$Meta(META)$ 补一篇Stratechery关于Meta财报的点评,很好的解释了Ai在meta增效中的作用(翻译是openai插件机翻 懒得人工校正):

Meta Earnings Meta收益

From Bloomberg: 来自彭博社:

Meta Platforms Inc. announced plans to buy back an additional $50 billion in shares and issue its first-ever quarterly dividend as Chief Executive Officer Mark Zuckerberg works to convince investors that his costly bets on the metaverse and artificial intelligence will pay off. The social media giant also reported strong fourth-quarter results, posting a 25% gain in sales and profits that tripled, while also projecting revenue growth for the current period that surpassed projections. The shares jumped more than 14% in extended trading. The stock had gained 12% this year through Thursday’s close after nearly tripling last year.

Meta平台公司宣布计划回购额外500亿美元的股票,并发放首个季度股息,首席执行官马克·扎克伯格努力说服投资者,他在元宇宙和人工智能上的高成本投资将会取得回报。这家社交媒体巨头还报告了强劲的第四季度业绩,销售额增长25%,利润增长了三倍,同时预计当前时期的收入增长将超过预期。股票在盘后交易中上涨了超过14%。该股票今年截至周四收盘已经上涨了12%,去年几乎翻了三倍。

From Bloomberg again, a day later:

来自彭博社的消息,一天后:

Meta Platforms Inc. just became Wall Street’s top comeback kid. It was only a couple of years back the Facebook owner suffered the single biggest market value destruction in stock-market history. But the company has come a long way since then, on Thursday it dazzled shareholders with yet another impressive quarterly earnings report as the social media giant focuses on cutting back costs and shoring up billions in profits. The stock rose 20% Friday to close at an all-time high of $474.99 per share. The gain added $197 billion to its market capitalization, the biggest single-session market value addition, eclipsing the $190 billion gains made by Apple Inc. and Amazon.com Inc. in 2022.

Meta平台公司刚刚成为华尔街的最佳复苏者。仅仅几年前,Facebook的所有者遭受了股市历史上最大的市值毁灭。但是自那时以来,该公司已经取得了长足的进步,周四,它以又一份令人印象深刻的季度盈利报告让股东们大为惊艳,因为这家社交媒体巨头专注于削减成本并增加数十亿美元的利润。周五,股价上涨20%,收于每股创历史新高的474.99美元。这一涨幅使其市值增加了1970亿美元,成为单个交易日市值增加最大的公司,超过了苹果公司和亚马逊公司在2022年获得的1900亿美元的增长。

It has actually only been five quarters since I wrote 网页链接{Meta Myths} the week the stock hit a nadir of $90. Since then Meta has lapped tough COVID and ATT comps, figured out ad targeting in a probabilistic world, driven Reels adoption and monetized it effectively, all while its core products — including Facebook — have continued to grow.

自从我在股价跌至90美元的那周写下《元神话》以来,实际上只过去了五个季度。自那时以来,Meta已经超越了艰难的COVID和ATT竞争对手,找到了概率世界中的广告定位方法,推动了Reels的采用并有效地实现了盈利,同时其核心产品——包括Facebook在内——仍在持续增长。

And then there is AI.

然后还有人工智能。

Meta, AI, and ATT元数据,人工智能和ATT

Myth 5 in “Meta Myths” was “Meta’s Spending is a Waste”:

“元神的花费是浪费”的“元神神话”中的神话5:

What also has investors spooked, though, is Facebook’s increasing capital expenditures, which have nothing to do with the Metaverse (Metaverse spending is almost all research and development). Meta expects to spend $32-$33 billion in capital expenditures in 2022, and $34-$39 billion in 2023; that won’t hit the income statement right away (capital expenditures show up as depreciation in cost of revenue), but that just means that longer-term profitability may be increasingly impaired. Facebook’s gross margins were down to 79% last quarter, its lowest mark since 2013, and if revenue growth doesn’t pick back up then those margins will fall further, given that the costs are already built in…

然而,让投资者感到不安的还有Facebook不断增加的资本支出,这与元宇宙无关(元宇宙的支出几乎全部用于研发)。Meta预计在2022年的资本支出将达到320-330亿美元,在2023年将达到340-390亿美元;这不会立即影响损益表(资本支出会以成本费用中的折旧形式出现),但这意味着长期盈利能力可能会受到越来越大的影响。Facebook上个季度的毛利率降至79%,为2013年以来的最低水平,如果收入增长不恢复,那么这些利润率将进一步下降,因为成本已经内含在内...

