译者 王为

文中黑字部分为原文,蓝字部分为译文,红字部分为译者注释或补充说明

If the Fed Cuts Interest Rates, Will Longer-Term Bond Yields Fall?

By Kathy AJones

Here’s a quick quiz: If the Federal Reserve cuts interest rates, what direction will long-term bondyields take?

问个脑筋急转弯式的小问题:美联储如果降息,长期限美国国债的收益率会往何处去?

If you said “lower,” you’re in good company—but very possibly incorrect. Counter-intuitive as it may sound, rate cuts can actually mean higher bond yields—and lower bond prices—if the market believes the cuts will lead to stronger economic growth and inflation down the road. That can be the case when the first cut of the rate cycle occurs when the economy isn’t in recession.

如果你的回答是“向下”,请别介意,这个回答很可能是错的。虽然听上去可能有悖常理,但降息实际上会导致债券价格出现下跌,收益率水平上行,前提是市场认为降息会让美国经济以及未来的通胀强劲增长。在美国经济没有陷入衰退的情况下实施新一轮降息周期的第一次降息,债券收益率的水平是有可能不跌反涨。

Markets are projecting a 100% probability of a rate cut at the July 30-31 Federal OpenMarket Committee meeting, according to the CME Group’s FedWatch Tool, with that cut followed by two to three more rate cuts over the next year. Although the economy appears to be growing at a relatively healthy pace, Fed officials recently have talked about the need for more stimulus to offset the risk that U.S. growth will cooldue to trade conflicts and slowing growth abroad.

芝加哥商品交易所的“联储动向观察工具”显示,市场预期在7月30-31日的公开市场委员会例会上联储决策降息的概率达到100%,之后一直到明年还会有两到三次降息。尽管美国经济看上去增长状况良好,但联储官员最近却表示有必要出台更多的经济刺激举措以消除贸易争端和其他国家经济减速给美国带来的经济减速风险。

During hisrecent congressional testimony, Fed Chair Jerome Powell answered a questionabout the risks of the labor market running “hot” with the comment, “To call something hot, you need to see someheat.”He pointed out that despite widespread talk about shortages of workers, wageshaven’tmoved up very much.

在最近的一次美国国会听证会上,针对关于美国就业市场是否会出现“过热”风险的质询,联储主席鲍威尔回答道“如果想称某种现象为过热,首先得有这种现象升温的迹象。”他指出,尽管人人都在说劳动力市场出现供应短缺,但美国的薪酬水平却并没有上升多少。

Bond market in the middle

债券市场进退维谷

Riskier assets responded positively to Fed comments—high-yield corporate bond prices rose andyields dropped. Pundits who were predicting rising yields late last year begancalling for 10-year Treasury yields to drop to 1% or even zero.

高风险资产对于联储的表态做出了积极反应,美国高收益债的价格出现上涨,收益率下行。去年年底认为美国国债收益率未来将走高的市场专家们开始转而预测10年期美国国债的收益率将跌至1%甚至零。

However,10-year Treasury yields actually have edged up slightly in recent weeks, asintermediate and long-term yields reacted more strongly to better-than-expectedeconomic data than to comments from the Fed.

但实际情况是,10年期美国国债的收益率在最近几周反而略有上行,因中长期美国国债收益率对美国经济指标的超预期表现的反应要远超对美联储表态的反应。

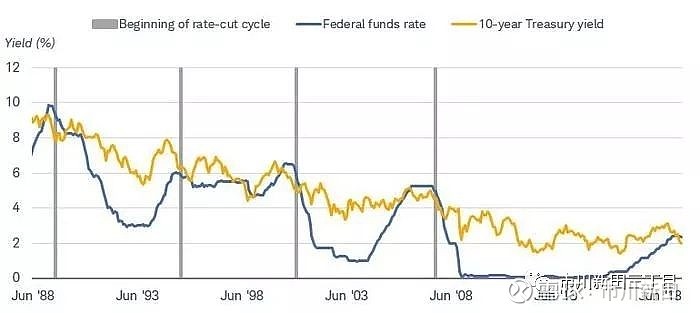

Even though theFed may be about to cut the target for its benchmark short-term rate, thefederal funds rate,1 it isn’t necessarily the case that long-term rateswill fall by much, if at all. In past cycles, the yield curve has steepened when the Fed has eased policy— sometimes with long-term rates actually moving higher in anticipation of stronger growth and inflation.

