总结: 目前唯一的超高运价航线欧洲至美东虽然运价目前在下降,但仍然是疫情前运价的3倍(WCI 6322USD/FEU),也是美西运价的3倍(WCI 2072USD/FEU)。

22年此航线运价维持高位的原因主要是1月至11月来自欧洲的集装箱进口同比增长2% ,比疫情爆发前的2019年同期增长13% 。从欧洲进口的集装箱主要是建筑用品、葡萄酒和其他饮料、家具、汽车零部件、纸制品和食品。去年成交量的推动因素之一是美元兑欧元走强。 (此外欧洲港口下半年罢工的此起彼伏和美东沿岸的拥堵也是运价持续高位的原因)

未来随着船司在此航线上逐步增加航次,拥堵释放运力,欧元美元汇率趋势逆转,美东拥堵消失,未来此航线运价大幅下降也是预期内的事情。

Europe-US rates declining, yet remain almost triple pre-pandemic levels

欧洲至美国的运价在下降,但仍几乎是大流行前水平的三倍

Greg Miller 格雷格 · 米勒·Monday, January 30, 2023

The rise of East Coast ports has been largely credited to the fall of West Coast ports — to shippers switching routes following the expiration of the West Coast port labor contract in July. But that’s only part of the story.

东海岸港口的兴起在很大程度上要归功于西海岸港口的衰落ーー在西海岸港口劳动合同于7月份到期后,货主转换了运输路线。但这只是故事的一部分。

Double-digit growth in imports from Europe has been another big driver of East Coast strength.

来自欧洲的两位数进口增长,是东海岸经济强劲增长的另一大驱动力。

Even after recent declines, Europe-East Coast spot rates remain almost triple pre-pandemic levels and more than triple rates in the Asia-West Coast market.

即使在最近的下降之后,欧洲-东海岸现货运价仍然几乎是大流行前水平的三倍,同样也是亚洲-西海岸市场现货运价的三倍以上。

Indexes falling but still very high

指数在下降,但仍然很高

Different spot rate indexes provide different numbers but generally show the same trend. The Drewry World Container Index (WCI) put Rotterdam-New York spot rates at $6,322 per forty-foot equivalent unit in the week ending Thursday, unchanged from the week before. In contrast, Drewry’s Shanghai-Los Angeles Index and its global composite are just above $2,000 per FEU, close to pre-pandemic levels.

不同的即期汇率指数提供不同的数字,但通常表现出相同的趋势。Drewry World 集装箱指数(WCI)显示,在截至周四的一周内,鹿特丹-纽约现货价格为每40英尺当量单位6,322美元,与前一周持平。相比之下,德鲁士的上海-洛杉矶指数(Shanghai-Los Angeles Index)及其全球综合指数仅略高于每股2000美元,接近疫情爆发前的水平。

While the WCI Rotterdam-New York index has fallen 15% from its all-time high in November, it’s still 2.6 times higher than it was in January 2020.

尽管 WCI 鹿特丹-纽约指数已从去年11月的历史高点下跌15% ,但仍比2020年1月高出2.6倍。

Blue line: Rotterdam-NY. Green line: Shanghai-LA. Orange line: global average. (Chart: FreightWaves SONAR) 蓝线: 鹿特丹-纽约。绿线: 上海-洛杉矶。橙线: 全球平均。(图表: 海浪声纳)

The Freightos Baltic Daily Index assessed Europe-East Coast spot rates at $5,210 per FEU on Friday, relatively unchanged since the beginning of this year.

货运波罗的海每日指数(Freightos Baltic Daily Index)周五评估欧洲-东海岸现货价格为每 FEU 5,210美元,与今年年初相对持平。

This is down 27% from November, but still 2.9 times January 2020 levels.

这比11月份下降了27% ,但仍是2020年1月份水平的2.9倍。

Blue line: Europe-East Coast. Green line: China-West Coast. Orange line: global average. (Chart: FreightWaves SONAR) 蓝线: 欧洲-东海岸。绿线: 中国-西海岸。橙线: 全球平均水平。(图表: 海浪声纳)

Xeneta tracks both contract rates and spot rates. Its short-term index put North Europe-U.S. East Coast rates at $6,086 per FEU as of Wednesday. Long-term rates for this trade were under $6,000 per FEU as of mid-January.

