声明:本系列文章基于原期刊目录和摘要内容整理而得,仅限于读者交流学习。如有侵权,请联系删除。

期刊介绍:

“Geneva Papers on Risk & Insurance- Issues and Practice” 创刊于1976年,是日内瓦协会主办的一本国际学术期刊,聚焦保险经济学的前沿热点问题,旨在为保险学术界和业界专业人士之间的交流提供桥梁,提升保险业的专业知识。该刊为季刊,每年4期,每期发表文章10篇左右,2022-2023年影响因子为1.6。

本期看点:

● 家庭投资组合对解释人们拥有人寿保险的决定很重要。较多债券资产配置的家庭明显减少了定期寿险的需求。

● 寿险和非寿险保费都与商业周期同步变动。市场集中度仅对寿险有影响,而价格渠道仅对非寿险有影响。

● 将老年抚养比作为阈值变量的情况下,银行集中度和利率对寿险市场规模的影响具有机制转换效应。

● 在《偿付能力 II》中,建议将投资组合互换(portfolio swaps)作为一种新的多样化解决方案,使小型和专业化保险公司能够提高其多样化程度,从而减轻其多样化劣势。

● 在接受保单贴现的决策中,绩效预期、预期的易用性和社会影响结构是相关的变量,道德问题并不相关。

● 在美国西部,农作物保费补贴增加1%会分别导致总体灌溉用水量增加0.446%和表层淡水灌溉用水量增加0.673%。

本期目录

● A dynamic analysis of the demand for life insurance during the 2008 financial crisis: evidence from the panel Survey of Consumer Finances

● On the macrofinancial determinants of life and non-life insurance premiums

● Threshold effect for the life insurance industry: evidence from OECD countries

●Earthquake loss and Solvency Capital Requirement calculation using a fault-specific catastrophe model

●Solvency determinants: evidence from the Takaful insurance industry

●Diversification and Solvency II: the capital effect of portfolio swaps on non-life insurers

● Investment guarantees in financial products: an analysis of consumer preferences

● Factors influencing policyholders' acceptance of life settlements: a technology acceptance model

●Crop insurance premium subsidy and irrigation water withdrawals in the western United States

A dynamic analysis of the demand for life insurance during the 2008 financial crisis: evidence from the panel Survey of Consumer Finances

2008年金融危机期间寿险需求的动态分析:来自消费者财务调查的证据

作者

Ning Wang (北乔治亚大学)

摘要:Prior research indicates a significant relation between life events and the demand for life insurance. This paper is the first study to relate the demand for life insurance to household portfolio holdings in a dynamic framework. The study examines changes in life insurance demand as a function of changes in household portfolio holdings and life events using panel data during the recent financial crisis. The results indicate that household portfolio holdings are more significant than life events in explaining life insurance ownership decisions, and suggest a complementary rather than a substitution relationship between the ownership of life insurance and the holdings of equity and bonds during recessions. The results also indicate that households with more financial assets allocated to bonds drop significantly more term life insurance coverage. Further implications for practitioners are discussed.

已有研究表明,生命事件与寿险需求之间存在显著的关系。本文首次在动态框架下研究了家庭投资组合与寿险需求之间的关系。本研究使用最近的金融危机期间的面板数据,考察了人寿保险需求变化与家庭投资组合和生活事件变化之间的函数关系。结果表明,家庭投资组合持有比生命事件对解释人们拥有人寿保险的决定更为重要。结果还表明,在经济衰退期间,人寿保险的持有与股票和债券的持有之间存在互补而不是替代关系。结果还指出,将更多财务资产配置给债券的家庭明显减少了定期寿险的保障。文章还讨论了对从业者的进一步影响。

原文链接:

On the macrofinancial determinants of life and non-life insurance premiums

论寿险和非寿险保费的宏观金融决定因素

作者

Martin Hodula (捷克国家银行); Jan Janků (捷克国家银行); Martin Časta (捷克国家银行); Adam Kučera (捷克国家银行)

摘要:This paper tests potential determinants of the development of the insurance sector. Using a rich dataset for 24 European countries spanning two decades, we identify a set of macrofinancial factors that are the most robust predictors of growth of gross premiums in the life and non-life insurance sectors. We show that both life and non-life premiums co-move with the business cycle and are positively related to higher savings and a more developed financial system. In addition, we provide new evidence on the role of market concentration and price effects. We find that market concentration matters only for life insurance, whereas the price channel is significant only for non-life insurance. From a policy perspective, our empirical estimates can be used to refine the existing macroprudential stress tests of the insurance sector.

