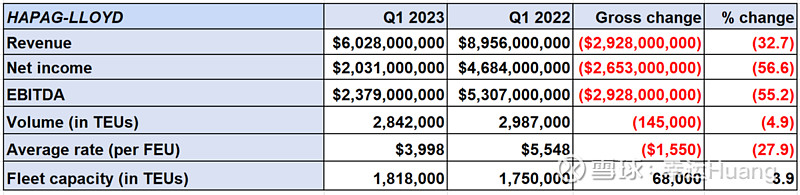

Hapag-Lloyd posts $2B Q1 net income, maintains full-year profit outlook 赫伯罗特公布第一季度净利润20亿美元,维持全年盈利预期

Greg Miller 格雷格•米勒 Thursday, May 11, 2023 2023年5月11日,星期四

Ocean carrier Hapag-Lloyd expects a moderate rate rebound ahead. (Photo: Shutterstock/EQRoy) 远洋运输公司赫伯罗特预计未来费率将适度反弹。(图:上面/ EQRoy)

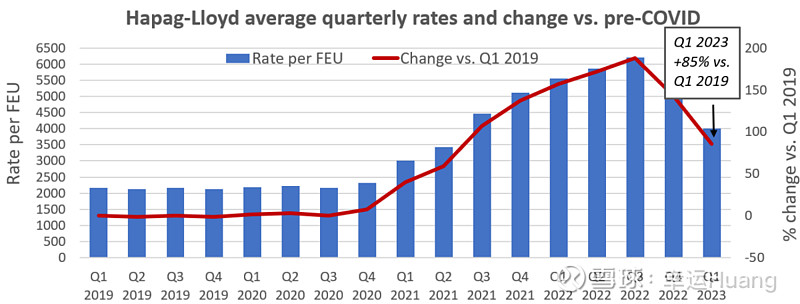

Germany’s Hapag-Lloyd, the world’s fifth-largest shipping line, posted better-than-expected results for the first quarter of 2023, with freight rates averaging $3,998 per forty-foot equivalent unit, 85% above pre-COVID levels.

世界第五大航运公司德国赫伯罗特(Hapag-Lloyd)公布了2023年第一季度好于预期的业绩,每40英尺等效单位的平均运费为3998美元,比新冠疫情前的水平高出85%。

“Volumes remained subdued as the inventory correction starting in the second half of last year continued, but the numbers started to look a little better toward the end of the quarter,” said CEO Rolf Habben Jansen on Thursday’s conference call.

该公司首席执行官Rolf Habben Jansen在周四的电话会议上表示:“由于去年下半年开始的库存调整仍在继续,销量仍然低迷,但接近季度末时,数据开始看起来有所好转。”

“We think it’s going to remain subdued [in the second quarter] but I do believe the second quarter will be better than the first. I don’t think that means we’re now going to see a very quick recovery, but I do think it underlines the point that destocking is slowly but steadily coming to an end, and at some point in time, we will quite likely see a bit of a pickup in demand.”

“我们认为(第二季度)经济将继续低迷,但我确实相信第二季度会好于第一季度。我不认为这意味着我们现在将看到一个非常迅速的复苏,但我确实认为它强调了一点,即去库存正在缓慢但稳步地结束,在某个时间点,我们很可能会看到需求有所回升。”

Cargo volumes dropped sharply in the second half of last year. Habben Jansen predicted that “at some point, probably in Q3, [volume] will cross into year-on-year growth,” with full-year totals coming in close to or slightly above 2022 levels despite low first-half demand.

去年下半年,货运量急剧下降。Habben Jansen预测,“在某个时候,可能是在第三季度,[数量]将进入同比增长”,尽管上半年需求低迷,但全年总量将接近或略高于2022年的水平。(这个预计相当乐观啊。。。![]() )

)

‘We are still wrapping up negotiations’ 我们仍在结束谈判。

Spot rates have been below breakeven for carriers in the trans-Pacific and Asia-Europe trades, he said. 他说,跨太平洋和亚欧航线的现货运价一直低于盈亏平衡。(萝卜成本确实不低)

“Right now, we see spot rates being very, very low in a number of the headhauls. If we see a bit of an uptick in seasonal demand going into peak season, I expect to see a bit of a recovery in those spot rates, for a number of months, probably starting toward the end of Q2 [and lasting] at least until Golden Week [the first week of October].”

