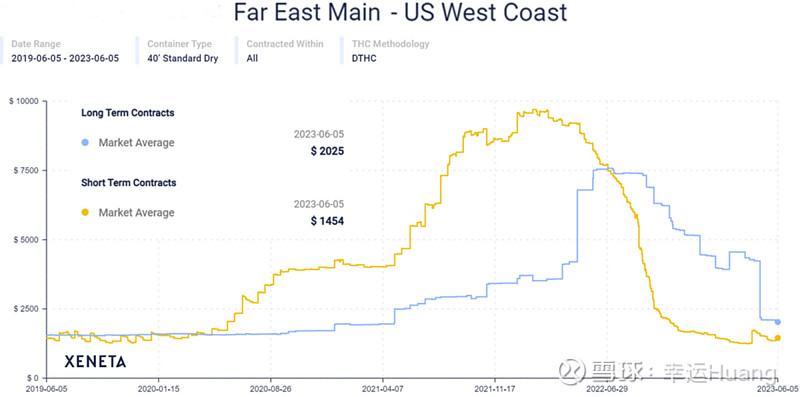

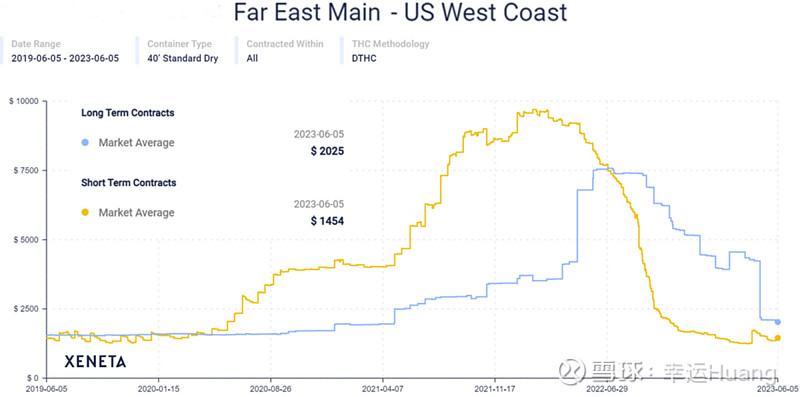

重点: 1、6.5日Xeneta远东-西海岸航线的平均长期运价为每FEU 2025美元,仍比2019年同期(covid - 19前)上涨了30%;Xeneta远东-西海岸航线的平均短期运价为每FEU 1,454美元,与新冠疫情前的水平相当

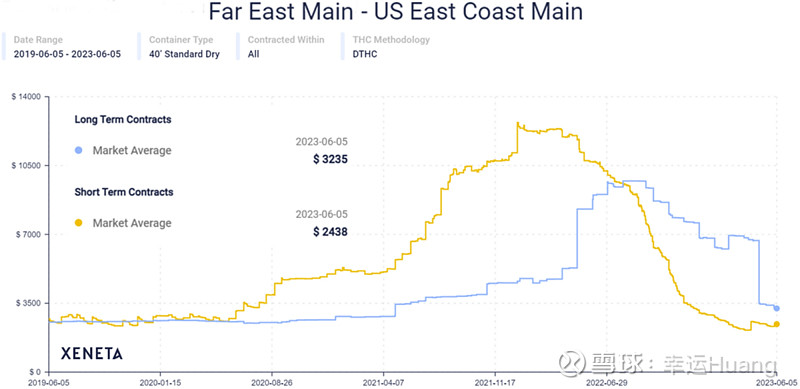

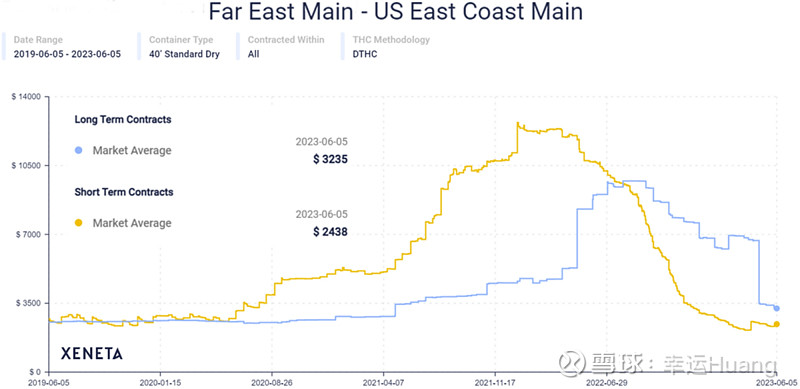

2、6.5日Xeneta评估的目前远东-东海岸的平均长期价格为3235美元/ FEU,比新冠肺炎前的水平高出28%,比目前的平均短期运价2438美元/FEU高出每FEU 797美元约33%。

3、海运公司和港口的共识是,随着假日商品的运输,旺季的货运量至少会有适度的增长,这与典型的covid前模式一致,这应该会在整个夏季和初秋为现货价格提供一些支撑,但不会出现“烟花”。需求大幅反弹的希望已经变得渺茫。

