“Today’s economy is a lot like looking into a kaleidoscope, with the view changing and the data providing a different reflection of what’s happening every time you look.” “今天的经济很像一个万花筒,视角在变化,每次看到的数据都能反映出不同的情况。”

NRF Chief Economist Jack Kleinhenz NRF首席经济学家Jack Kleinhenz说

WASHINGTON – Economic indicators are giving conflicting signs but the nation does not appear to be in a recession and should be headed toward a soft landing from the rampant inflation and high interest rates of the past two years, National Retail Federation Chief Economist Jack Kleinhenz said today in the June edition of NRF’s Monthly Economic Review.

华盛顿——美国零售联合会首席经济学家Jack Kleinhenz今天在《全国零售联合会每月经济评论》6月版上说,经济指标显示出相互矛盾的迹象,但美国似乎没有陷入衰退,应该会从过去两年的严重通货膨胀和高利率中走向软着陆。

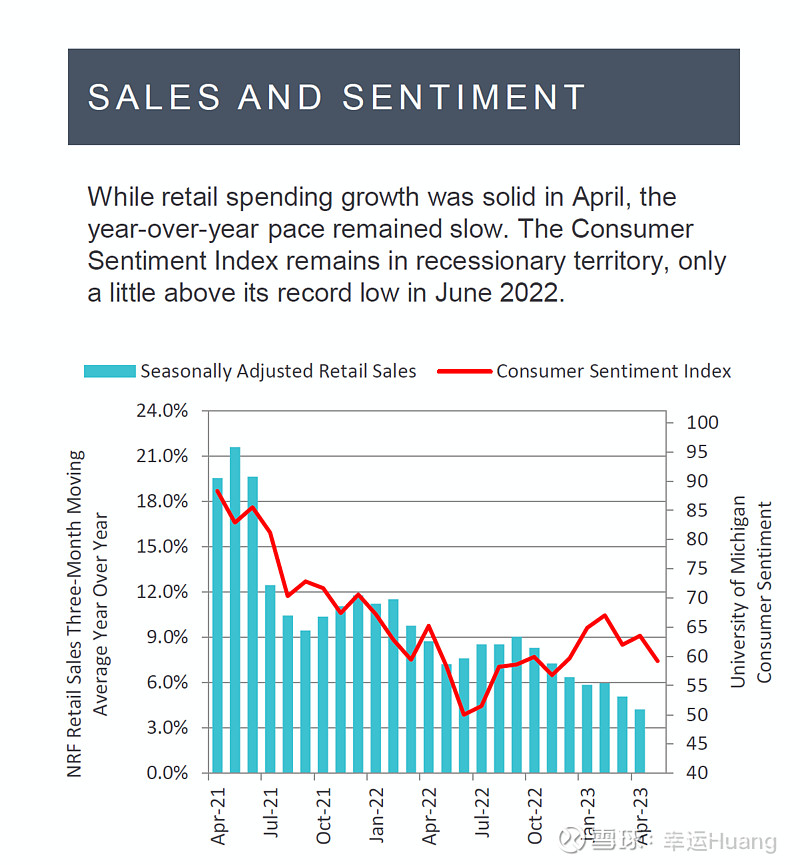

“Today’s economy is a lot like looking into a kaleidoscope, with the view changing and the data providing a different reflection of what’s happening every time you look,” Kleinhenz said. “Depending on which data you view in the economic kaleidoscope, you get two different angles on the state of the consumer. While survey data shows consumers do not have much confidence in the economy, actual spending data shows they were upbeat as the second quarter kicked off.”

Kleinhenz说:“今天的经济很像一个万花筒,视角在变化,每次看到的数据都能反映出不同的情况。”“根据你在经济万花筒中看到的数据,你会从两个不同的角度看到消费者的状况。尽管调查数据显示消费者对经济信心不足,但实际支出数据显示,第二季伊始,消费者表现乐观。"

“Consumer spending has been bolstered by a strong job market and rising wages, which have helped counter rising prices and higher borrowing costs,” Kleinhenz said. “While it’s difficult to reconcile these views, what we’ve learned over the last several years is don't count the American consumer out, at least not yet.”