本文检验了保险业发展的潜在决定因素。利用24个欧洲国家20年的丰富数据集,我们确定了一组宏观金融因素,这些因素是寿险和非寿险行业毛保费增长的最稳定的预测因素。我们证实,寿险和非寿险保费都与商业周期同步变动,并与更高的储蓄和更发达的金融体系呈正相关。此外,本文还对市场集中度和价格效应的作用提供了新的证据。我们发现市场集中度仅对寿险有影响,而价格渠道仅对非寿险有影响。从政策的角度来看,我们的实证估计可以用来完善现有的保险业宏观审慎压力测试。

原文链接:

Threshold effect for the life insurance industry: evidence from OECD countries

寿险行业阈值效应:来自经合组织国家的证据

作者

Ingrid-Mihaela Dragotă(布加勒斯特经济研究大学),Cosmin Octavian Cepoi (布加勒斯特经济研究大学),Lavinia Ştefan (布加勒斯特经济研究大学)

摘要:We investigate the impact of new financial and economic determinants on life insurance demand for 29 OECD countries for the period 2005–2017 while controlling for a set of widely used socio-demographic and economic characteristics. Based on a panel smooth transition regression model, we find a regime-switching effect characterising the impact of bank concentration and interest rate on the size of the life insurance market, in light of the old-age dependency ratio as the threshold variable. We also show that life insurance development is boosted in countries with high scores for investment freedom and with high levels of foreign direct investment rates, regardless of the level of the old-age dependency ratio. The impact of GDP per capita on the demand for life insurance products is positive and statistically significant, regardless of the level of the threshold variable.

我们研究了 2005-2017 年间 29 个经合组织国家的新金融和经济因素对寿险需求的影响,同时控制了一系列广泛使用的社会人口和经济特征变量。基于面板平滑转换回归模型,我们发现,在将老年抚养比作为阈值变量的情况下,银行集中度和利率对寿险市场规模的影响具有机制转换效应(regime-switching effect)。我们还发现,在投资自由度得分高和外国直接投资率水平高的国家,无论老年抚养比水平如何,都会促进寿险业的发展。人均国内生产总值对人寿保险产品需求的影响是积极的,并且在统计意义上是显著的,与阈值变量的水平无关。

原文链接:

Earthquake loss and Solvency Capital Requirement calculation using a fault-specific catastrophe model

使用特定断层巨灾模型计算地震损失和偿付能力资本要求

作者

Georgios Deligiannakis(雅典农业大学),Alexandros Zimbidis(雅典经济与商业大学),Ioannis Papanikolaou(雅典农业大学)

摘要:As of January 2016, the Solvency II Directive demands that all insurance companies in the EU perform a Solvency Capital Requirement (SCR) calculation. We propose an earthquake catastrophe model that calculates the SCR using an innovative hazard module. We test our model in the Attica region, which hosts 41.6% of the insured buildings in Greece. The results show a risk premium of 1.63% up to 3.16% for residential buildings, depending on exposure and deductible policy. A comparison between the EIOPA’s Standard Formula (SF) and our model shows that the SF overestimates the SCR by 19.3% in the Attica region. The addition of the 2% deductible to the exposure policies results in a 56.8% lower SCR than when using the SF. The overestimation varies from 2.7% to 133.57% in seven out of 10 catastrophe risk evaluation and standardising target accumulations zones, and by 16.28–32.97% in the three remaining zones.

自 2016 年 1 月起,欧盟《偿付能力II指令》要求所有保险公司进行偿付能力资本要求(SCR)计算。我们提出了一个地震巨灾模型,该模型利用创新的灾害模块计算SCR。我们在雅典地区测试了模型,该地区拥有希腊 41.6% 的投保建筑。结果显示,对于住宅建筑物,根据风险暴露和免赔额政策的不同,风险保费为1.63%至3.16%。我们的模型与EIOPA的标准公式(SF)进行比较,结果显示在雅典地区,标准公式计算高估了SCR的19.3%。在风险敞口保单中增加2%的免赔额,比使用标准公式计算SCR时低了56.8%。在 10 个巨灾风险评估和标准化目标累积区域中,有 7 个区域的高估率从 2.7% 到 133.57% 不等,其余 3 个区域的高估率为 16.28%-32.97%。

原文链接:

Solvency determinants: evidence from the Takaful insurance industry

偿付能力决定因素:来自伊斯兰教保险业的证据

作者

Jassem Alokla(萨塞克斯大学), Arief Daynes(朴次茅斯大学), Paraskevas Pagas(朴次茅斯大学),Panagiotis Tzouvanas(萨塞克斯大学)