“目前,我们看到一些大宗商品的即期运价非常、非常低。如果我们看到季节性需求在进入旺季时有所上升,我预计现货价格会在几个月内有所回升,可能从第二季度末开始,至少持续到黄金周(10月的第一周)。”

Average rates — including both contract and spot — are set to fall further starting in the second quarter due to renewals of annual trans-Pacific contracts at much lower levels than last year.

从第二季度开始,包括合约和现货在内的平均费率将进一步下降,原因是跨太平洋年度合约的续约水平远低于去年。(只是萝卜,对各家其实不一样)

Trans-Pacific contracts generally run from May 1 to April 30, but Hapag-Lloyd has yet to finish talks. “We are still wrapping up negotiations as we speak,” said Habben Jansen. “Negotiations on the trans-Pacific have not been easy this year.” 跨太平洋合同的期限一般为5月1日至4月30日,但赫伯罗特尚未完成谈判。他说:“就在我们说话的时候,我们仍在结束谈判。“今年跨太平洋贸易协定的谈判并不容易。”(明摆着就是低价合同不愿意签)

He confirmed that contracts that have been signed are at rates above loss-making spot levels. “Some of the spot rates have gone to levels that do not make sense, because you simply lose too much money. We do not close contracts for 12-month durations if we know up front that we are going to lose a significant amount of money. So yes, most of the contract rates have been closed at levels that are definitely above spot levels.”

他证实,已签署的合约价格高于亏损的即期价格。“一些即期运价已经达到了不合理的水平,因为你损失了太多的钱。如果我们事先知道我们会损失一大笔钱,我们就不会结束为期12个月的合同。所以,是的,大多数合约价格的收盘价肯定高于现货价格。”

Why rates could increase despite capacity deluge 为什么在产能过剩的情况下,费率还会上涨

In the medium and longer term, the big challenge for shipping lines is the orderbook. An unprecedented amount of new capacity is being deliveredstarting this year and continuing through 2025.

从中长期来看,航运公司面临的最大挑战是订单。从今年开始,到2025年,将有前所未有的新产能交付。

“It is a very significant orderbook. There are quite a lot of ships in the pipeline,” said Habben Jansen.

“这是一个非常重要的订单。有相当多的船只在管道中,”Habben Jansen说。

Although deliveries started ramping up in March and are now in full swing, he believes capacity pressure won’t peak until next year.

尽管今年3月交付量开始增加,目前正如火如荼地进行,但他认为产能压力要到明年才会达到峰值。

“For 2023, I think the effect is still manageable because quite a lot of new ships won’t come until the second half. But certainly for the next two years, it will put pressure on the market. When we look to 2024 and 2025, the likelihood that supply growth will outpace demand growth is high.”

“对于2023年,我认为这种影响仍然是可控的,因为相当多的新船要到下半年才会出现。但可以肯定的是,在未来两年,这将给市场带来压力。当我们展望2024年和2025年时,供应增长超过需求增长的可能性很高。”

Despite these supply pressures, he argued that market forces will push freight rates up to levels that cover higher carrier costs.

尽管存在这些供应压力,但他认为,市场力量将把运费推高至能够覆盖更高运输成本的水平。(他们能覆盖成本,我控就会大把挣钱)

“When you look at rates falling back to pre-COVID levels, those rates are not sustainable in the long run because costs have come up. The reality today is that everybody faces costs that are 25-30% higher [than before the pandemic].

“当你看到费率回落到covid前的水平时,从长远来看,这些费率是不可持续的,因为成本已经上升。今天的现实是,每个人面临的成本(比大流行之前)高出25%至30%。

“If you look back in history, there have only been short periods of time when rates were really far below costs. That is because 65% of the costs of every voyage are variable costs. As soon as the market drops too much, carriers will start taking out costs [by canceling sailings]. Over time, that helps rates go back to a level that is at least at or hopefully slightly better than costs.

