一、

李录价值投资理念与哲学发展

1、李录价值投资的哲学和理念有何变化?

2、李录和其他价值投资者之间有什么区别?

3、投资者应该是专才还是通才?

4、价值投资者新人应该接受什么样的教育?

5、李录如何回顾看待自己过往的人生决策?

二、

价值投资研究公司相关的方法

1、好公司的特点和估值方式

2、好公司获得持续竞争优势的因素有哪些?

3、李录在挑选要投资的公司时考虑哪些因素?

4、投资中,如何看待公司管理层?

三、

对宏观市场环境的分析与评论

1、今天市场的情况像过往当中的哪一个阶段呢?

2、如何应对宏观环境的各种危机?

3、如何理解亚洲尤其是中国市场?

4、新兴科技是否会吸引李录这样的价值投资者?

5、如何看待美国亚裔群体的生存现状?

主持人Bruce:

Live streaming from Columbia business School in New York city. My name is Bruce. Welcome to the final session of the 13th Columbia China business conference. Home to value investing, Columbia business school is at the forefront of the theoretical development and practices of value investing.

这里是纽约哥伦比亚商学院的现场直播,我是Bruce。欢迎各位出席哥伦比亚中国商业论坛的最后一场讨论。哥伦比亚大学商学院是价值投资的发源地,也是价值投资理论发展和实践的前沿。

Given the ever changing global dynamics and market uncertainties, what are the potential advancements on unwavering fundamentals of value investing? How should practitioners realize about investing in China?

面临瞬息万变的全球局势和市场的不确定性,价值投资的基本思想和方法有何可能的改进?实践者如何在中国实现价值投资?

Joining us today are Professor Bruce Greenwald and Mr. Li Lu.

今天参加我们论坛的嘉宾是Bruce Greenwald教授和李录先生。

Professor Bruce Greenwald is the founding director of the Heilbrunn Center for Graham and Dodd Investing at Columbia business school. It's a leading voice in value investing.

Bruce Greenwald教授是哥伦比亚学商学院哥雷厄姆和多德投资法海尔布伦中心的创始主任,他是一位价值投资的主要倡导者。

Mr. Li Lu is the founder and chairman of Himalaya Capital, a multi-billion dollar investment firm that primarily focus on long-term investment opportunities in Asia and the US. He's a distinguishing alumnus of Columbia, and Mr. Li Lu currently serves as a member of the board of trustees of Columbia University. Mr. Li Lu has in-depth knowledge about the Chinese market. His insights are trusted by investment legends like Buffett and Munger.

李录先生是喜马拉雅资本的创始人兼董事长,喜马拉雅资本是一家管理着上百亿美元资产的投资公司,主要专注于亚洲和美国的长期投资机会。李录先生也是哥伦比亚大学的杰出校友,他在哥大同时获得了三个学位,他现在还是哥大董事会的成员。

Professor Greenwald routinely won plaudits for his classes and has trained a generation of value investors, including Mr. Li Lu himself. Mr. Li Lu has in-depth knowledge about the Chinese market. His insights are trusted by investment legends like Buffett and Munger.

Bruce Greenwald教授在哥大商学院开办的价值投资课程一直受到学生们的追捧,并培养了一代的价值投资者,其中就包括李录先生本人。李录先生对中国市场有着深入的了解,他对中国市场的洞见得到了巴菲特和芒格等投资传奇人物的认可。

Now, imagine yourself stepping into the most overcrowded investment classroom at one of the best business schools across the globe. Welcome professor Greenwald and Mr. Li.

现在,想象你自己身处世界上最好的商学院最拥挤的投资课堂上,让我们欢迎Bruce Greenwald教授和李先生。

一

李录价值投资理念与哲学发展

1、李录价值投资的哲学和理念有何变化?

Professor Greenwald:

I think this is gonna be a rare privilege for everybody. I've only known Li Lu for more than 20 years and not only is he a great investor, but he's a great conversationalist. So why don't we just start out by talking about how your investment philosophy has changed? Because value investing is, after all, always an evolving field, since you began the field, literally, I think I would say, 25 years ago? 20 years ago?

(Mr. Li Lu: More like 28, hahaha.)

How time flies! So how has it evolved? How have you been influenced by people like Charlie Munger and so on? Go ahead.

