forcode:上午读高毅资产发的那个2020年伯克希尔年会全文翻译,现在再打开这个英文原文,然后用机器翻译,发现机器翻译质量反而更好,那些所谓中文版,简直坑爹,漏了很多内容,很多翻译不准确……

不过,很多地方,还是得读英语原文,才更容易理解:

前段时间,我发了2篇对巴菲特的猜测:《巴菲特为何割肉航空股?》和《巴菲特为何还不满仓?》,今天读了伯克希尔年会会议记录,基本印证了我的判断。

巴菲特在年会里其实解释了为何持有如此多现金,伯克希尔旗下保险业务销售结构化付款的保险业务,比如医疗事故、车祸等人生意外造成的按月赔付,很多家庭依靠伯克希尔的每月理赔来支付医疗费和生活费。相信在目前这种大规模感染和死亡的情况下,这类结构化付款面临很大的资金需求。

Warren Buffett: (01:28:13)

But basically these businesses will produce cash even though their earnings decline somewhat. And if we’ll go to part two, at Berkshire, we keep ourselves in an extraordinary strong position. We’ll always do that—that’s just fundamental. We insure people. We’re a specialist to some extent and a leader. It’s not our main business, but we sell structured settlements. That means somebody gets in a terrible accident, usually an auto accident, and they’re going to require care for 10, 30, 50 years.

查了一下结构化保险的介绍:

What is a Structured Settlement?

Structured settlements are a method of compensating injury victims. A structured settlement is a voluntary agreement reached between two parties, typically a plaintiff and a defendant, under which the injured person is compensated for damages in the form of a stream of periodic cash payments purchased for the plaintiff on behalf of the defendant. Structured Settlements are a completely voluntary agreement between the injury victim and the defendant.

How are Structured Settlements paid?

Under a structured settlement agreement, an injury victim doesn't receive compensation for their injury in one lump sum. The victim receives a stream of tax-free payments tailored to meet future medical expenses and basic living needs.

伯克希尔手头大约有1240亿美元现金和国债,大约1800亿的股票持仓,但这并不意味着伯克希尔持有40%那么多的现金仓位,因为1800亿不包括伯克希尔旗下非上市公司的股权,所以,伯克希尔1240亿美元看起来很多,但其实整体现金仓位远低于40%。

巴菲特提到美股历史上曾经因为战争或恐慌,股票市场关门过几个月的情况,如果真的发生股市关门几个月这种黑天鹅事件,那旗下企业急需用钱应对资金链断裂的时候,无法随时卖出股票换到现金的,伯克希尔需要考虑这类情况,所以,伯克希尔手头总是要有大笔现金备用。

And we will always keep plenty of cash on hand, and for any circumstances, with a 9/11 comes along, if the stock market is closed, as it was in World War I—it’s not going to be, but I didn’t think we were going to be having a pandemic when I watched that Creighton-Villanova game in January either.

过去一些年,由于低利率,很多美国公司过度负债,当股市暴跌时,很多公司争相去杠杆,导致对现金的需求远超华尔街的承受能力……

2008~2009年,市场崩盘时,出现流动性彻底消失的情况,即使那些投资级公司的交易,都出现买盘消失冻结的局面。今年3月23日,美股也出现了流动性消失造成的恐慌性抛售,还好有美联储出手。

And we don’t want to be dependent on the kindness of friends even because there are times when money almost stops. And we had one of those, interestingly enough. We had it, of course, in 2008 and ’09.

Warren Buffett: (01:33:32)

But right around in the day or two leading up to March 23rd, we came very close but fortunately we had a Federal Reserve that knew what to do, but money was… investment-grade companies were essentially going to be frozen out of the market.

但美联储未必每一次都会及时出手救助,救助力度也未必足够,我们想为任何情况做好准备。加上伯克希尔全资拥有的企业,在疫情中也需要消耗大量现金,这就是伯克希尔持有1240亿美元现金的原因。

We have businesses we own directly that are going to be hurt significantly. The virus will cost Berkshire money. It doesn’t cost money because of our stock. And various other businesses moves around. I mean, if XYZ, which say is one of our holdings and we own it as a business and we liked the business. The stock was down 20 or 30 or 40%. We don’t feel we’re poor in that situation. We felt we were poor in terms of what actually happened to those airline businesses just as if we don’t a hundred percent of them.

