LinkedIn | 网页链接{Sarah HENG}

Executive Summary

Digital transformation, health and fitness and ESG – Nippon Computer Dynamics Co., Ltd. (NCD) is a company that will be able to ride the waves of these trends. With a solid customer base and strong demand, NCD has a sustainable business model and steady revenue potential.

Company Overview

NCD is an Information Technology company that develops and provides systems solutions through 3 main businesses – system development, support and service and bicycle parking. For the system development business, the company builds systems such as Enterprise Resource Planning (ERP) systems and project management solutions. For the support and service business, it provides troubleshooting and system failure solutions. For its parking system business, it provides bicycle parking lot management systems. The majority of its revenue stems from its system development business at 41%.

Founded in 1967, NCD started as a software development company in Tokyo and soon in 1970 became the first company in Japan to develop software overseas. It started its support & service business in 1995 and its parking system business in 1997. It currently has 7 offices across Japan and 5 related subsidiaries.

Management

NCD has 1033 employees, and the company is organized into 3 headquarters under the company president – Management Headquarters, IT Business Headquarters and the Parking System division. Its president, Osamu Shimojo aged 65, joined the company in 1986 and had taken up various directorial posts in NCD and its subsidiaries, similarly with most of the other directors. Shimojo owns 258,400 of NCD’s shares or about 3%. Since 2018, the company has introduced a performance-based stock compensation plan that aims to incentivise directors to increase corporate value.

The table below demonstrates their well-rounded expertise in various fields, as well as the company’s rigorous directorial selection process. In addition, many of the directors are external, and are more likely to provide unbiased opinions.

Business model:

System Development Business

This involves conducting outsourced system integration, from the planning to management of mission-critical systems. Quality is cultivated through its proprietary standards - the system development process standard “NS-SD” and project management standard “NS-PM” for projects. NS-SD involves defining the activities and deliverables in all processes of development and selecting the relevant deliverables according to the development scale. NS-PM involves defining a management process for the execution of the project as defined in NS-SD.

It targets mainly medium sized and major corporate groups and has worked with many products for the international market. For instance, task management tools for Salesforce as well as China’s number 1 management, ERP and financial accounting software, the Yoyu U8, in terms of packaged software market share.

Support & Service Business

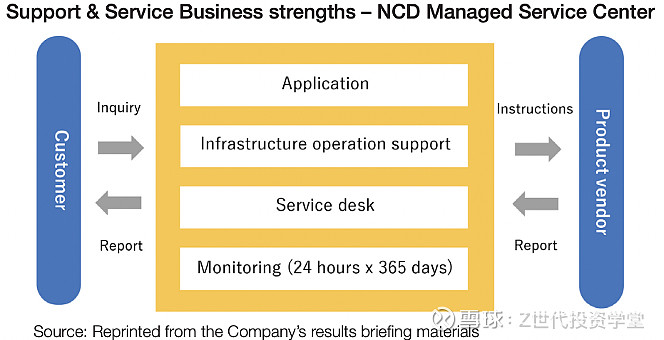

NCD helps companies support a wide range of customers’ IT operations. This includes construction of IT infrastructure, operational services in terms of helping maintain the infrastructure and lastly troubleshooting support.

NCD has successfully constructed a migration service for tech giant Amazon’s Amazon Web Services (AWS) with one-stop support for customers. It also provides support for customers implementing Microsoft Azure, a cloud computing platform, throughout the process. Support is available for customers 24 hours a day, the entire year.

Parking System Business

With its unique IT technology and consulting skills it has accumulated over the past 26 years, NCD promotes automation and labour-saving in bicycle parking lot operations. It caters to a wide range of customers including local governments, commercial facilities and railway operators.

Key products include “EcoStation21” an hourly rental bicycle parking system that utilises electromagnetic locks and a remote management system. It is equipped with functions such as real-time availability information and various payment methods. “ECOPOOL” is a monthly parking lot management system involving online customer registration that takes less than a couple of minutes.

