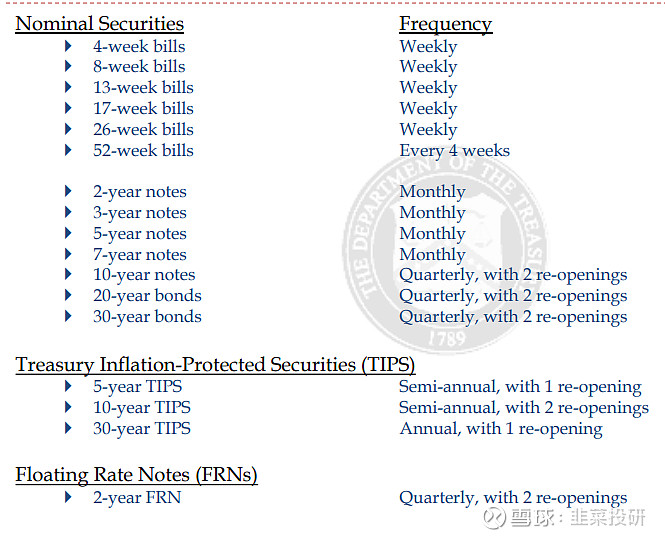

1.Types of Marketable Treasury Securities

Bills – Maturities less than 1-year, sold at competitive auction at a discount to par. Returns par at maturity.

Notes – Maturities from 1-year to 10-years, sold at competitive auction, semi-annual coupon payments.

Bonds – Maturities > 10-years, sold at competitive auction, semi-annual coupon payments.

Treasury Inflation-Protected Securities (TIPS) – Maturities of 5-, 10- and 30-years. Sold at competitive auction. Semi-annual coupon payments. TIPS have a “Real Rate Coupon.” Principal is indexed to NSA-CPI.

Floating Rate Notes (FRN) – 2-year maturity. Sold at competitive auction; quarterly interest payments with weekly reset. Indexed to the 13-week T-bill auction result.