摘要:This paper contributes to the nascent literature on Takaful by investigating the solvency determinants for Takaful firms in both the Gulf Cooperation Council (GCC) and Malaysian economies. Our main objective is to develop a deeper understanding of the solvency determinants of these firms. Using hand- collected microdata for the period 2011 to 2016 for 52 Takaful firms, we document that firm size and wakalah fees significantly decrease solvency. From a regulatory point of view, this finding underscores that the percentage of wakalah fees should be closely monitored. Moreover, we find that other explanatory variables, including return on assets and the risk retention and investment income ratios, are not significantly associated with solvency. Overall, our results remain robust to many different model specifications. Further analysis indicates significant differences between the GCC and Malaysian Takaful firms. This may be explained by the different stages of financial development in the two markets.

本文通过研究海湾合作委员会(GCC)和马来西亚经济中的Takaful(伊斯兰教在传统保险方面的替代品)公司的偿付能力决定因素,为有关伊斯兰教保险的新兴研究做出了贡献。我们的主要目标是深入了解这些公司的偿付能力决定因素。利用手动收集的 2011 年至 2016 年期间 52 家伊斯兰教保险公司的微观数据,我们发现公司规模和wakalah(代理)费用会显著降低偿付能力。从监管角度来看,这一发现强调了应密切监控wakalah费用的比例。此外,我们还发现,其他解释变量,包括资产回报率、风险自留额和投资收益比率,与偿付能力并无显著关联。总体而言,我们的结果在许多不同的模型规格下仍然是稳健的。进一步的分析表明,海湾合作委员会和马来西亚的伊斯兰教保险公司之间存在重大差异。这可能是由于两个市场的金融发展阶段不同造成的。

原文链接:

Diversification and Solvency II: the capital effect of portfolio swaps on non-life insurers

多样化与《偿付能力II》:投资组合互换对非寿险公司的资本影响

作者

Barry Sheehan(利默里克大学), Christian Humberg(利默里克大学), Darren Shannon(利默里克大学), Michael Fortmann(科隆应用科学大学),Stefan Materne(科隆应用科学大学)

摘要:Diversification plays a pivotal role under the risk-based capital regime of Solvency II. The new rules reward large and well-diversified insurance companies with relatively low capital requirements compared to those of small and specialised nature. To enhance diversification, insurance companies can adjust their strategy by engaging in mergers and acquisitions or new market entries. Alternatively, insurers can accept higher Solvency II capital requirements, displaying a competitive disadvantage and impeding future growth. This research proposes a Solvency II portfolio swap as a new diversification solution that allows small and specialised insurance companies to improve their diversification, and thus, mitigate their diversification disadvantage. The effect of such swaps is demonstrated through the use of two hypothetical insurance companies by swapping 20% of their portfolio over four different scenarios. The swap allowed for a 6% reduction in the Solvency Capital Requirement (SCR) and a maximum increase of the SCR coverage ratio of 17%. With Solvency II posited to stimulate further mergers and acquisitions within the European insurance market, this paper offers an alternative method for insurers to diversify their portfolio. Furthermore, it is suggested that the proposed alternative risk transfer method may improve insurance market competition within the EU by facilitating small and specialised insurers’ competitiveness.

在欧盟《偿付能力 II》的风险资本制度下,多样化发挥着关键作用。与规模小、专业化程度高的保险公司相比,新规则以相对较低的资本要求奖励规模大、多样化程度高的保险公司。为了加强多样化,保险公司可以通过并购或进入新市场来调整战略。或者,保险公司也可以接受较高的《偿付能力 II》资本要求,这样会在竞争中处于劣势,阻碍未来发展。本研究建议将《偿付能力 II》投资组合互换作为一种新的多样化解决方案,使小型和专业化保险公司能够提高其多样化程度,从而减轻其多样化劣势。通过使用两家假定的保险公司,在四种不同的情况下互换其投资组合的 20%,可以证明这种互换的效果。互换后,偿付能力资本要求(SCR)降低了 6%,SCR 覆盖率最高提高了 17%。由于《偿付能力 II》将刺激欧洲保险市场的进一步并购,本文为保险公司提供了另一种分散投资组合的方法。此外,本文还提出,所建议的替代风险转移方法可促进小型和专业化保险公司的竞争力,从而改善欧盟内部的保险市场竞争。

原文链接:

Investment guarantees in financial products: an analysis of consumer preferences

金融产品中的投资保证:消费者偏好分析

作者

Daliana Luca(瑞士赫尔维提亚保险集团), Hato Schmeiser (圣加仑大学), Florian Schreiber(苏黎世应用科学与艺术大学)

摘要:We analyze the preferences of 1180 German consumers for investment guarantees in financial products by means of choice-based conjoint and latent class analysis. Based on the segment-level partworth utility profiles, we then identify the most important investment guarantee features, analyze consumer demand in a realistic market setting, and test whether individual purchasing behavior can be explained by socioeconomic characteristics. Our results show that two buyer and two nonbuyer segments exist. Although their willingness to buy varies significantly, we document only a small degree of heterogeneity with respect to the individual guarantee attributes and levels. Across the sample, the guarantee period is most important, followed by the volatility of the underlying fund, and the up-front premium. Finally, we illustrate that particularly those socioeconomic characteristics with an impact on individuals’ financial situation are promising predictors of their willingness to purchase investment guarantees.

我们通过基于选择的结合分析和潜在类别分析,分析了1180位德国消费者对金融产品中的投资保证的偏好。基于分段水平的效用曲线,我们确定了最重要的投资保证特征,分析了现实市场环境中的消费者需求,并测试了个体购买行为是否可以通过社会经济特征来解释。我们的研究结果表明,存在两个购买者和两个非购买者的消费者细分群体。尽管他们的购买意愿存在显著差异,但就保证属性和水平而言,我们仅发现了较小程度的异质性。在样本中,保证期限最为重要,其次是标的基金的波动性和预付保费。最后我们指出,那些对个人财务状况产生影响的社会经济特征,最适合作为预测个体购买投资保证意愿的影响因素。

原文链接:

Factors influencing policyholders' acceptance of life settlements: a technology acceptance model

影响投保人接受保单贴现(LSs)的因素:一个技术接受模型

作者

Jorge de Andrés-Sánchez(罗维拉-维尔吉利大学), Laura González-Vila Puchades(巴塞罗那大学), Mario Arias-Oliva(马德里康普顿斯大学)

摘要:The most significant market for life settlements (LSs) is the U.S. LSs are not present in some European countries, such as Spain, and can therefore be seen as a novel and innovative financial service in those countries. This last consideration motivates this paper, which analyses the key factors, from the seller’s perspective, for the development of a secondary life insurance market through LSs in Spain. To do so, we use consumer behaviour findings from academic research on the acceptance of new technologies and services. Our analysis is based on the technology acceptance model developed by Davis (MIS Q 13:319–340, 1989) and Venkatesh et al. (MIS Q 27:425–478, 2003) and it is adjusted by means of a partial least squares-structural equation modelling. The findings show that relevant variables for the use of LSs are performance expectancy, expected easiness and social influence constructs. Ethical problems are not relevant in the decision to accept LSs.

保单贴现(LS)最重要的市场在美国。在一些欧洲国家(如西班牙),保单贴现(LS)并不存在,因此可以将其视为这些国家中的一项新颖和创新的金融服务,这就是启发进行本文研究的动机。本文从卖方的角度分析了在西班牙通过保单贴现开展二级寿险市场发展的关键因素。为此,我们利用了学术研究中关于新技术和服务接受的消费者行为的研究结果。我们的分析基于Davis(1989年)和Venkatesh等人(2003年)提出的技术接受模型,并通过偏最小二乘结构方程模型进行调整。研究结果显示,对于使用保单贴现而言,绩效预期、预期的易用性和社会影响结构是相关的变量。道德问题在接受保单贴现的决策中并不相关。

原文链接:

【注】保单贴现(life settlements),指的是保单持有人将一张正在生效的人寿保单以高于保单现金价值、低于保单保额的价格出售给第三方,满足其对现金的需求。

Crop insurance premium subsidy and irrigation water withdrawals in the western United States

农作物保险保费补贴与美国西部地区的灌溉用水量

作者

Prasenjit N. Ghosh(南印第安纳大学), Ruiqing Miao(奥本大学) ,Emir Malikov(内华达大学)

摘要:We estimate the effects of the federal crop insurance premium subsidy on freshwater withdrawals for irrigation among U.S. counties to the west of the 100th meridian. Our results indicate that a 1% increase in premium subsidy leads to a 0.446% (about 475,901 acre-feet/year) and 0.673% (about 474,026 acre-feet/year) increase in total freshwater withdrawals for irrigation and fresh surface water withdrawals for irrigation, respectively. The elasticity of total freshwater withdrawals for irrigation and fresh surface water withdrawals for irrigation with respect to revenue insurance premium subsidy is more than twice as large as those with respect to yield insurance premium subsidy. Groundwater withdrawals for irrigation are not found to be responsive to crop insurance premium subsidy. Because the elasticities are all non-negative, moral hazard should not be a dominant factor in the relationship between crop insurance subsidies and freshwater withdrawals for irrigation. Thus, exploring the causal relationship between crop insurance premium subsidy and agricultural input uses, this study underscores the unintended effect of the federal crop insurance programme on water resource sustainability in the U.S.