这次对谈对大家来说都是非常难得的机会,我认识李录二十多年了,他不仅是一个顶级投资人,也是一个很好的谈话对象。首先我想请你跟大家分享一下,从你接触和学习价值投资到实践的这20多年中,伴随着价值投资理念的进化,你的投资哲学与理论发生过怎样的变化呢?像查理·芒格等这样的价值投资者是如何影响你的?

Mr. Li Lu:

Well so before I started, I just want to, first of all, thank you for all the organizers of this great conferences. I mean, look at all the speakers, they are just really unbelievable. The quality of the student has dramatically improved since I was the student there, so thank you for all for that wonderful work of putting together this great conferences.

首先我想感谢这次大会的主办者(哥大商学院中国学生会)!我看了大会的议程,这次论坛受邀嘉宾的规格之高令人难以置信,说明今天哥大商学院学生的质量与我当年相比已经有了戏剧性的提升!非常感谢你们做出的所有工作,才将所有的要素汇聚在一起,办成了这么棒的一个论坛。我非常的荣幸和高兴受邀来跟Bruce Greenwald教授一起参加这场讨论。

In fact, I got into this field really because of Professor Green Greenwald’s class. I think that, you know, basically you got Buffett to come to speak to a student rally, roughly 28 years ago. And it was really that first lecture that really got me into this field. So thank you so much.

我走上价值投资之路,其实就是因为当时听了布鲁斯·格林伍德教授的一堂价值投资课。我还清楚记得,那是在28年前,布鲁斯·格林伍德教授请来巴菲特先生给学生上课。就是因为我当年在您的课堂上听了巴菲特先生的演讲,从此走上价值投资这条路。所以我太感谢教授您了。

And of course, I later, as a business school student, took all of the courses that Professor Green Greenwald offered and learned a great deal, made a lot of money too, so thank you.

当然,后来我就转到哥大商学院学习,修完了布鲁斯·格林伍德教授教的所有课程,学到很多东西,这让我赚了很多钱。所以我特别感谢您,布鲁斯·格林伍德教授,当然也感谢商学院。(笑)

Yeah, So the philosophy is that, it is you know uh relatively simple, the practice is really hard. So I wouldn't say the philosophy really evolved all that much for me. Before I got really exposed to value investing through Buffett's lecture at Professor Bruce Greenwald's class, I think my whole approach to life was pretty much a set along similar lines, and so there's not much of a jump for me.

价值投资知易行难,道理很简单,实践却很难。我不能说价值投资理论本身发生过多大的变化。其实在我听巴菲特先生在您价值投资课所做演讲之前,我在生活中为人处世的基本原则就和价值投资的想法是基本一致的,因此对我本人而言,并没有什么巨大的变化。

The idea of uh buying something at a discount for something that really worth more, is simply intelligent. So I would say that almost all intelligent investing involves some kind of value investing. And now the difference is it is that your focus on value evolves over time. And to different individuals, they tend to focus on different areas of that.

这种以较低的价格、买有更高价值的东西的做法,本身就很聪明,我认为所有聪明的投资方法都会某种程度地涉及价值投资的理念,差别就在于人们对价值的关注点会随着时间演进变化,不同的价值投资者对价值的关注点不太一样。

For me, when I first started as a value investor, this is now 27 or 28 years ago, when I bought my first stock, I don't really know much about business. I know I was born and raised in China during the Cultural Revolution. There was not much of a private business or open market economy back then. So I have to learn everything anew.

对我来说,自28年前我开始了价值投资。其实当我购买第一只股票的时候,对商业的了解并不多。我在中国出生,并成长于六七十年代,那时并没有多少私人的商业行为和开放的市场经济,因此,我需要从头学习商业相关的所有内容。

So at the beginning, obviously look for value primarily on the balance sheet, in the classic style of Benjamin Graham, looking for a cigarette butt, looking for the last puff basically, looking for statistically cheap businesses, and ignore what the business really is, and that served me well.

一开始,我主要是践行本杰明·格雷厄姆的经典风格,埋头在资产负债表里寻找一些有价值的“烟蒂股”(企业价格低于流动资产价值的股票)。巴菲特把这种投资策略比喻为捡烟头——像在路上找人家丢弃不要的烟头,短得你只能抽上最后一口了,但是价格便宜啊,免费,不用花一分钱。(那时的我)基本上只是在找这种统计学意义上的便宜的生意,虽然我靠这个过的还不错,但却忽略了股票背后生意的本质是什么。

And that over time I evolved into understanding smaller businesses.And because I was just intensively curious about how businesses run, so much so, I actually involved into health funding or co-creating a dozen or so early-stage start-up companies. And that experience has taught me a lot about how business run, what constitute a good or bad or mediocre businesses.

