重点:1、 Danaos报告称,2023年第一季度净收入为1.462亿美元。调整后每股收益为7.14美元,高于市场普遍预期的6.22美元。扣非净收入同比增长16%,营收增长6%。

大多数吨位供应商与集装箱航运公司签订的船舶合同都是多年期的。上行空间依然稳固。此外,尽管有大量新船交付,但吨位供应商与班轮公司签订新的租船合同(价格较低,但仍有利可图)并不困难。

截至今年2月,Danaos 2023年的产能已售罄93%,2024年的产能已售罄64%。截至周一,今年的覆盖率为97%,明年为73%。其平均租期为3.2年。

2、Costamare公布2023年第一季度净收入为1.416亿美元,而2022年第一季度为1.154亿美元。调整后每股收益为38美分,略高于市场预期的36美分。同比增长23%。

Costamare今年的集装箱船运力预订率为98%,明年为86%。其租约的平均teu加权期限为4.1年。

3、 衡量全球租船费率的Harpex指数较2022年3月的历史高点下跌了74%。但它比3月份的低点上涨了17%,比2019年5月中旬(covid - 19前)的水平高出一倍多。

"新船订单仍是市场的主要威胁," Costamare首席财务官Gregory Zikos周一在与分析师的电话会议上承认。即便如此,他指出,“租船费率呈上升趋势,需求普遍较高,而固定期限也在延长。”

Danaos首席执行官John Coustas在周二的电话会议上表示:“由于自由船舶供应非常有限,以及由于承租人寻求遵守CII[环境]法规而降低速度的影响,租船市场已经有所改善。”

结论:集运业内人士都是傻子,都不知道未来有多少新船下水也不懂周期,![]()

![]()

![]()

![]()

Owners renting ships to liners have leases locked in through 2024 将船舶租给班轮公司的船东的租约将锁定到2024年

Greg Miller 格雷格•米勒 Tuesday, May 16, 2023 2023年5月16日,星期二

Foreign container lines were widely blamed for stratospheric freight rates during the supply chain crisis. President Joe Biden proclaimed last June he was “viscerally angry” at the “rip-off,” clenching his fist and saying he felt like “popping someone,” presumably a foreign container-line executive. 在供应链危机期间,外国集装箱航运公司被普遍指责为运费过高的罪魁祸首。去年6月,美国总统乔·拜登(Joe Biden)宣称,他对这种“敲诈”感到“发自内心的愤怒”,他握紧拳头,说他想“干掉某人”,大概是一位外国集装箱航运公司的高管。

As the shipping lines took the heat for raking in billions amid the pandemic, another group of foreign-owned container shipping companies quietly raked in record sums outside the publicity glare: the container-ship lessors, otherwise known as tonnage providers. 当航运公司因在疫情期间赚取数十亿美元而受到指责时,另一批外资集装箱航运公司在公众视线之外悄悄赚取了创纪录的金额:集装箱船出租人,也被称为吨位供应商。

Shipping lines own about half their fleets and rent the rest. The supply chain crisis was not just the greatest period in history for shipping lines, it was the greatest period in history for the shipowners that rented the tonnage to the liner companies. 航运公司拥有大约一半的船队,其余的租用。供应链危机不仅是航运公司历史上最严重的时期,也是向班轮公司出租吨位的船东历史上最严重的时期。

The more ships the liner companies could get their hands on, the more money they could make off cargo shippers. Liners were desperate for ships in 2021-2022 and tonnage providers could dictate the terms, forcing charter durations to years beyond what liner companies wanted and jacking up rates to historic highs. At one point, some ships were renting for six figures per day. 班轮公司掌握的船只越多,他们从货主那里赚的钱就越多。班轮公司迫切需要2021-2022年的船舶,而吨位供应商可以决定条款,迫使租船期限比班轮公司想要的时间长几年,并将费率推高至历史高位。一些船只的租金一度达到每天六位数。

Now that the dust has settled, tonnage providers are far less exposed than shipping lines to the pullback in import demand. They’re heavily shielded by their charters through 2024. Not only did they completely avoid public and political backlash during the boom, but their post-boom earnings will stay stronger for longer. 既然尘埃落定,吨位供应商受到进口需求回落的影响远小于航运公司。他们在2024年之前都受到学校章程的严格保护。它们不仅在繁荣期完全避免了公众和政治上的反弹,而且它们在繁荣期后的盈利将在更长时间内保持强劲。

Danaos orders more newbuildings Danaos订购了更多的新船

The second-largest publicly listed tonnage provider, Greece’s Danaos Corp. (NYSE: DAC), recorded aggregate net income of $1.8 billion in 2020-2022. Danaos owns a fleet of 68 container ships plus eight under construction, with total capacity of 476,293 twenty-foot equivalent units. 第二大公开上市吨位供应商希腊Danaos Corp.(纽约证券交易所代码:DAC)在2020-2022年的总净利润为18亿美元。Danaos拥有68艘集装箱船,另有8艘正在建造中,总运力为476293艘20英尺当量单位。

