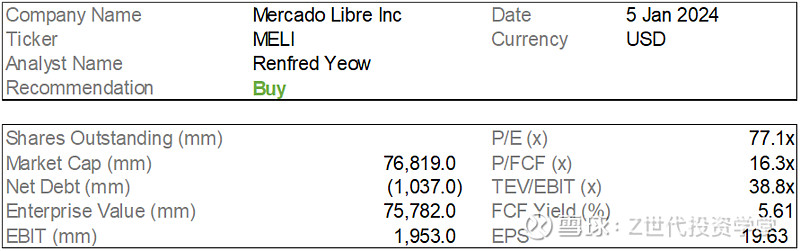

I initiate coverage on Mercado Libre (MELI) with a buy recommendation; price target of USD 1,671(10% upside) based on a 5-year investment horizon. I take a positive view on MELI as an underappreciated high growth stock, with strong business fundamentals and growth potential.

Investment Theses:

(1) Investments in the MELI+ program creates strong customer loyalty that

complements MELI suit of products’ flywheel effect, allowing MELI to sustain high

topline growth

(2) MELI’s extensive logistic network and continued expansion efforts allow MELI to

increase last mile fulfilment capacity while achieving cost-efficiency via economies of

scale

(3) MercadoPago – MercadoPago is an under-appreciated growth driver of MELI and is

well positioned to be LATAM’s comprehensive, everyday financial services solution

given its first mover advantage.

(1) MELI’s ability to beat quarterly earnings amidst macro fears will push prices up.

(2) Further growth in MELI’s fintech arm given their heavy investment into the area

will push prices up.

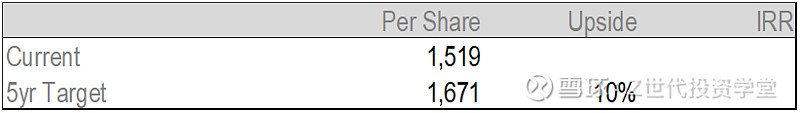

Company Overview

A leading Latin American (LATAM) E-commerce Platform

MercadoLibre (MELI) was founded in 1999 with e-commerce operations in Argentina

and rapidly expanded to 18 other LATAM countries, including Brazil, Mexico, Colombia,

Chile, Venezuela and Peru. The company can be divided into two large segments; (1)

MercadoLibre(E-commerce), which makes up 57% of total revenue, and (2)

MercadoPago(Fintech), which started as a value-added service to its marketplace and

gained substantial stand-alone significance in recent years, making up 43% of total

revenue.

Meli has built a trusted, agile, and people-centric ecosystem For over 20 years, Meli has been using technology to democratize commerce and money in Latin America (LATAM), generating profound transformation for their 100+ million unique active user.

Meli’s ecosystem

Business Model

MELI is a market leader in the LATAM e-commerce industry

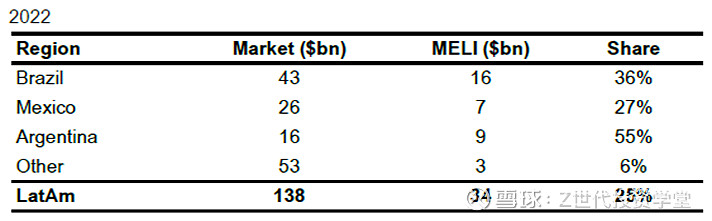

Commerce: MELI is a market leader in the LATAM e-commerce market with 25% share

in the $138bn GMV 2022.

Payments: MELI provides support to third-party online and offline merchants. This

segment can be further broken down into two groups: (1) Acquiring (68%) where it

offers online and offline payments with credit and debit cards as well as QR code

payments, and (2) Digital Accounts (32%); comprise wallet payments, P2P transfers,

and prepaid cards.

Credit: MELI’s credit portfolio has been growing at a very fast pace and reached $4.4bn

in 2Q23, up 7% q/q. The highest component is consumer credit (%1.8bn), followed by

credit cards ($748m), credit to marketplace sellers ($429m), and finally, credit to mPOS

merchants ($278m).