但随着时间的推移,我对商业是如何运作的有了强烈的兴趣,我开始逐渐更理解相对小一些公司的商业模式。实际上,我参与投资或共同创建了十几个早期创业公司。这段经历教会了我很多关于商业运作的知识,并了解到哪些要素构成一个好生意、差生意或平庸的生意。

And so over time I evolved into looking for really good businesses, small maybe, but really good business. and then that lead me to look for good businesses in Asia, and eventually for businesses with enduring competitive advantage with some long growth trajectory ahead.

后来,我开始更多地关注那些小而美的生意,而这一切都引领我去发掘在亚洲市场的好投资机会。最终,我找到了一些有持续增长与竞争优势的公司。

And so the places we're looking for value, evolves over time. But the basic philosophy has pretty much remained the same. It's just our core competence expanded over time.

我们寻找价值投资的重点,随着时间在不断演进,但背后的基础逻辑其实是永恒的,变化的是我们的核心竞争力在不断扩展。

Now I've been very fortunate to be influenced at the very beginning by the investment giant, Buffett and Munger.And later on, I was really really lucky, and it was really just a stroke of luck, that you can't even make it up in fictions, that I strike a good connection with Charlie Munger, and became an investor in 2003 or 2004, and we've been partners. Since then, basically, he has been a mentor, an investor, a business partner and a great friend all this years.

我特别幸运的是能够在职业发展早期就受到投资大师巴菲特和芒格的影响。后来的我更是非常非常幸运,获得了小说都不敢写的一系列眷顾——我得以和查理·芒格先生建立很好的关系,并在2003或2004年的时候,芒格先生成为了我的投资人,直到现在我们仍然是合作伙伴。不仅如此,除了投资人与商业伙伴,芒格先生也一直是我持续多年的良师益友。

And for many many years we've been, we have dinner every Tuesday night. That's my version of a "Tuesday night with Charlie" every week(similar to "Tuesday afternoon with Morrie"). That lasted for years until just right around the pandemic, and we talk a lot more.

多年以来,我们每周二都会共进晚餐,聊很多话题,这成为了我个人版本的“与芒格相约周二晚”。这一惯例持续了很多很多年,直到疫情来临。

So obviously I had a great deal of influence by him. But I have to say that the greatest influence from Charlie, was really beyond just the investment. He was more of a role model and the way he conducted himself in real life. Now, I think for every profession, everybody, it is wonderful to have models in life. And often we find role model among the eminent dead, because it is safer.

显而易见,查理·芒格对我影响至深。他对我最大的影响,其实远超投资领域。他的为人处世,一直是我的榜样和标杆。我认为每个人的生命里能有一个榜样是特别好的。通常我们会在逝去的大师里寻找榜样,因为这样更安全。

It is pretty risky to pick a role model who is still alive and there is always a risk of disappointment.But in my case, I got really really lucky in the sense that my role model never failed me and instead continued to inspire me right into his 97th year.

的确,寻找一个活着的榜样是有让自己失望的风险。但对我而言,我非常非常幸运。因为我的榜样在他97岁的人生中从不曾让我失望,并且还能一直激励我。

And so mostly it is really basically his attitude towards life and his ability to keep equanimity in a sense, in the face of ups and downs, successes or setbacks, and I witness quite a bit of them over the 17 years or so we've been working closely, and to maintain that rational composure, common sensical approach to all problems, investment or life. That is extraordinarily hard. And it is a bit of, I guess, against every natural tendencies.

他对我的影响更多的是他的生活态度,面对生活的波澜而保持荣辱不惊的能力。在过去超过十七年的紧密合作中,我见证了他不少的起起落落,但他的生活哲学与能力,总能让他时刻保持镇定。不论面对任何困难,关于投资或者人生,要维持理性、逻辑和镇定是极难的,这多少有点反人性。

I've really watched closely, up close and in person how Charlie had conducted himself and it is in their regard that he is probably the most influential person in my life. And I have been very, very lucky in that regard.

而我有这个殊荣能近距离地观察他是如何处事待人,的确非常幸运,我也受他影响最深。

2、李录和其他价值投资者之间有什么区别?

