Executive Summary

UiPath’s AI Adoption to Expand its Robotic Process Automation Niche

Partnership with SAP Creating a Seamless Experience for Clients

Potential for UiPath to Capitalize on a Rapidly Growing RPA Market

Company Overview

UiPath (NYSE: PATH), founded in 2005 in Bucharest, Romania, and incorporated in Delaware in 2015, has evolved into a global leader in enterprise automation software through its Robotic Process Automation (RPA) niche. The company's core focus is on building and managing automations and developing computer vision technology. UiPath's vision is to enable automation across all knowledge work to accelerate human achievement.

The platform offers an end-to-end platform for automation, combining the leading robotic process automation (RPA) technology to empower employees to quickly build automations for both existing and new processes, utilizing software robots to perform diverse tasks, including logging into applications, extracting information from documents, and updating databases.

Business & Revenue Segments

The UiPath generates revenue from the sale of software licenses for the use of their UiPath proprietary software, maintenance and support for UiPath’s licenses, the right to access certain software products (i.e., SaaS), and professional services.

UiPath offers a comprehensive range of automation solutions via a suite of interrelated software offerings. In addition, UiPath offers a managed, multi-tenant, SaaS version of certain products (i.e., SaaS products), which allows customers to begin automating without the need to provide infrastructure, install applications or perform additional configurations. UiPath also offers customers maintenance and support, training, and implementation services to facilitate their adoption of its platform.

Licenses: UiPath primarily sells term licenses, providing customers the right to use software for a specified period. Licenses contributed 54% to UiPath’s revenue in 2021.

Subscription Services: Subscription services revenue consists of maintenance and support revenue generated through technical support and the provision of unspecified updates and upgrades. Subscription services contributed 41% to UiPath’s revenue in 2021.

Professional Services and Other: Professional services and other revenue consists of fees associated with professional services for process automation, customer education, and training services. Professional Services and Other contributed 5% to UiPath’s revenue in 2021.

Cost Drivers

Sales and marketing and research and development cost amounted to an estimated amount of USD 987 million which constituted the largest share of the company’s cost in 2023. Other costs include, licenses, subscription services, professional services and others.

Sales and Marketing

Sales and marketing expenses consist primarily of personnel-related expenses associated with our sales and marketing employees and related sales support teams, including salaries and bonuses, stock-based compensation expense, and employee benefit costs, sales and partner commissions, marketing events, advertising costs, travel, trade shows, other marketing materials, and allocated overhead.

Advertising costs are expensed as incurred and are included in sales and marketing expenses. Such costs were $41.5 million, $43.3 million, and $21.3 million for fiscal years 2023, 2022, and 2021, respectively.

Research and Development

Research and development expenses consist primarily of personnel-related expenses, including salaries and bonuses, stock-based compensation expense, and employee benefits costs, for our research and development employees, and allocated overhead. Research and development expenditures are expensed as incurred.

Competitor Analysis

UiPath went public in April 2021, raising $1.34 billion, marking one of the largest US software IPOs in history. Subsequently, the company expanded its platform through strategic acquisitions, including StepShot and ProcessGold in 2019, Cloud Elements in 2021, and Re:infer in July 2022, enhancing its natural language processing capabilities.

Since its inception in 2005, UiPath has maintained a prominent position as a leader in robotic process automation (RPA). Unlike hardware-based robotics, UiPath's platform empowers employers to build, deploy, and manage software robots capable of mimicking a myriad of human tasks, ranging from fully automatic processes to those involving some level of human interaction. Addressing a rapidly growing market, estimated by Gartner to be worth over $93 billion annually, UiPath faces formidable competition from contenders such as Automation Anywhere, Blue Prism, and Datamatics.

Automation Anywhere

Year founded: 2003

Headquarter: San Jose, California

Automation Anywhere is a software enterprise specializing in the development of Robotic Process Automation (RPA) software. Renowned for its Automation 360 solution, an end-to-end program seamlessly operating in the cloud, it excels in automating repetitive processes. Since its inception, Automation Anywhere has successfully garnered $1.04 billion in investments, boasting a workforce of over 2,200 employees. Alongside UiPath, Automation Anywhere contributes to the realm of RPA software, aiming to enhance organizational productivity. Despite initial expectations for an IPO in 2022, Automation Anywhere did not go public, raising $290 million in its latest funding round in November 2019 at a post-money valuation of $6.8 billion..