NCD has successfully collaborated with the government and public companies. It was selected to be the designated manager of parking lots in multiple wards around Japan, such as at the busy Shibuya Station and for the entire western Shinjuku. It also assisted Nomura Real Estate Development with parking lot designs for over 1200 bicycles.

Industry Overview

Systems Development Services

With high competitive pressure and new regulatory standards such as the GDPR, companies are increasingly pressured to transform. The digital transformation market is expected to grow at a CAGR of about 19% from 2021 to 2026. Expenditure on digital transformation is expected to increase steadily and global investment in digital transformation is expected to almost double from 2022 to 2025.

Mid to large-sized companies are largely responsible for the increasing adoption of popular ERP software in the US, aligning with NCD’s target customer base. Additionally, these software are largely complex and would require much assistance to implement, involving technical experts and consulting services. NCD is well poised to leverage onto the abovementioned trends.

Digital Transformation Tools

The project management software market is expected to grow at a CAGR of 10.77% from 2022 to 2030, and its services market is expected to grow at a CAGR of 16.5% from 2020 to 2030. Companies are utilising these software to increase productivity, save expenses and encourage employee cooperation.

The ERP market size is expected to grow at a CAGR of 9.76% from 2023 to 2028. ERP software is being adopted increasingly as the number of businesses worldwide increases and the adoption of innovative technologies that require ERP software increases. ERP systems provide integrated applications that improve productivity, optimise workflows and improve customer service.

Business Support Services

The market size for business support services is expected to grow at a CAGR of 8.1% from 2022 to 2027. With increasing use of digital technology and online platforms, there would be higher demand for customer support services. The outsourcing of support services would allow companies that lack the relevant expertise deliver high-quality customer services. This is especially crucial with the sudden shift to online services due to the COVID-19 pandemic.

Nevertheless, outsourcing technical support might compromise the quality of the support due to a lack of depth of understanding about the company’s products. As such, there is a small risk of companies shifting away from outsourcing in the long-term.

Cycling and Bicycle Parking

Increasing awareness of environmental issues and a growing emphasis on health and fitness have facilitated the increase in cycling as a form of commute. Around the world, governments are also encouraging cycling through urban planning, such as through the creation of dedicated bike lanes and bike parking infrastructure. The Cycling Embassy of Japan is devoted to improving bike infrastructure, in light of the challenge of many bikes clustered around metro stations.

In Japan, the number of cyclists had surged amidst the COVID-19 pandemic and boosted demand for bicycle parking lots. In addition, the easing of COVID-19 restrictions on activities would facilitate higher bicycle usage. Another key trend is the increasing adoption of smart parking solutions, which utilize advanced technologies including sensors and real-time monitoring, improving the user experience.

Revenue Drivers

NCD’s revenue drivers stem from its three main business segments: System Development Business, Support and Service Business and Parking System Business.

As seen in the graph below, the Support and Service Business demonstrates the strongest growth rate, at a CAGR of 12% from FY3/20 to FY3/23 (annualised). The System Development Business nevertheless remains the largest revenue earner.

Sales of the System Development Business increased due to it acquiring new system development projects for insurance companies.

Sales of the Support and Service Business increased due to the expansion of business domain for a work outsourcing project, and new cloud-related projects. It also gained orders for services for leading energy companies.

The Parking System Business’ revenue is highly impacted by bicycle parking lot usage fee income. This is generated mostly from self-operated bicycle parking lots which had increased sales of 110.8% YoY, followed by designated management with 6.0% and lastly consignments with 7.1%.

Cost drivers

The company mentions their IT related business incurring personnel expenses and other upfront investments, including the impact of a change in method of calculating the reserve for bonuses.

The Support and Service Business also incurs significant costs from large new consignments such as replacement consignments.

The Parking System Business incurs costs from management and operation as well.

SG&A expenses increased 16% YoY because of human capital investment and digital transformation related investments.

Valuation

Discounted Cash Flow

Revenue was projected to be driven by the 3 main businesses as mentioned, which make up about 98% of NCD’s total revenue.

Revenue growth for the System Development Business was projected with reference to the CAGR of the project management services market and the company’s projected growth rate for the business of 2.3%.