强劲的就业市场和薪资上涨提振了消费者支出,这有助于抵消物价上涨和借贷成本上升的影响," Kleinhenz称。“虽然很难调和这些观点,但我们在过去几年里学到的是,不要把美国消费者排除在外,至少现在还没有。”

Kleinhenz said the Federal Reserve’s increases in interest rates in an effort to control inflation have been slowing the economy but not so much as to tip it into recession.

Kleinhenz说,美联储为控制通货膨胀而提高利率的措施已经减缓了经济,但还没有到使经济陷入衰退的地步。

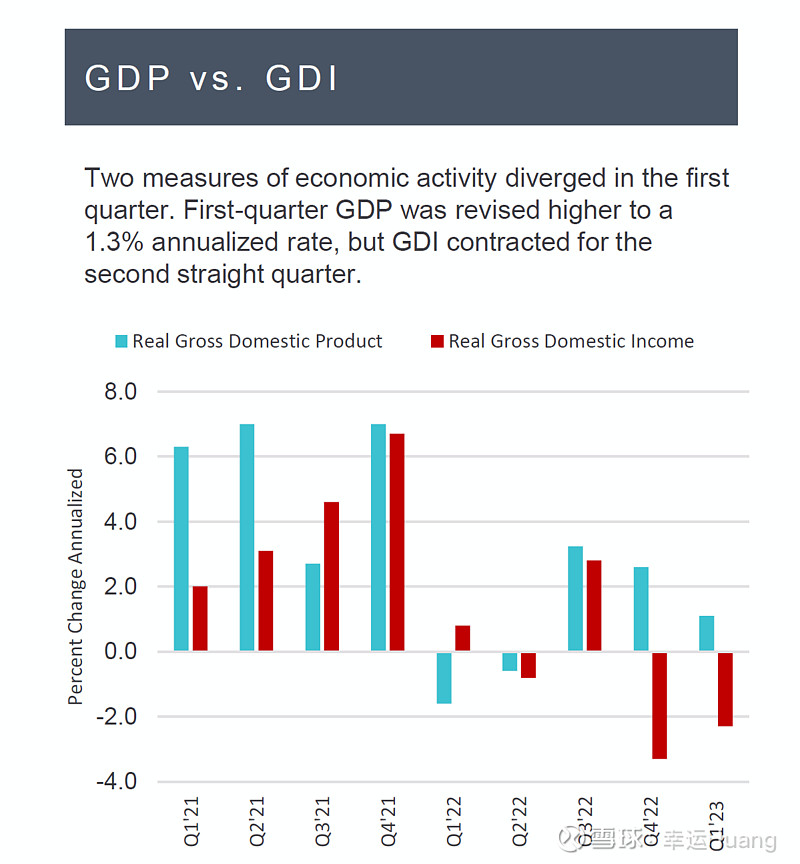

Revised data shows that gross domestic product grew at an annualized rate of 1.3% in the first quarter rather than the original estimate of 1.1%. Furthermore, the average of GDP and gross domestic income – a measure of everything earned during production and often a bellwether of revisions to GDP – decreased 0.5% in the first quarter following a decrease of 0.4% in the fourth quarter.(While GDP conceptually measures the value of everything produced, GDI measures the value of everything earned during production, including wages, rent, interest and corporate profits. In theory, growth in GDI should be identical to growth in GDP because one person’s spending is another’s income. Nonetheless, there is always a discrepancy between the two and GDI tends to signal eventual revisions to GDP.)This suggests that GDP likely overstates U.S. economic growth and that higher interest rates, tighter credit and persistent inflation are having more of a concerted effect on the direction of the economy than suggested by GDP alone. Given that, we continue to look for a soft landing this year. Real GDP is likely to remain challenged throughout the rest of 2023 and should rise just 1% based on the current NRF retail sales forecast.

