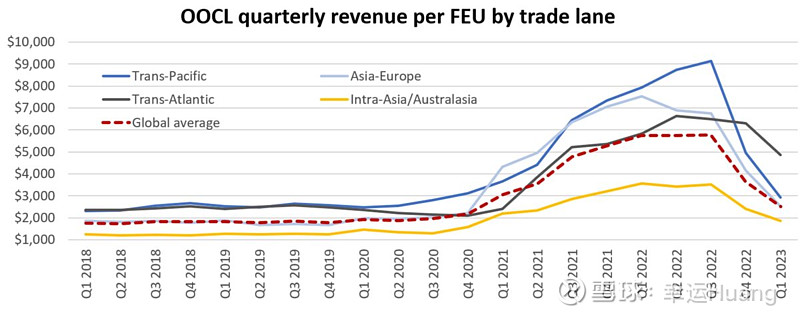

重点: 东方海外每FEU收入比疫情前高出40%(每TEU的单箱收入直接除以2跟我自己的计算结果没什么区别,不过注意这个都只是叫做换算价格,便于统计的一致口径而已;在实际报价中每TEU和每FEU的报价并不是2倍的关系,而且每个航线FEU和TEU的价格关系也都有差异),其中

跨太平洋航线1457USD/TEU比疫情前上升16%,

欧线1261USD/TEU比疫情前上升42%,

跨大西洋2433USD/TEU比疫情前高出99%,

亚洲航线933USD/TEU比疫情前高出51%。

看明细很清楚了比疫情前高很多的主要是欧线,跨大西洋和亚洲内部,而目前还在用“老长协”的美线运价升幅是最小的,还觉得一季度业绩主要是靠长协在支撑吗?

运价中枢上移是必然的的,还在幻想今年集运暴亏的该醒醒了。。。

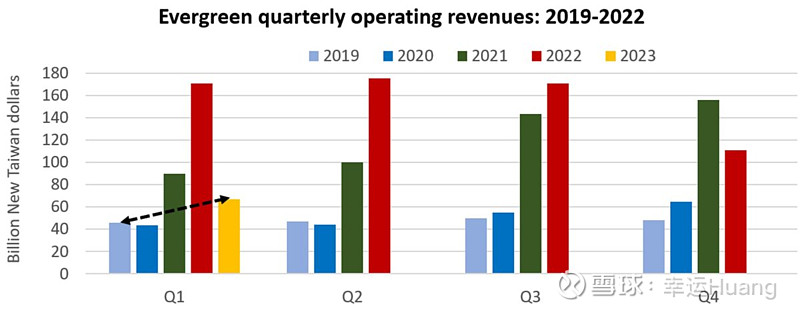

长荣集团2023年第一季度的营业收入总计新台币668亿元(合22亿美元)。同比下降61%,季率环比下降40%,但仍比2019年第一季度(covid前)增长46%。作为对比东方海外Q1营收环比下降是32%,基本可以预计Q1公司环比营收降幅和EBIT降幅都会优于同行。

(一个不确定的存在是萝卜,它的长协价Q1还能硬挺吗?待下月初验证)