Xeneta 跟踪合同费率和即期费率。其短期指数显示,截至周三,北欧-美国东海岸的 FEU 利率为6,086美元。截至1月中旬,这种贸易的长期利率低于每 FEU 6000美元。

Spot rates have fallen below contract rates in almost all of the world’s container trades — but not yet in the trans-Atlantic westbound lane. In markets where spot rates have sunk well below contract prices, carriers have agreed to lower some of their long-term rates in mid-contract, further reducing revenues. That renegotiation dynamic does not apply in the trans-Atlantic.

在全球几乎所有的集装箱交易中,即期利率都低于合约利率,但在跨大西洋西行线上还没有出现这种情况。在现货价格远低于合同价格的市场,航运公司已同意在合同中期降低部分长期费率,从而进一步减少收入。这种重新谈判的动力并不适用于跨大西洋地区。

Europe-U.S. rates remain “historically strong,” said Xeneta Chief Analyst Peter Sand earlier this month, adding that both short-term and contract rates in January 2021 “were roughly a third of today’s prices.”

Xeneta 首席分析师 Peter Sand 本月早些时候表示,欧美利率仍然“历史性地强劲”,并补充说,2021年1月的短期和合约利率“大约是目前价格的三分之一”

Carriers shift more ships to the Atlantic

航司将更多的船只转移到大西洋

Rate strength continues to attract more ships to the trade, which are being shifted in from less profitable markets like the trans-Pacific. The new capacity is “now undermining the high rates that attracted the vessels in the first place,” noted Sand.

运价上涨继续吸引更多船舶进入这一贸易领域,这些船舶正从利润较低的市场(如跨太平洋)转移进来。桑德指出,新的运力“现在正在削弱最初吸引这些船只的高运价”。

Sea-Intelligence said last month that trans-Pacific westbound capacity will increase 20%-30% in the first quarter.

海洋情报局上个月表示,第一季度跨太平洋西行运力将增长20% -30% 。

Alphaliner has reported numerous service additions: Cosco, OOCL and ONE doubled the sailing frequency of their East Med-East Coast “EMA” service. THE Alliance and Ocean Alliance reinstated calls in New York and Savannah, Georgia, for their joint Med-East Coast “AL6” loop. Ellerman City Liners launched a new North Europe-East Coast service. Evergreen upsized its ships in the trans-Atlantic market. The 2M alliance between Maersk and MSC added three ships to its coverage.

Alphaliner 报告了许多新增的服务项目: 中远、东方海外公司和 ONE 将其东地中海-东海岸“ EMA”航行频率提高了一倍。THE联盟和海洋联盟恢复了在纽约和佐治亚州萨凡纳的服务-地中海东海岸“ AL6”航次。埃勒曼城市邮轮公司推出了新的北欧-东海岸服务。常春公司在跨大西洋市场扩大了船只规模。Maersk 和海上安全委员会之间的2M 联盟增加了3艘舰艇的覆盖范围。

Meanwhile, East Coast port congestion has largely cleared, releasing even more vessel capacity into the market.

与此同时,东海岸港口的拥堵状况已基本得到缓解,释放出更多的船舶运力投入市场。

Platts, a division of S&P Global, believes these additions are having an increasingly negative effect on spot rates. Unlike the Drewry and Freightos indexes, which were steady last week, Platts’ trans-Atlantic assessment plunged. Its Europe-East Coast index fell $800 per FEU, to $5,000 per FEU, down 14% from the week before.

标普全球(S & P Global)旗下的普氏能源资讯(Platts)认为,这些新增资产正对现货利率产生越来越负面的影响。与上周持稳的 Drewry 和 Freightos 指数不同,普氏跨大西洋评估指数大幅下挫。其欧洲-东海岸指数下跌800美元每 FEU,至5000美元每 FEU,下降14% ,从一周前。

Sources told Platts that the sudden drop was due to capacity additions and that they expect rates to keep falling.

