Executive Summary

This executive summary provides an overview and analysis of Nutrien Ltd.'s stock performance, highlighting key financial and market indicators. Nutrien is a leading global provider of crop inputs and services, producing and distributing agricultural products to farmers and customers worldwide.

Nutrien has demonstrated strong financial performance over the years but had experienced slight dip in its revenue in 2023Q1 mainly due to lower sales and gross margins for its business segments. Nutrien Ag Solutions (“Retail”) adjusted EBITDA declined to $(34) million in the first quarter of 2023 primarily due to lower sales and gross margins for crop nutrients and crop protection products compared to the record levels achieved in 2022. Potash adjusted EBITDA declined to $676 million in the first quarter of 2023 due to lower net realized selling prices and lower sales volumes. Nitrogen adjusted EBITDA declined to $676 million in the first quarter of 2023 due to lower net realized selling prices for all major nitrogen products.

Nutrien holds a prominent position in the global agriculture industry, benefiting from its comprehensive offering of fertilizers, crop protection products, and digital solutions. The company's strong distribution network and strategic partnerships enable it to reach a wide customer base across key agricultural markets. Nutrien's focus on innovation and sustainability further strengthens its competitive advantage and positions it well for future growth.

The agriculture industry has witnessed steady growth in recent years, driven by increasing global population and rising food demand. Nutrien is well-positioned to capitalize on this trend, as it operates across the entire agricultural value chain, providing essential products and services to farmers. The company's exposure to both developed and emerging markets further diversifies its revenue streams, mitigating risks associated with regional fluctuations.

Nutrien has pursued a growth strategy through strategic acquisitions and partnerships, expanding its product offerings and market presence. The company's recent acquisitions, such as Casa do Adubo S.A., have allowed Nutrien to expand its presence and market reach in Brazil which is one of the largest Agricultural markets. Nutrien's focus on targeted acquisitions strengthens its ability to adapt to evolving market dynamics and positions it as a leader in the agtech sector.

Despite Nutrien's strong performance, the company faces certain risks and challenges. Fluctuating commodity prices, weather patterns, and regulatory changes can impact the agricultural sector, potentially affecting Nutrien's financial results. Additionally, competitive pressures and evolving customer preferences require continuous innovation and adaptability to maintain market leadership.

Company Overview

A Canadian fertilizer company based in Saskatoon, Saskatchewan, that produce and distribute over 27 million tonnes of potash, nitrogen and phosphate products for agricultural, industrial and feed customers globally. It has operations and investments in 13 countries, supported by nearly 25,000 employees worldwide. They supply products and services to key markets in North America, South America, Asia and Europe.

Business Segments

Today, the company operates 4 main business segments namely Retail, Potash, Nitrogen and Phosphate. Retail segment distributes crop nutrients, crop protection products, seed and merchandise, and provides services directly to growers through a network of Retail locations in North America, South America and Australia. The Potash, Nitrogen and Phosphate segments are differentiated by the chemical nutrient contained in the products that each produces:

Retail Network: Nutrien Ag Solution, an extensive agriculture retail network that services over 500,000 grower accounts. The company retail footprint covers 7 countries with a network of over 2000 retail locations to help growers rear crops sustainably. Company is aiming to be the one stop shop for customers to get access to all the things that they want digitally.

Potash: World’s largest potash producer with over 20 million tonnes of potash capacity at their six lower-cost potash mines in Saskatchewan. This helps to minimise supply risk for customers and limits the potential for lost sales due to unforeseen production downtime. They have a record history of high quality reserves supported by well-developed infrastructure and its multi-year expansions allowed them to be well positioned to meet global long term potash needs.

Nitrogen: Third-largest nitrogen producer in the world with over 7 million tonnes of gross ammonia capacity and the ability to produce more than 11 million tonnes of total nitrogen products in the US, Canada and Trinidad. Its nitrogen production network is low-cost and diversified, with opportunities to execute high-return and low-risk brownfield projects, expand our production of sustainability products and significantly lower our carbon footprint.

Phosphate: Second largest phosphate producer in North America, Nutrien sells approximately 3 million tonnes of finished product annually. The company operates two large integrated phosphate mining and processing facilities and four regional upgrading plants in the US. It sells a wide range of fertilizer, feed and industrial phosphate products.

Revenue Drivers

The company has delivered record earnings last year which was mainly resulted from strong agriculture fundamentals, higher fertiliser selling prices and excellent performance in its retail business segment. The company’s retail network is its greatest revenue driver that covers 57.7% of its revenue which is approximately $21,350 USD in 2022. In 2022, the retail business revenue has also increased by 60.7% with 2019 as the base year. It delivered record adjusted EBITDA of $2.3 billion driven by higher sales and gross margins across nearly all product categories and regions where it operates in.