预订量数据至少从低点有所改善,这可能预示着正常季节性增长的开始。

4、在周一的一次在线演讲中,赫伯罗特首席执行官罗尔夫·哈本·詹森在续约问题上表示:“人们一直在推迟(做出承诺的时间),但总的来说,我们获得的合同承诺(数量)与去年相当。”

Shipping lines’ latest round of general rate increases partially successful 航运公司最新一轮一般运价上调部分成功

Greg Miller 格雷格•米勒 Monday, June 05, 2023 2023年6月5日,星期一

Shipping lines have pulled Asia-U.S. spot rates off the floor, but it’s a slog: two steps up, one step back, another two steps up, a slide back again. 航运公司已经把亚洲和美国的贸易关系拉了下来。即期汇率跌至谷底,但这是一个艰难的过程:上升两步,下降一步,再上升两步,再次下滑。

The general rate increase (GRI) on Thursday was partially successful, clawing back some ground lost after the April 15 GRI. 周四的总利率上调(GRI)取得了部分成功,收复了4月15日GRI上调后的部分失地。

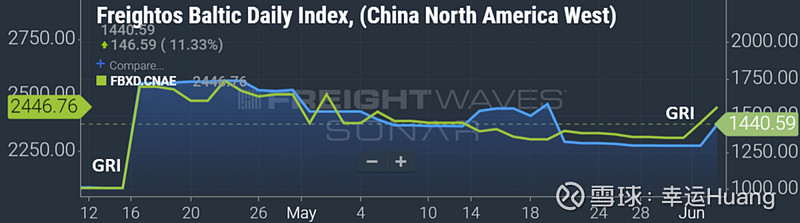

According to the Freightos Baltic Daily Index (FBX), China-West Coast spot rates were $1,441 per forty-foot equivalent unit on Friday, up 11% from prior to Thursday’s GRI and up 44% from prior to the April 15 GRI. 根据波罗的海运费每日指数(FBX),周五中国-西海岸现货运价为每40英尺当量1441美元,比周四GRI之前上涨11%,比4月15日GRI之前上涨44%。

The FBX index put China-East Coast rates at $2,448 per FEU on Friday, up 6% since the most recent GRI and 17% since the April 15 GRI. FBX指数显示,上周五中国-东海岸运价为每FEU 2,448美元,较最近一次GRI上涨6%,较4月15日的GRI上涨17%。

Blue line: Spot rate in USD per FEU, China-West Coast. Green line: China-East Coast. (Chart: FreightWaves SONAR) 蓝线:中国西海岸每FEU美元即期汇率。绿线:中国东海岸。(图表:FreightWaves声纳)

The Shanghai Containerized Freight Index rose 5% in the week ending Friday versus the prior week. Linerlytica said Monday that the SCFI rose “on the back of the June 1 trans-Pacific increases,” while “sentiment remains poor” globally and other trade lanes are “under significant pressure.” 截至上周五的一周,上海集装箱运价指数较前一周上涨5%。Linerlytica周一表示,SCFI指数“在6月1日跨太平洋增长的背景下”上涨,而全球“情绪仍然低迷”,其他贸易通道“面临巨大压力”。

Platts said Monday that the market remains bearish “despite a general rate increase for North American imports from the Far East on June 1 that offered temporary relief to the weak spot market.” Platts’ spot-rate assessments from North Asia and Southeast Asia to both U.S. coasts inched up last week as a result of GRIs. 普氏能源公司周一表示,市场仍然看跌,“尽管6月1日北美从远东进口的原油价格普遍上涨,暂时缓解了疲软的现货市场。”受GRIs影响,普氏能源资讯上周对从北亚、东南亚到美国东海岸的现货利率评估小幅上升。

But market participants told Platts that cargo demand can’t support spot rate increases and the expectation is for rates to slide back again. “It’s a good strategy at the end of the day,” a freight forwarding source told Platts. “If [carriers] ask for $500 and get $100, they will take it. It’s better than just watching the rates drop.” 但市场参与者告诉普氏能源资讯,货运需求无法支撑现货运价上涨,预计运价将再次回落。一位货代消息人士对普氏能源资讯表示:“归根结底,这是一个好策略。”“如果(运营商)要求500美元,得到100美元,他们就会接受。这比眼睁睁地看着利率下降要好。”

Annual contract rates plunge, as expected 年度合约利率如预期般大幅下挫

The normalization of spot rates and cargo volumes to pre-COVID levels was expected by ocean carriers after one-off pandemic drivers eased. Another expectation was that annual trans-Pacific contracts for the May 1, 2023, to April 30, 2024, period would sink back toward normal price levels. That too has come to pass. 在一次性大流行驱动因素缓解后,海运公司预计现货价格和货运量将恢复到新冠肺炎前的水平。另一个预期是,2023年5月1日至2024年4月30日期间的年度跨太平洋合同价格将回落至正常水平。这也发生了。

