Snowflake 2Q2024/July-2023业绩

主要观点:

云计算消费在企稳,但没有见到明显的反弹。大客户仍然谨慎,给增长带来压力。

从5月份开始看到复苏,6~8月份的趋势均不错。但公司对下半年仍然谨慎,虽然本季度业绩超预期,公司并没有提高全年的业绩指引。

总订单有所增长,这显示出客户的需求仍在。但是短期RPO增长缓慢,体现出客户仍然在延后或优化使用。

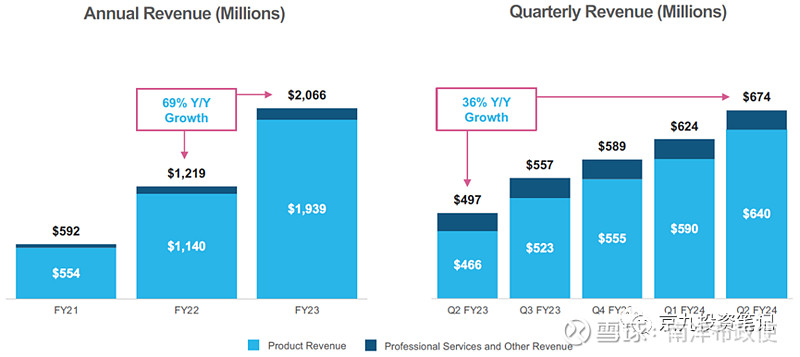

Snowflake二季度收入增长37%,高于预期的34%。虽然三季度超预期,但是公司保持了全年34%增长的指引,意味着四季度增速放缓到25%。公司对下一季度仍然是谨慎的观点。公司CFO提到“Our forecast assumes that our largest customers will continue to be a growth headwind. We are seeing encouraging signs of stabilization, but not recovery. Our forecast calls for these customers to more closely align their consumption with their annual contract value”.

云使用的优化仍在继续中。大客户大概进行了50%,仍然给增长带来压力;腰部与小客户仍在优化过程中。随着AI项目的展开,客户逐渐从优化消费转向再投入。云使用从5月份开始转正,6与7月保持了增长的趋势,8月份也较为强劲。“ In May, we saw a return to growth with strength continuing into June and July. From a booking standpoint, we saw promising signs of stabilization with new bookings outperforming our expectations. However, we believe, productivity has room for further improvement.”

目前看,云使用基本触底,但还没有看到明显的反弹,"We're not seeing customers reduce their consumption right now" and "August is shaping up very good".

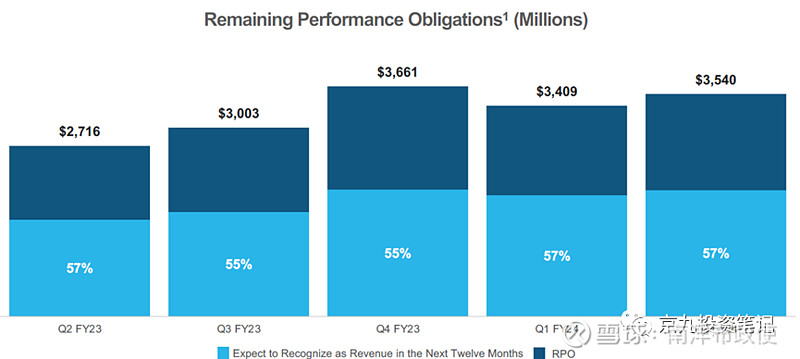

Total RPO增长30% yoy,但仍没有回到去年底的高点。与上个季度相比,current RPO增长4%,低于去年同期的12%,也低于一季度的29%的增长。年初至今增长是13%。这反映了客户在宏观的不确定性下,需求有较为明显的暂缓或优化。这与其他云公司的反馈是相似的,即客户开始重启投资,但是对投入的决心仍然较为谨慎。

“we're seeing customers renew. This quarter was a good renewal quarter. We had our largest customer, they renewed under their existing terms. They did a $100 million three-year renewal, even though their revenue run rate is at a higher amount than that.”

“we kind of saw customers more reengaging with us in July on contracts and that continues into this quarter.”

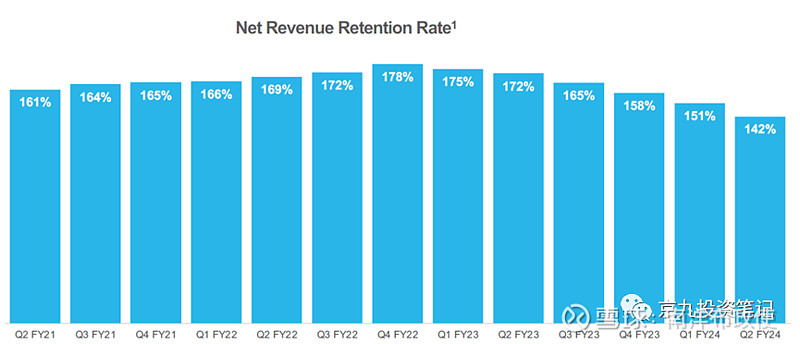

另一个值得注意的是retention rate进一步下滑,也体现出客户的计算需求仍然较为疲软,“I do think it will stabilize, but I do expect it's going to come down slightly from where it's at right now just in what we're seeing today.”