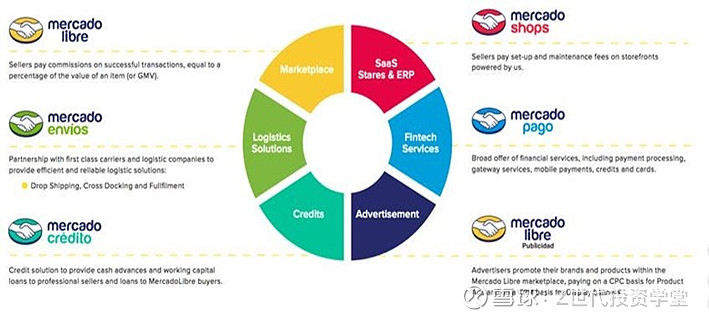

E-Commerce Marketplace (Mercado Libre):

The main revenue source for Libre is a final value fee paid by sellers when items are

sold. MELI’s final value fees depend on the type of listing chosen by the seller, which

can be free, classic or premium.

Mercado Pago (Fintech)

Mercado Pago is a FinTech arm of Mercado Libre. This arm of MELI has been growing,

and this allows MELI to control/oversee the transactions that flow through the platform,

providing MELI with data insights into how much sales the merchants are making, and

their credit repayment abilities.

These are critical data that most incumbents (i.e. traditional banks) lacked in the first

place to provide credit to these SMEs. Furthermore, MercadoLibre has access to

merchants living in rural areas where traditional banks could not as they are bound by

its inability to scale by building out physical branches (due to huge CAPEX).

MercadoPago Product Offerings:

(1) Digital Wallet: Enables users to store their money in a virtual wallet and have

access to Mercado Pago’s services such as making payments via QR codes,

paying bills, money transfers, access to credits/loans.

(2) Mercado Credito: It seeks financing from investment banks such as Citibank and

Goldman Sachs and loans those capital out to merchants in return for higher

rates. For Mercado Pago, the cost of financing is incredibly low compared to the

interest they charge. The risk lies in how they can properly manage

non-performing loans.(3) Buy Now Pay Later (BNPL): It makes purchases more affordable for consumer.

This drives transaction volume, revenue and profit (cost of financing low, while

cost of interest payments charged by Mercado Pago is bore by Merchants).

(4) Mobile PoS/Qr code: For offline merchants to accept digital payment. The

underlying goal is to offer loands to tier-1 merchants i.e. McDonald’s through

Mercado Credito.

(5) Mercado Fondo: A mutual fund platform to encourage user invest their money.

MELI worked with banks to manage customers’ fund and receive a fee for

interest customers earned.

Superior Flywheel Effect Drives Adoption

Altogether, the synergy between Pago and Libre creates a superior flywheel effect,

driving adoption on both sides. For instance, more customers transacting using

Mercado Pago entices more merchants to adopt Mercado Libre and vice versa.

Key Financials and Metrics

Key Financials

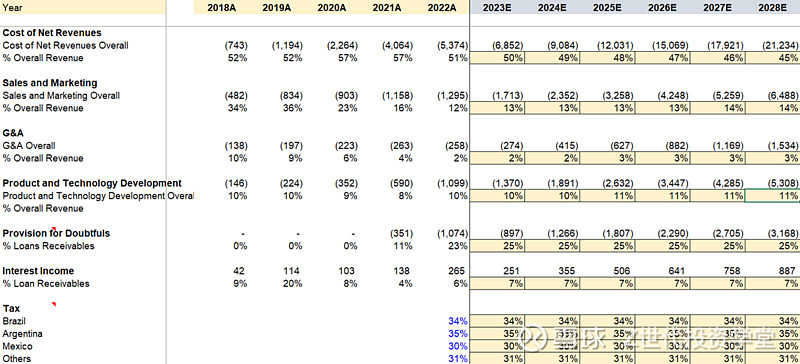

The company has experienced significant growth in revenue as well as EBITDA

margins over the past 4 years. Gross margins have stabilized within 51-57% range that

is largely attributed to the strength of e-commerce revenue growth, expansion efforts in

the profitable credit segment as well as considerably low operating costs.

Management Focus

MELI’s cost structure has changed significantly overtime, given its introduction of new

features and services. In the more recent years, there are 2 identified phases:

(1) Reinvestment in growth (2019-2021) where management indicated its intent to

reinvest most of the margin into growth while not incurring losses

(2) Focus on cost efficiencies (2022 onwards) where MELI started to focus more on

lowering costs and scale benefits of larger markets.