“如果你回顾历史,只有很短的一段时间,费率真的远低于成本。这是因为每次航行的成本中有65%是可变成本。一旦市场下跌太多,航空公司就会开始(通过取消航班)削减成本。随着时间的推移,这有助于利率回到至少等于或希望略高于成本的水平。

“So, your long-term outlook on rates should be that they will remain 25-30% above what we saw in 2018-19 simply because if they don’t, we would end up with a lot of cash-negative shipments. And with 65% of the costs being variable, we would have to take action to mitigate costs.”

“因此,你对费率的长期展望应该是,它们将比我们在2018-19年看到的水平增加25-30%,因为如果它们不这样做,我们最终将面临大量的现金负增长。”由于65%的成本是可变的,我们必须采取行动来降低成本。”

Why rates could stay low for longer 为什么费率可以在更长的时间内保持低位

At least, that’s Habben Jansen’s theory. 至少,这是Habben Jansen的理论。

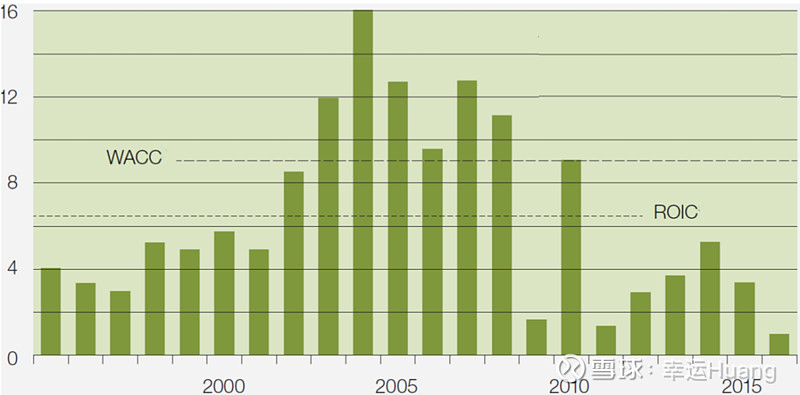

The counter argument is that the liner industry did indeed suffer extended losses in the decades prior to the COVID boom. Carriers were able to survive years in the red, in some cases due to government support.

相反的观点是,在新冠疫情爆发前的几十年里,班轮行业确实遭受了长期的损失。在某些情况下,由于政府的支持,航空公司能够在亏损状态下存活多年。

And this time around, carriers are flush with billions in windfall cash from the boom, so they can more easily sustain prolonged losses. As Sea-Intelligence CEO Alan Murphy ,told Splash “The only thing that scares me more than shipping lines without money is shipping lines with money.”

而这一次,航空公司从繁荣中获得了数十亿美元的意外之财,因此它们可以更容易地承受长期亏损。正如Sea-Intelligence首席执行官Alan Murphy告诉Splash的那样,“唯一比没有钱的航运公司更让我害怕的是有钱的航运公司。”

Regarding losses in earlier eras, former APL CEO Ron Widdows said during a Marine Money conference in 2014: “With the structure of the companies — some of these are state-backed, some quasi-state-backed — the operating philosophies and how they price and how they view returns are different.

关于早期的亏损,APL前首席执行官Ron Widdows在2014年的海洋货币会议上表示:“随着公司的结构——其中一些是国家支持的,一些是准国家支持的——运营理念、定价方式以及对回报的看法都是不同的。

“Those with state backing don’t necessarily have to generate the kind of returns a stand-alone company or a publicly listed one has to generate,” said Widdows. “The container sector hasn’t made its cost of capital during the past decade, or for any decade you want to look at,” he said of pre-2014 returns (referring to a period when the industry was much less consolidated than it is today).