Norway-based Xeneta collects data on both long-term and short-term (spot) rates. It put average long-term rates on the Far East-West Coast route at $2,025 per FEU on Monday. That’s down 52% from the end of April as a result of new annual contracts coming into force in May. 总部位于挪威的Xeneta收集长期和短期(即期)汇率的数据。周一,远东-西海岸航线的平均长期运价为每FEU 2025美元。由于新的年度合同将于5月份生效,这一数字较4月底下降了52%。

Average long-term rates on this route were 3.7 times higher ($7,545 per FEU) at their peak a year ago. Nevertheless, the current long-term average is still up 30% versus this time in 2019, pre-COVID, according to Xeneta data. 一年前,这条航线的平均长期运价达到峰值时的3.7倍(7545美元/ FEU)。尽管如此,根据Xeneta的数据,目前的长期平均水平仍比2019年同期(covid - 19前)上涨了30%。

(Chart: Xeneta) (图:Xeneta)

Xeneta put average short-term rates on the Far East-West Coast route at $1,454 per FEU as of Monday, matching pre-COVID levels. 截至周一,Xeneta将远东-西海岸航线的平均短期费率定为每FEU 1,454美元,与新冠疫情前的水平相当。

The current long-term average is $571 per FEU or 39% higher than the short-term average, implying carriers have had at least some success in propping up revenues in the face of weak demand, given that a higher share of their volume is on contract. 目前的长期平均价格,比短期平均价格高出FEU 571美元约39%,这意味着运营商在面对需求疲软的情况下,至少在支撑收入方面取得了一些成功,因为他们的订单份额更高。

The pattern is the same in the Far East-East Coast lane. Xeneta assessed current average long-term rates at $3,235 per FEU on Monday. These rates have plunged 52% from late April as new annual contract rates have taken effect. 远东-东海岸航线的情况也一样。Xeneta周一评估了目前的平均长期价格为3235美元/ FEU。随着新的年度合同费率生效,这些费率较4月底下降了52%。

Peak long-term rates on this route, in August 2022, were triple current rates. However, current average long-term rates in the Far East-East Coast trade are 28% higher than pre-COVID levels and $797 per FEU or 33% higher than current average short-term rates, according to Xeneta data. 2022年8月,这条航线的长期利率达到峰值,是目前利率的三倍。然而,根据Xeneta的数据,目前远东-东海岸贸易的平均长期费率比新冠肺炎前的水平高出28%,比目前的平均短期费率高出每FEU 797美元约33%。

(Chart: Xeneta) (图:Xeneta)

Peak season ahead 旺季即将来临

The consensus of ocean carriers and ports is that there will be at least a moderate bump in peak-season volumes as holiday goods are shipped, in line with typical pre-COVID patterns, which should provide some support to spot rates through summer and early fall, but no fireworks. Hopes of a significant demand rebound have dimmed.海运公司和港口的共识是,随着假日商品的运输,旺季的货运量至少会有适度的增长,这与典型的covid前模式一致,这应该会在整个夏季和初秋为现货价格提供一些支撑,但不会出现“烟花”。需求大幅反弹的希望已经变得渺茫。

During an online presentation Monday, Hapag-Lloyd CEO Rolf Habben Jansen said on contract renewals: “People have been pushing out [the timeline for] making commitments, but by and large, the contract commitments [volumes] we have secured are fairly comparable to what we had last year. 在周一的一次在线演讲中,赫伯罗特首席执行官罗尔夫·哈本·詹森在续约问题上表示:“人们一直在推迟(做出承诺的时间),但总的来说,我们获得的合同承诺(数量)与去年相当。

“The market has normalized and there was definitely subdued demand in Q4 and Q1, but there is a little bit of a recovery now,” said Habben Jansen. Habben Jansen说:“市场已经正常化,第四季度和第一季度的需求肯定是低迷的,但现在有一点复苏。”

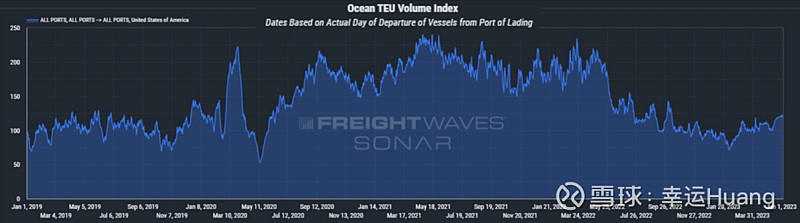

Bookings data shows at least some improvement from the lows, which might indicate the beginning of a normal seasonal increase. 预订量数据至少从低点有所改善,这可能预示着正常季节性增长的开始。

The proprietary bookings index of FreightWaves SONAR’s Container Atlas — which measures bookings bound for the U.S. from all destinations as of the scheduled date of departure — was at 121 points on Monday (100 is indexed to Jan. 1, 2019), very near the high for this year and in line with the levels at this time in 2019, pre-COVID. FreightWaves SONAR的集装箱地图集(Container Atlas)的专有预订指数(衡量截至预定出发日期从所有目的地前往美国的预订量)在周一达到121点(100点的指数为2019年1月1日),非常接近今年的高点,与2019年这个时候的水平一致。

(Chart: FreightWaves SONAR Container Atlas) (图:FreightWaves SONAR货柜地图集)