Balance Sheet

As of 2Q23, MELI reported cash & cash equivalents of $6.8bn and $4.7bn of gross

debt, $1.3bn.Management Overview

Chief Executive Officer (CEO) – Marcos Galperin

MELI is founder led – MercadoLibre is run by its co-founder, Marcos Galperin who has

been the CEO since inception.

Chief Financial and Legal Officer (CFO) – Martin de los Santos

Appointed CFO in August 2023. Before that he was Senior VP of Credit.

President of Commerce – Ariel Szarfsztejn

Appointed in 2021. Before that he was VP of Logistics & Supply Chain.

President of Fintech – Osvaldo Gimenez

Appointed since 020. Before that was CEO of Mercado Pago and Head of Mercado

Libre in Argentina.

Chief Operating Officer (COO) – Daniel Rabinovich

Appointed in 2021. Previously served as CTO.

Industry Outlook - E-commerce

LATAM is a blue ocean market for e-commerce

Latin America harbors more than 300m digital buyers, a figure forecasted to grow by

more than 20% by 2027. Although e-commerce adoption in this part of the world is still

lower than in other regions, online retail sales in LATAM was estimated at $168bn and

set to account for almost 20% of total retail by 2026.

The Mercado Libre Hegemony

Mercado Libre has played a leading role in the development of the sector in LATAM,

with a 25% share in the LATAM e-commerce market. MELI is highly dominant in

Argentina, with 55% share, followed by leading stakes in Brazil (36%) and Mexico

(27%). Although the third-party sales giant maintains a growing influence, many

competitors such as The Chilean group Falabella which have upped their digital game

by acquiring online shopping portal Linio in 2018, still, no local competitor has been able

to near the revenues generated by Mercado Libre.

E-commerce penetration in LATAM to grow further In terms of penetration, it is noted that GMV generated by e-commerce in LATAM represented 12.3% of total retail sales, which is estimated to amount to $1.1tn in 2022. This places LATAM as the second least penetrated region, ahead of only Africa and Middle East. The LATAM e-commerce market is forecasted to grow to ~$200bn by 2025. With the global average of 19.7%, I believe MELI’s operations are placed in a region with significant growth potential in the mid to long term as e-commerce penetration is projected to increase as retail activity picks up post interest rates hikes and country economic development.

Industry Outlook - Fintech

Large Unbanked Populations and Instant Payments Leading the Way

In 2022, the LATAM payments market saw a transaction volume of $2.7tr, as reported

by FIS’s Worldpay study. Notably, 32% of this volume occurred in Brazil, and 23% in

Mexico. Despite this, LATAM has a history of large unbanked populations due to low

incomes, lack of trust in FIs and limited access to banking, especially in rural areas. As

a result, 70% of LATAM’s population remain unbanked and 58% of point-of-sale

purchases are still made in cash a figure considerably higher than the 10% observed in

the US.

This highlights an opportunity for the payments industry in the region. Throughout

LATAM, the adoption of instant money transfer is driving financial inclusion, cutting

costs, and fostering digital commerce. A recent annual study on the region project

growth rates of over 40% for instant bank transfers and 20% for digital payments

annually, extending through 2026.

E-commerce and Digital Wallets Growth Accelerating due to Improving Regulatory and

Structural Landscape

Amidst the burgeoning e-commerce landscape in LATAM, digital wallets are anticipated

to consistently constitute a 10% share of all online transactions in the coming years.Key players in this domain include Mercado Pago, PicPay, and Nequi. The expansion of

digital payment is driven by authorities recognizing the potential of Fintech to drive

economic growth, and impact of Covid-19 pandemic. Internet penetration rates have

thus been inmproving steadily and reached an all-time high of 70%, 66%. And 74% for

Brazil, Argentina and Mexico respectively. Regionally, digital penetration has reached

78% in LATAM.

Mercado Pago, at the Forefront of Fintech in Latin America

Mercado Pago, positioned as a front runner in LATAM fintech, gained an early mover

advantage in pivotal markets such as Argentina, Brazil, Chile, Colombia and Mexico.

Pago is expected to gain the most market share in the second quarter of this year

through its integrated offerings which allows it to stand out in a highly competitive

market with tight margins.

