the model moves with the new odds:

假设我们对各候选人胜选后美股点位的预测结果保持不变,看看新的胜选概率代入预测模型后会出什么结果?

By my rudimentary calculations, the S&P 500 should be 63 points higher (3173-3110) due to the change in election odds.

我用模型大概算了一下,由于各候选人胜选概率的变化,标准普尔500指数当前的价位应该在3173才对,即比当前的水平高63个点,即3173-3110=63。

In this time frame, the S&P 500 is 43 handles higher (3066.91 to 3110). Now obviously this analysis is back-of-the-napkin voodoo. It's not supposed to be precise by any means.

实际上在这段时间里,标准普尔500指数的点位从3066.91涨了43个基点至3110点。以上分析显然比较粗糙,根本不应看做是一种精确的计算。

Yet I think it's illustrative of how the election might be moving markets.

但我认为该预测结果说明大选结果会给股市带来何种变化。

But even more importantly, as Paul Tudor Jones says, "as an investor, you have to have a view on the election because the outcomes are so extreme."

更重要的是,Paul Tudor Jones说过,“一名投资者需要对选举结果有一个判断,因为最后的市场反应差异如此之大。”

Lest your dislike of politics encourage you to ignore the election, Jones has a warning;

由于担心对政治的厌恶导致投资者对选举结果关心不够, Jones是这样提醒注意的:

"[the President] does make a difference. Ronald Reagan, when he became President, he was a huge difference to the stock market. And I would say, who the next President is will also have a huge impact on the economy, the stock market and particularly asset prices cause clearly asset prices today; whether it be US stocks, interest rates, whether it's the dollar, because it's all priced off of, in my opinion, a 5% budget deficit with this incredibly stimulative fiscal policy, combined with this overly stimulative monetary policy is creating this US exceptionalism that one day - like if we normalized our deficit to where Europe is right now, we would have completely different valuations for the stock market, valuations for the dollar - the dollar would be substantially lower.

“最终谁当总统结果可大了去了。罗纳德·里根成为总统后给美国股市带来了巨大变化,我要说的是,下届总统最终揭晓后也会给美国经济、美国股市尤其是资产的价格带来重大影响。因为我认为,如今的资产定价水平,无论是美股,利率还是美元的汇率,都建立在当前美国财政赤字达GDP的5%为前提的,力度空前的财政刺激再加上过度宽松的货币政策导致市场上产生了一种不管别人如何洪水滔天美国仍将独善其身的错觉,如果有那么一天,比如美国财政赤字占GDP的比率降至欧洲当前的水平,对美国股市和美元汇率的估值方法就将完全不同了,届时美元汇率将明显贬值。”

So, this next Presidential election, and what policies they pursue afterwards - this one is going to be more meaningful than any in my lifetime."

因此,这次大选以及候选人胜选后要干点啥会比我余生中其他任何东西都重要。

Paul Tudor Jones likes to apply probability calculations to his stock market forecast, where Ray Dalio claims to be more "mechanistic" about this analysis.

Paul Tudor Jones喜欢结合各候选人的胜选概率来预测未来美股的走势,而Ray Dalio则喜欢用更传统更具体的方法分析股票市场的走势。

"If you take the way corporate taxes would be changed (the undoing of that), then that's worth 7% or 8%. If you take the changes in GAAP accounting, that's worth about 15% of earnings and would therefore drop [the stock market] on the basis of that alone. If you take then the wealth tax, which is $2.8 trillion over 10 years, and so that will have an effect, and then that doesn't have to do with regulation. I think we are dealing with the question - again like the 30's - is it populism of the left or populism of the right? And how is that going to work? So we have an issue in that politics will certainly matter to asset prices."

“如果你认为美国企业所得税的税率会被调整,那么上市公司的利润会因此而增加7%或8%;如果认为美国通用会计准则会发生变化,那么上市公司的利润会因此而减少15%,仅凭该因素就将使美股下跌;如果你认为美国富人财产税的税率会增加,也就是未来十年会增加2.8万亿美元,这会带来一些影响。我认为我们当前遇到了与1930年代一样的问题,是左派的民粹主义上台还是右派的民粹主义上台?结果会是什么?因此问题的关键是政治局面的变动肯定会给资产的价格带来重大影响。”

Either way you approach it, there is no denying politics matter. More than ever. I just doubt the market is doing a good job discounting it...

不管你是咋想的,都无法否认政治影响的重要性,其影响远超以往,我担心的是金融市场是否在定价中充分考虑到了这一点。