Summary

INSW is a diversified tanker company.The company believes oil market data "sets the stage for a tanker recovery".But I think they are ignoring 2021-2022 and long-term demand projections.I see also a misinterpretation of "orderbook" data for new ships.INSW's false optimism may lead to poor capital allocation decisions.Looking for a portfolio of ideas like this one? Members of Boslego Risk Services get exclusive access to our model portfolio.

Photo: International Seaways, Inc.

International Seaways, Inc. (INSW), headquartered in New York City, NY, is a large tanker company providing energy transportation services for crude oil and petroleum products in International Flag markets. With a market cap around $483 million (January 21, 2021), its peers, by market cap, are Sprague Resources LP (SRLP), Oasis Midstream Partners LP (OMP), GasLog Ltd. (GLOG), Nordic American Tankers Limited (NAT), and TORM plc (TRMD).

The company's fleet is primarily (by deadweight tons) dedicated to crude oil transportation in VLCCs but also is diversified into the oil products sector. The company's introductory slide from its January 2021 presentation is shown below, providing more details.

Seaways commenced operations through its predecessor company in 2016. Since inception, it has traded at a low of $11.58 and high of $28.11.

Over the past year, the stock has lost about 35%, closing at $17.00 (January 21).

There was a mini-rally in tanker stocks in early January that appeared to reflect optimism following Covid-19 vaccine announcements. But "Vaccination campaigns take time," the International Energy Agency (IEA) said. "We assume that the [they] will start to have an impact on mobility and transport fuel demand in the second half of 2021."

Oil Demand

The demand for oil tankers is a "derived demand." Without oil demand, there would be no demand for oil tankers.

Logistics complicates matters. Even if global supply matched global demand, there would be the need for shipping in the world as we know it. The major producers are in the Middle East, but the major consumers are in North America, the Far East and Europe.

And then there is trading demand. Price relationships may justify shipping oil from one location to another.

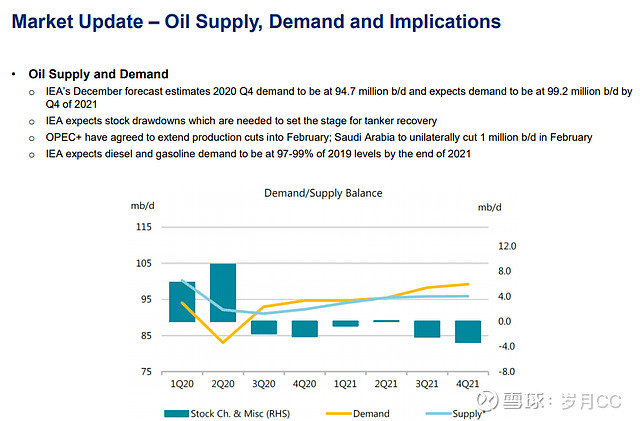

Seaways included a slide in its presentation based on the December IEA forecast. The data appear to provide some support "to set the stage for a tanker recovery."

But in January the IEA backtracked, forecasting that global oil demand will be lower in 2021 than previously expected.

It will take more time for oil demand to recover fully as renewed lockdowns in a number of countries weigh on fuel sales. [But] the global vaccine rollout is putting fundamentals on a stronger trajectory for the year."

The IEA said that:

Global oil demand is expected to rise by 5.5m b/d in 2021 as a whole to 96.6m b/d after falling by 8.8m b/d in 2020. But it is not expected to recover to pre-pandemic levels of around 100m b/d until 2022 at the earliest."

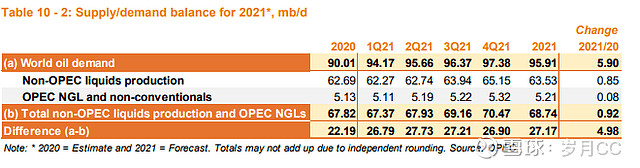

OPEC assessed that world oil demand in 2020 is now estimated to have declined by 9.8 mb/d year-on-year (y-o-y) to average 90.0 mmbd in 2020. For 2021, it projects global oil demand to increase by 5.9 mmbd y-o-y to average 95.9 mb/d.

The Energy Information Administration (EIA) forecasts that global oil consumption will rise by 5.56 million barrels per day in 2021. But that gain is against a loss of 8.96 mmbd in 2020.

It also provided its first estimate for 2022. It projects global oil consumption will still be slightly less than in 2019. However, projections out that far with the uncertainties in today's world provide little confidence.

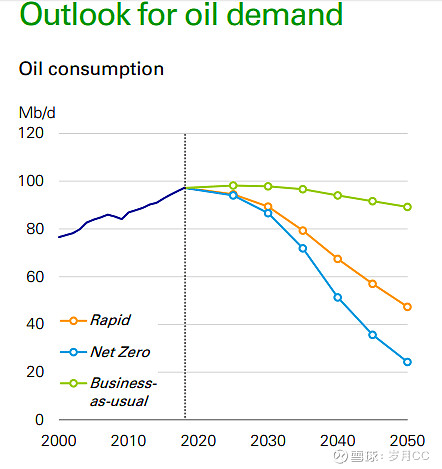

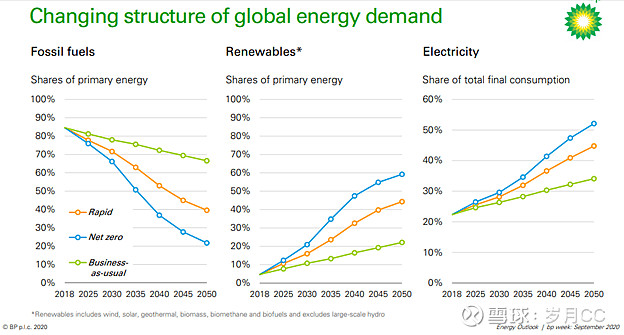

Longer term, the BP Energy Outlook 2020 says that global oil demand may have already peaked in 2019 and that oil consumption may never recover to the pre-pandemic levels. Two of its three scenarios show oil demand dropping by over 10% by 2030, and the most conservative scenario shows oil demand leveling-off for the balance of the decade before declining further.