Competitive Positioning

MELI is the largest e-commerce player in LATAM, present in 18 countries with an

aggregate market share of 25% in the region. In addition, their credit business in 1Q22

versus a select peer group of Neobanks and retail financing arms have average yield

over gross loans with a focus on consumer credit, explaining higher Non-Performing

Loans (NPLs) vs Neobanks but similar NPLs with Neobanks

Value Proposition

Vertical integration - MELI+ provides a full customer experience that can retain both

customers and merchants, integrating both their Fintech's payment business as well as

High Levels of Trust - Trust in ecommerce remains low in Brazil compared to developing

countries. MELI+ was first to provide a reliable escrow payment service and continues

to expand their fintech business mainly from consumer credit. (an anomaly the LATAM

market)

Porter Five Forces(Ecommerce)

Bargaining Power of Suppliers (Low)

Suppliers of products of both the 1P and 3P business model of MELI are mainly

individual sellers, small businesses and medium-sized retailers based in South America.

They are heavily dependent upon ecommerce platforms given that they depend on

these sites as distribution channels to penetrate markets rapidly. There are large

number of suppliers on these platforms and in general suppliers are not sufficiently

large to be considered critical to ecommerce sites. Hence the bargaining power ofsuppliers in the ecommerce industry are low as they are highly dependent on

ecommerce sites for their revenue.

Bargaining Power of Buyers (High)

There are a variety of types of buyers of products on ecommerce platforms including

small business, individual consumers. Switching cost for the buyers are relatively low

given competitors often sell the similar products (e.g Magazine Luiza, Lojas Americans,

VIA).

Threat of New Entrants (Low)

Threat of new entrants of ecommerce is low due to high barriers to entry driven by

economies of scales of existing incumbents. In addition, incumbents have built an

efficient logistic and supply chain management system which is critical in LATAM

ecommerce. New entrants either lack financial muscle to match the capital expenditure

or expertise in the LATAM market required to build an efficient logistics network.

Threat of Substitute Products (Low)

Threat of substitute products are mainly in the form of businesses with solely a

brick-and-mortar presence. This threat is low with a greater shift in demand towards

ecommerce or omni hardline-online business models

Competitive Rivalry (High)

Main players are Magazine Luiza, Lojas Americanas, Amazon, Shopee. Competition is

intense in the ecommerce market due to the financial power of existing players in the

market. They also provide similar services and have a sizeable market share.

Porter Five Forces(Fintech - Credit/Payment)

Bargaining Power of Buyers (Payment-Low,Credit-Moderate)

Bargaining power of consumers in the credit business in LATAM is moderate. Because

while consumer credit has high delinquency rate, there are several competitors

targeting the consumer credit business. Bargaining power of users of fintech payment

users are low as they rely on the convenience of in-application payment modes on

ecommerce sites for convenience thus their less price sensitive

Threat of New Entrants (Payments & Credit - Low)

Threat of New Entrants in the consumer business is low due to the high barriers to

entry. Due to high delinquency rates of consumer credit in LATAM as well as the nature

of the credit business, new entrants need to have healthy and substantial cashflow or

credit. In addition, the credit business involves new players to navigate various complex

regulatory environments .The payments business is also one that has high barriers toentry due to required synergies with existing business that has an existing sizeable

active user base as well as established trust.

Competitive Rivalry (Payments – Low)

In the consumer credit business in Latin America is considered highly underpenetrated

relative to developed economies. This is because incumbent bank still focus on more

affluent segments in the economy. In addition, the LATAM payment still has room to

grow given high percentage of cash transactions. Implying lower expected competition

in the future

Threat of Substitute Products - (Payments & Credit - Low)

In the Payments business, substitute products include other forms of traditional

payment methods such as credit cards or debit cards issues from banks or cash in

general. The threat of such substitutes remains moderate as there is no close

substitutes that provide for similar services being layered on E-commerce and offline

retail payments.

Investment Thesis

1) Strong customer loyalty coupled with flywheel effect allows MELI to sustain high

topline growth

Strong customer loyalty program (MELI+) drives MELI’s MAU’s growth by luring

customer into MELI’s sticky echo chamber of growth

MELI+ (MercadoLibre’s loyalty program) creates customer stickiness by enhancing

MELI’s loyalty value proposition in consumers’ daily life – that ranges from credit card

spending to entertainment/Lifestyle needs. MELI+ requires users to constantly engage

in MELI’s ecosystem of services that ranges from online shopping to payment needs.

