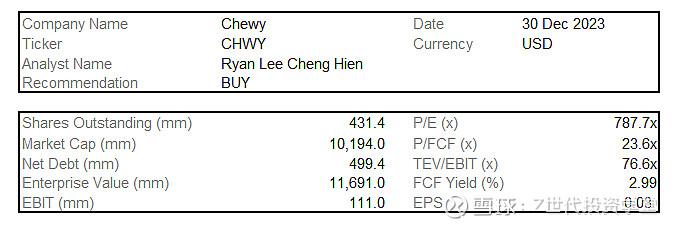

Overview of Chewy

Founded in 2010 and headquartered in Florida, Chewy, Inc is a pure play e-commerce business that sells pet food and treats, pet supplies and pet medications, and other pet-health products along with pet services. Chewy has a wide range of products and services for dogs, cats, fish, birds, small pets, horses, and reptiles sold through its retail website and mobile applications. The company offers approximately 110,000 products from 3,500 partner brands. Chewy went public in Jun 2019 via an IPO on the New York Stock Exchange with the Ticker CHWY.

Chewy Stock Price from Y Charts (2023)

Chewy business segments

Chewy business segments are separated into consumables, hard goods as well as other products and services for pets [1].

Consumables: Refers to various types of pet food, vitamins and medicines etc. that pets can consume. Chewy offers wet, dehydrated and fresh pet food with brands such as Royal Canin, Purina and Hills’ Pet Nutrition on the platform. Vitamins and health products for common health issues such as allergies, digestion, anxiety and urinary issues are present on Chewy’s platform.

Hard Goods: Refers to durable goods and products such as toys, leashes, grooming tools and clothing for dogs, cats and a wide range of other animals.

Others: Chewy provides healthcare services through telehealth vet consultations that pet parents can request for on the platform from 6am to 12am daily. Pet Insurance plans are available on the platform through Careplus, Chewy’s pet insurance platform. Pet parents can also find out more information about common pet ailments and conditions via the PetMD platform, a comprehensive online resource with a symptom checker for dogs and cats.

Pet Industry Overview

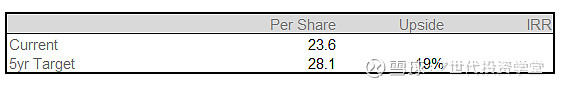

Pet humanization and premiumization: Pets are increasingly treated as part of the family and pet parents are more willing to spend more on higher quality food and services for their pets. According research from Statista in 2022, 91% of pet owners in the US considered pets to be part of the family. This trend will help to drive revenue and more sales of the products that Chewy offers for pets [2].

Owner behaviour towards pets in the US [2]

Rising number of pet parents in the world: There has been an increasing trend of pet ownership during the COVID-19 pandemic. With more millennials becoming homeowners, having smaller families and delay having children, they tend to spend more on their pets. This has led to millennials accounting for the largest percentage of growth among new pet owners. The rising number of pet owners in the world presents a large market opportunity for Chewy to capture and sell its products as well as services [3].

Rising Pet Ownership in the US [3]

Cost drivers for Chewy

Most of Chewy’s cost drivers are from the cost of goods sold and the selling and general administration costs.

Cost of Goods Sold: The cost of goods sold includes third-party brands and private brands that are sold to customers, inventory freight, inventory shrinkage costs and shipping costs. With such a wide variety of products available, the inventory carrying costs would be higher for Chewy compared to its competitors that hold less SKUs. This may increase as Chewy expands its offering of brands and products on the platform, which will result in an increase in inventory and inventory-related costs.

Selling, general and administrative costs: Consists of employee expenses for general corporate functions in the Chewy business – accounting, finance and human resources etc. Other costs include fulfilment costs to operate fulfilment and customer service centres, such as inspecting inventory and responding to customer queries. These costs could increase as Chewy plans for its expansion in Canada and opens up new fulfilment centres that would lead to and increase in the costs related to employees as well as fulfilment and customer services centres.