Revenue growth for the Support and Service Business was projected with reference to CAGR of the business support services market and the company’s project growth rate for the business of 2.3%.

Revenue growth for the Parking System Business was projected with reference to the company’s projected growth rate for the business of 2.1% The market demand is nevertheless expected to remain steady and follow historical trends, as the government provides continued support for the business. In addition, the impact of COVID-19 causing a 24.4% dip in sales from 2020 to 2021 was excluded, in light of the easing restrictions on activities and work-from-home arrangements.

By computing a weighted average growth rate with the 3 main revenue drivers, a 7.9% annual growth in revenue was obtained.

With a WACC of 3.1% derived from the relevant inputs from various online sources, a 5-year target price of ¥2,886.18 is obtained. This is a 122% 5-year upside from NCD’s current trading price of ¥1300.

Competitor Analysis

Threat of New Entrants: Medium

There is a medium threat of new entrants. Entering the IT services industry requires significant technical know-how, as well as solid connections for a sustainable customer base.

They require time to build up for the company to establish itself as a reliable service provider. Nevertheless, only a relatively low level of upfront capital is required for potential entrants to enter the industry.

For the bicycle parking systems industry, significant upfront capital investment is required for R&D and the manufacturing of the parking systems. There are also significant barriers to entry in terms of regulatory and bureaucratic barriers.

Bargaining Power of Suppliers: Medium

There are few suppliers NCD relies on for the provision of IT services, being a developer of such services itself. Suppliers of other IT services NCD provides to its customers are also among many other potential suppliers in the industry. As such it would be in the suppliers’ best interests to continue working with NCD to allow more customers to implement their services.

For the bicycle parking systems industry, suppliers would include raw material providers such as iron and steel companies and manufacturers. Due to the personalized nature of NCD’s bicycle management systems, there might be complex equipment to be manufactured, providing suppliers with some bargaining power.

Bargaining Power of Buyers: Low

Demand for digital transformation is high and customers have to adapt quickly in transforming their businesses to continue remaining competitive, requiring the aid of IT services to quickly do so. Nevertheless, most buyers are either medium or large companies with the financial ability to be able to switch between suppliers, or even invest in developing their own technical know-how.

For bicycle parking systems, users of the systems have low bargaining power as they would be limited by the need for convenience in terms of parking at convenient spots only. Additionally, the costs of using bicycles are already significantly less than that of car usage, rendering customers less sensitive to bicycle parking prices. Governments would also largely mandate how the parking systems turn out.

Threat of Substitutes: Low

There are relatively many available substitutes in the industry even in Japan alone, where there are many similar outsourcing companies such as XNET Corporation, Densan Co. Ltd and Cyberlinks CO. Nevertheless, NCD has is a pioneer in the industry and has managed to form many strong long-term connections, including with major blue-chip companies. With its deep expertise and close collaborations with companies, it is unlikely they would switch to other service providers.

Internal Competition: High

There are many similar competitors in the market, and market share is shared with many companies. There are hence challenges in terms of differentiating their services provided. With the expansion in IT investment, there might be an increasing number of similar companies, intensifying competition as well.

In Japan, there are also numerous bicycle parking systems by various companies. For instance, the market leader GIKEN which is known for their Eco-Cycle underground parking system, and JFE Engineering Corporation which offers multi-level automated bicycle parking facilities. Nevertheless, the government does allocate areas for various companies to take charge of, helping regulate competition.

Investment Theses

Well positioned to leverage onto companies’ digital transformation.

Organisations are increasingly turning to technology to improve productivity and efficiency. With the digital transformation market expected to grow at a CAGR of about 19% from 2021 to 2026, there is strong demand for NCD to leverage on to.

With its extensive implementation track record for a variety of software, NCD has the expertise, accumulated over decades, to become a leading and reliable IT service provider. Providing for a variety of personalised customer needs has also allowed NCD to cultivate breadth of knowledge. Being further down the experience and learning curves, it will be able to value-add to customers at a lower cost than many other competitors.