This creates customer stickiness as it positions MELI as consumers’ one-stop shop for

their retail needs with MELI’s omnipresence in their daily life.

To grow MELI’s customer base, MELI+ has been aggressively adding compelling

shipping benefits, MELI+ marketing efforts, and giving users access to world class

content bundle. For instance, MELI+ gives users access to a world class content bundle

which includes Disney+ and Star+, special discounts to subscribe to HBO Max,

Paramount+ and Lionsgate+, and free shipping above 29 reais, as well as free music

from Deezer.

MELI+ helps MELI maintain its position as the market leader in the ecommerce

industry – creating a high barrier to entry for entrants such as Amazon and

Shopee in the region.

With the high growth in LATAM’s internet penetration rate, and revenue in the

e-commerce is projected the reach 68B by 2025 – an expected CAGR of 9%,e-commerce giants such as Amazon, Shopee, and Americanas have attempted to steal

a share of the pie from MELI. However, their MAU and GMV remains low, with Shopee

ceasing operations in late 2022. While Amazon attempts to expand its user base

through incentives such as the entertainment shows/sport scenes, these measures

have been proven to be of little threat to MELI. MELI remains consumers’ preferred

e-commerce platform given the high customer stickiness and retention rate – justified by

high MAU and GMV.

LATAM’s consumer market remains fragmented, and MELI is best positioned to

continue consolidating the market.

E-commerce sales only accounted for 3.1% of total retail sales in LATAM with reasons

such as the lack of banking infrastructure, lack of access to credit, and a mistrust in

financial institutions as the main drivers. Hence, the existing network effect that MELI

has – large amount of MELI merchants running bank accounts within the platform

coupled with the strong customer loyalty developed through MELI+, position MELI as

continued market leader in the LATAM’s e-commerce space

2) MELI’s extensive logistic network and continued expansion efforts allow MELI to

increase last mile fulfilment capacity while achieving cost-efficiency through

economies of scale

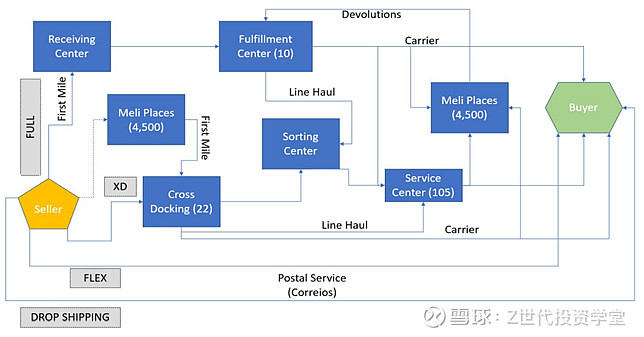

MELI has 3 logistical offerings under Mercado Envios – Drop-shipping,

Cross-docking, and Fulfillment as well as Mercado Envios Flex, where sellers are

able to integrate their own or third-party delivery services.

Mercado Libre Logistic Network(Brazil)

Expansion in fulfillment leads to an improvement in delivery time for MELI and a

record level of penetration of shipments

In Q3’23, MELI opened their first regional fulfillment center in Rio de Janeiro, which able

them to increase same-day shipping promise in Brazil’s second larges ecommerce

market, with another facility that will be open next year in Sao Paulo, accompanied by a

few more fulfillment centers in Mexico to ensure that capacity is growing in tandem with

growth.

On-time deliver hit record levels in Brazil, Mexico, Chile and Colombia which is a

testament to MELI’s successful investment in their logistic networks. As of 2Q23, ~80%

of shipments were delivered in up to 48 hours, and ~56% were delivered between the

same and next day. In Brazil specifically, fulfillment is covering 90% of the population

with one-day delivered. Record level penetration of 48% shipments (up from 40% in

Q3’22) were also seen, with sellers’ NPS for fulfillment reaching a record high.