修正后的数据显示,第一季度国内生产总值(gdp)折合成年率增长1.3%,而不是最初估计的1.1%。此外,国内生产总值(GDP)和国内总收入(GDI)的平均值继第四季度下降0.4%之后,第一季度下降了0.5%。(GDP在概念上衡量的是生产的所有东西的价值,而GDI衡量的是生产过程中所赚取的所有东西的价值,包括工资、租金、利息和企业利润。从理论上讲,GDI的增长应该与GDP的增长相同,因为一个人的支出是另一个人的收入。尽管如此,两者之间总是存在差异,而GDI往往预示着GDP的最终修正).这表明GDP可能高估了美国的经济增长,而高利率、信贷紧缩和持续的通货膨胀对经济方向的协同影响比GDP本身所显示的要大。鉴于此,我们预计今年美国经济将实现软着陆。在2023年的剩余时间里,实际GDP可能仍然面临挑战,根据目前的NRF零售销售预测,实际GDP应该只会增长1%。

While aggressive Fed tightening of credit has resulted in a recession every time it has been tried since 1970, there have been other times that the Fed has tightened interest rates and been able to slow the economy and inflation without a recession, Kleinhenz said, including 1994-1995 and 2015-2018.

Kleinhenz表示:“尽管自1970年以来,美联储每次试图积极收紧信贷,结果都导致了经济衰退,但美联储也曾在其他时候收紧利率,并在没有衰退的情况下减缓了经济和通货膨胀,包括1994-1995年和2015-2018年。

Kleinhenz said the latest “state coincident indexes” of state-level economic data produced by the Federal Reserve Bank of Philadelphia have increased in every state except Alaska in the past three months, “suggesting that we are not in a recession.” A study by the Federal Reserve Bank of St. Louis says at least half of the indexes need to show negative growth to provide reasonable confidence that the nation’s economy is in recession.

Kleinhenz表示,费城联邦储备银行(Federal Reserve Bank of Philadelphia)发布的最新州级经济数据"各州同步指数"在过去三个月里除阿拉斯加州外,所有州的经济都有所增长,"表明我们并未陷入衰退"。圣路易斯联邦储备银行的一项研究表明,至少有一半的指数需要显示负增长,才能让人有理由相信美国经济正处于衰退之中。