Its Potash and Nitrogen businesses comprise the next biggest revenue segment of Nutrien’s total revenue with Potash and Nitrogen segments comprising of 21.3% ($7,899 USD, EBITDA: $5.8 billion) and 20.3% ($7,533 USD) respectively. In 2022, its Potash and Nitrogen businesses have grown by 2.03% and 1.64% respectively. The recorded earnings from its Potash business is mainly due to higher realized prices and strong offshore volumes more than offset lower North American sales volumes, higher cash cost of goods sold per tonne and higher provincial mining taxes. Potash supply constraints from Russia and Belarus during 2022 resulted in higher prices in both spot and contract markets.

Cost Drivers

For its potash segment, cost drivers includes tax expenses which was reported to have increase in 2022 primarily due to higher provincial mining taxes from higher average potash selling prices, which are the basis for certain taxes. Nutrien is subjected to Saskatchewan provincial resource taxes, including the potash production tax and the resource surcharge.

For nitrogen business, costs have increased in 2022 primarily due to higher natural gas costs. Raw materials and other input costs were also higher in 2022 compared to 2021. Ammonia controllable cash cost of product manufactured per tonne increased due to lower production and higher input costs (mainly electricity).

ESG Considerations

Environmental factors

Given that Nutrien is an agriculture and chemical company, the company will be very sensitive to environmental regulations and policies within the region of its operations. Its Canadian manufacturing facilities located in the provinces of Alberta and Saskatchewan are subject to a variety of federal and provincial requirements to reduce GHG emissions ranging from carbon taxes to emissions intensity reduction requirements. Changes to regulatory requirements in the jurisdiction in which they operate such as changes to carbon tax prices and establishment of absolute emissions limits will impact the company’s business negatively. According to CBC, federal carbon pricing in both provinces will increase from $50 per tonne to $65 per tonne in 2023. Last year, the company unveiled plans on building the world’s largest clean ammonia production facility in Louisiana which will significantly help to reduce their carbon emissions in their production process.

Social factors

Social risks such as Cybersecurity threats and Talent and organisation culture are social risks that the company have highlighted. In managing such key risks, the company have promoted strong culture of cybersecurity awareness among employees and conducted regular simulated phishing and targeted cybersecurity training. With regards to ensuring that their employees remain relevant at work, the team is committed to the career development of its employees and have utilised incentives programs to encourage continuous learning among employees.

Governance factors

The company has a string corporate governance that supports its long term plans that they have set out. Executive compensation is structured as pay-for-performance and is tied to performance drivers such as ESG performance. Putting compensation at risk incentivises executives to work towards their collective goal. Furthermore, the skillsets that the board members possessed seemed to be more leadership and strategic based with other fields such as sustainability, innovation and operations. This shows the balance of expertise across the board to implement plans and changes for the company.

Competitor Analysis Market Competitors

Nutrien’s primary competitors are located in Russia, Belarus, Canada, Germany, Israel and Jordan. This includes Syngenta, Yara International and Eurochem Group.

Syngenta: a leading science-based agtech company that provides farmers with agricultural solutions. They are very proactive in their R&D initiatives where they utilise Artificial intelligence to provide farmers with advanced and comprehensive solutions.

Yara International: a Norwegian chemical company that produces, distributes, and sells nitrogen-based mineral fertilizers and related industrial products. Its product line also includes phosphate and potash-based mineral fertilizers, as well as complex and specialty mineral fertilizer products. These are similar to Nutrien’s product lines.

Eurochem Group: a Swiss fertilizer producer fertilizer manufacturer with its own capacity in all three primary nutrients – nitrogen, phosphates and potash.Economic moats

Diversified business model enhances the stability of earnings: Nutrien offers a comprehensive portfolio of crop nutrients, including nitrogen, phosphates, and potash, as well as other inputs such as seeds, crop protection products, and agronomic services. This diverse product offering enables Nutrien to cater to different crop types and geographic regions, maximizing its potential customer base. Nutrien’s global footprint, diversified business model and portfolio of agricultural products, services and solutions will enable them to respond to changing economic conditions. It not only targets growers’ demand for nutrients for their crop production, but it also provides a suite of plantation solutions for them. The recognise that growers are increasingly looking for whole-acre solutions that include a full suite of products, services and solutions. For instance, the Australian market is unique in that growers require a full suite of crop production inputs but also solutions for livestock, water and irrigation services.