CAPEX investment continues; reaching inflexion point for MELI to realize its

economies of scale (cost saving)

Q3’23 saw broadly stable net shipping costs as a percentage of GMV vs Q2’23. This is

also reflected in the stabilizing cost per item as shipping revenue per item steadily

increases. This could signal the start MELI’s ability to reap the economies of scale in

terms of cost saving.

3) MercadoPago – under-appreciated growth driver of MELI; Pago aims to be

LATAM’s comprehensive, everyday financial services solution

MELI’s credit portfolio has been growing at a very fast pace, leveraging on trends

such as increasing internet penetration in LATAM where majority remain

unbanked

The LATAM payment still had a relevant 29% of total transaction being settled in cash

(vs 10% in US), suggesting an opportunity for the payment industry. MELI produced

TPV of $234bn in 2022, commanding a 4.6% share of payments in LATAM and is well

positioned to capture a larger market share and benefit from LATAM’s transition into a

more digitalized economy.

MELI’s credit portfolio concentrates on consumers, and have a higher revenue

yield versus peers

MELI’s credit portfolio has been growing at a very fast face – 7% q/q (2Q23). Within

consumer credit, more than half is currently used on buy-now-pay-later (JPM insights),

with mostly used within MELI’s marketplace. However, personal loans have beengrowing, and is expected to surpass 50% as MELI increases its customer acquisition

efforts.

Cross-selling of credit products - recent launch of MercadoPago credit card for

merchants, helps to strengthen the suite of credit products available to

merchants

MELI continues to offer larger and longer loans to business owners/users as part of

their strategy to increase user engagement with their credit products and enjoy the

positive knock-on impact on MELI’s ecosystem. Such initiatives have seen to continue

to drive platform TPV, with high NPS and TPV as a testament to users’ satisfaction and

MercadoPago’s continued success and sustainable high growth rates.

MercadoPago is able to grow profitability through a stable credit portfolio with

appropriate risk mitigation in place to ensure NPL/Past Due remains low

When looking at provision coverage, Mercado Credito’s 90-day NPL is well covered (at

200% covered to Renner, 100% and Marisa/MGLU at c. 150%).

Coverage over 90d NPLs has been decreasing for MELI since 1Q22 (from 198% to

137% in 2Q23), driven by the higher focus on lower risk cohorts in credit origination.

The fall in >90 days past due, also highlights MELI’s ability to leverage platform data to

improve credit models and increasing origination.

Financial Analysis

Revenue by Segment

Between 2018 and 2022, both the Fintech and Commerce segments have been

generating higher revenue y-o-y. The Fintech segment has also rose to compare

reasonably with the Commerce segment, taking up 44.88% of the total revenue in 2022.

Revenue by Geography

Brazil leads the company in growth, followed by Argentina and finally Mexico. Other

countries include markets ike Chile and Columbia. Over the years, all geographical

markets have achieved higher revenue y-o-y which is a healthy signal for MELI.

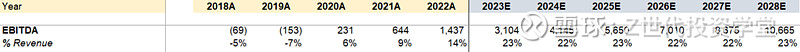

Progressive growth and EBIT margin expansion

Emerging stronger from the covid pandemic, MELI’s EBIT continued to demonstrate

growth and margin expansion, with a 22.9% increase q-o-q and 131.3% increase y-o-y

based off Q3’23 figures. Such positive result was due to the robust revenue growth and

lower costs(dilution of expenses especially in the G&A category).

No short-term liquidity issue in sight

Current ratio and quick ratio are in a healthy range with current ratio consistently above

1.0x albeit quick ratio dipping to 0.7x in FY2022. The ratios indicate MELI’s ability to

meet its short-term obligations.Cash conversion cycle

Factoring in the business segments MELI operates in, MELI’s cash conversion cycle

has been consistently negative which is desirable. This indicates that the business can

generate more cash from its sales than what it spends on purchasing new inventories

and paying its expenses.

Gaining traction for profitability

Due to MELI’s unique premium positioning with value-added services, MELI is seeing

success and growth in profitability across ROE, ROA and ROC over the past 3 financial

years and this will remain consistent moving forward.

Valuation - DCF Assumptions

WACC: MELI’s capital structure mainly comprises debt, equity, and leases. Due to lack

of disclosure on specific interest rates, I opted for a blended average of effective interest

rate and interest coverage approximated by a synthetic rating. Cost of equity used

4.67% (US 10Y) and 5.5% ERP from US with a revenue weighted country premium to

give ~16%.