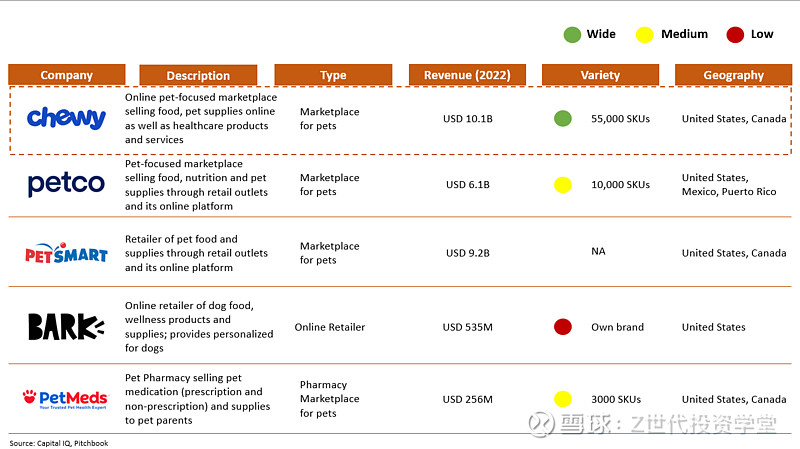

Chewy Competitor Analysis

Chewy’s main competitors are other pet focused marketplaces selling food, supplies and healthcare products. Petco and Petsmart are close competitors but lack the variety of products that Chewy provides with 55,000 SKUs to meet the needs and wants of Pet Parents [4].

Economic moat compared to other competitors

Wide range of pet products and services: Chewy has ~55,000 SKUs and more than 3500 brands to suit the needs and wants for pet parents to provide the best for their pets. Apart from pet products, Chewy provides free educational media such as videos, blogs and tutorials etc. to help pet parents pick the right product for their pet. Chewy is also backed by vets, providing telehealth services and insurance services with Careplus for pets.

Effective distribution network to provide efficient delivery: Chewy’s fulfilment centers are strategically located in the US and allows them to ship at low costs to over 80% of the US population overnight and 100% in 2 days. Chewy has high volume of sales, high subscription rates to their Autoship subscription programme and relatively low seasonality. This allows them to optimize the usage of their assets and inventory levels as well as the fixed and variable costs per unit.

Scalable Technology platform: Chewy platform enables them to grow their sales volume and customers while minimally increasing transaction and operational costs. They have also improved their processes to pick and package orders with investments in automated fulfilment processes, better forecasts, inventory placement and labour management. Another example is the rollout of Practice Hub in 2021 to integrate vets with Chewy’s e-commerce platform.

Investment Thesis

Ability to satisfy customers with a wide range of products and services: Chewy’s wide range with 3500 pet brands and 55,000 SKUs that Chewy provides allows it to meet the various demands of Pet Parents and a wide range of pets from common dogs to less common pets such as reptiles and birds. This variety is difficult for competitors to match in a short period of time to onboard brands on the platform. Moreover, Chewy can deliver these products swiftly within 1 to 2 days to satisfy customer and meet their needs quickly. Lastly, Chewy provides a wide range of pet healthcare services with Telemedicine and Insurance plans. This will allow it to attract more customers with the convenience it provides pet parents and variety with all these services on one single platform.

Development of pet healthcare service offerings: Chewy’s development of its services to address pet health will allow it to capture market share in the large pet healthcare space with a global total addressable market size of about USD 211B growing at a CAGR of 7.4% from 2023 to 2033. Chewy health has developed telehealth vet consult offerings with “Connect With a Vet” along with a pet pharmacy. Chewy will also be able to capture market share in the pet insurance market with its Careplus pet insurance plans supported by a partnership with Lemonades pet insurance vertical. This will accelerate the growth of Chewy and allow it to increase in sales and margins [7].

Canada expansion plans: Chewy is planning for its first expansion to Canada, starting from metropolitan Toronto before expanding in other parts of Canada. This expansion would help to increase sales and net income with 61% of Canada population (40.5M people) owning a pet [5], Chewy’s strong brand equity and improvement of the company’s fundamentals. With a total addressable market size of USD 7.0B in the Canada pet care market [6], the expansion is likely to help Chewy grow even further as long as it picks ideal locations for its fulfilment centres and manages its inventory-related costs in Canada well.

Valuation of Chewy

Using the discounted cash flow method, we arrived at an intrinsic share price of USD for Chewy.

Revenue projections: Revenue was projected by breaking down the business segments and using the CAGR for the Consumables, Hard Goods and Others (healthcare services etc.) for pets to project the expected future revenue for Chewy.

Cost projections: Cost of goods sold as well as the Selling General and Administrative costs will continue to increase across the years as Chewy expands. However, as Chewy expands and begins to reap better economies of scale by being able to buy in larger quantities, this can lower the costs of pet products per unit. In turn this could lead to cost savings being passed to pet parents in the form of lower prices to attract more pet parents on the Chewy platform compared to other competitors.