Professor Greenwald:

But then what other dimensions do you do things differently today than other investors who are less successful?

你自己如何评估,相较于其他投资人或者价值投资者,你的投资方法有什么样的独特之处?

Mr. Li Lu:

I don't spend my time study a hundred people doing that that way. We spend most of our time studying industries, studying specific companies. We're looking for the ones who are really successful, trying to answer what really makes them successful? Can that success be continued?

我其实不花时间研究其他投资者的是怎么做的,我们把绝大多数时间花费在研究行业以及其中特定的公司上。我们在寻找那些已经成功的企业,并找出他们真正成功的原因,以及这样的成功是不是可以延续?

And some of the time we have answers, and some of the time we don't, we just continue to really study them and continue edit until we have an answer.

有的时候我们能够找到答案,有的时候找不到。我们能做的只是持续地研究,学习,直到找到答案。

And then one thing that we need to bet is always important for us is this intellectual honesty. Basically knowing that we really don't know, what we do know and we don't. In other words if you claim a circle of confidence. You have to understand the ash of the confidence. You have to know what is false in what is close call. You have to be very honest with yourself.

有一点对于我们而言一直是非常重要的,就是“对知识的诚实”。说白了就是明白你知道什么和不知道什么。你要有一个能力圈,并且明白它的边界在哪。你必须要了解一家公司的优势在哪里,包括哪一些是可以预测的,哪一些是看不到的,你必须对自己保持这样的诚实。

So we really insist on knowing inside and out the particular businesses and to the point where we are able to predict its outcome, for example, in the next 10 years. At least I want to know at the worst case scenario, what the business would look like 10 years from now. That's what we do have a long term horizon in terms. We can't really predict that forever. But I want to see what I can predict with a very high degree of confidence in 90% of confidence that at a minimum with the business will look like in 10 years and then all different contingencies.

所以我们坚持要把一个生意的里里外外都了解得非常清楚,直到我们有能力预测它的发展。举个例子,我们至少希望了解在最糟糕的境遇下,一个公司十年后变成什么样?因此,我们可以说是具备了长期视野,虽然不可能预测得到永远的未来,但我们希望看到自己至少有90%的把握预测未来的十年里,在各种偶发事件之下,一个公司到底会发展如何?

And so and most of the time but we don't have an answer. We just keep studying and keep at it. And sometimes we study for years and years before you see. we really get it and then we will wait for price to come to our striking zone and a lot of the time they don't. And so that makes our selection very, very difficult. so when we do select them, we tend to really own them for very very long time.

绝大多数时候,其实我们并没有答案。我们只是持续地研究,学习。直到经过了多年不为人知的研究学习之后,我们会真正懂得其中的关键,并等待价格来到我们能买入的“击球区”。但很多时候价格并不在合适的区间,这让我们的选择变得非常非常困难。但一旦我们选择买入后,我们会很长时间地持有这些公司。

Because the business is where they are really good and we really fully understand and are very rare. And how do you mean when you really do you understand, so anything that we would own we would buy a lot more as they go down.

因为真正优质而我们又足够了解的生意是极其稀有的。当我们真正了解一家公司时,这意味着什么呢?这意味着任何我们选择持有的标的,当其价格下跌时,我们会持续购入。

Professor Greenwald:

How do you start?

你们具体会怎样开始?

Mr. Li Lu:

Yeah, if they go, that's 50% is 60% of the brand we buy more. So that really gives you a measure of our definition of whether we understand them.

当价格下跌百分之五十甚至百分之六十时,我们会更大规模的增持。这样的举动,就是我们对一个公司是否足够了解的界定标准。

3、投资者应该是专才还是通才?

Professor Greenwald:

Do you prefer to be a generalist or a specialist investor? And would one work better in the Chinese market than the other?

作为投资者,你倾向于当一个通才还是专才?在中国市场做投资,哪一种能把投资做的更好?

Mr. Li Lu:

Well in a sense, you always want to be a generalist, uh, in terms of a student of businesses. And you’re interested, you know, you have to have to be good at this game, you have to have the innate intensive curiosity about the business, all kinds of businesses. It doesn’t mean you’re going to really get to the bottom of it. Oftentimes you don’t if you’re honest with yourself.