Terminal Growth Rate: A terminal rate of nominal 4% was chosen to reflect a

persistent growth for MELI. Given that MELI operates in LATAM and has huge revenue

exposure to Brazil specifically, I factored in Brazil’s average GDP growth rate at 3-4%

and given that MELI’s growth story is largely driven by the underlying macro backdrop, I

believe that 4% is a fair terminal growth rate to use for MELI

Exit Multiple: I utilized the 75th percentile EV/Gross profit multiple of 8.5 to reflect the

competitive advantage that MELI has, justifying a premium to their valuation. This

multiple was also chosen as it was the least volatile amongst all the comparable

companies chosen for relative valuation, indicating reliability for future operations.

Revenue assumptions

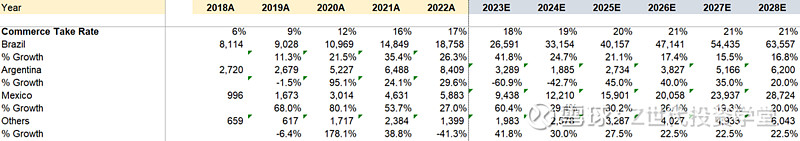

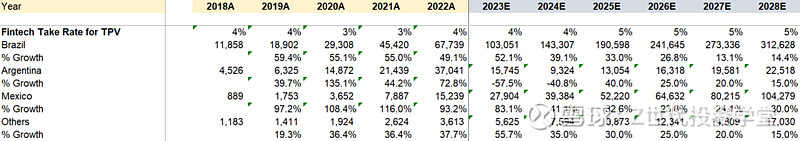

MELI’s main revenue streams come from their commerce and fintech segments, from 4

different regions (Brazil, Argentina, Mexico, and Others (Chile, Colombia, Uruguay). In

FY2022, Brazil comprised 54% of total revenue, Argentina comprised 24%, Mexico

comprised 18%, and Others comprised 5%. At the same time, Fintech revenue

comprised 45% of total revenue, while Ecommerce revenue comprised the remaining

55%. (Due to the lack of financial information, I forecast revenues using a top-down

approach and approximate GMV and TPV per region instead of customers per region;

as such, revenue in USD = GMV/TPV * take rate). Below is an overview of the revenue,

with take rate and GMV forecasts being more detailed as per the model.

Ecommerce is still on the rise in LATAM, which would provide a broad-based tide to lift all boats within the sea. To reflect MELI’s strong lead on all regions of the markets, I projected more aggressive growth into 2023 – 2025, and tapering off from 2026 onwards due to increasing competition within the landscape. Argentina may witness an initial negative FX-neutral growth in their GMV due to the recent inflation crisis, causing it to depreciate against the USD, but still experience growth in local currency (LC) terms. MELI’s take rates will continue to grow, but stagnate at the end of 2028 due to increasing competition from other players as well. TPV:

Fintech is projected to grow at a faster pace than ecommerce due to larger portions of the population still being unbanked and lacking access to payments services. MELI’s early investment into fintech to strengthen their flywheel effect will pay off as the region develops and more people gain access to banking services. As such, I reflect higher growth in the TPV of all regions, with Argentina still subject to FX risks. Unlike ecommerce, I only forecast marginally higher take rates for fintech given that it is more subject to competitive pressure due to lower barrier to entry. Additionally, MELI is not one of the first movers within LATAM for fintech (Nubank and others were there prior to them), which will weigh on their ability to take a larger share of the pie.

Due to MELI’s scale and our belief that their investments will enable them to reap competitive scale advantages into the future, cost of net revenues will decrease to provide higher gross profit margins in the future as a result of their strong logistics network, from 48% in 2018 to 55% by 2028. On the other hand, I expect MELI to have to continually invest in marketing and R&D to stay competitive as the landscape develops and attracts more competitors, which results in those costs % revenue to increase. MELI’s credit also utilizes a proprietary credit analysis machine learning model, which I predict will be able to keep doubtful provisions down as a % of their increasing portfolio.

As a result, EBITDA margins are forecasted to be accretive, reaching about 23% by 2028, inline with a company like Alibaba or Amazon, whose EBITDA margins are also forecasted to break 20%.