Blue Prism

Year founded: 2001

Headquarter: Warrington, United Kingdom

Blue Prism, a multinational software corporation under the ownership of SS&C Technologies, a global provider of solutions for the financial services and healthcare sectors, provides an RPA tool that harnesses the potential of a virtual workforce driven by software robots. As of October 2022, Blue Prism boasted a user base exceeding 2,800 customers. Its comprehensive enterprise RPA solution efficiently automates intricate operational tasks. The Java-based tool incorporates a user-friendly visual designer featuring drag-and-drop functionalities. In October 2022, SS&C Technologies introduced the Blue Prism Intelligent Automation Platform (IAP), a suite integrating RPA, business process management (BPM), AI, and no-code capabilities.

Datamatics

Year founded: 1975

Headquarter: Mumbai, India

Datamatics is an Indian digital operations, technology, and experiences company. It offers intelligent solutions to help data-driven businesses increase productivity and improve the customer experience. As of Jul 2022, Datamatics operated across four continents with delivery centers in the USA, India, and the Philippines. Datamatics offers IT and engineering services, BPM, big data, and analytics solutions powered by AI. Like UiPath, Datamatics provides a 网页链接{comprehensive Intelligent Automation (IA) suite of products}, but Datamatics combines TruBot RPA and TruCap IDP solutions with AI, ML, and NLP models. In Jul 2022, Gartner positioned Datamatics in the Magic Quadrant for Finance and Accounting BPO as a Niche Player.

Economic Moat

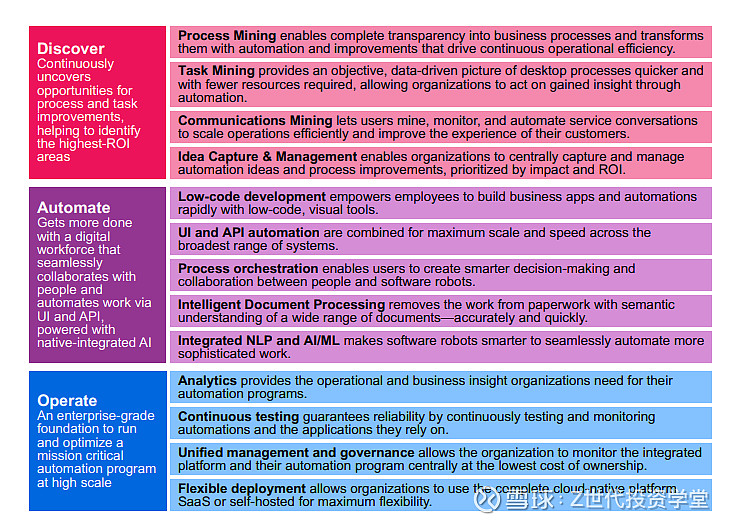

End to end Business Automation

Uipath is a full business automation platform that provides and identify the highest-ROI opportunities for continuous process optimization and automation. Notable ‘Discover’ capabilities include, process mining, task mining, communications mining, automation hub and an AI-powered business automation platform. This full breadth of automation on the UiPath platform covers the entire spectrum of automation, from opportunity discovery to deployment and management. This comprehensive solution reduces integration complexities, fostering efficiency and creating a seamless collaboration between human and digital tools.

UiPath is the only one RPA tool that delivers both the attended and unattended automation in the enterprise RPA system. An attended software robot can run on your PC, and you can decide when to begin it. An unattended automation enables automation on the remote system even out of sight on a timed schedule.

UiPath solidifies a substantial economic advantage through its provision of a comprehensive business automation platform. This all-encompassing solution simplifies integration challenges for clients, promoting efficiency and fostering seamless collaboration between human and digital workforces. UiPath's strong development environment, scalability, and adaptability empower organizations to effortlessly adjust and enhance their automation endeavours. The platform's emphasis on enhancing operational efficiencies, combined with the loyalty of its customers and the costs associated with switching after implementation, positions UiPath as a leader in the market. This makes it difficult for competitors to replicate its extensive capabilities, ensuring a lasting competitive edge.

Switching Costs

Another important economic moat for UiPath involves switching costs. UiPath’s robots are designed to be deployed and carry out everyday tasks for businesses. If a company wishes to switch away from UiPath, it would be very difficult to do so without interrupting their business processes.