消息人士告诉普氏能源资讯(Platts) ,利率突然下降是由于产能增加,他们预计利率将继续下降。

Imports from Europe exceptionally strong in 2022

2022年来自欧洲的进口异常强劲

Customs data compiled by the U.S. Census Bureau shows that containerized imports from Europe are dominated by building supplies, wine and other beverages, furniture, automotive parts, paper products, and food.

美国人口普查局编制的海关数据显示,从欧洲进口的集装箱主要是建筑用品、葡萄酒和其他饮料、家具、汽车零部件、纸制品和食品。

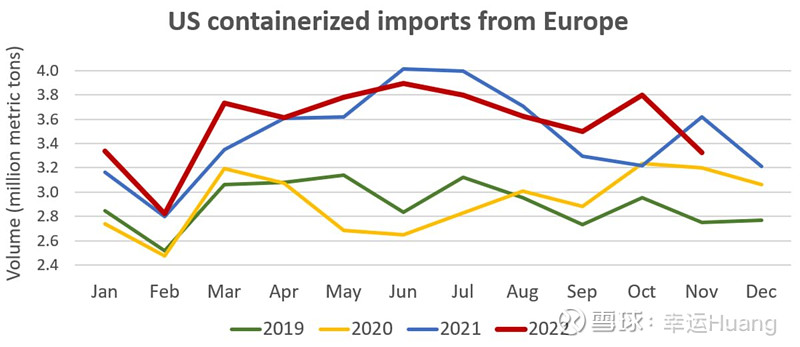

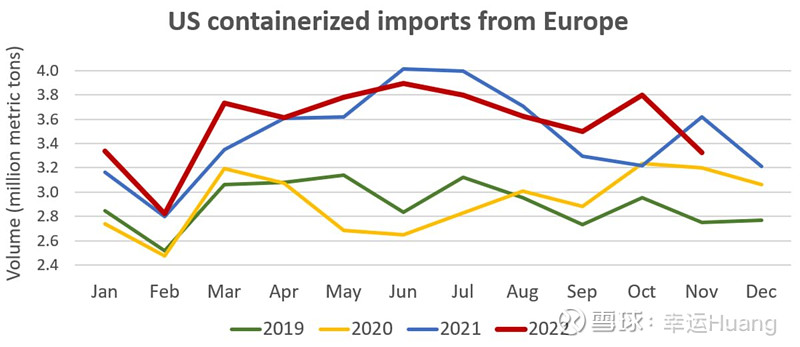

According to the latest data, containerized imports from Europe in January-November were up 2% year on year and up 13% versus the same period in 2019, pre-COVID.

根据最新数据,1月至11月来自欧洲的集装箱进口同比增长2% ,比疫情爆发前的2019年同期增长13% 。

While imports from Europe fell in November versus October, they were still 21% higher than volumes in November 2019.

尽管11月份从欧洲的进口比10月份有所下降,但仍比2019年11月份高出21% 。

(Chart: American Shipper based on data from U.S. Census/U.S. Customs) (图表: 基于美国人口普查/美国海关数据的美国托运人)

One volume driver last year was the strength of the dollar versus the euro. This currency advantage has been reversing over the past three months.

去年成交量的推动因素之一是美元兑欧元走强。过去3个月,这种汇率优势一直在逆转。

Maritime Strategies International (MSI) said in a report on Friday: “There has been a brightening of investor sentiment toward the European economy, which could result in an influx of money into Eurozone financial assets, strengthening the euro against the dollar. This could further weigh on U.S. imports from the region.”

国际海事战略组织(MSI)在周五的一份报告中说: “投资者对欧洲经济的情绪已经有所改善,这可能导致大量资金涌入欧元区金融资产,从而使欧元对美元走强。这可能进一步拖累美国从该地区的进口。”

As a result of the currency factor, reduced U.S. consumer demand and the unwinding of congestion at East Coast ports, MSI expects trans-Atlantic rates “to drop further in the coming months.”

由于汇率因素、美国消费者需求减少以及东海岸港口的拥堵状况有所缓解,微星国际预计跨大西洋运费“在未来几个月将进一步下降”