从某种方面来讲,作为学习商业的学生,最好是方方面面都有所了解,如果你想要做一个好的投资者的话,你必须要对各种各样的行业有着强烈的好奇心,这并不是说一定要对每个行业都要有非常透彻的了解。坦白地讲,这常常是做不到的。也很难对每个行业那么了解,我们还是要对自己诚实一些。

But by the time you really get into the companies you really decided to invest, you really better become a true specialist. And to the point you really know,hopefully better than anybody in the world you can find, including the top management team, the top management team, because they manage the company, they tend to be, uh deeply personally vested in their own biases, and may not be able to look at the business as objectively rationally as you do.

但是你一定要有这样的好奇心,当你决定投资一家公司的时候,你一定要成为这家公司的专才,要非常了解这家公司,要比世界上任何一个人都要了解这家公司,甚至比他们的高管更加了解,因为高管在日常管理工作中都会带上自己的认知偏见,有的时候可能身在此山中没有办法跳出来看。所以你必须要成为对于这家公司真正的了解,把你自己全身心的投入其中,这样你才能更加有信心的投资这家公司。

So that’s a really test, so you want to be a true specialist in the company you chose to really invest. But you want to be a generalist always of business in general. So that your core confidence, your circle of confidence constantly evolving and enlarging over time.

所以说,这真的很有挑战,就你要投资的个体公司而言,你应该是一个专家,但是对于整体的商业你要有广泛的认知,这样你的认知能力圈和核心竞争力才可以不断的拓展增强。

If I still really know what I knew when I started, when I first took your class, where would you first invest with, we will not really have anywhere near the results, and we both enjoyed,so luckily that, that we continue to expand, and we continue to learn.But on the other hand, it is a fascinating to see that how business evolved over the last few decades will continue to evolve in the next few decades and that really makes me feel that boy, I’m lucky to choose this field that I get paid to, really satisfy my curiosity and to learn from all these great people and great enterprises serving society, so I feel happy everyday doing what I do.

我在最开始学习和实践投资的时候,其实没有达到这样的程度,但是幸运的是我们一直在路上,一直在持续学习。这样的过程其实也是非常美好的,你可以亲历过去几十年商业社会的发展,并且在未来继续见证,这让我非常庆幸于自己对于投资职业的选择。这也是为什么我每天都很享受于工作的原因,我不仅获得财务回报,还满足了好奇心,还能跟各行各业的优秀人才学习。

4、新的投资者应该接受什么样的教育?

Professor Greenwald:

OK, so in terms of value investing education you actually played a big role in promoting and advocating value investing from the books to actually underwrote this class that we talked about where I went to Beijing University, and I think it still survives. What’s your vision for the kind of education that a new investor should embrace and where that education might be available?

接下来想问问你关于价值投资领域的教育。其实你也在积极的倡导和支持价值投资的理论传播。包括你也一直在支持北京大学价值投资的课程。从你的角度看,对于新投资者来说,应该如何去学习和了解价值投资呢?

Mr. Li Lu:

Well, first of all, thank you, Bruce, for come to teach at the Beijing University value investing class that my colleague Jin Chang and I started 6 years ago, and now is 6 years and still running, and running very well. And you have played an important role to that.

首先,非常感谢您曾来北京大学教授价值投资的课程。这门课程是我和我的同事常劲六年前发起的。现在六年时间过去了,课程进行的很好。

(2015年李录先生在北大讲授价值投资课)

I think our original inspiration for that class was really based on pretty much your class. And your class is pretty much inspired and the continuation of the Ben Graham's class, and Graham and Dodd, and which had among others, Warren Buffett as a student, and I'm your student. There will be many more, much brighter investors coming after us, and that's a good thing. So we're trying to do our part, to really to pass on the philosophy, the thinking, and the practical parts of value investing, to the next generation, in a sense.

您对于这个课程的设立其实有着至关重要的作用,因为这个课程设计的最初启发,就源于您在哥大的课程。您的课程是本杰明格雷厄姆教授经典课程的延续与传承。格雷厄姆教授的众多优秀弟子中,有巴菲特这样的著名学生;而我是您的学生。之后,会有更多更聪明的投资新星,将从我们这里继续薪火相传。这是一个好事情,所以我们尽自己的绵薄之力,把我们的想法、我们的认知以及我们在实践当中所学到的经验教授给新的投资者,教给下一代。我们希望尽自己的绵薄之力把我们的价值投资的理念、认知以及实践当中所学到的经验传承给下一代。

So, in terms of a younger student, when you started today, so I think a few things will be important. When I talk to young students and people who started out, trying to get into the field, I say several things that is important.