The long-term solution to ATT, though, is to build probabilistic models that not only figure out who should be targeted (which, to be fair, Meta was already using machine learning for), but also understanding which ads converted and which didn’t. These probabilistic models will be built by massive fleets of GPUs, which, in the case of Nvidia’s A100 cards, cost in the five figures; that may have been too pricey in a world where deterministic ads worked better anyways, but Meta isn’t in that world any longer, and it would be foolish to not invest in better targeting and measurement.

然而,解决ATT的长期方案是建立概率模型,不仅能够确定应该针对谁进行定向广告(公平地说,Meta已经在使用机器学习进行这方面的工作),还能够理解哪些广告转化了,哪些没有转化。这些概率模型将由大规模的GPU集群构建,例如Nvidia的A100显卡,价格在五位数;在确定性广告效果更好的世界中,这可能过于昂贵,但Meta已经不再处于那个世界,不投资于更好的定向和测量将是愚蠢的。

Moreover, the same approach will be essential to Reels’ continued growth: it is massively more difficult to recommend content from across the entire network than only from your friends and family, particularly because Meta plans to recommend not just video but also media of all types, and intersperse it with content you care about. Here too AI models will be the key, and the equipment to build those models costs a lot of money.

此外,相同的方法对于Reels的持续增长至关重要:从整个网络中推荐内容要比仅从你的朋友和家人那里推荐内容要困难得多,特别是因为Meta计划不仅推荐视频,还推荐各种类型的媒体,并将其与你关心的内容交织在一起。在这方面,AI模型将是关键,而构建这些模型的设备成本很高。

In the long run, though, this investment should pay off. First, there are the benefits to better targeting and better recommendations I just described, which should restart revenue growth. Second, once these AI data centers are built out the cost to maintain and upgrade them should be significantly less than the initial cost of building them the first time. Third, this massive investment is one no other company can make, except for Google (and, not coincidentally, Google’s capital expenditures are set to rise as well).

从长远来看,这项投资应该会有回报。首先,有了更好的定位和更好的推荐,可以重新启动收入增长。其次,一旦这些人工智能数据中心建成,维护和升级的成本应该会大大低于第一次建设的初始成本。第三,这项巨额投资是其他公司无法做到的,除了谷歌(不巧的是,谷歌的资本支出也将增加)。

That last point is perhaps the most important: ATT hurt Meta more than any other company, because it already had by far the largest and most finely-tuned ad business, but in the long run it should deepen Meta’s moat. This level of investment simply isn’t viable for a company like Snap or Twitter or any of the other also-rans in digital advertising (even beyond the fact that Snap relies on cloud providers instead of its own data centers); when you combine the fact that Meta’s ad targeting will likely start to pull away from the field (outside of Google), with the massive increase in inventory that comes from Reels (which reduces prices), it will be a wonder why any advertiser would bother going anywhere else.

那最后一点可能是最重要的:ATT对Meta的伤害超过了其他任何公司,因为它已经拥有迄今为止最大且最精细调整的广告业务,但从长远来看,它应该会加深Meta的护城河。对于像Snap或Twitter或其他数字广告中的其他落后者来说,这种投资水平根本不可行(即使超越了Snap依赖云提供商而不是自己的数据中心的事实);当你将Meta的广告定位很可能开始超越领域(除了谷歌之外),再加上来自Reels的大规模库存增加(降低价格),任何广告商为什么还要费心去其他地方呢,真是令人惊讶。

This is almost completely correct, and even the part that is wrong — which I will get to in a moment — only makes the initial point even stronger.

这几乎完全正确,即使是错误的部分 - 我马上会提到 - 只会更加强调最初的观点。

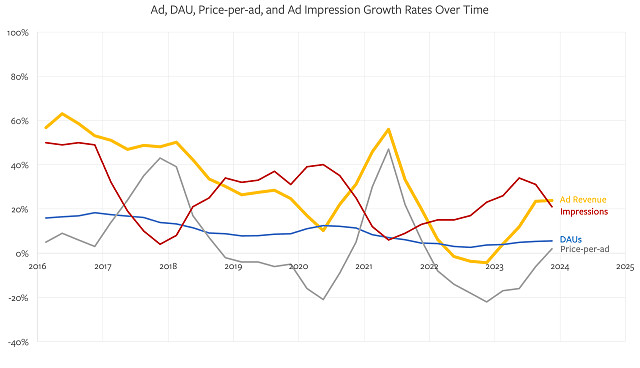

Start with ad targeting and conversion tracking, and my go-to Meta chart:

从广告定位和转化跟踪开始,以及我首选的Meta图表

As I noted 网页链接{last quarter}, the attenuation in inventory growth — which is still 21% — was evidence that Reels was both being widely adopted and increasingly saturated in terms of ad load; that attenuation continued this quarter as expected, given the precedent set by Instagram (the first dip in impressions growth on this chart) and by Stories (the second dip in impressions growth on this chart). This is how Meta builds new businesses: they drive usage to new apps or formats, then add ads, and then optimize those ads. We are now in the optimization stage for Reels; that, along with the slowdown in impressions growth, leads to higher prices-per-ad.

正如我在上个季度所指出的,库存增长的减弱(仍然为21%)表明Reels在广泛采用并在广告负载方面越来越饱和;鉴于Instagram(图表上印象增长的第一个下降)和Stories(图表上印象增长的第二个下降)所设定的先例,这种减弱在本季度继续发生,这是预料中的。这就是Meta建立新业务的方式:他们推动用户使用新的应用程序或格式,然后添加广告,然后优化这些广告。我们现在正处于Reels的优化阶段;加上印象增长的放缓,这导致每个广告的价格上升。

That optimization is very much driven by AI; CFO Susan Li said 网页链接{on the earnings call}:

该优化非常受人工智能驱动;首席财务官Susan Li在财报电话会议上表示:

We’re delivering continued performance gains from ranking improvements as we adopt larger and more advanced models and this will remain an ongoing area of investment in 2024. We’re also building out our Advantage+ portfolio of solutions to help advertisers leverage AI to automate their advertising campaigns. Advertisers can choose to automate part of the campaign creation set up process, such as who to show their ad to, with Advantage+ Audience. Or, they can automate their campaign completely using our end-to-end automation tool for driving online sales, Advantage+ Shopping, which continues to see strong growth. We’re also now exploring ways to apply this end-to-end automation to new objectives.

我们通过采用更大、更先进的模型,不断提升排名,这将是我们在2024年持续投资的领域。我们还在构建我们的Advantage+解决方案组合,帮助广告商利用人工智能自动化他们的广告活动。广告商可以选择自动化部分广告创建设置过程,例如选择向谁展示他们的广告,使用Advantage+ Audience。或者,他们可以使用我们的端到端自动化工具Advantage+ Shopping,完全自动化他们的广告活动,该工具在在线销售方面持续增长。我们现在还在探索将这种端到端自动化应用于新目标的方法。

On the ads creative side, we completed the global roll out of two of our generative AI features in Q4 – text variations and image expansion – and plan to broaden availability of our background generation feature later in Q1. Initial adoption of these features has been strong and tests are showing promising early performance gains. This will remain a big area of focus for us in 2024.

在广告创意方面,我们在第四季度完成了两项生成式人工智能功能的全球推广——文本变体和图像扩展,并计划在第一季度扩大我们的背景生成功能的可用性。这些功能的初步采用情况非常好,测试显示出了有希望的早期性能提升。这将是我们在2024年继续关注的重点领域。

The first part is what we used to call machine learning before 网页链接{everything became AI}, but it’s very much a real thing, particularly in a post-ATT world: Meta is continually learning what signals relate to what outcomes, and the best way for advertisers to take advantage of that learning is to simply give Meta a number that they want to hit, whether that be sales, leads, etc., and how much they are willing to pay. You can see, if you think about it, why advertising is a great arena for the application of AI in this way: it is goal-centric and measurable, and thus optimizable in a way that is tailor-made for machine learning (and speaking of tailor-made, this is the part of the business for which 网页链接{Meta has made custom silicon}).

