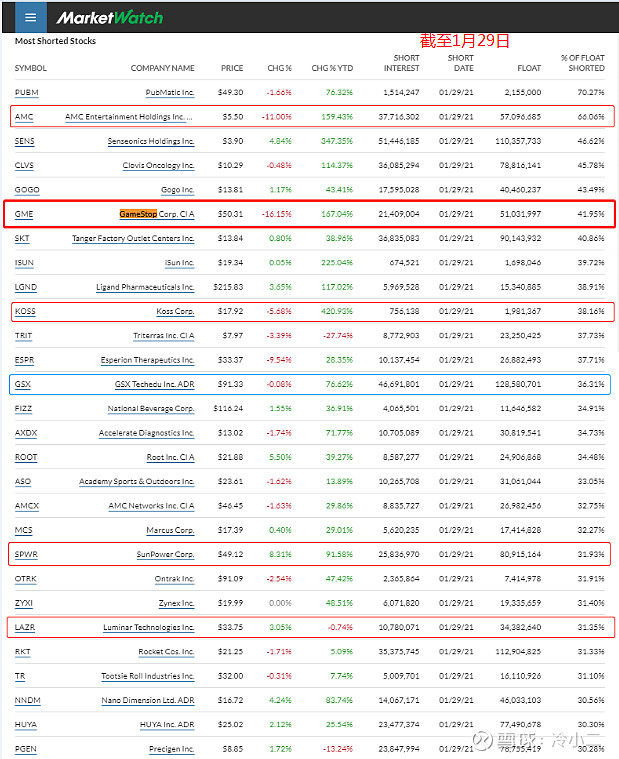

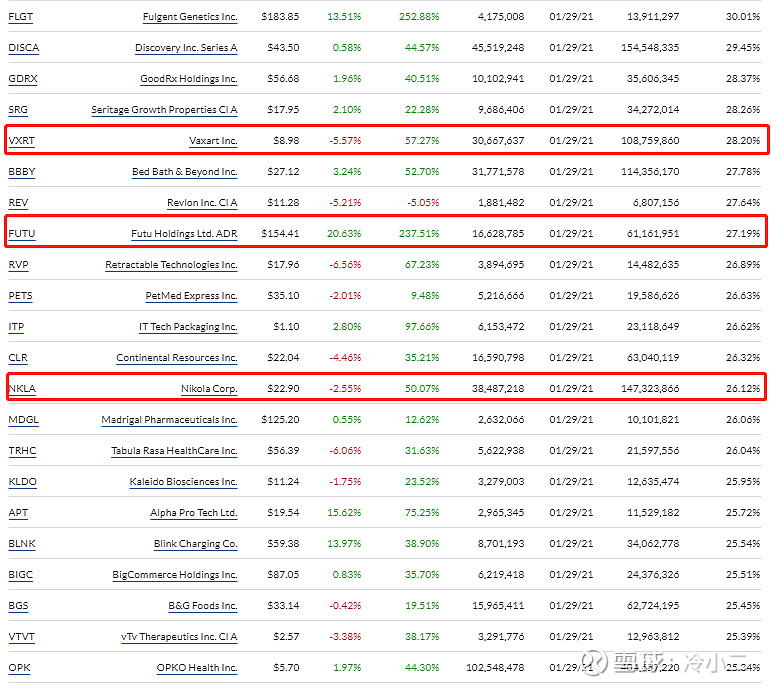

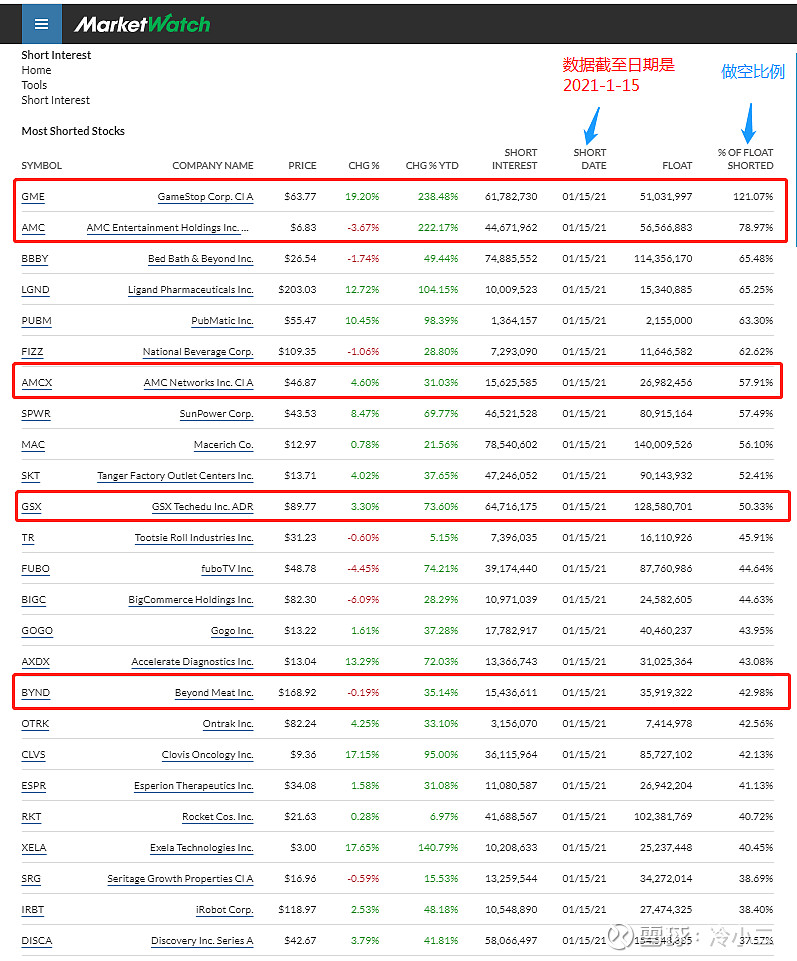

虽然我认为这个信息没啥用,但是很多球友可能还是感兴趣,尤其是最近高比例做空的股票大涨“逼空”之后! 这个MarketWatch的网站网页链接可以直接看数据,是不是看到很多熟悉的面孔:

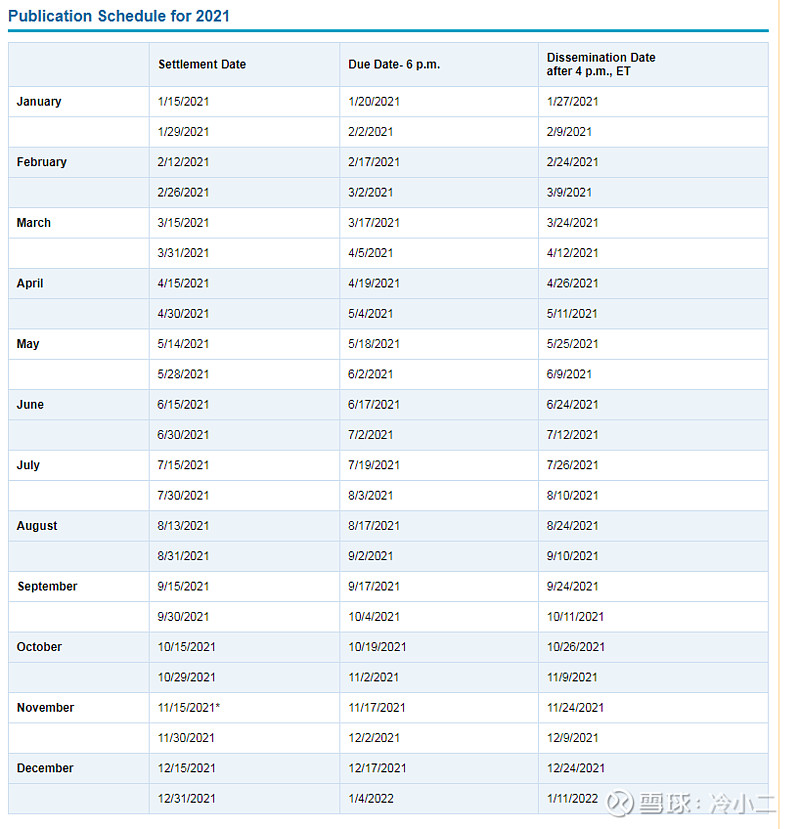

纳斯达克每半个月会公布股票做空的比例【网页链接】,因此信息可能有延迟,2021年全年做空数据的报告将会按照如下时间表公布:

[以下是转的著名财经分析人士David Webb关于做空知识讲解的文章,希望对大家有所启发]

【要点:所有多头头寸减去所有空头头寸的总和总是100%。例如,如果未偿空头头寸(如报告/估计)为140%,则多头头寸为240%,这个道理大家一定要想明白】

游戏驿站(GameStop)的游戏将如何停止(STOP) 2021年1月28日

【以下内容为百度翻译,凑乎着看哈,英文版本附后】在GameStop Corp(GME)

所谓的“短时间挤压”中,他们花了一段时间仔细研究了工作中的人群心理,在WallStreetBets Reddit页面的回音室中表达的近乎宗教的信仰似乎大致如下:

- 我们知道股票的交易价格是其公允价值的很多倍,但我们不在乎,因为。。。

- 我们正在“伤害”大型对冲基金,他们认为做空股票估值过高,而且。。。

- 我们是小人物,所以我们赚钱的代价是那些经营对冲基金的暴富集团,0.1%,我们指责他们[插入你选择的社会经济困境]。这是一场“运动”,一场“金融革命”和“我们会在伤害他们的地方打击他们”。

Reddit大军中的大多数步兵似乎没有意识到的是,除了将财富转移给上级之外,在退出泡沫时,通过后期进入者充实早期进入者,当泡沫破裂时,新兵最终将充实最后一批空头头寸持有者。