我们估计了联邦农作物保险保费补贴对美国西部100度经线以西县级行政区的灌溉用水量的影响。我们的研究结果表明,保费补贴的增加1%会分别导致总体灌溉用水量增加0.446%(约为475,901英亩英尺/年),和表层淡水灌溉用水量增加0.673%(约为474,026英亩英尺/年)。相比之下,总体灌溉用水量和表层淡水灌溉用水量相对于收入保险保费补贴的弹性是相对于产量保险保费补贴的两倍以上。我们没有发现农作物保险保费补贴对于地下水灌溉用水量有显著影响。由于所有弹性均为非负值,道德风险不应是农作物保险补贴与灌溉用水量之间关系的主要因素。因此,通过探索农作物保险保费补贴与农业投入使用之间的因果关系,本研究强调了美国联邦农作物保险计划对水资源可持续性的非预期影响。

原文链接:

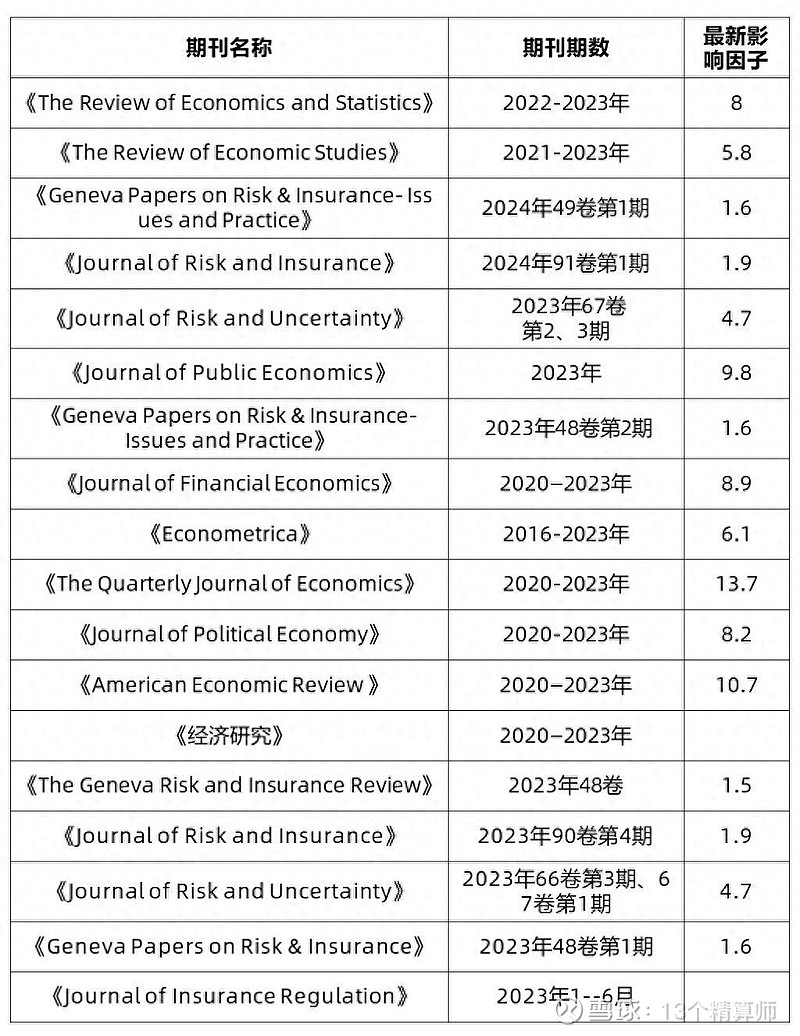

往期文章:

更多推荐文章:

《The Review of Economics and Statistics22-23年保险类精选文章目录与摘要》

《The Review of Economic Studies 2021-2023年保险精选文章目录与摘要》

《Journal of Insurance Regulation 2023年7月-2024年2月目录》

《文章推荐:影子保险---定义、发展趋势及行业影响》

《期刊Geneva Papers on Risk & Insurance 2024年49卷第1期目录》