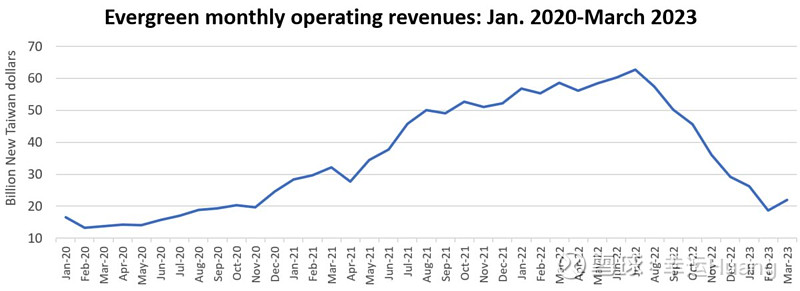

从月度趋势看长荣3月份的营业收入为新台币219亿元,这一数据较2月份增长17%,为去年7月以来的首次增长。

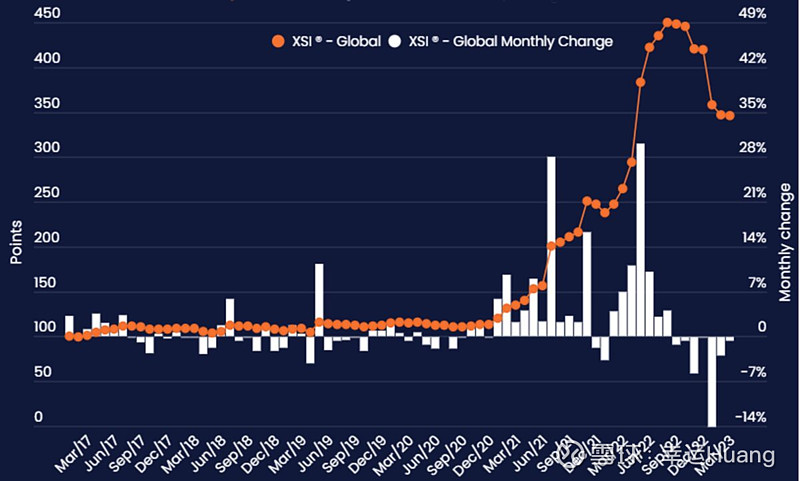

涵盖即期和合约价格(动态合约价,包括较短的季度约等)的XSI全球指数3月份仅比2月份下跌0.5%,约为疫情前指数水平的三倍。

OOCL’s Q1 revenue per FEU 40% higher than in 2018-2019 东方海外第一季度每FEU收入比2018-2019年增长40%

Greg Miller 格雷格•米勒

Early numbers on the first quarter are starting to trickle in from container shipping lines. They show a big step down from the fourth quarter, but they also confirm that earnings are still well above the pre-COVID “normal.” 集装箱航运公司已开始陆续公布第一季度的初步数据。数据显示,第四季度环比大幅下降,但也证实,收益仍远高于新冠疫情前的“正常水平”。

Spot rates in the trans-Pacific eastbound market have collapsed, yet carriers continue to be shielded by annual contracts signed in 2022. Meanwhile, spot rates in the trans-Atlantic westbound market remain much higher than they were prior to the pandemic. 跨太平洋东行市场的现货价格已经暴跌,但运营商继续受到2022年签署的年度合同的保护。与此同时,跨大西洋西行市场的现货利率仍远高于疫情前的水平。

Average revenue per forty-foot equivalent unit — the big driver of container shipping net income — remains higher than it was before 2020. 每40英尺当量单位的平均收入——集装箱运输净收入的主要驱动力——仍然高于2020年之前的水平。

OOCL revenue per FEU 40% higher than pre-COVID 东方海外每FEU收入比疫情前高出40%

Hong Kong-based OOCL, a subsidiary of China’s Cosco, earned a global average of $2,503 in revenue per FEU in Q1 2023. 总部位于香港的中国远洋的子公司东方海外,在2023年第一季度,每FEU的全球平均收入为2503美元。

That’s down 56% year on year (y/y) and 31% sequentially versus Q4 2022. However, OOCL averaged $1,793 in revenue per FEU in the eight quarters during 2018 and 2019, prior to the pandemic-induced shipping boom. Its Q1 2023 revenue per FEU was 40% above that average. 同比下降56%,环比下降31%。然而,在大流行引发航运繁荣之前,东方海外在2018年和2019年的八个季度中,每个FEU的平均收入为1793美元。其2023年第一季度每FEU的收入比平均水平高出40%。

(Chart: FreightWaves based on data from OOCL securities filings) (图表:FreightWaves基于东方海外证券备案文件数据)

OOCL achieved $2,914 in revenue per FEU in the trans-Pacific lane in Q1 2023, down 63% y/y and 41% quarter on quarter (q/q) but still up 16% versus pre-COVID. 东方海外2023年第一季度跨太平洋航线的每FEU收入为2914美元,同比下降63%,环比下降41% (q/q),但仍比新冠疫情前增长16%。

OOCL’s Asia-Europe trade averaged $2,524 per FEU, down 66% y/y and 39% q/q but 42% above the 2018-2019 average. 东方海外的亚欧贸易平均为每FEU 2,524美元,同比下降66%,季环比下降39%,但比2018-2019年的平均水平高出42%。