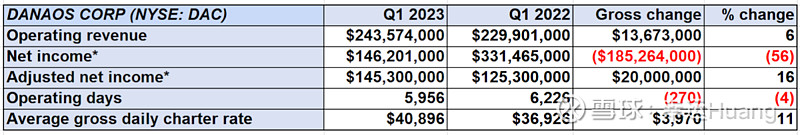

On Monday, Danaos reported net income of $146.2 million for the first quarter of 2023. Adjusted earnings per share came in at $7.14, topping the consensus forecast of $6.22. 周一,Danaos报告称,2023年第一季度净收入为1.462亿美元。调整后每股收益为7.14美元,高于市场普遍预期的6.22美元。

Danaos’ earnings were inflated by a dividend from its stake in liner company Zim (NYSE: ZIM) in Q1 2022. Excluding the earlier Zim gain (it no longer owns Zim shares), Danaos’ Q1 2023 adjusted net income was up 16% year on year. Operating revenues were up 6%. Danaos的收益因其在2022年第一季度所持班轮公司Zim(纽约证券交易所代码:Zim)股份的股息而虚高。不包括早些时候Zim的收益(它不再拥有Zim的股票),Danaos 2023年第一季度调整后的净收入同比增长16%。营业收入增长了6%。

* Net income includes Zim dividend; adjusted net income excludes Zim dividend. *净收入包括Zim股息;调整后净收入不包括Zim股息。

That’s a stark contrast to what’s happening with first-quarter shipping line profits, which have plunged by 60% to 95% year on year. 这与一季度航运公司利润的情况形成了鲜明对比,一季度航运公司利润同比下降了60% - 95%。

Most shipping line contracts with cargo shippers last only one year. Virtually all of the freight contracts signed at inflated rates during the boom have now expired. 大多数航运公司与货主签订的合同只持续一年。几乎所有在繁荣时期以虚高价格签订的货运合同现在都已到期。

Most of the tonnage providers’ boom-inflated vessel contracts with container lines were signed for multiple years’ duration. The upside is still firmly in place. Furthermore, tonnage providers are having no trouble signing fresh charter contracts with liners (at lower yet still profitable rates) despite a flood of newbuilding deliveries. 大多数吨位供应商与集装箱航运公司签订的船舶合同都是多年期的。上行空间依然稳固。此外,尽管有大量新船交付,但吨位供应商与班轮公司签订新的租船合同(价格较低,但仍有利可图)并不困难。

As of February, Danaos had 93% of its capacity sold out for 2023 and 64% sold out for 2024. As of Monday, it was 97% covered for this year and 73% covered next year. Its average charter duration is 3.2 years. 截至今年2月,Danaos 2023年的产能已售罄93%,2024年的产能已售罄64%。截至周一,今年的覆盖率为97%,明年为73%。其平均租期为3.2年。

Danaos booked an additional $380.7 million in contracted revenue over the past three months. That included $262 million for three-year charters for six newbuildings to be delivered in the second half of 2024. (Two have 7,100-TEU capacity, four have 7,200-TEU capacity; all are methanol-fuel-ready.) Danaos在过去三个月的合同收入增加了3.807亿美元。其中包括2.62亿美元,用于在2024年下半年交付6艘新船的三年租约。(7100teu容量2个,7200teu容量4个;它们都可以用作甲醇燃料。)

The company is so confident in future prospects that it just signed contracts for two additional 6,000-TEU newbuildings — without charters attached and without financing in place. One is due for delivery in Q4 2024, the other in Q2 2025. 该公司对未来前景充满信心,刚刚签署了另外两艘6000 teu新船的合同——没有附加租约,也没有融资。一架将于2024年第四季度交付,另一架将于2025年第二季度交付。

Danaos’ shares rose 4.6% on Tuesday as the broader market fell and the Dow dropped over 300 points. Danaos股价周二上涨4.6%,而大盘下跌,道琼斯指数下跌逾300点。

Costamare’s container segment ‘remains robust’ Costamare集装箱业务“保持强劲”

Atlas Corp., owner of Seaspan, was previously the largest U.S.-listed tonnage provider. It was taken private by buyers Fairfax Holdings, company insiders and ocean carrier ONE, and delisted in March. The largest U.S-listed tonnage provider now is Greece’s Costamare (NYSE: CMRE). It owns 71 container ships with aggregate capacity of 524,000 TEUs. 西斯班的所有者阿特拉斯公司此前是美国最大的上市吨位供应商。该公司被收购方费尔法克斯控股(Fairfax Holdings)、公司内部人士和海运公司ONE私有化,并于今年3月退市。目前在美国上市的最大吨位供应商是希腊的Costamare(纽约证券交易所代码:CMRE)。拥有集装箱船舶71艘,总运力52.4万标准箱。