UiPath had a dollar-based net retention rate (or DBNRR) of 138% in its latest quarter. Essentially, UiPath is getting its customers to spend even more as they utilize more robots, thereby making UiPath more embedded into the day-to-day operations of its customers and increasing switching costs.

Furthermore, it had a gross retention rate of 98% in the latest quarter – meaning that 98% of customers who were there one year ago are still with UiPath today.

Investment Theses

UiPath’s AI Adoption to Expand its Robotic Process Automation Niche

UiPath has now moved from a narrow RPA product to one that infuses AI solutions. It has various strategic investments across natural language processing, large language models and semantic automation.

Specifically, they recently announced their expanded suite of tools targeted to widen their RPA niche to generative AI. They include an expanded suite of generative AI and specialized AI tools including general availability and support of connectors for Amazon's Falcon Large Language Model (LLM), OpenAI, Azure OpenAI supporting GPT-4 and the preview of Google's Vertex connector supporting its PaLM 2 LLM.

Above all, their latest platform upgrade includes UiPath Autopilot, which is a combined integration of generative AI, specialized AI (functions designed to provide intelligence inside what are often smaller closed-loop spaces that offer industry or domain-specific intelligence and are typically more secure in terms of their access to mission-critical data) and robotic process automation that allows any user to automate work using human natural language.

UiPath Autopilot can transform paper documents into automation-powered apps with a single user click. Delivered as AI features within the UiPath Business Platform, these enterprise-grade capabilities are engineered to a) take the grunt work out of business and b) now that we have evolved somewhat with automation in general, to enable people (and in some cases machines) to work smarter in the first place. In other words, the improvements are expected to provide faster reporting, improved building and monitoring capabilities and importantly providing deeper insights into workforce dynamics and processes.

With its AI adoption, UiPath is following a platform development trajectory that sees it both widen and broaden its user base. Looking to now serve the needs of businesspeople, software engineers, automation specialists and higher-level business analysts, the percolation process here has been undertaken with what appears to be a sympathetic regard for different user groups and I believe will help to drive demand and revenue by increasing client interest in its subscription services.

Partnership with SAP Creating a Seamless Experience for Clients

UiPath announced it 网页链接{expanded its partnership} with SAP to offer the UiPath Business Automation Platform to customers. The expanded partnership enables customers to execute business transformations, migrate critical business systems to the cloud, and augment existing business systems with the UiPath Platform and helps enterprises take advantage of a clean core. The UiPath Platform is planned to be offered as a SAP-endorsed application and on the 网页链接{SAP Store}, the online marketplace for SAP and partner offerings.

This means that UiPath as a automation platform will make it even easier for customers like 网页链接{EDF Renewables} and Orica to maximise SAP investments. This is being achieved by integrating with enterprise vendor applications and custom applications across SAP and non-SAP solutions. The company is also seeking to rapidly advance digital transformation efforts, automate critical business operations, and ease migrations to 网页链接{SAP S/4HANA®} in the hopes of reducing cost, time, and effort. The potential is huge considering SAP is being used by over 404,000 businesses across 180 different countries.

Furthermore, this development comes at a time when a UiPath and Bain & Co. report indicates that 70% of businesses regard AI-driven automation as vital for achieving strategic goals, with 74% anticipating positive ROI from their automation initiatives. However, a McKinsey report highlights that nearly half of organizations have not fully implemented AI at scale.

With these latest innovations, UiPath aims to bridge this gap and make automation more accessible to businesses. Enhanced features like UiPath Process Mining and Task Mining have been introduced for deeper workforce, process, and automation insights, including a new model-based process graph.