关于AI,管理层的信息是“it’s not going to happen overnight for our customers” 与“it’s a struggle to get GPUs (Snowflake secured 1,000 GPUs from AWS for $1m per month.)” 。这里对AI的预期与微软是类似的,即AI革命不会在隔夜就马上显现出来。

渠道调研也传递类似的信息:

... larger enterprise customers have been responsible for a slowdown in consumption as these customers have focused on curtailing their cloud costs as of last quarter.

Demand Environment Relatively Unchanged Over Last Six Months; Stability Could Provide Path Toward Improving Sentiment. We wouldn’t expect any recovery in software any time very soon and would be surprised if there was a meaningful recovery before year-end.

The AI Revolution is Real, and It Is Happening Now.

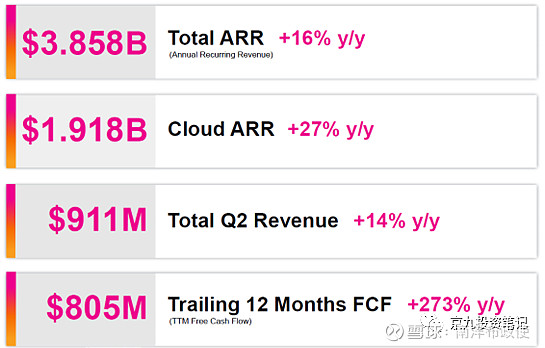

Splunk2Q2024/July-2023业绩

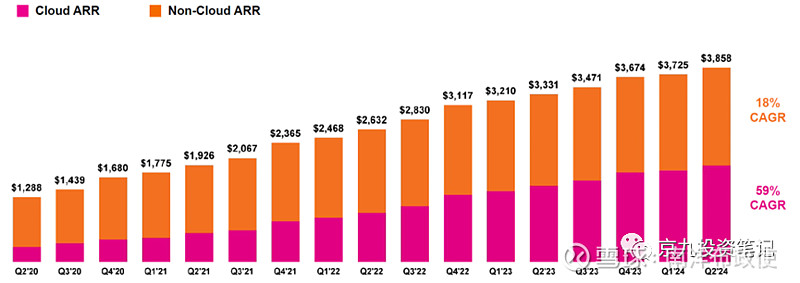

Splunk发布了整体稳健的财报。衡量ARR增速net new ARR终于重新回到正增长,结束了长达6个季度的下降。公司提升了全年ARR的指引。云业务的27%的增速,环比略微下降。

因为之前DDOG与Dynatrace的业绩都低于预期,因此市场对Splunk这次财报的预期也是较低的。Splunk的股价也是先跌为敬。虽然说不上出彩,但一份稳健的财报事实上超过了市场的预期。在很有挑战性的环境中,Splunk显示出了很强的韧性与alpha属性。

在业绩电话会上,管理层表示宏观环境依然充满不确定性,公司的业绩来源于自身的执行力,并非大环境的改善。传递的信息是较为类似的,整体大环境没有明显的改善,客户在开销上仍然谨慎。

"we continue to see a high level of deal scrutiny, we see cloud migrations continue to be thoughtfully reviewed. It's stabilized in the sense. I think we understand what that environment looks like. I think we're executing extremely well in this particular environment. I would say the macro environment is pretty much the same of what we see in the entire year as we mentioned in the prepared remarks."

"I would say the macro environment has been largely consistent this entire year. And what that means to us has been we've seen choppiness in cloud migrations, meaning customers hem and haw over cloud migrations, they will defer them if they can because it represents an incremental project. There continues to be a lot of scrutiny, meaning additional sign-offs, etc. I think, though, having said all that, as we described earlier, I think our team has done a really good job of navigating through that."

可以看到,公司的RPO企稳,但没有显著增加。

渠道调研显示:

Checks for Q2 showed incremental sequential improvement for Splunk, with resellers indicating a mostly-inline quarter and slightly improved growth compared to Q1. Vendors mentioned strength from existing customers and renewals.

1)continued softness as a result of deals getting further pushed into Q3/Q4, 2) extra scrutiny of budgets not alleviating this quarter, and 3) slower than expected cloud migration activity.

MongoDB业绩展望

主要云基础设施软件中,MDB将在本月31号发布财报。之前渠道调研显示Specifically, partners noted a resumption of new workload growth and a resumption of cloud migrations as customers' mindset shifted from cost cutting over the past few quarters back towards execution on strategic initiatives.

同为数据基础设施软件的DataDog与Dynatrace的季报都低于预期,MDB股价已经先跌为敬,回调10%。在进入季报前,setup已经友好了许多。考虑到公司之前已经指引二季度会环比增长,叠加去年三季度算一个小的高基数,因此大幅度超预期难度较大。结合最近Snowflake与Splunk的数据,MDB大幅度下修指引的概率也不大。3Q指引在400m算是在预期内。

MDB今年已经大幅度跑赢小伙伴,显示出极强的alpha属性。