而对于年轻刚刚起步的学生来讲,应该考虑如下几个重要的点。这也是我一直给想进入投资领域的年轻人和年轻学生说的。

You need to always adopt a owner's mentality. And so I like to really ask a young student or an analyst at our firm basically to imagine, all of a sudden that one of your unknown uncle died and handed over 100% ownership to the company to you, and that's the business you are going to study, so any company, think of the starting point that way.And once you really, kind of, think on your own 100% that way, your mentality is totally different.

首先,你需要有一种所有人意识。我会经常问年轻的学生或者我们公司新的分析师这个问题:假设你有个从未谋面的远房叔叔突然去世了,他公司百分之百的的股权转交到了你的手上。这就是你需要去研究的公司,任何公司我认为都是要从这个起点出发去了解研究的。一旦你认识到你对一个公司有着全部的股权,你的心态会完全不一样。

So you never know that business existed, now you own 100% of it. You have no idea how to run it. You don’t know the people who will run it. What do you do? A lot of the things you know, you don't understand. You just know the facts, you don't understand it, but that's ok, you are gonna continue to learn, until you get 100% of it.

此前,你根本不知道这个公司的存在,但现在你却100%拥有了全部股权——虽然你还不知道如何经营这个公司,对它的管理团队也不了解。这种情况下,你会怎么做?你肯定是想方方面面的能了解多少就了解多少,有的时候你对拿到的信息不了解,没关系,你可以进一步的研究,直到你了解熟悉掌握。

And even if then, because of the constant change, you're gonna to continue to evolve you knowledge of it. Now if you adopt that mentality, study any businesses, you will have really started the process of becoming a real value investor. So that's the first thing.

即便是这样,因为事物都是在不断地变化的,所以你也要持续的研究和学习。现在,如果你能具备这样的所有人意识,再来研究任何的公司,你就能在价值投资者的道路上走得更好。这是第一点。

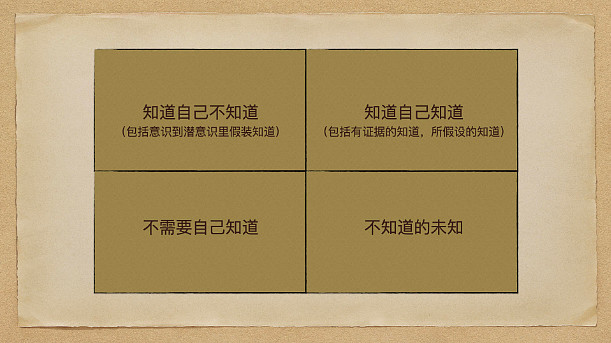

The second thing is you really want to maintain intellectual honesty and that is very very very important. You have to be really honest of what you know, what you assume, what you pretend unsubconsciously, and what you don’t know, how do you really know that.

第二点,你需要保持对知识的诚实的态度。知之为知之,不知为不知,一定要诚实,这一点非常非常重要。你必须诚实地面对自己所知道的,所假设的,潜意识里假装知道的,以及不知道的事物。你是怎么知道这些呢?

One of the things that Charlie have talked about that I think make the most sense is that I'm never entitled to have a view, until I can find the smartest people on the planet who took the other side of that view and I can argue better that opposition than he does, and when I can do that, I would be entitled to have a view. Same thing applies to investing in a sense that, that intellectual honesty is a good life philosophy to begin with. It is critical, it is vital when it comes to investment.

查理·芒格曾经说过一个我认为很有道理的观点,除非我找到地球上最聪明的同时与我持有不同观点的人,并且能辩过他;否则我就无权发表观点。当我能做到这一点,我才有权拥有一个观点。理性诚实是很重要的人生哲理,在投资领域也是必不可少的。

Because as I said, the security market always exists to a point, to really to find your weaknesses, your dishonesty, your pretension, your bushy-mushy knowledges, and if you do not really possess that fundamental attitude of intellectual honesty, you'll be destroyed at some point during this, during your career by the financial market. It was always designed that way to catch you.