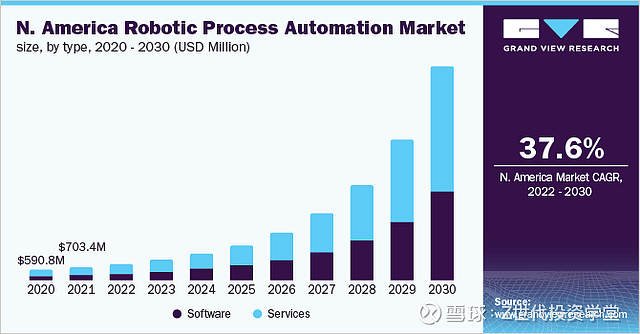

UiPath’s AI & Gen AI Adoption to Expand its Robotic Process Automation Niche

With the goal of automating and optimizing business processes that might include anything from vetting resumes to automating software development and testing to processing documents or detecting fraud, the robotic process automation industry is fast-growing and its total addressable market that Gartner estimates is already worth more than $93 billion annually. By extension to that, according to 网页链接{Grand View Research}, the RPA market in North America is expected to skyrocket over the upcoming decade, growing at an almost unfathomable 37.6% CAGR. I believe this leaves UiPath a long runway for growth from its roughly $1.1 billion in trailing-12-month revenue. Also, given UiPath is the clear leader in this space, I believe that it will continue to ride the huge tailwind of RPA to future success.

Valuation

A DCF model was used to determine the present value of future cash flows by discounting them back to their current value. This process involves estimating the anticipated future cash inflows and outflows associated with an investment and applying a discount rate to account for the time value of money. In this case, considering UiPath’s potential to capitalize on a rapidly growing RPA market and the adoption of AI, I estimated the following rates: a revenue 5-year CAGR of 17.2%, a 5-year EBITDA margin of 18.1%, a selected perpetuity growth rate of 7%, and a discount rate of 5.5%. This analysis yielded an implied fair value of $26.21, with an upside of 5.5%.

Risks and Mitigation

Risk: Investing in a company like UiPath entails significant risk related to data protection and privacy, particularly concerning the utilization of artificial intelligence (AI). The reliance on extensive and diverse datasets for training AI models raises concerns about potential violations of data protection laws such as the General Data Protection Regulation (GDPR) and the Swiss Data Protection Act. These regulations impose strict obligations on the collection, processing, and transfer of personal data, accompanied by rights granted to data subjects. Failure to adhere to these laws can result in severe consequences, including substantial fines, legal actions, damage to reputation, and the erosion of customer trust.

Mitigation: UiPath has strategically employed Reco AI tools to bolster data privacy and security within its SaaS collaboration platforms. Reco, a SaaS security platform, leverages artificial intelligence (AI) to analyze unstructured data and communications, constructing a real-time interaction graph that offers contextual insights into sensitive data and involved parties. By automating risk reduction processes, Reco's platform reduces the likelihood of data exfiltration and theft, simultaneously alleviating operational burdens on UiPath's security team. UiPath benefits from enhanced SaaS collaboration security and time savings, allowing a focus on strategic initiatives.

Risk: The future trajectory of OpenAI and other emerging language models presents a pivotal question, particularly regarding their development and applications. As UiPath's valuation continues to soar, the prospect of acquisition by larger companies looms large. Amidst this landscape, potential competition emerges, and a notable player in the BPO (Business Process Outsourcing) market, WNS (WNS), comes into focus. While UiPath is recognized for its disruptive influence in the automation sector, WNS is not only a current participant in the BPO space but is also actively investing in AI and machine learning (AI/ML). This strategic move positions WNS as a prospective competitor to UiPath in the evolving landscape of automation and intelligent technologies. The dynamic nature of the tech industry, coupled with the evolving capabilities of companies like WNS, adds a layer of complexity to UiPath's competitive landscape, posing a potential investment risk.

Mitigation: UiPath has devised a comprehensive set of growth strategies to proactively address competition risks. Focused on customer acquisition and expansion, the company employs a refined go-to-market approach, positioning its automation platform as transformative for businesses. Utilizing a diversified sales strategy and targeted segmentation, UiPath optimizes resource allocation across enterprise, mid-market, and small to mid-sized business segments. The commitment to continuous platform investment and innovation is evident in the regular release of updated versions, introducing new features and enhancing security. Strategic acquisitions, such as Re:inter LTD, contribute to product and market expansion. Additionally, UiPath prioritizes community engagement, fostering a global network of automation professionals through initiatives like UiPath Academy and Community Edition. These growth strategies collectively demonstrate UiPath's proactive stance in navigating competition and positioning itself for sustained success in the dynamic automation landscape.

ESG Assessments

Sustainalytics Risk Rating

Sustainalytics, a prominent ESG (Environmental, Social, and Governance) rating agency, plays a pivotal role in assisting investors in making socially responsible investment decisions. The agency provides comparable ratings that facilitate assessments among industry peers and across various sectors.