2.Treasury Issuance Calendar

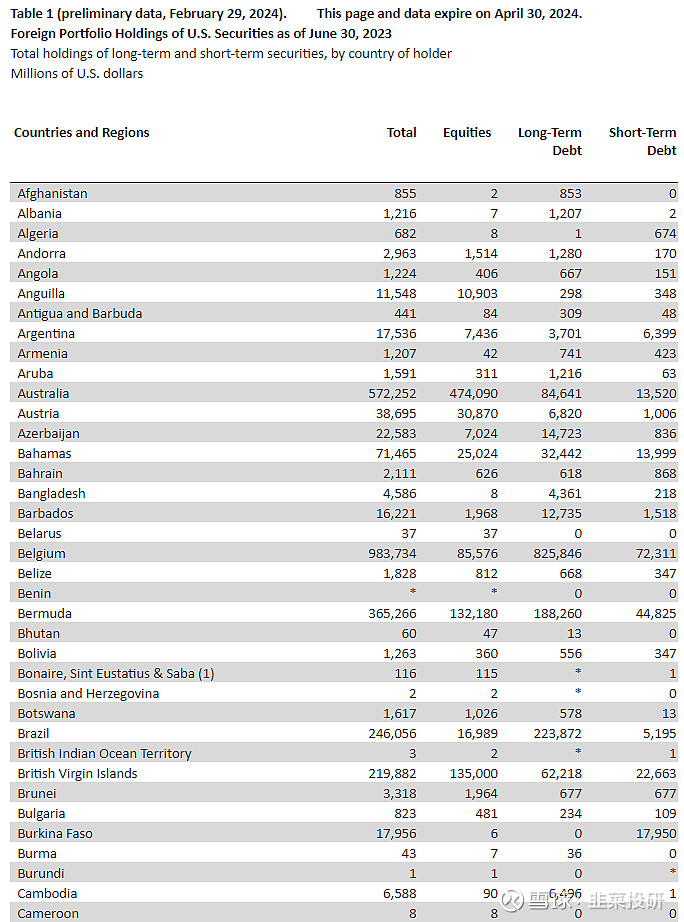

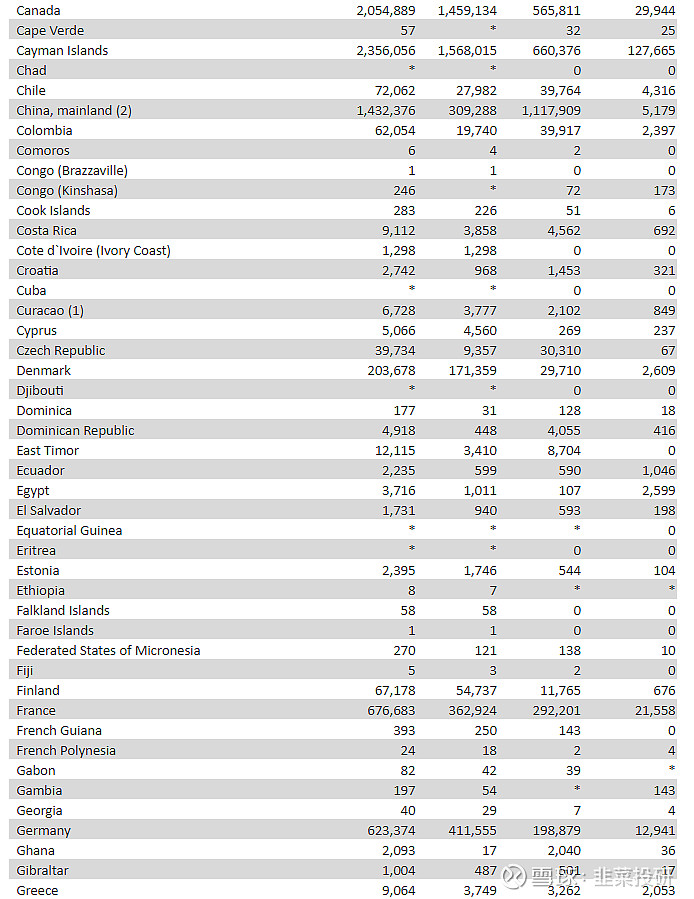

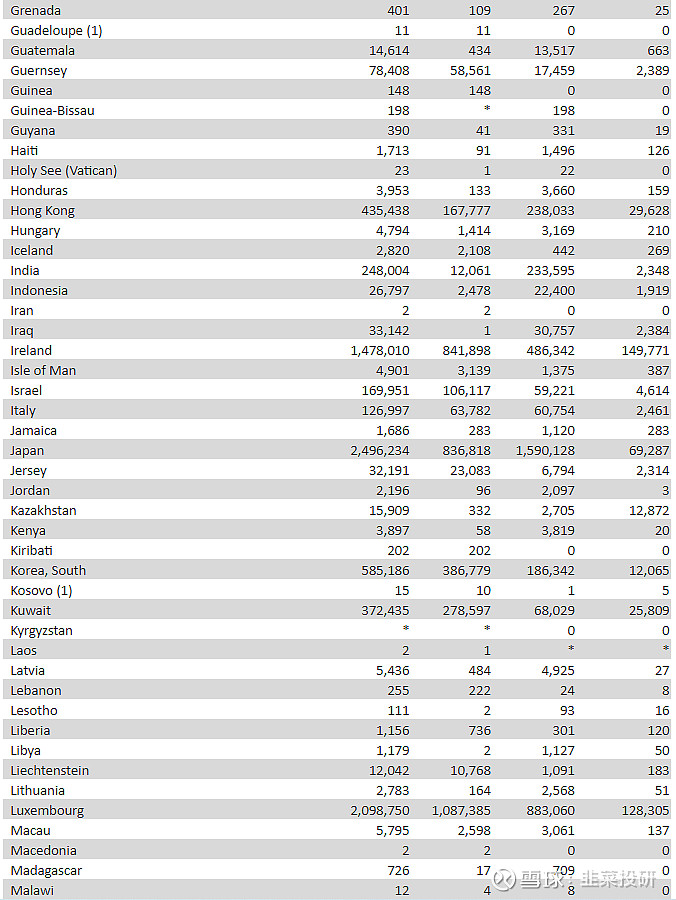

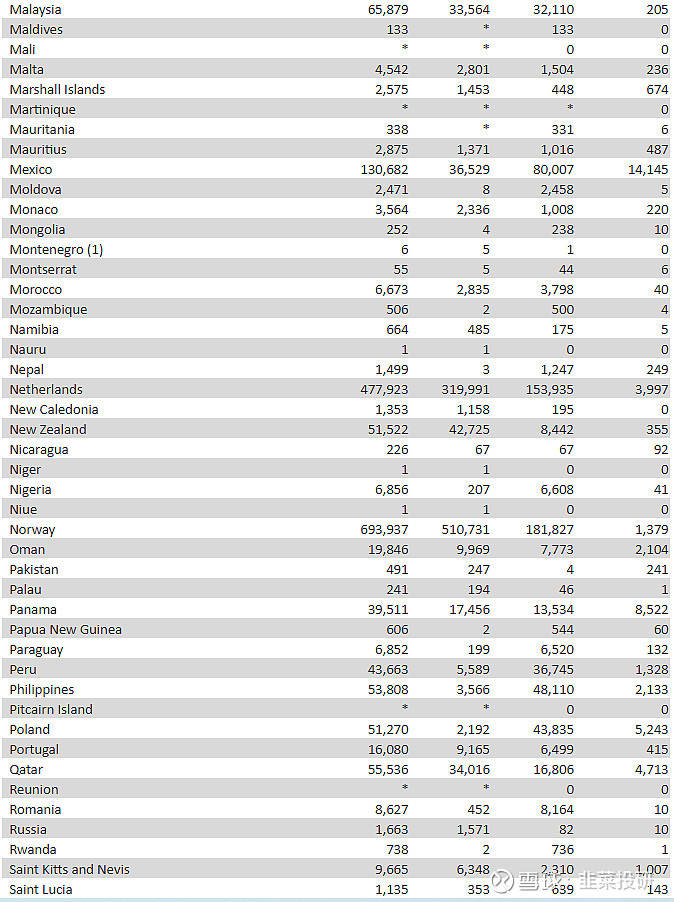