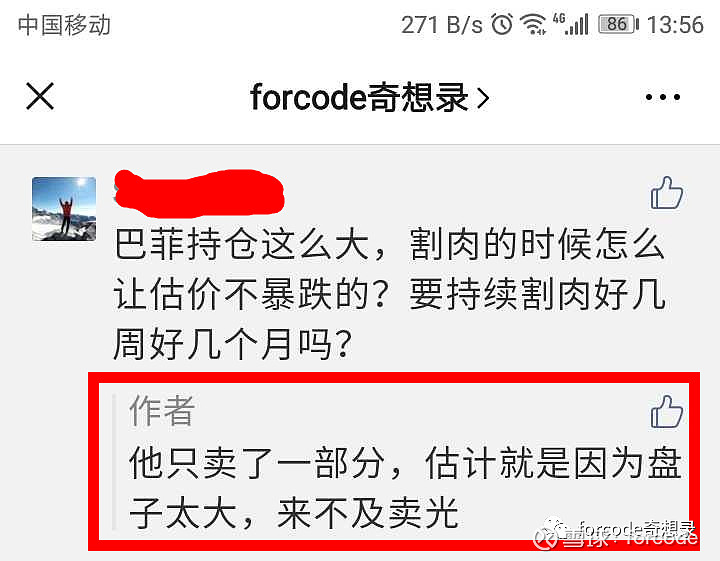

forcode:前段时间新闻说巴菲特减仓航空股,还有人(估计跟巴菲特买航空股被套牢)自我安慰说巴菲特只卖了一部分,并不是不看好(不是下面这个截图,找不到是哪个帖子了)。我说没全卖光只是因为盘子太大,一下子来不及清空。结果新闻出来,巴菲特果然已经全卖掉了。不想持有十年,就不要持有十分钟,航空股有很大的倒闭风险,巴菲特卖出肯定就是准备全卖掉,不会低买高卖做波段的。

巴菲特卖出航空股,主要因为他买入的四家航空公司,未来几年每家都要融资至少100~120亿美元才能活下去,融资的条件可能不利,损害原有股东利益。

另外,不确定航空业两三年能否恢复,如果只能恢复60~80%,那会打价格战,因为飞机很难去产能,多出来的飞机不会被拆掉,价格战会导致巨大的亏损。

巨额融资需求+连续产能过剩价格战亏损,是巴菲特清空航空股的主要原因。

People have been told basically not to fly. I’ve been told not to fly for a while. I’m looking forward to flying them. May not fly commercial, but that’s another question. The airline business, and I may be wrong and I hope I’m wrong, but I think it changed in a very major way, and it’s obviously changed in the fact that there’re four companies are each going to borrow perhaps an average of at least 10 or 12 billion each.

Warren Buffett: (01:44:11)

You have to pay that back out of earnings over some period of time. I mean, you’re 10 or $12 billion worse off if that happens. And of course in some cases they’re having to sell stock or sell the right to buy a stock at these prices. And that takes away from the upside down. And I don’t know whether it’s two or three years from now that as many people will fly as many passenger miles as they did last year. They may and they may not, but the future is much less clear to me, [inaudible 00:02:52], how the business will turn out through absolutely no fault of the airlines themselves. That’s something that was a low probability event happened, and it happened to hurt particularly the travel business, the hotel business, cruise business, the theme park business, but the airline business in particular. And of course the airline business has the problem that if the business comes back 70% or 80%, the aircraft don’t disappear.

Warren Buffett: (01:45:26)

So you’ve got too many planes, but it didn’t look that way when the orders were placed a few months ago, when arrangements were made. But the world changed for airlines.

================

forcode:另外,我们也可以看到,美股大部分公司的估值,相比2008年,并没有出现暴跌导致的极度低估现象。

在美联储无限量购买资产的话术影响下,美股蓝筹股,大部分已经涨回到去年底的价格,尤其微软、亚马逊反而创出了新高,根本没有2008年那种跌幅和便宜程度……

这次疫情造成的股灾,主要是石油、旅游、餐饮、汽车等与出行有关的产业受损,大部分标普500指数标的跌幅有限,估值还是贵得很!

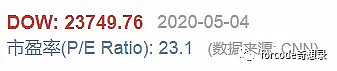

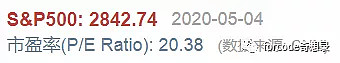

目前道琼斯指数平均市盈率23.1倍,标普500平均市盈率20.38倍,纳斯达克平均市盈率27倍。相比美国历史平均14倍市盈率,目前美股整体还处于高估状态。参考:《1881-2017标普平均PE、CPI、盈利、利率、分红》

下载1881-2017年标普平均市盈率的excel格式数据:关注本订阅号:forcode奇想录,发消息“市盈率”,将自动回复excel文件的下载地址。

这种情况下,巴菲特没有大把买进,也是可以理解的。

================

本文首发微信号:forcode奇想录

未来新技术与新趋势的种种可能……