In the evaluation of UiPath through Sustainalytics' risk management methodology, the company received a commendable rating of "Low Risk," with a risk score of 17.1. This positions UiPath at the 153rd place out of 1105 within the Software & Services industry and globally at 2694 out of 15841, reflecting its strong standing in terms of risk management within both its specific industry and the broader global context.

In UiPath’s fiscal year 2023 impact report, 2 key milestone were reached.

Firstly, it detailed the company’s first materiality assessment, which is the result of an in-depth study and identifies the most relevant areas of impact on stakeholders. UiPath places strong emphasis on stakeholder engagement to inform its ESG approach, and completion of this assessment ensures that the ESG strategy is anchored in an understanding of stakeholders’ expectations and priorities.

Secondly, for the first time, the report includes a comprehensive greenhouse gas (GHG) inventory of data across Scopes 1, 2, and 3 and introduces a commitment by UiPath to set corporate climate targets, in alignment with the Science-Based Target Initiative (SBTi).

Conclusion

In conclusion, UiPath’s adoption of AI to augment its RPA niche, partnerships with SAP and the rapidly growing RPA market presents an extremely strong potential for UiPath to deliver real value to its clients and customers with their product. Considering its opportunity to create significant competitive advantage and disrupt the RPA market coupled with its ability through its strong balance sheet, to weather and protect itself from downside risks, UiPath’s upside potential is high as they continue and strive to reach its fullest potential.

References

Finbox. (n.d.). UiPath Inc. 网页链接

UiPath. (2023). The Foundation of Innovation. 网页链接

UiPath. (n.d.). Company Information. 网页链接

Goel, S. (2023, January 20). What does UiPath do | How does UiPath work | Business Model. The Strategy Story. 网页链接)%2C%20and%20professional%20services.

Piazza, J. (2023, December 1). UiPath stock spikes more than 20% after earnings beat, generative AI integration. CNBC. 网页链接

Sustainalytics. (n.d.). UiPath, Inc. 网页链接

Business Wire. (2023, June 13) UiPath Issues Fiscal Year 2023 Impact Report. Yahoo Finance. 网页链接

Business Strategy Hub. (n.d.). Top 15 UiPath Competitors and Alternatives. 网页链接

Kimes, K. (2023, August 7). UiPath named a Leader in Gartner® Magic Quadrant™ for five years in a row. UiPath. 网页链接

Sureka, A. (n.d.). 18 Unparalleled UiPath Features for Successful RPA in Business. Clarion Technologies. 网页链接

Business Wire. UiPath Offers End-to-End AI-Powered Business Automation Platform to Accelerate Digital Transformation for SAP® Customers. Yahoo Finance. 网页链接

Jackson, A. (2023, May 20). UiPath to offer AI-powered Business Automation Platform. AI Magazine. 网页链接

Ebiefung, W. (2023, December 5). Cathie Wood Is Buying These AI Stocks -- And Both Could Make You Richer in 2024. The Motley Fool. 网页链接

Symington, S. (2023, August 2). Why UiPath Is One of the Market's Most Underappreciated AI Stocks. The Motley Fool. 网页链接

Stevens, R. (n.d.). Three insights you might have missed from the UiPath ‘FORWARD VI’ event. 网页链接

Bridgwater, A. (2023, October 10). Automation Generation, UiPath Widens Scope With Autopilot Assistant. Forbes. 网页链接

网页链接{Navigator. What Companies Are Using SAP?. 网页链接}.

Galvin, J. (2022, June 28). UiPath: The Negativity Has Gone Too Far. SeekingAlpha. 网页链接

Capital, T. (2023, March 25). UiPath: It Has The Potential To Have A Very Deep Moat. SeekingAlpha. 网页链接

Bridgwater, A. (2023, October 11). UiPath and SAP Deepen Partnership and Endorsements at Forward VI. ERP Today. 网页链接

Rajan, R. (2023, November 8). UiPath Introduces AI-Driven features to enhance enterprise productivity. Investing. 网页链接

Moloney, E. (2023, May 3). Uipath leverages Reco AI tools to increase SAAS Data Security. ERP Today. https://erp.today/uipath-leverages-reco-ai-tools-to-increase-saas-data-security/

Rosenauer, P. & Sahin, F. (n.d.). What private equity and venture capital firms should consider when investing in AI companies. PwC. 网页链接

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。《大赢家:看动漫画学投资》