第一部分是我们过去称之为机器学习的东西,在一切都变成人工智能之前,但它确实是一种真实存在的东西,特别是在后ATT时代:Meta不断学习哪些信号与哪些结果相关,广告商利用这种学习的最佳方式就是简单地给Meta一个他们想要达到的数字,无论是销售额、潜在客户等,以及他们愿意支付多少。如果你仔细思考一下,你会明白为什么广告是应用人工智能的一个很好的领域:它以目标为中心,可衡量,因此可以通过机器学习进行优化(说到量身定制,这正是Meta专门制造的硅片的用途所在)。

The generative AI portion is what is new (and what we mean by “AI” in the ChatGPT sense), but here again advertising is tailor-made for this particular use case: one of the challenges of generative AI is knowing whether what was created is “right”; in the context of ads what is “right” is what drives conversions. Thus Meta (and also Google) is creating an entire pipeline where a customer can specify goals and the price they are willing to pay and their desired brand appearance and message, and their advertising AI will not only figure out what customers to advertise to (and where), but also exactly how to show and articulate the ad so that it works.

生成式人工智能部分是新的(也是我们在ChatGPT中所指的“人工智能”的意思),但在这里,广告是专门为这个特定用例量身定制的:生成式人工智能的一个挑战是知道所创建的内容是否“正确”;在广告的背景下,“正确”的意思是能够促成转化。因此,Meta(以及Google)正在创建一个完整的流程,客户可以指定目标、愿意支付的价格、期望的品牌形象和信息,他们的广告人工智能不仅会找出要向哪些客户进行广告投放(以及在哪里进行投放),还会准确地展示和表达广告,以使其发挥作用。

This gets at the last point in this excerpt: no one else can do this at the same scale, for a lack of infrastructure, data, and talent. Michael Nathanson asked Li 网页链接{on the follow-up call} how good Meta’s targeting was now as compared to the pre-ATT deterministic system; Li answered:

这涉及到这段摘录的最后一点:由于缺乏基础设施、数据和人才,其他人无法以同样的规模进行这项工作。迈克尔·纳桑森在后续电话中问李,与ATT之前的确定性系统相比,Meta的定位有多好;李回答说:

So on the first question about where ROAS is relative to pre-ATT, I don’t have a comparison to give you relative to pre-ATT. In general, we think the landscape has changed so much that it’s kind of hard to know the counterfactual of what the world would look like without ATT today. But we’ve made meaningful improvements to our performance and measurement in recent periods. We believe that advertising is a relative performance gain and that we are very well-positioned here because of all of the investments we’ve made, and we’ve received consistently positive feedback from advertisers who adopt our tools.

关于ROAS相对于ATT之前的情况,我无法提供与ATT之前的比较。总的来说,我们认为整个环境发生了很大变化,很难知道如果没有ATT,现在的世界会是什么样子。但是我们在最近一段时间内在性能和测量方面取得了显著的改进。我们相信广告是相对性能的提升,由于我们所做的所有投资,我们在这方面处于非常有利的位置,并且我们一直收到采用我们工具的广告商的积极反馈。

This is, at first read, an affirmation of what I have maintained all along: ATT would hurt Meta the most because it had the largest deterministic ad business, but it would also leave Meta in a stronger competitive position. From 网页链接{Apple and Facebook}:

这是我一直坚持的观点的肯定:ATT对Meta的影响最大,因为它拥有最大的确定性广告业务,但它也会使Meta在竞争中处于更强的位置。来自苹果和Facebook。

Still, I wouldn’t count Facebook out: to the extent the company is hurt, it seems likely that the universe of 3rd-party ad tech companies that lack Facebook’s direct connection with users, both in terms of data collection and ad display, will be in far worse shape, and it is not as if the digital ecosystem — and its associated advertising — is going to disappear. Indeed, much like GDPR, the safe bet is the company with the wherewithal to make lemons out of lemonade. Notably, Apple’s alternative for app install ad campaigns, SKAdNetwork, is so limited that there is likely to be tremendous value in whatever company can create the exact sort of automated campaign creation that Facebook is already offering.

然而,我不会排除Facebook的可能性:如果该公司受到伤害,那么缺乏与用户直接联系的第三方广告技术公司,在数据收集和广告展示方面都将处于更糟糕的境地,数字生态系统及其相关广告也不会消失。事实上,就像GDPR一样,明智的选择是那些有能力将柠檬变成柠檬水的公司。值得注意的是,苹果为应用程序安装广告活动提供的替代方案SKAdNetwork非常有限,因此能够创建与Facebook已经提供的自动化广告活动创建完全相同的公司很可能具有巨大的价值。

It is worth noting that while the digital ecosystem did not disappear, it absolutely did shrink: Nathanson, in his Meta earnings note, explained what he was driving at with that question:

值得注意的是,尽管数字生态系统并未消失,但它确实缩小了:纳森森在他的Meta收益报告中解释了他提出这个问题的意图

While revenues have recovered, with +22% organic growth in the fourth quarter, we think that the more important driver of the outperformance has been the company’s focus on tighter cost controls. Coming in 2023, Meta CEO Mark Zuckerberg made a New Year’s resolution, declaring 2023 the “Year of Efficiency.” By remaining laser-focused on reining in expense growth as the top line reaccelerated, Meta’s operating margins (excluding restructuring) expanded almost +1,100 bps vs last 4Q, reaching nearly 44%. Harking back to Zuckerberg’s resolution, Meta’s 2023 was, in fact, highly efficient…

尽管收入已经恢复,第四季度有22%的有机增长,但我们认为超额表现的更重要驱动因素是公司对更严格的成本控制的关注。在2023年,Meta首席执行官马克·扎克伯格制定了一个新年决心,宣布2023年为“效率年”。在顶线重新加速的同时,通过保持对支出增长的高度关注,Meta的运营利润率(不包括重组)与上一季度相比增长了近1100个基点,达到近44%。回顾扎克伯格的决心,事实上,Meta在2023年非常高效...

Putting this in perspective, two years ago, after the warnings on the 4Q 2021 earnings call, we forecasted that Meta Family of Apps would generate $155 billion of revenues and nearly $68 billion of GAAP operating income in 2023. Fast forward to today, and last night Meta reported that Family of Apps delivered only $134.3 billion of revenues ($22 billion below our 2-year ago estimate), yet FOA operating income (adjusted for one-time expenses) was amazingly in-line with that two-year old forecast. For 2024, while we now forecast Family of Apps revenues of $151.2 billion (almost $30 billion below the forecast made on February 2, 2022), our current all-in Meta operating profit estimate of $56.8 billion is also essentially in line. In essence, Meta has emerged as a more profitable (dare we say, efficient) business.

将此放入透视中,两年前,在2021年第四季度收益电话的警告之后,我们预测Meta应用家族将在2023年实现1550亿美元的收入和近680亿美元的GAAP营业利润。快进到今天,昨晚Meta报告称,应用家族仅实现了1343亿美元的收入(比我们两年前的估计低220亿美元),然而FOA营业利润(调整后的一次性费用)与那个两年前的预测惊人地保持一致。对于2024年,虽然我们现在预测应用家族的收入为1512亿美元(比2022年2月2日的预测低近300亿美元),但我们目前的Meta总体运营利润估计为568亿美元,也基本保持一致。实质上,Meta已经成为一个更有利可图(也许我们可以说更高效)的企业。

That shrunken revenue figure is digital advertising that simply disappeared — in many cases, along with the companies that bought it — in the wake of ATT. The fact that Meta responded by becoming so much leaner, though, was critical to not just surviving ATT, but also laid the groundwork for where the company is going next.

那个缩水的收入数字是数字广告,它们在ATT之后就消失了,很多情况下,连购买广告的公司也一起消失了。然而,Meta的回应是变得更加精简,这对于不仅是应对ATT的生存,还为公司接下来的发展奠定了基础。

Meta’s New Playbook Meta的新策略手册

This gets to the piece of my analysis above that I got wrong: Meta is not at all slowing down its spending on AI infrastructure. Li announced:

这涉及到我上面分析中的一个错误之处:Meta在人工智能基础设施上的支出并没有减少。李宣布:

We expect higher infrastructure-related costs this year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint…

我们预计今年基础设施相关成本会增加。鉴于我们近年来增加的资本投资,我们预计2024年的折旧费用将比2023年增加更多。我们还预计运营更大规模基础设施会导致更高的运营成本...

We anticipate our full-year 2024 capital expenditures will be in the range of $30-37 billion, a $2 billion increase of the high end of our prior range. We expect growth will be driven by investments in servers, including both AI and non-AI hardware, and data centers as we ramp up construction on sites with our previously announced new data center architecture. Our updated outlook reflects our evolving understanding of our AI capacity demands as we anticipate what we may need for the next generations of foundational research and product development. While we are not providing guidance for years beyond 2024, we expect our ambitious long-term AI research and product development efforts will require growing infrastructure investments beyond this year.

