比较文字这种杂务还是留给GPT吧,但是GPT还是不太擅长判断被删除的那句话的重要性

结论:1.美联储毫无疑问认识到区域银行信贷紧缩的确定性,不确定的是影响的深度

2.被删除3月声明最重要的一句话"The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time." 委员会预计还需要更多的紧缩政策来实现足够限制性的货币政策以抗击通胀。这句被删除,说明已经实现了足够的紧缩。

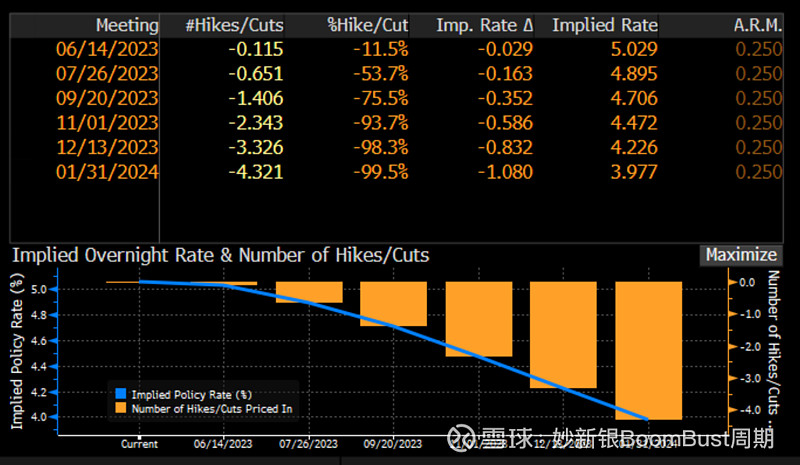

3.市场已经开始定价7月降息

——————————————————-

我的指令:“please compare Federal Reserve's FOMC announcements for May 2023 and March 2023 and highlight all the changes in wording?” 对比3月和5月声明,找出不一样的地方。然后我把两份声明扔给了它

GPT的回复

Here are the main changes between the Federal Reserve's FOMC announcements for March 2023 and May 2023:

March 2023:

"Recent indicators point to modest growth in spending and production."

May 2023:

"Economic activity expanded at a modest pace in the first quarter."

March 2023:

"Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation."

May 2023:

"Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation."

March 2023:

"The Committee decided to raise the target range for the federal funds rate to 4-3/4 to 5 percent."

May 2023:

"The Committee decided to raise the target range for the federal funds rate to 5 to 5-1/4 percent."

March 2023:

"The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

May 2023:

"In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

In summary, the main changes in the May 2023 announcement compared to the March 2023 announcement include:

A change in the description of recent economic activity.

A slight rephrasing of the sentence about tighter credit conditions and their effects.

An increase in the target range for the federal funds rate.

A more detailed explanation of the factors that the Committee will consider when determining the extent of future policy firming.

然后我提醒它它忽略了被删除那句话的重要性“i think you missed the importance of Fed deleting "The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time." in its May 2023 announcement”

它的回答

You're correct. I apologize for not highlighting that change in my previous response. The deletion of the sentence "The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time" in the May 2023 announcement could be seen as a signal of a slightly more dovish stance from the Federal Reserve.

This change suggests that the Fed may not be as confident about the need for additional policy tightening to return inflation to its target level. Instead, the May 2023 announcement provides a more detailed explanation of the factors that the Committee will consider when determining the extent of future policy firming, which could be interpreted as a more cautious approach.

Thank you for pointing this out, and I hope this clarification better addresses your original question.

你说得对。我为没有在之前的回复中强调这个变化而道歉。在2023年5月的声明中删除了“委员会预计可能需要一些额外的政策加强措施,以实现货币政策的立场足够紧缩,以使通胀在一段时间内回归2%”,这可能被视为美联储略微鸽派立场的信号。

这种变化表明,美联储可能对需要进一步紧缩政策以使通胀回归目标水平的必要性不那么自信。相反,2023年5月的声明更详细地解释了委员会确定未来政策加强程度时将考虑的因素,这可能被解释为更为谨慎的方法。

谢谢你指出这一点,我希望这个澄清更好地回答了你最初的问题。