即便美联储有可能降低其短期指标利率即联邦基金利率的水平,但长期利率也未必会下降多少。在过去的利率变动周期里,当美联储放松货币政策的时候,美国国债收益率曲线的形态有时会出现陡峭化,因为长期利率的水平在降息会导致美国经济增速和通胀率上行的预期影响下出现上扬。

10-yearTreasury yields and the federal funds rate have diverged before

10年期美国国债收益率和联邦基金利率的走势历史上也出现过背离

Source: Effective Federal Funds Rate, (FEDFUNDS) and10-Year Treasury Constant Maturity Rate, Percent, Monthly, Not SeasonallyAdjusted (DGS10). Data as of 6/30/2019. Past performance is no guarantee offuture results.

The disparity between what the Fed is saying and what the economic data indicate leaves thebond market caught in the middle. On the one hand, the prospect of more Fedeasing is bullish. On the other hand, if the market believes that the Fed has ashot at boosting inflation, it’s bearish. As longer-term bond yields arethe sum of the weighted average of short-term rates plus a risk premium (termpremium), lower short-term rates should lower long-term rates.

联储表态和经济数据所显示情况之间的不一致导致美国债券市场进退维谷。一方面,美联储未来有可能降息对债券市场是个利好;另一方面,如果市场认为联储降息有可能导致通胀增速上行,对债券市场将构成利空。由于长期限国债收益率是短期利率和期限溢价(或称风险溢价)的加权平均值,因此短期利率下行应会导致长期利率水平出现降低。

However, the more likely it is that inflation will actually materialize from the rate cuts,the more the term premium should rise. That potentially results in short- andlong-term yields moving in different directions, which is what happened this month. So far, the steepening of the yield curve has been slight, but it may be a hint that the market view of the economy is turning positive.

但是,如果降息导致通胀增速升高的可能性越大,期限溢价就会升得越高,结果有可能导致美国长短期国债的收益率走势出现背离,本月发生的情况就是如此。到目前为止,美国国债收益率曲线的陡峭化程度并不明显,但这有可能预示着市场对美国经济的评价正在转向正面。

Rising risksmay limit returns

市场风险上升可能会导致债券投资的回报受限

Returns infixed income have been very strong year to date—anywhere from 2.6% to 12.6%. But with yields low and prices high, those strong returns are unlikely to continuethrough the second half. Returns through the end of the year are likely to be driven by coupon payments, not further price appreciation.

今年以来,美国固定收益市场的回报表现相当靓丽,各类债券的回报率在2.6%至12.6%区间。但是随着债券价格上涨,回报率水平走低,如此强劲的回报不太可能在今年下半年继续得以维持。从现在开始到年底前的债券投资收益有可能主要来自于票息收益,而不是债券价格的进一步上涨。

Year-to-date returns have been strong

Source:Bloomberg, as 7/12/2019. Asset classes are represented by the followingindexes: US Aggregate = Bloomberg Barclays U.S. Aggregate Bond Total ReturnIndex; Short-term core = Bloomberg Barclays U.S. Aggregate 1-3 Years Bond TotalReturn Index; Intermediate-term core = Bloomberg Barclays U.S. Aggregate 5-7Years Bond Total Return Index; Long-term core = Bloomberg Barclays U.S.Aggregate 10+ Years Bond Total Return Index; Treasuries = Bloomberg BarclaysU.S. Treasury Index; TIPS = Bloomberg Barclays U.S. Treasury TIPS Total ReturnIndex; Agencies = Bloomberg Barclays U.S. Agency Bond Total Return Index;Securitized = Bloomberg Barclays U.S. Securitized Bond Total Return Index;Municipals = Bloomberg Barclays Municipal Bond Total Return Index; IGCorporates = Bloomberg Barclays Corporate Bond Total Return Index; HYCorporates = Bloomberg Barclays U.S. High Yield VLI Total Return Index; IGfloaters = Bloomberg Barclays US Floating Rate Notes Total Return Index; Bankloans = The S&P/LSTA U.S. Leveraged Loan 100 Index; Preferreds = MerrillLynch BofA Preferred Stock Total Return Index; Int. developed (x-USD) =Bloomberg Barclays Int'l Developed Bonds (x-USD) Total Return Index; EM =Bloomberg Barclays Emerging Market Bond (USD) Total Return Index. Please seethe Important Disclosures section for definitions of indices used. Pastperformance is no guarantee of future results.