我们预计2024年全年的资本支出将在300-370亿美元的范围内,较之前范围的高端增加20亿美元。我们预计增长将由对服务器的投资推动,包括人工智能和非人工智能硬件,以及数据中心,因为我们加快了先前宣布的新数据中心架构的建设进度。我们更新的展望反映了我们对人工智能容量需求的不断演变的理解,因为我们预计我们在未来几代基础研究和产品开发中可能需要的内容。虽然我们没有提供2024年以后的指导,但我们预计我们雄心勃勃的长期人工智能研究和产品开发努力将需要超过今年的基础设施投资。

It’s hard to believe that capital costs were what broke the camel’s back in late 2022, leading to the largest stock slide of all time, even as they now are part and parcel of a result that led to the largest stock gain, but Zuckerberg certainly remembers. From Zuckerberg’s prepared remarks:

很难相信资本成本是导致2022年末最大股市下滑的导火索,尽管现在它们是导致最大股市上涨的结果的一部分,但扎克伯格肯定记得。根据扎克伯格的准备好的讲话:

I recently shared that by the end of this year we’ll have about 350k H100s and including other GPUs that’ll be around 600k H100 equivalents of compute. We’re well-positioned now because of the lessons that we learned from Reels. We initially under-built our GPU clusters for Reels, and when we were going through that I decided that we should build enough capacity to support both Reels and another Reels-sized AI service that we expected to emerge so we wouldn’t be in that situation again. And at the time the decision was somewhat controversial and we faced a lot of questions about capex spending, but I’m really glad that we did this.

我最近分享了,到今年年底,我们将拥有大约35万个H100,加上其他GPU,将达到约60万个H100的计算等效能。由于从Reels中学到的经验,我们现在处于一个良好的位置。我们最初在Reels的GPU集群建设方面建设不足,当我们经历这个过程时,我决定我们应该建立足够的容量来支持Reels和另一个预计会出现的与Reels规模相当的AI服务,这样我们就不会再陷入同样的境地。当时这个决定有些有争议,我们面临了很多有关资本支出的问题,但我真的很高兴我们这样做了。

Remember that Meta’s stock slide happened just weeks before the release of ChatGPT, when it suddenly became a very big deal that Meta was already buying GPUs before the rest of the world suddenly wanted in. Zuckerberg was right!

请记住,Meta的股价下滑发生在ChatGPT发布的几周前,当时Meta已经开始购买GPU,而其他人突然也想要加入。扎克伯格是对的!

What Zuckerberg seems to have learned, though, is that being right isn’t always enough, at least if you want to avoid a lot of pain. Zuckerberg regularly references various “playbooks”, such as the company’s approach to monetization that I mentioned above: first iterate on the product, then invest in growth, then monetize, and then optimize. He added several other playbooks on this call, including the company’s plan to link research with product goals, its open source playbook, and its playbook for learning from data and rapid iteration — the word “playbook” appeared seven times on the call.

扎克伯格似乎已经学到了一点,那就是仅仅正确并不总是足够的,至少如果你想避免很多痛苦的话。扎克伯格经常提到各种“playbooks”,比如我上面提到的公司的盈利方法:首先在产品上进行迭代,然后投资增长,然后实现盈利,最后优化。他在这次通话中还提到了其他几个playbooks,包括公司将研究与产品目标相结合的计划,开源playbook以及从数据和快速迭代中学习的playbook — 在通话中,“playbook”这个词出现了七次。

The new playbook, though, wasn’t labeled as such, but it seemed just as premeditated: before Li announced the capital expansion plan, the company (1) announced fantastic results with expanding profitability, (2) announced an expanded stock buyback program, and (3) announced that the company would start paying a dividend for the first time. That sounds like an excellent playbook for receiving investor permission for new spending. Meta is proving itself to be a responsible caretaker of shareholder money, is giving a big chunk of it back, and is committing to a regular payment schedule. Only then is it asking to spend more for product capabilities that are already showing their worth, and this time investors were more than happy to oblige

然而,这本新的剧本并没有被标记为这样,但它似乎同样是经过预谋的:在李先生宣布资本扩张计划之前,公司(1)宣布了令人惊讶的业绩增长,(2)宣布了扩大的股票回购计划,以及(3)宣布公司将首次开始支付股息。这听起来像是一个出色的剧本,用于获得投资者对新支出的许可。Meta正在证明自己是股东资金的负责任管理者,正在返还其中的一大部分,并承诺按照固定的支付时间表进行支付。只有在这之后,它才请求为已经显示出价值的产品能力进行更多的支出,而这一次投资者们非常乐意配合。