Revenue and cost drivers

Projected Income Statement

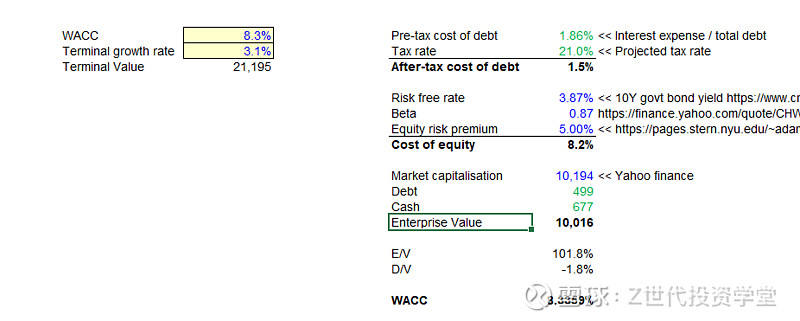

Cost of debt: The cost of debt was arrived at using the interest expense divided by the total debt of Chewy. Using the federal statutory tax rate of 21%, it allows us to arrive at an after-tax cost of debt of 1.5%.

Cost of equity: The risk free rate of 3.87% was taken from the Yield-to-maturity for a 10 year long-term unsecured US government bond while the Beta of 0.87 was taken from yahoo finance. The 0.87 beta suggests that Chewy is not too volatile compared to the stock market and is relatively stable. Finally, the equity risk premium was taken from Damodaran’s research of equity risk premiums by country.

Weighted average cost of capital: By calculating the capital structure, and multiplying the respective cost of debt and cost of equity by the weight of debt and equity, it allows us to arrive at a weighted average cost of capital (WACC) of 8.335%.

WACC Calculation

Discounting the Free Cash flows by the WACC allows us to arrive at the respective Present values each year. Summing them together and adding them together with the terminal value using a terminal growth rate of 3.1% equal to the current inflation rate of the US allows us to get an enterprise value of. Subtracting debt and adding cash allows us to get the equity value of which divided by the number of outstanding shares allows us to get an intrinsic share price of USD 28.10 with an upside of 19%.

ESG Considerations

There is not much information available regarding the ESG efforts for Chewy, but some considerations as a marketplace business would be to possibly source for local suppliers to deliver locally and reduce emissions from transport. This would reduce the carbon emissions from sale to delivery to customers and help to mitigate any possible supply chain disruptions while meeting customer demand swiftly.

Chewy should ensure the well-being and efforts to encourage diversity among its employees and strong corporate governance efforts in the company.

Risks associated with Chewy

Risks of Labour force and Supply Chain Disruptions: Events such as the COVID-19 Pandemic may reduce the labour available and limit their ability to work or travel to certain locations. This may affect the ability of Chewy to meet customer demand and affect the flow of obtaining products from vendors and transporting them to customers in a timely manner. Chewy has faced labour shortages at their fulfilment centres due to the COVID-19 Pandemic which has adversely affected operations. Competition with other retailers for labour may result in higher wages to retain labour and increase labour costs.

Disruptions to Shipping arrangements: Currently, Chewy relies on third-party logistic providers to deliver the products to customers. Inability to negotiate favourable prices and terms with logistic providers would disrupt the efficiency of receiving inbound inventory and the ability to meet customer demand. Other natural factors such as weather changes (e.g. fire, flood, earthquakes) could affect the operations of shipping companies and possibly damage the products ordered by customers.

Mitigations

Diversification of supply chain: broadening the suppliers that Chewy has can help to mitigate the disruption from one or two suppliers. Looking for suppliers that are nearer to their storage locations and stocking up more on inventory during periods of expected disruption can help to mitigate supply chain shock such as natural disasters.

Automation of menial tasks: To reduce the impact of the lack of staff, Chewy can work on automating certain tasks in their fulfilment centres to ensure that operations are still smooth and possibly reduce labour costs.

Conclusion

In conclusion, Chewy has multiple growth drivers for its business segments, including its entry into pet health and its expansion into Canada. As long as it is able to maintain this trend of growth and cost levels, Chewy presents an interesting opportunity illustrating the rise of the pet sector post pandemic.

Sources

[1] Capital IQ

[2] 网页链接

[3]网页链接

[4] 网页链接

[5] 网页链接).

[6] 网页链接

[7] 网页链接

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。