There is also strong support from the local government in terms of the multiple projects NCD gets assigned to. As such, NCD has successfully stepped past the bureaucratic barriers and possesses an edge over other potential competitors in terms of having access to a wider market.

Solid customer base

NCD has cultivated a solid customer base with leading blue-chip companies, that would provide it with a sustainable source of revenue. As per the table below, many of its transactions have taken place since decades ago and continue till today, a competitive edge it has over other companies, especially since these connections would require significant time to build up.

NCD hence proves its ability to force strong and long-term connections with critical customers. It has even successfully worked with the local government as mentioned, and with various other organisations. Looking ahead, NCD is assured of a sustainable source of customers and revenue.

Positive trends in bicycle usage

In Japan, there is robust demand for bicycle usage. Bicycle sales in Japan remain relatively strong over the years, albeit at a declining rate. In 2022, about 1.5 million bicycles were sold in Japan. There also has been increasing importance placed onto health and fitness.

In addition the easing of COVID-19 restrictions from the downgrading of the legal status of COVID-19 to the same category as common infectious diseases in May 2023 will facilitate increased bicycle usage and hence demand for its parking systems.

ESG

NCD shows relatively strong commitment to ESG initiatives. In October 2021, it established the Sustainability Promotion Committee. As illustrated below, the company has successfully identified the relevant SDGs to tackle and has taken measures to do so.

Environmental: The company advocates contributing to realising carbon neutrality. Its Parking System Business contributes to the reduction of carbon dioxide emissions through the increased utilisation of bicycles as transportation. Its promotion of digital transformation also facilitates digitalisation including going paperless. NCD is also environmentally conscious and goes paperless, uses forest-certified paper and collects eco-caps. Nevertheless, there seems to be a lack of quantification of environmental impact attained.

Social: The company performs well on social issues, and has put in place a comprehensive human resources strategy and targets to work on issues including diversity and inclusion and improvement of workplace environment. It had acquired gold authorisation with their approach to health and productivity management in September 2021. Additionally, it is also highly transparent about their performance regarding diversity and inclusion, and publishes the metrics such as ‘Percentage of female employees”, “Gender wage gap” and “Percentage of male employees taking childcare leave” in an Fact Book.

Governance: The company has put in place targets to improve the gender ratio of its leaders. For instance, targeting to reach 25% female managers in 2031, from 10.5% in 2022. While there is currently no female representation on its board of directors, it targets to have at least 2 in 2031. It also utilises a directors’ skill matrix and electronic voting platform, demonstrating a rigourous leadership selection process. It also has various committees committed to ensuring the sound corporate governance of the company, such as a compliance committee and risk management committee.

In all, NCD shows dedication towards ESG initiatives.

Risks and Mitigation

As the digital landscape experiences rapid changes, NCD risks obsolescence over time if it is unable to stay ahead of the trends. Digital transformation strategies are constantly evolving and companies are hence always on the lookout for better solutions. In ERP for instance, its future is to be characterized by continuous innovation and adaptation to meet the ever-changing needs of businesses, facilitated by emerging technologies such as artificial intelligence and machine learning. The company nevertheless aims to become a total solution provider and plans for significant R&D investment of ¥600 million from 2024 to 2026.

There are also data protection risks involved, especially for its bicycle parking business solution ECOPOOL where personal information is handled. For instance, data leakage and cybersecurity attacks on the cloud. As such, the company conducts training sessions for all parking lot staff to help them fully understand the Personal Information Protection Act before engaging in work.

Another risk is damage of infrastructure due to weather or natural disasters. Japan is especially earthquake prone and there might be damages caused by an earthquake to the bicycle racks. Nevertheless, the systems have a disaster-resistant operation system that would be able to continue providing services to users, minimizing financial losses.

Conclusion

In conclusion, Nippon Computer Dynamics Co Ltd is a strong buy, having demonstrated a sustainable business model and good competitive positioning. It also performs well on ESG measures with especially good corporate governance that will be able to take the company far. Trends such as digital transformation and an increasing emphasis on health and the reduction of carbon emissions will further drive NCD forward.

References:

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接