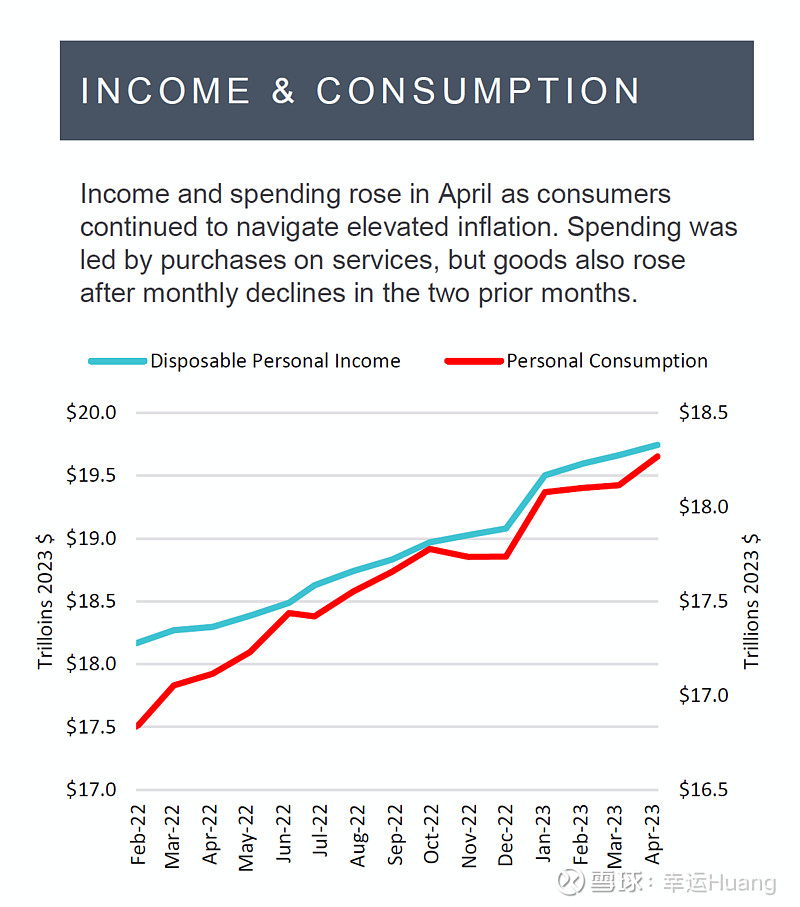

The University of Michigan Consumer Confidence Index, which had risen to 64.9 in January after a record low of 50 last June, was at 59.2 in May, a 4.3-point drop from April. Nonetheless, personal consumption was up 6.7% year over year in April while personal disposable income was up 4.7%, indicating that “the economy is holding up better than many have argued,” Kleinhenz said.

密歇根大学消费者信心指数(University of Michigan Consumer Confidence Index)在去年6月达到创纪录低点50后,1月升至64.9,5月降至59.2,较4月下降4.3点。尽管如此,4月份个人消费同比增长6.7%,个人可支配收入增长4.7%,这表明“经济比许多人认为的要好,”克莱因亨茨说。

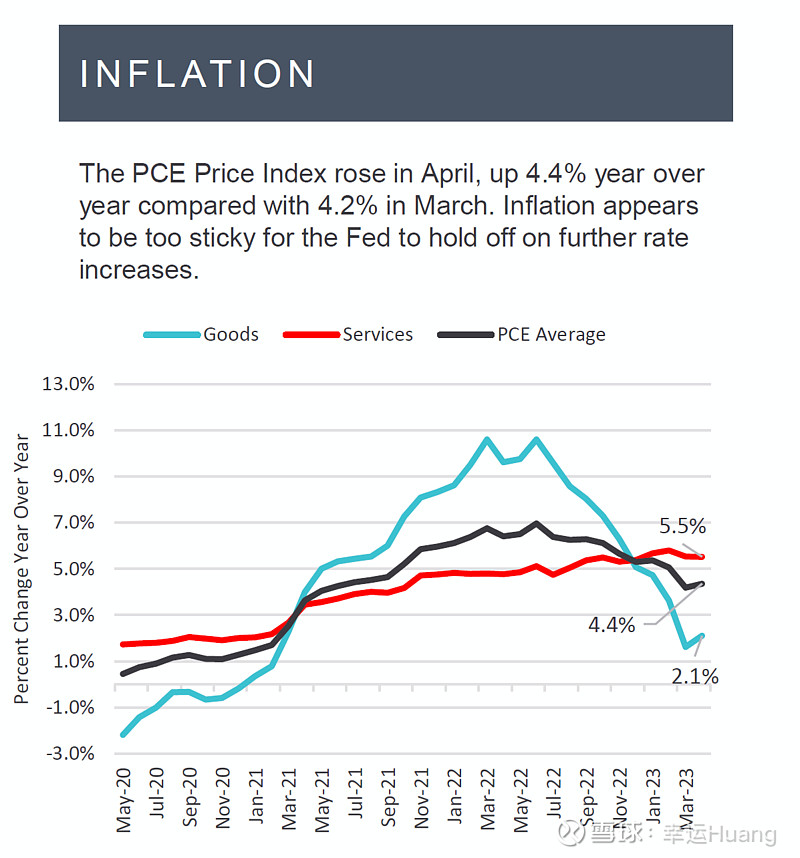

Year-over-year inflation as measured by the Personal Consumption Expenditures Price Index was at 4.4% in April. That compared with 4.9% in the first quarter and 5.7% in the fourth quarter.

以个人消费支出价格指数(PCE)衡量,4月份的同比通胀率为4.4%。相比之下,第一季度和第四季度分别为4.9%和5.7%。

由于消费者继续应对高通胀,4月份收入和支出双双上升。服务支出领涨,但商品支出在前两个月下滑后也有所上升。