所有多头头寸减去所有空头头寸的总和总是100%。例如,如果未偿空头头寸(如报告/估计)为140%,则多头头寸为240%。一只股票可以无限次地借出和借入,每次卖出时,将多头和空头仓位扩大1股——上面没有写“我是借来的”。即使一些股票在流通中从贷款池中撤出,其他股票也可以松懈。因此,只要其他人同样愿意抛售或做空股票,买入股票并不一定会影响股价。理论上,一只股票可以有1000%的多头和900%的空头。

是的,一些卖空者可能已经平仓,无法承受进一步的损失,但其他人总是愿意在价格上涨时介入。同样,一些早期买家已经拿下了利润,悄悄地走开了。那么GameStop游戏将如何停止或结束呢?可能和大多数泡沫一样。这是一个零和游戏,除非公司发行新股。股价越偏离合理价值,卖出的诱惑就越大,无论你是做多还是做空。把它想象成一个氦气球在大气层中升起——它膨胀并最终爆炸,使有效载荷下降。那些涨幅最大的投资者会悄悄地先套现,尤其是如果这对他们来说意味着一个改变生活、大幅增持的头寸,吸收了最后一笔愚蠢的资金买入,随着势头逆转,整个市场将迅速崩溃。

所以,我们有消息告诉Reddit大军:你不一定会伤害卖空者作为一个群体。最后的空头持有人,如果有的话,将赢得他们的赌注。

唯一可以肯定的是,你正在让你的军队的早期领导人富有,一些在你的网站上最响亮的人,牺牲了其他人,无论长短。”“HODL”是他们的口号,但飞行员们将退出我是您的机长:我们代表全体机组人员,为打断您的飞行表示歉意,但对于坐在平底船左侧的各位,如果您眯着眼睛,您可以看到我们在下面很远的游艇上。感谢您选择平流层航空公司。”如果你想知道:韦伯网站从来没有交易过GME,多头或空头。

How the GameStop game will stop28 January 2021

Having spent some time perusing the crowd psychology at work in the so-called "short squeeze" of GameStop Corp (GME), their almost religious beliefs expressed in the echo chamber of the WallStreetBets Reddit page seem to run broadly as follows:

We know the stock is trading at many times its fair value, but we don't care because...we are "hurting" big hedge funds which short stocks they think are overvalued and...we're the little guys, so we are making money at the expense of the obscenely wealthy cabal that run hedge funds, the 0.1%, whom we blame for [insert socio-economic woes of your choice]. This is a "movement", a "financial revolution" and "we're gonna hit them where it hurts".

What most of the foot-soldiers in the Reddit Army don't seem to realise is that apart from transferring wealth to their superiors, with late entrants enriching early entrants as they exit the bubble, the new recruits are eventually going to enrich the final cohort of short-position holders when the bubble bursts.

The sum of all long positions minus all short positions is always 100%. For example, if the outstanding short positions are (as reported/estimated) 140%, then the long positions are 240%. A share can be lent and borrowed an unlimited number of times, each time expanding the long and short positions by 1 share when it is sold - it doesn't have "I am borrowed" written upon it. Even if some shares are withdrawn from the lending pool in circulation, the others can be relent. So buying stock isn't necessarily going to move the price as long as someone else is equally willing to sell it or short it. Theoretically then, a stock can be 1000% long and 900% short.

Yes, some short-sellers may have closed their positions, unable to withstand further losses, but others will always be willing to step in against an increasing price. Similarly, some early buyers have already taken their profits and quietly walked way. So how will the GameStop game stop, or end? Probably the same way most bubbles do. This is a zero-sum game, unless the company issues new stock. The further a stock price deviates from sensible values, the greater the temptation to sell, whether you are long or going short. Think of it as a helium balloon rising up through the atmosphere - it expands and eventually bursts, dropping its payload.

Those with the largest gains will quietly cash in first, particularly if it represents a life-changing, massively-overweight position for them, absorbing the last foolish money to buy in, and as the momentum reverses, the whole thing will rapidly crash. So, we have news for the Reddit Army: you're not necessarily hurting short-sellers as a group. The final short-holders, if any, will win their bets. The only thing for sure is that you are enriching the early leaders of your army, some of the loudest people on your site, at the expense of everyone else, long or short. "HODL" is their rallying cry - but the pilots will bail out. "This is your captain speaking: on behalf of the entire crew, we apologise for interrupting your flight, but for those of you sitting on the left-hand side of the gondola, if you squint, you can see us in the yacht far below. Thank you for choosing Stratospheric Airways."

In case you're wondering: Webb-site has never traded GME, long or short.

$游戏驿站(GME)$ $AMC娱乐(AMC)$ $富途控股(FUTU)$ #中概小票活蹦乱跳# #空头头寸锐减GME等散户逼空股暴跌# #美国散户抱团股逆势大涨# #医美延续强势爱美客市值涨破1400亿# #散户抱团#