Costamare, unlike Danaos, is a mixed-fleet operator. It also owns 43 dry bulk vessels and is the lead investor in a leasing platform that covers multiple shipping segments. 与Danaos不同,Costamare是一家混合舰队运营商。它还拥有43艘干散货船,是一个涵盖多个航运领域的租赁平台的主要投资者。

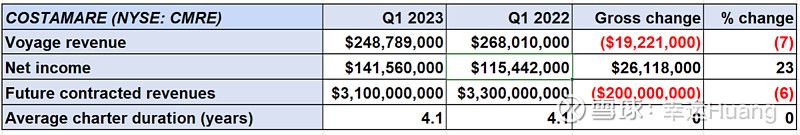

Costamare now has 98% of its container-ship capacity booked for this year and 86% for next year. The average TEU-weighted duration of its charters is 4.1 years. Costamare今年的集装箱船运力预订率为98%,明年为86%。其租约的平均teu加权期限为4.1年。

On Monday, Costamare reported net income of $141.6 million for Q1 2023 versus $115.4 million in Q1 2022. Adjusted earnings per share came in at 38 cents, just above the consensus forecast for 36 cents. 周一,Costamare公布2023年第一季度净收入为1.416亿美元,而2022年第一季度为1.154亿美元。调整后每股收益为38美分,略高于市场预期的36美分。

Costamare’s results were “impacted by the softer dry bulk environment … [but] the container segment remains robust, more than offsetting losses from the dry bulk segments,” said Nokta. Nokta表示,Costamare的业绩“受到干散货市场疲软的影响……但集装箱业务仍然强劲,足以抵消干散货业务的损失。”

According to Stifel analyst Ben Nolan, Danaos’ dry bulk fleet “has been a drag to performance,” whereas its container-ship fleet “continues to pay out impressive levels of cash flow on relatively long-duration contracts.” 据Stifel分析师Ben Nolan称,Danaos的干散货船队“拖累了业绩”,而其集装箱船船队“继续在相对长期的合同上支付可观的现金流”。

Container-ship charter rates “have fallen off materially” from boom-era highs, but Costamare has an “extremely favorable glide path” courtesy of “its pandemic-related contract extensions,” said Nolan. 诺兰表示,集装箱船租船费率已从繁荣时期的高点“大幅下降”,但由于“与大流行相关的合同延期”,Costamare的“下滑路径非常有利”。

Charter market rises off the bottom 租船市场触底回升

The container-ship charter market has defied negative expectations. It has risen off the bottom since March, despite a record wave of newbuildings entering the market and a continued fall in average freight rates. 集装箱船租赁市场顶住了负面预期。自3月份以来,尽管创纪录的新船进入市场,平均运费持续下降,但该价格已从底部上涨。

The Harpex index, which measures global charter rates, is down 74% from the all-time high reached in March 2022. But it’s up 17% from March lows and is over double levels in mid-May 2019, pre-COVID. 衡量全球租船费率的Harpex指数较2022年3月的历史高点下跌了74%。但它比3月份的低点上涨了17%,比2019年5月中旬(covid - 19前)的水平高出一倍多。

“The orderbook remains the principal threat to the market,” acknowledged Costamare CFO Gregory Zikos on Monday’s conference call with analysts. Even so, he noted that “charter rates are on a rising trend with high demand across the board, while fixture periods are increasing in duration.” "订单仍是市场的主要威胁," Costamare首席财务官Gregory Zikos周一在与分析师的电话会议上承认。即便如此,他指出,“租船费率呈上升趋势,需求普遍较高,而固定期限也在延长。”

Danaos CEO John Coustas said on Tuesday’s call, “The charter market has improved due to the very limited supply of charter-free vessels as well as the impact of speed reductions as charterers seek to comply with CII [environmental] regulations.” Danaos首席执行官John Coustas在周二的电话会议上表示:“由于免租船舶供应非常有限,以及由于承租人寻求遵守CII[环境]法规而降低速度的影响,租船市场已经有所改善。”

Coustas expressed little concern about the company’s five 13,082-TEU ships on charter to South Korea’s HMM at $64,918 per day that come up for renewal next year. Those vessels have options for three-year extensions at $60,418 per day that would need to be declared starting in Q4 2023. costas对该公司以每天64,918美元的价格租给韩国现代商船的5艘13,082 teu船表示不太担心,这些船将于明年续约。这些船舶可以选择以每天60,418美元的价格延长三年,需要从2023年第四季度开始申报。

“We are not really concerned, because there are very few, if any, ships of that size available in 2024,” said Coustas. 库斯塔斯说:“我们并不真的担心,因为到2024年,这种规模的船只很少,如果有的话。”

“We are already in contact with a number of liner companies about the employment of these ships. So, we will definitely have something fixed as soon as there is more clarity on whether the existing charterer is going to exercise the options.” “我们已经与一些班轮公司就聘用这些船只进行了接触。因此,一旦现有承租人是否会行使期权的问题更加明确,我们肯定会解决一些问题。”