NVDA现在这个位置,多头的论调听太多了,不如听听空头们在想什么。

(老规矩,感兴趣的戳私信进群讨论)

1. While Nvidia is by far not as expensive as Cisco was during the peak of the dot.com bubble, Nvidia Corporation is pricey. That being said, business growth does not necessarily translate into share price gains in the near term -- investors that bought Cisco Systems (CSCO) during the dot.com bubble will know that for sure.

虽然 Nvidia 的股价远没有思科在互联网泡沫高峰时期那么昂贵,但也不便宜,考虑到该公司的增长及其强大的市场地位,这并不算离谱,但历史上Nvidia 的估值并不总是这么高。业务增长并不一定会在短期内转化为股价上涨--在互联网泡沫期间买入思科系统公司(CSCO)的投资者肯定深有体会。

将现在的英伟达比作当年的思科有一点道理,都是一个新时代开启时的资本开支最大受益者。当年的思科甚至相当于“互联网”三个字的代名词,和今天的英伟达地位相当(可能还要强于英伟达,那时候没有OpenAI)。但思科开始崛起的90s-00s,互联网应用本身命题已经成立(只不过2000出现泡沫),也就是思科所承接的资本开支起码是ROI算得过来账的。但英伟达这方面的确还有很多questionmark。鉴于AI更像是计算范式的变革,个人觉得更可比的对象是大型机时代的IBM。“蓝色巨人”当年的垄断力可一点不比现在的英伟达差。后面的故事众所周知,随着个人PC的开启更大的受益者是Apple。因此资本开支类型的生意Upside和持续性可能是要比2C生意差一些。美国投资者,尤其是经历过多次科技cycle的,从超长期视角看英伟达,对这种生意持续性的concern不可避免。

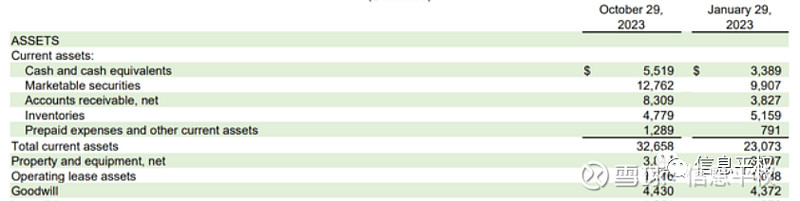

2. Unlike product sales where revenue is recognized when the product has been shipped (transfer of control) to customers, part of Nvidia's data center revenues could be software licenses where revenues are recognized upfront, even though payment and deliverables could be at a later date。Historically, bad debts have been very low for Nvidia, since products and cash changed hands almost at the same time. Going forward, if the "AI revolution" experiences any downturns and some of the Nvidia's customers become financially stressed, we may see Nvidia having to take provisions and charge-offs against its "accounts receivables,"

这个季度的应收款明显上升,有部分软件授权收入是先确认收入后分期支付。假如AI应用迟迟不落地,这部分软件应收款可能产生一些write off坏账。

这个我觉得不太makesense,因为软件收入全年才10亿美金(且有些是Ominiverse),无法解释这么高的应收增加。且应收turn over变化不大,更多还是业务增长太快导致。(有更多insight的小伙伴欢迎私信进群交流)

3. Nvidia funding startups that in turn acquire massive quantities of Nvidia GPUs financed by loan·s collateralized by said GPUs may be perfectly legal, it does optically create potential conflicts of interest. In fact, some may even argue this practice is reminiscent of the off-balance sheet entities used by Enron to illegally boost its revenues

投资一堆start up如CoreWeave,然后融资现金转一圈回来买卡,被认为是一种表外加杠杆虚增收入。

这个体量其实很小倒也不至于,但这些创业公司自己拿卡去抵押贷款,再去买卡的行为的确是在给存量市场加杠杆 ,这不仅像茅台,还像ETH 1.0时期的矿机,一旦周期扭转就是螺旋向下了。当然说到底这部分体量还不大,持续观察。

4. Although Nvidia believes the decline in Chinese revenues will be more than offset by growth in other jurisdictions, China accounted for 20-25% of Data Center revenues for Nvidia in the past few quarters, so the new licensing requirements for the export of high-end Nvidia GPUs to China could prove to be a major headwind for the company in the coming years.

质疑中国这部分收入缺失的问题,尤其是已经对Q4的guidance造成了拖累。

这个问题似乎从10月新规更新之后就开始消化,造成了大概5-10%的波动,然后就是400到500的反弹。说实话可能已经不是主导股价中长期的核心因素。从上上个季度投资者已经开始担心china double booking,从10月新规更新算是加速消化,这次体现在earning guidance中似乎到了消化尾声了。剩下是阉割版的出货时间分歧。尤其是新加坡rev segment的暴增证明,不仅可以洗钱,还可以“洗卡”。咱们群里竟然有小伙伴都在搞这事,可见多么普遍,多了就不说了。

5. the company now faces mounting competitive threats that create uncertainty about its ability to maintain premium market share over the long run. Major players like Microsoft Corporation (MSFT), Huawei, and emerging startups like Tigris (potentially) may erode Nvidia's leadership position in key product categories.Nvidia arguably deserves above-average multiples given its innovation track record and exposure to secular growth tailwinds in areas like AI and cloud infrastructure. However, current prices extrapolate a rosy scenario of unchecked market dominance that underestimates risks from new competitive dynamics.OpenAI CEO Sam Altman's Tigris project could represent a significant shift in Nvidia's market dynamics. With his intention to spin up an AI-focused chip company capable of producing semiconductors to compete against Nvidia, a notable stir in the market is anticipated. Theendeavoris still in its nascent stages, but with Altman's reputation and the potential backing from heavyweight investors and OpenAI employees, the impact on Nvidia's market share could be substantial.

华为、微软巨头自制ASIC、OpenAI体外成立芯片公司的竞争问题,进而导致的估值溢价收缩风险。

的确是中长期风险。之前我们文章分析过HBM+IO对于ASIC翻盘的重要性(英伟达财报后的思考)。尤其是如果市场分歧在2025年,2025年的ASIC对手可能会非常强劲(今天的这些的确不争气):1)2025年的HBM产能可获得性大幅提升,甚至HBM本身出现工艺重大变化,除非NV继续引领;2)大公司模型架构趋于稳定;3)模型优化技术不断进步,让推理卡的可用门槛越来越低。大规模训练存在能用不能用的0和1问题,而推理两年后很有可能是成本问题。这里引出另一个更大的争议,就是模型量化剪枝蒸馏等各种优化压缩方法后,部署参数是不断浓缩的,也就是单位智力的算力成本在降低;另一方面,随着应用越来越多,AI对现实世界渗透提升,参数总量提升。这是2个相互消减的独立变量。而问题是后者如果应用出不来,那只有前者在下降,对推理算力是反噬。

总结来说,长期因素是cycle,这类投资者思维背后实质是常识、大数定律(通吃全产业链价值量80%不可持续)。中期因素是应用难产导致的Capex风险、竞争。短期因素是china(Q4-Q1)。有些风险的确没有被充分定价,或者依然朦胧看不清,而市场也在寻找方向的过程中继续校准定价。