“那些有政府支持的公司不一定要产生独立公司或上市公司必须产生的那种回报,”Widdows说。他在谈到2014年之前的回报时表示:“在过去10年里,或者在你想看的任何10年里,集装箱行业都没有实现其资本成本。”2014年之前的回报指的是该行业整合程度远低于今天的时期。

Container lines’ percentage annual return on invested capital (ROIC) 1995-2016. WACC: weighted average cost of capital. (Chart: McKinsey & Co., February 2018. Sources: Capital IQ, CPAT, McKinsey analysis) 集装箱班轮公司1995-2016年投资资本年回报率(ROIC)百分比。加权平均资本成本。(图表:麦肯锡公司,2018年2月)资料来源:Capital IQ, CPAT,麦肯锡分析)

McKinsey & Co. estimated in a report published in February 2018 that ocean carriers “destroyed over $100 billion in shareholder value over the last 20 years.”

麦肯锡公司(McKinsey & Co.)在2018年2月发布的一份报告中估计,海运公司“在过去20年里摧毁了超过1000亿美元的股东价值”。

The consultancy noted that the liner industry’s profitability “was particularly poor between 2011 and 2016, when the industry average return on invested capital was consistently lower than the weighted average cost of capital.”

该咨询公司指出,班轮行业的盈利能力“在2011年至2016年期间尤为糟糕,当时该行业的平均投资资本回报率一直低于加权平均资本成本。”

Q1 results far surpassed pre-COVID results 第一季度的业绩远远超过了疫情前的业绩

Hapag-Lloyd reported net income of $2.03 billion for Q1 2023, down 57% year on year. Earnings before interest, taxes, depreciation and amortization came in at $2.38 billion, above analysts’ forecast for $2.1 billion. Earnings before interest and taxes totaled $1.87 billion, topping the forecast for $1.6 billion.

赫伯罗特报告称,2023年第一季度净利润为20.3亿美元,同比下降57%。息税折旧及摊销前利润为23.8亿美元,高于分析师预测的21亿美元。息税前利润总计18.7亿美元,超过16亿美元的预期。

Results for Q1 2023 were “a solid beat of 12% at the EBITDA level and 19% at the EBIT level,” said Deutsche Bank analyst Andy Chu.

德意志银行分析师Andy Chu表示,2023年第一季度的业绩“在息税折旧摊销前利润率达到12%,在息税前利润率上达到19%。” (EBITDA利润率应该是39%,EBIT利润率31%,没看懂可能是原来分析师的预计吧)

According to Habben Jansen, “The financials are quite exceptional if you look at them in a historical context.”

根据Habben Jansen的说法,“如果你从历史背景来看,他们的财务状况是非常特殊的。”

Comparing Q1 2023 to Q1 2019, pre-COVID, net income was 19 times higher in the latest period, driven by the 85% improvement in average rates. Hapag-Lloyd’s EBIT margin (operating profit as a percentage of revenue) was 7% in Q1 2019. In the latest quarter, it was more than quadruple that: 31.1%.

将2023年第一季度与2019年第一季度(新冠肺炎前)相比,由于平均单箱收入提高了85%,最近一段时间的净收入增长了19倍。2019年第一季度,赫伯罗特的息税前利润率(营业利润占收入的百分比)为7%。而在最近一个季度,这一比例为31.1%,是这个数字的四倍多。

(Chart: FreightWaves based on Hapag-Lloyd financial filings) (图表:FreightWaves基于赫伯罗特的财务文件)

In early March, Hapag-Lloyd introduced its full-year 2023 guidance for EBITDA of $4.3 billion to $6.5 billion and EBIT of $2.1 billion to $4.3 billion. It made no changes to that guidance on Thursday.

今年3月初,赫伯罗特公布了2023年全年EBITDA和EBIT预期,分别为43亿至65亿美元和21亿至43亿美元。周四,它对这一指引没有做出任何改变。

Given that Hapag-Lloyd earned 44% of the full-year EBITDA range midpoint and 58% of the EBIT midpoint in the first quarter alone, the maintained guidance implies a steep earnings decline ahead. Even so, if the carrier does hit its target, 2023 would be the third-best year in the company’s history.

鉴于赫伯罗特仅在第一季度就实现了全年EBITDA区间中值的44%和EBIT区间中值的58%,维持这一预期意味着未来盈利将大幅下滑。即便如此,如果该公司真的实现了目标,2023年将是该公司历史上第三好的一年。(老马和萝卜确实够保守。。。)