4Q20 revenue broadly in line; non-GAAP NP beats our forecast

4Q20 revenue rose 8.5% YoY to Rmb1.89bn; non-GAAP net profit rose 15% YoY to Rmb115.5mn. The revenue is broadly in line our forecast, and non-GAAP net profit beat our forecast by 28%.

We think the biggest positive surprise for this result is VIOT’s GPM in 4Q20 recoveredto 23.5% (up 3.6ppt YoY and 6.4ppt QoQ), the highest level since 3Q19. We believe this GPM recovery is mainly due to the better contribution from high margin products such as robot vacuum cleaners and the Viomi-branded waterpurification system.

Trends to watch

IoT @Home products (Smart kitchen products and others) expand to more countries. In 4Q20, VIOT’s IoT @Home portfolio increased by 15.7% to Rmb1.1bn, driven by growth of both sweeping robots and Viomi-branded new products. During the firm’s analyst briefing, VIOT pointed out its sweeping robot and Viomi-branded new products achieved good feedback from customers. We raise our 2021 revenue forecast of IoT @Home products by 10% to Rmb5,466mn, as well as 2021 GM by 1.2ppt, as we believe company will benefit from the strong growth in new products (with higher margin), and the market may expand from the Chinese mainland to overseas.

Strong ASP in Viomi-branded water purifier to mitigate weakness in Xiaomi-branded products.In 4Q20, Viomi reported a 5.9% YoY decline in water purification system sales, mainly due to the decrease in ASP of the Xiaomi-branded water purification system. This was partially offset by the successful introduction and increased sales of a new series of Viomi-branded water purifier products, which narrowed the YoY decline for home water solutions compared to previous quarters (32% YoY decline in3Q20). We believe the new Viomi-branded water purifier may partially mitigate the GPM decrease, thus we still expect the smart water purification revenue in 2021 will increased by 20% on a YoY basis.

Financials and valuation

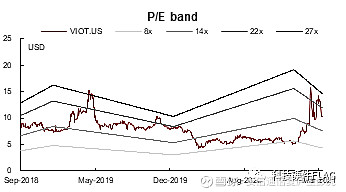

We raise our 2021 non-GAAP net profit forecast 11% to Rmb331mn and introduce our 2022non-GAAP net profit forecast at Rmb476mn, representing 49% YoY and 56.4% YoY growth, as we expect a GPM recovery from COVID-19 may strengthen the company’searnings growth in 2021 and 2022. The stock is trading at 14.6x 2021 and 10.2x 2022 P/E (non-GAAP). We maintain OUTPERFORM and raise our TP by 50.0% to US$12.00 (16.9x 2021 non-GAAP P/E and 11.7x 2022 non-GAAP P/E) for the future GPM recovery and potential IoT @Home valuation increase, offering 15.4% upside.

Risks:COVID-19 impact; intensified competition in water purifier industry.

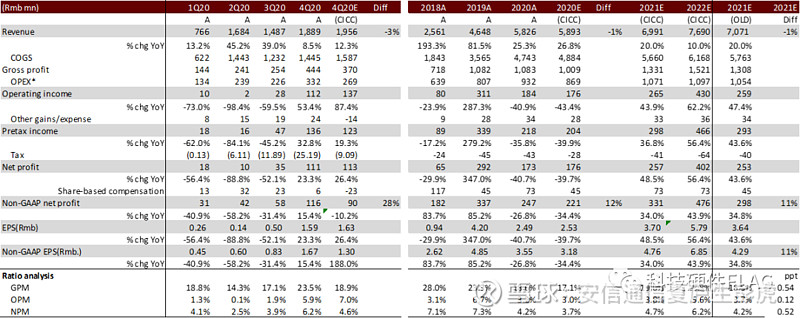

Figure 1: Results review and earnings forecast revisions

Note: Gross profit in this figure is calculated as operating revenue-operating costs

Source: Corporate filings, Wind Info, CICC Research

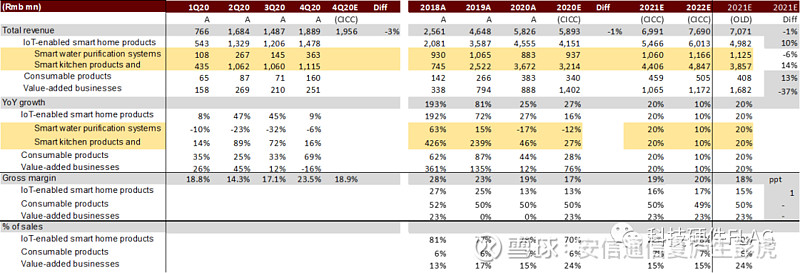

Figure 2: Earnings forecast breakdown by business segment

Source: Corporate filings, Wind Info, CICC Research

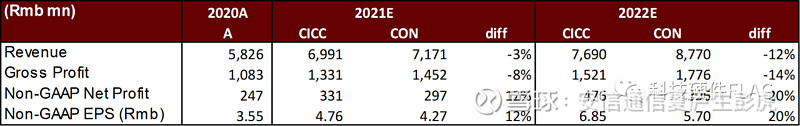

Figure 3: CICC estimates vs. market consensus

Source: Corporate filings, FactSet, Wind Info, CICC Research

Figure 4: P/E band

Source: Wind Info, Bloomberg, CICC Research

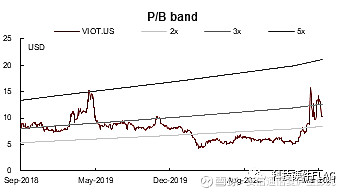

Figure 5: P/B band

Source: Wind Info, Bloomberg, CICC Research

文章来源

本文摘自:2021年3月29日已经发布的《云米科技(VIOT.US):上调目标价至12美元;2021年毛利率有望从疫情中复苏》

陈旭东 SAC 执证编号:S0080519120006 SFC CE Ref:BPH392

胡誉镜 SAC 执证编号:S0080517100004 SFC CE Ref:BMN486

彭 虎 SAC 执证编号:S0080521020001

法律声明

向上滑动参见完整法律声明

本公众号仅是转发中金公司已发布报告的部分观点,所载盈利预测、目标价格、评级、估值等观点的给予是基于一系列的假设和前提条件,订阅者只有在了解相关报告中的全部信息基础上,才可能对相关观点形成比较全面的认识。如欲了解完整观点,应参见中金研究网站(网页链接)所载完整报告。

本资料较之中金公司正式发布的报告存在延时转发的情况,并有可能因报告发布日之后的情势或其他因素的变更而不再准确或失效。本资料所载意见、评估及预测仅为报告出具日的观点和判断。该等意见、评估及预测无需通知即可随时更改。证券或金融工具的价格或价值走势可能受各种因素影响,过往的表现不应作为日后表现的预示和担保。在不同时期,中金公司可能会发出与本资料所载意见、评估及预测不一致的研究报告。中金公司的销售人员、交易人员以及其他专业人士可能会依据不同假设和标准、采用不同的分析方法而口头或书面发表与本资料意见不一致的市场评论和/或交易观点。

在法律许可的情况下,中金公司可能与本资料中提及公司正在建立或争取建立业务关系或服务关系。因此,订阅者应当考虑到中金公司及/或其相关人员可能存在影响本资料观点客观性的潜在利益冲突。与本资料相关的披露信息请访网页链接,亦可参见近期已发布的关于相关公司的具体研究报告。

未经书面许可任何机构和个人不得以任何形式转发、转载、翻版、复制、刊登、发表、修改、仿制或引用本订阅号中的内容。