The carrier’s smallest market by volume — the trans-Atlantic — was its best performer. Q1 2023 trans-Atlantic revenue came in at $4,865 per FEU, 99% higher than pre-pandemic levels. Trans-Atlantic revenue per FEU was down 17% y/y and 23% q/q. 该公司销量最小的市场——跨大西洋市场——表现最好。2023年第一季度跨大西洋收入为每FEU 4,865美元,比大流行前的水平高出99%。跨大西洋地区每FEU收入同比下降17%,季环比下降23%。

The intra-Asia trade is by far OOCL’s largest market by volume. In general, rates in this trade are lower than in the mainline east-west markets. OOCL posted revenue of $1,867 per FEU in Q1 2023 in the intra-Asia trade, down 48% y/y and 22% q/q but still up 51% from the 2018-2019 average. 亚洲内部贸易是东方海外迄今为止交易量最大的市场。一般来说,这种交易的利率低于东西向的主流市场。东方海外在2023年第一季度的亚洲内部贸易收入为每FEU 1,867美元,同比下降48%,季环比下降22%,但仍比2018-2019年的平均水平增长51%。

Evergreen operating revenue up in March vs. February 长荣3月份营业收入较2月份有所增长

Taiwan’s Evergreen, the world’s sixth-largest ocean carrier, reports monthly operating revenues. It disclosed its March revenues on Monday. 台湾长荣航空公布了月度营业收入。长荣航空是全球第六大远洋航空公司。该公司周一公布了3月份的收入。

Evergreen’s operating revenues totaled 66.8 billion New Taiwan dollars ($2.2 billion) in Q1 2023. That’s down 61% y/y and 40% q/q, but still up 46% from Q1 2019, pre-COVID. 长荣集团2023年第一季度的营业收入总计新台币668亿元(合22亿美元)。同比下降61%,季率下降40%,但仍比2019年第一季度(covid前)增长46%。

(Chart: FreightWaves based on Evergreen securities filings) (图表:FreightWaves基于长荣证券备案文件)

Looking at the monthly trend, Evergreen reported operating revenues of 21.9 billion New Taiwan dollars in March. 从月度趋势来看,长荣3月份的营业收入为新台币219亿元。

This was up 17% from February, marking the first m/m increase since last July. 这一数据较2月份增长17%,为去年7月以来的首次增长。

(Chart: FreightWaves based on Evergreen securities filings) (图表:FreightWaves基于长荣证券备案文件)

Freight rates fall at much slower pace 运费下降的速度要慢得多

Indexes covering spot freight rates and long-term rates show continued deterioration, but at a much slower rate of decline than in the second half of 2022. Xeneta’s XSI Global index, which tracks long-term contract rates, fell just 0.5% in March versus February, to 345.87 points, “a slower pace than in previous months,” said Xeneta. 涵盖现货运价和长期运价的指数仍在继续恶化,但下降速度比2022年下半年慢得多。Xeneta追踪长期合同利率的XSI全球指数3月份仅比2月份下跌0.5%,至345.87点,“比前几个月的速度要慢,”Xeneta说。

(Chart: Xeneta) (图:Xeneta)

The XSI is down 24% from its all-time high in August 2022, however, it’s still up 30.5% y/y and is around three times pre-COVID index levels. XSI指数较2022年8月的历史高点下跌了24%,但仍同比上涨30.5%,约为疫情前指数水平的三倍。

The Drewry World Container Index global composite — which measures average spot rates — was unchanged w/w for the week ending Thursday, at $1,710 per FEU. 在截至周四的一周,衡量平均现货汇率的德鲁里世界集装箱指数(Drewry World Container Index)全球综合指数(wpi)与前一周持平,为每FEU 1710美元。

The WCI global composite is down 79% y/y and is 84% below the all-time high of $10,277 per FEU reached in September 2022. Yet the index is still 20% above its 2018-2019 average, said Drewry. WCI全球综合指数同比下跌79%,比2022年9月达到的每FEU 10277美元的历史高点低了84%。德鲁里表示,该指数仍比2018-2019年的平均水平高出20%。