We are particularly concerned about rising risks in the corporate credit markets, including slowing global growth and expectations for slower corporate profit growth. Although credit prices have been supported fairly recently by factors including a corporate tax rate cut,easy financial conditions, plenty of liquid assets on corporate balance sheets,and high investor demand, those factors are beginning to fade. In our view, thegreatest risk of falling prices is in the riskier, lower-rated segments of thefixed income market, such as high-yield bonds and bank loans.

我们尤其关注的是美国公司债市场风险的上升,包括全球经济增速放缓以及市场对美国企业盈利增速放缓的预期。尽管最近一段时间以来美国信用债券市场的价格明显得到公司税率降低,融资状况宽松,公司资产负债表上流动资产充裕以及投资者需求高涨等因素的支撑,但这些利好因素的效应正在消退。我们认为,在美国固定收益市场中债券价格最有可能下跌的是那些高风险、低评级的资产类型,如高收益债和银行贷款等。

What toconsider now:

债券投资要考虑的要点

1. Rebalancing:Given strong recent performance, your portfolio may be overweight to fixedincome, which can increase your risk if the market should reverse direction.Consider rebalancing—that is, selling some assets that have appreciated andbuying others that have lagged—to return your portfolio to its originalasset allocation target.

资产配置比率再平衡。考虑到近期美国债券市场走势强劲,各类投资者可能已经在投资组合中超配债券资产了,如果债市行情逆转,投资者所面临的风险会增加。而再平衡策略就是卖掉一部分已经大幅上涨的资产,买入涨幅不高的其他资产,将投资组合中的资产配置比率调整回到初始目标值。

Rebalancing is especially important if you’ve experienced a big increase in the riskier segments of the markets, like high-yield or emerging-market bonds. At current yield spreads versus Treasuries, valuations for high-yield and EM bonds are high by historical standards, while risks are rising.

如果高风险债券品种如高收益债或新兴市场债券的价格经历了大幅上涨,再平衡策略就显得尤为重要。以当前的高风险信用债收益率与同期限美国国债收益率之间的利差来衡量,高收益债或新兴市场债券的估值水平已高于历史平均水平,说明市场风险正在上升。

2. Reducing exposure to higher-risk assets: Consider reducing exposure to higher-riskassets, like those mentioned above. For investment-grade corporate bonds, wesuggest moving up in credit quality, focusing on bonds rated “A” or higher. Givenglobal growth and corporate profit concerns, some (or many) bonds with “BBB” ratings—the lowest rung ofinvestment grade—could be downgraded to sub-investment-grade ratings,which would likely lead to large price declines.

减持高风险债券。投资者应减少对高风险债券的持仓量,就像上面提到的高收益债或新兴市场债券等品种。对于投资级公司债,我们建议应重点投资高评级的债券,如评级为A甚至更高评级的债券。鉴于全球经济增长和企业盈利前景令人担忧,有一些评级为BBB即投资级债券中评级最低档的债券有可能被降级至投资级以下,结果将导致债券价格出现大跌。

3. Checking your allocation: Make sure your asset allocation matches your risk tolerance and investing time horizon. If you’re not sure how to build a bond portfolio or how to combine stocks and bonds, consider the table below—it shows a Schwab “moderate conservative”model portfolio with a 60% allocation to bonds and cash investments and a 40% allocation to stocks. Your ideal portfolio could be different, but this is one starting point.

对资产配置状况做评估。投资者要确保投资组合与自身的风险承受能力及投资周期相匹配,如果拿不准应如何构筑债券投资组合或如何平衡投资组合中股票和债券的配置比率,可以考虑使用本公司推荐的“偏保守”型投资组合,即将六成资金配置于债券,四成资金配置于股票。投资者理想的投资配置比率可能会与此有所不同,但投资者可以该样本投资组合作为参考。

We recommend beginning with a portfolio of investment-grade core bonds and adding riskier bonds, based on your tolerance, to provide diversification and boost potential return. Investors can use Schwab’s Select Lists to find bond funds in the core and aggressive income categories.

我们的建议是当前投资者在做债券投资时应先从投资级核心债券开始,然后根据自身的风险承受能力加入高风险的债券品种,来为投资组合提供更多的多元化选择并提高未来的投资回报率,投资者可通过网页链接网页查询投资核心债券和激进收益型债券的债券基金名单作为参考。