Source: BP.

BP (BP) predicts fossil fuel demand will be replaced by renewables as the world transitions to electricity to meet future energy demand. BP CEO Bernard Looney said that the company plans to cut its oil and gas production by 40 percent over the next decade. The company also said it will accelerate investment in renewables and biofuels by 10-fold to around $5 billion per year by 2030.

Ship Supply

The supply of tankers changes as a result of newbuilds and scrapping. Again, logistics complicates matters. There can be a glut of ships in one location and a shortage in another.

The available supply can be affected by ships used for storage and those coming out of storage. Ships may be subject to sanctions, as were the COSCO tankers in late 2019 and Iranian tankers for years.

In the short-term, ship availability can be impacted by sailing speeds. Faster speeds add to supply, slower speeds take away from supply.

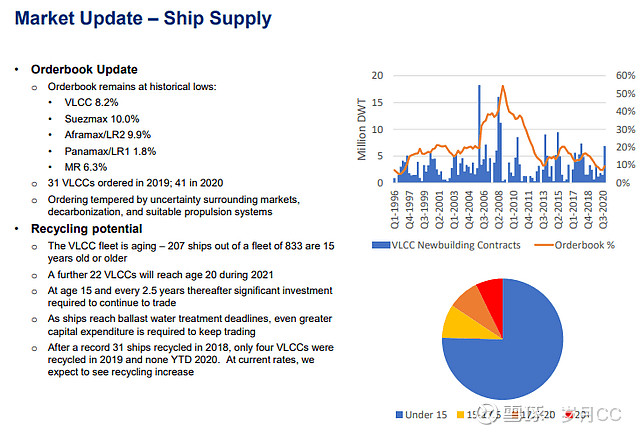

Seaways presented a familiar slide showing the orderbook for tankers are at "historic lows." Under "normal" historical conditions, this could imply that there may be a shortage of tankers ahead.

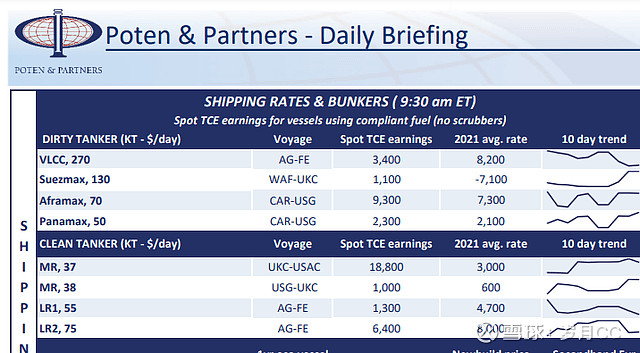

As of January 22, 2021, shipping rates are depressed. The VLCC Spot TCE earnings was reported at just $3,400 per day. This implies a supply glut of ships.

Under the oil demand scenarios discussed above, it is questionable at best whether ship owners should commit to newbuilds which may take around two years to build and have a useful life of about twenty years.

VLCCs' "Futures Market"

Unlike oil futures, there is no futures market for VLCC spot rates. However, the one-year time charter gives some visibility as to what rates companies are willing to transact.

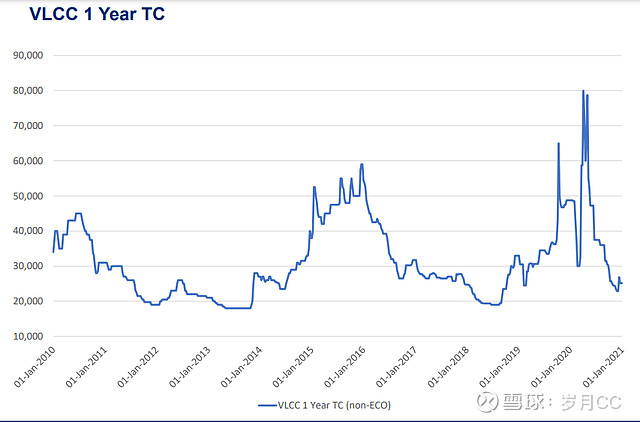

In Seaways' presentation, it shows how the VLCC charter rate has collapsed since its 2020 peak. It is back to its early 2019 level.

In Seaways' Earnings Summary in early November, CEO Lois K. Zabrocky said:

I think, that we continue to see the drawdowns, and demand picking up and the unwinding of the storage. So you have all these factors coming together. So to us we think that there'll be a few months of pain while the destocking happens, and then you're going to see increased demand and the market will pick up."

Following a few months of pain since November, there is no pick-up in sight.

Conclusions

A shipping company's capital allocation decisions are dependent on how it interprets and forecasts market fundamentals. I find Seaways' presentation uncompelling. For these reasons, I maintain my short position as previously discussed.