Preface to the Fourth Edition,

by Warren E. Buffett

第四版前言——沃伦·巴菲特

I read the first edition of this book early in 1950, when I was nine-teen. I thought then that it was by far the best book about investing ever written. I still think it is.

1950年初,当我九岁的时候,我读了这本书的第一版。当时,我认为这是那个时候投资方面的最棒的书。现在,我仍然这样认为。

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that frame-work. This book precisely and clearly prescribes the proper framework. You must supply the emotional discipline.

想要在一生中成功投资,不需要极高的智商,也不需要不同寻常的商业见解或内幕信息。我们需要的是一个可靠的决策智力框架,以及防止这个框架被情绪所侵蚀的能力。这本书就为我们准确、明确地提供了一个适当的框架。你还必须在这个框架的基础上进行情感训练。

If you follow the behavioral and business principles that Graham advocates—and if you pay special attention to the invaluable advice in Chapters 8 and 20—you will not get a poor result from your investments. (That represents more of an accomplishment than you might think.) Whether you achieve outstanding results will depend on the effort and intellect you apply to your investments, as well as on the amplitudes of stock-market folly that prevail during your investing career. The sillier the market’s behavior, the greater the opportunity for the business-like investor. Follow Graham and you will profit from folly rather than participate in it.

如果你能遵循格雷厄姆倡导的行为和商业法则——特别是注意第8章和第20章中的宝贵建议,你的投资就不会出现糟糕的结果(别小看这一点,要实现起来可没你想象的那么简单)。你是否取得出色的成绩将取决于你在投资中所付出的努力和智慧,以及在你的投资生涯中股市里所出现的愚蠢行为的幅度。市场行为越愚蠢,对商业投资者来说机会就越大。跟随格雷厄姆,你将会从市场的愚蠢中获利,而不是参与其中。

To me, Ben Graham was far more than an author or a teacher. More than any other man except my father, he influenced my life. Shortly after Ben’s death in 1976, I wrote the following short remembrance about him in the Financial Analysts Journal. As you read the book, I believe you’ll perceive some of the qualities I mentioned in this tribute.

对我来说,本·格雷厄姆远不止是一个作家或老师。除了我父亲以外,他对我的生活影响最大。1976年,格雷厄姆去世后不久,我在《金融分析师》杂志上写了一篇以下关于他的简短悼念。当你读这本书的时候,我相信你会理解我在这篇致敬文章中所提到的一些品质。

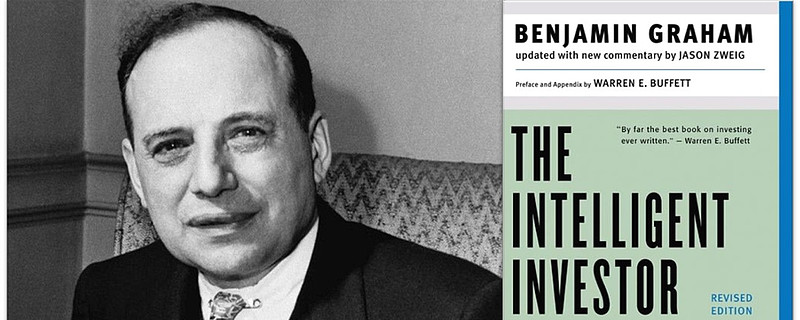

BENJAMIN GRAHAM 本杰明·格雷厄姆

1894–1976

Several years ago Ben Graham, then almost eighty, expressed to a friend the thought that he hoped every day to do “something foolish, something creative and something generous.”

几年前,年近八十的本·格雷厄姆和一位朋友说,“我希望每天都能做一些‘愚蠢、有创意、慷慨的事情’”。

The inclusion of that first whimsical goal reflected his knack for packaging ideas in a form that avoided any overtones of sermonizing or self-importance. Although his ideas were powerful, their delivery was unfailingly gentle.

这个异想天开的目标体现了他将陈旧的想法以一种避免说教或强调自我的形式包装起来的技巧。尽管他的想法很有说服力,但他们的表达始终是温和的。

Readers of this magazine need no elaboration of his achievements as measured by the standard of creativity. It is rare that the founder of a discipline does not find his work eclipsed in rather short order by successors. But over forty years after publication of the book that brought structure and logic to a disorderly and confused activity, it is difficult to think of possible candidates for even the runner-up position in the field of security analysis. In an area where much looks foolish within weeks or months after publication, Ben’s principles have remained sound—their value often enhanced and better understood in the wake of financial storms that demolished flimsier intellectual structures. His counsel of soundness brought unfailing rewards to his followers—even to those with natural abilities inferior to more gifted practitioners who stumbled while following counsels of brilliance or fashion.

这本杂志的读者并不需要凭借详尽的描述来衡量他的成就。虽然一门学科的创始人的光芒很少在短时间内就被继任者所掩盖,但对于格雷厄姆来说,更难得的是——在这本书出版40多年后,在证券分析领域仍然没有潜在的继任者能望其项背。这个领域的书籍经常在出版几周或几个月后就会显得愚蠢了,而格雷厄姆的原则却在今天仍然可靠,在脆弱的知识结构一次又一次被金融风暴摧毁后,这些原则的价值就会一次又一次地得到增强和更好的理解。他的可靠建议为追随者们带来了可靠的回报,甚至对那些天赋较弱的从业者也十分有效,而那些更有天赋、却在投资中遵循漂亮或时尚的建议的从业者则会遇到困难。

A remarkable aspect of Ben’s dominance of his professional field was that he achieved it without that narrowness of mental activity that concentrates all effort on a single end. It was, rather, the incidental by-product of an intellect whose breadth almost exceeded definition. Certainly I have never met anyone with a mind of similar scope. Virtually total recall, unending fascination with new knowledge, and an ability to recast it in a form applicable to seemingly unrelated problems made exposure to his thinking in any field a delight.

格雷厄姆在他的职业领域占据主导地位的一个显著特点是,他的成就并不是通过将所有精力集中在一个目标来实现的。相反,他的成就不过是他作为一名超然智者的自然而然的产物。当然,我再也没有遇到过其他类似的人——过目不忘的记忆力,对新知识有着无尽的迷恋,还能将这些新知识以看似无关的形式重塑,这些使得他在任何领域的思考都充满乐趣。

But his third imperative—generosity—was where he succeeded beyond all others. I knew Ben as my teacher, my employer, and my friend. In each relationship—just as with all his students, employees, and friends—there was an absolutely open-ended, no-scores-kept generosity of ideas, time, and spirit. If clarity of thinking was required, there was no better place to go. And if encouragement or counsel was needed, Ben was there.

慷慨是格雷厄姆最重要的特质,甚至超过其他所有的。他是我的老师,我的雇主,也是我的朋友。就像他与其他所有的学生、员工和朋友一样,在我们的每一种关系中都能看到一种绝对的、难以描述的慷慨的想法、时间和精神。如果你想要清晰的思路,那就没有比这里更好的地方了。如果你需要鼓励或建议,格雷厄姆也依然会在那里。

Walter Lippmann spoke of men who plant trees that other men will sit under. Ben Graham was such a man.

沃尔特·李普曼(Walter Lippmann)说过“前人种树,后人乘凉”,而格雷厄姆就是这样一位种树的前人。

Reprinted from the Financial Analysts Journal, November/December 1976.

转载自《金融分析师》,1976年11月