证券市场的存在几乎就是为了找到人的弱点,人的不诚实,人的自命不凡以及急躁而又糊涂的观点。如果不具备理性诚实的人生态度,那么你在职业生涯中的某个时候会被金融市场摧毁。金融市场几乎就是为攻击人性的弱点而设计的。

Professor Greenwald:

Can I, can I say something about that, because It was better designed that way. Every time you buy a security, thinking it's going to do well, somebody else is selling you that security thinking it's going to do bad, and vice versa. And one of you is always wrong. So you better be sure that you're the one that's on the right side of that transaction.

我能说两句吗?我觉得金融市场要好于你认为的设计路径。每次你在投资的时候觉得这个股票绝对是好的才会买,但是卖方在卖出的时候肯定是觉得这个股票不行了才卖,反之亦然。所以其中一方肯定是想错了。所以你必须要确保在交易的买卖双方当中你是对的那一方。

Mr. Li Lu:

Well, it is, there is some zero-sum aspect, but not always.

好吧,这里有一点零和博弈的味道,不过并不是每个交易都是这样的。

Professor Greenwald:

Oh, no, it's a hundred percent zero-sum. The average return to all investors in any asset class and therefore in all all asset classes, is the average return to all those assets, it brings out ...

不不不,我认为证券市场是百分之百的零和市场。任意资产类别中所有投资者的平均回报,也就是所有资产类别中所有投资者的平均回报,就是所有这些资产的平均回报。

Mr. Li Lu:

I just take a slight different view, but I'm never going to argue against my professors.

你的观点和我的有些不一样,但是我不会和您,我的教授争辩的。

Professor Greenwald:

I’m just gonna say…

我就是想说……

Mr. Li Lu:

Let’s just agree to disagree. That’s OK. It’s a fair point. It is a fair point. Another thing I would say is that you want to really devote as much time as possible to study the history of the businesses, and the history of the great businessmen in the past. The more you study more companies, the better you are when it comes to judgement on good opportunities and the judgment about fundamental characteristics of the company of interest.

在这个问题上,我们就保持各自不同的观点,求同存异吧。您讲的确实也很有道理。

第三点就是要全身心的投入去研究这个公司的过往,包括成功的商人过去的一些历史经历。你研究学习的越多,你在决策的时候就判断的更准,更容易抓住好的机会,而且更加能够把握好你感兴趣公司的基本面特征。

And so, I say all three things are important:

1. to start with the 100% owner mentality,

2. to continue to train yourself to have a high degree of intellectual honesty,

3.and lastly to be really a thorough student of the history of the businesses.

All three things are really going to be very helpful if you are beginning to get into the field of investment or you want to really improve your game. So that's my advice to the students.

这三点都非常重要:

首先,要锻炼自己保持百分之百的所有人心态,

第二,一定要训练自己保持百分百对知识诚实的态度,

第三,一定要保持不断学习的心态,去彻底了解这个公司的过往和方方面面。

如果你刚刚进入到价值投资的领域,或者你纯粹就是为了提升自己的投资水准学习,所有这些都能够帮助到你。这就是我对年轻学生们的建议。

Professor Greenwald:

That's good advice. I'm not going to argue with that.

非常好的建议,我完全同意。

5、李录如何回顾看待自己过往的人生决策?

Professor Greenwald:

When you look back over your own career, are there things that whether at Columbia Business School or in your career since then, you would have done differently that would have helped you get to where you are today sort of more quickly and more easily?

回望您个人的发展路程,包括在哥大学商学院以及后来的职业生涯,有没有什么事情你今天会做法不同的?

Mr. Li Lu:

Yeah well, when I look back, I feel extraordinarily lucky and I feel nothing but gratitude. I feel lucky to accidentally stepped into Buffett's lecture at your class basically, at the first time he came. I feel extraordinarily lucky that when I got into the business and that I stroke up a relationship with Mr. Charlie Munger. I feel extraordinarily fortunate to live in a period of time when both the United States and China are going through a fundamental economic growth and provide enormous amount of opportunity that I happen to really know both markets well. And so, I look back at my career, I feel nothing but gratitude.

回看过去,我觉得自己超级幸运,并充满感恩:

我非常幸运地偶然在您的课上遇到了巴菲特先生,这还是他第一次来哥大演讲。

我非常幸运地进入投资行业,并和能和查理·芒格先生建立紧密的关系。

更幸运的是,我所在的时代,中国和美国都在经历着巨大的的经济增长,这样的发展也给我们带来了非常多的机遇,而我刚好对两边的市场都比较了解。

因此,回望过去的职业路径,我没有什么后悔的,我都是充满了感恩之心。