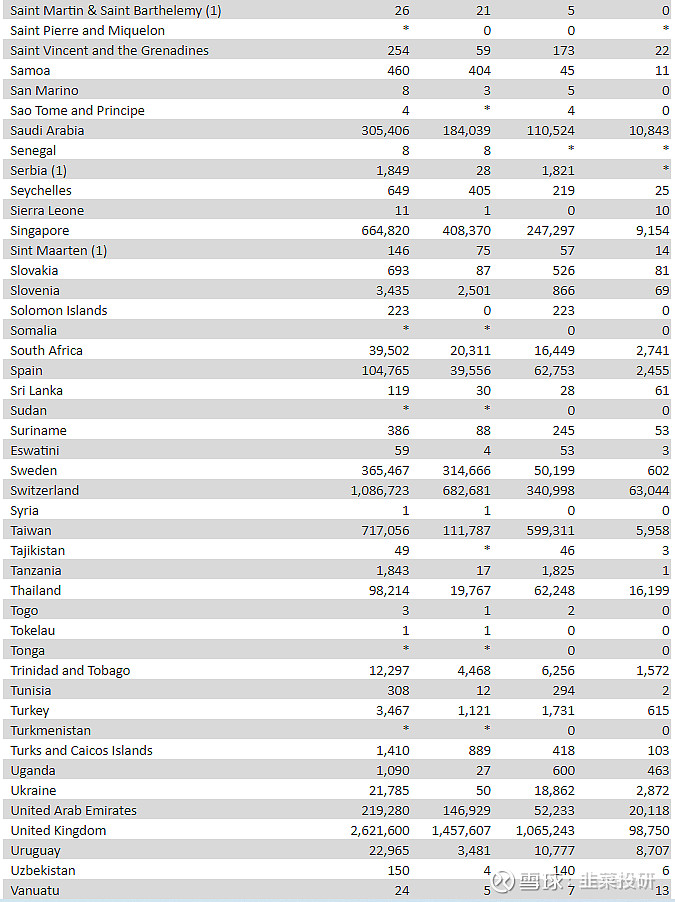

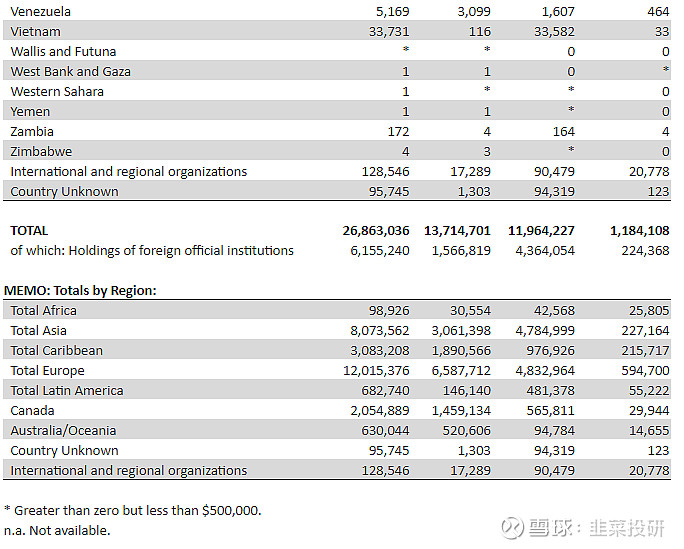

3,Total holdings of long-term and short-term securities, by country of holder

——UK ,JAPAN,ISLANDS

US securities are so popular