Success of Nutrien Ag Solutions: the ability to tackle the needs of growers comprehensively by focusing on both provision of nutrients for crop plantation and innovative solutions for growers has contributed to its success and earnings from both ends.

Capability of its whole-acre solutions approach to generate high-quality carbon outcomes: Given that Nutrien retail business lies in the provision of life cycle advice and solutions for their clients, Nutrien has the ability to influence growers (their clients) and our industry to accelerate climate-smart agriculture and soil carbon sequestration while rewarding growers for their efforts. With the integration with its carbon program and the power of its network of growers, suppliers, government and industry players, this would allow Nutrien to meet its collective sustainability goals and objectives. By providing solutions that minimize our environmental footprint to their clients, this will enable traceability to cope with the emerging carbon markets.

Strong acquisition capability as part of its growth strategy to increase its market share: To date, Nutrien has completed 21 acquisitions in the US, Brazil and Australia in 2022. Nutrien has started venturing into the Brazilian market since 2019 and have acquired Brazilian Ag retailer Casa do Adubo S.A last year to expand its Brazilian retail business. The buyout will cover 39 locations and 10 distribution centres, and will expand Nutrien's footprint in Brazil to 13 states from 5.

Strong agriculture market prospect in Brazil: Brazil is one of the world’s largest and fastest-growing agriculture markets and is currently the largest soybean producer (figure 1) and the third largest producer. A country with ample land and water in reserve, Brazil still has much unfarmed land that holds potential for future agriculture production. Furthermore, Brazilian grower economics for soybeans and corn are strong, and Nutrien can expect support for another year of above-trend acreage growth in that market. The USDA Agricultural Projections to 2031 indicate an additional 20 million hectares of cropland will be brought into production by 2031, a 2.6% annual rate of expansion. Coupled with the all-time favourable governmental policies enacted, Brazil’s agricultural sector has the potential to gain a larger share of the global market in coming years.

Figure 1: growth of the value of Brazilian Figure 2: % of commodities to

exports since 20022 international markets

Investment ThesisStrong potential in its potash business

Potash as core business: Potash accounts for approximately 50% of Nutrien’s EBITDA. Furthermore, it covers about 70% of Nutrien’s production capacity as shown in figure 4.

Figure 3: Production capacity of Nutrien Figure 4: Breakdown of Nutrien’s earnings

by operating segments

Strategic location of its production mines: Nutrien operate low-cost potash mines in Saskatchewan, Canada, which have access to the best potash geology in the world and in a stable geopolitical environment. It is strategically located in a very favourable environment with the largest known global potash reserves which accounts for 40% of the total.

The value of high quality potash reserves: High quality potash reserves in significant quantities are limited to a small number of countries globally. The majority of the major potash-consuming nations in Asia and Latin America have little to no capacity for production and are therefore dependent on imports to meet their needs. Most product is sold on a spot basis, while customers in certain countries, such as China and India, purchase under contracts.

Flexible mine network: Nutrien’s Six-mine network helps the company bring on significant additional low-cost production that competitors are not able to deliver. This allows Nutrien to flex its min network and increase production as needed to meet the demand at a low cost. In 2022, they have completed underground mine development, secured additional mining equipment, increased site-based storage and loadout, and hired additional employees. They have announced plans to ramp up its annual operational capability to approximately 18 million tonnes in 2026 at a very low capital cost of $150 to $200 per tonne.

Consistent and strong demand due to the rising population

The rising global population: The world’s population has increased by more than three times since the mid-twentieth century. In mid-November 2022, global population has reached 8.0 billion which is an up from an estimated 2.5 billion in 1950. In the figure 5, as shown below, world’s population is estimated to peak at 10.43 billion in 2085. However, existing global resources are being strained trying to produce and deliver enough wholesome food for the eight billion people on the planet. According to the United Nations, over 10% of people on the planet are thought to be food insecure.

Figure 5: Forecast about the development of the world population from 2022 to 2100 (in billions)

The importance of potash: The world's expanding population depends heavily on potash for food production. Around 95% of the potash produced worldwide is utilized as fertilizer, with the remaining 5% going into other chemicals and manufactured goods. Approximately 95% of all potash production goes into the agriculture sector, where it is used as a plant nutrient. The role of potassium cannot be substituted by any other nutrient. Furthermore, potash has no commercial substitute as a potassium fertilizer source. Global demand growth for potash has outpaced that of other primary nutrients, with an average annual growth of 2.8% between 2001 and 2021.

To help feed a growing population while tackling the environmental and social difficulties the agriculture sector is facing, Nutrien is in a good position to create products and creative solutions.

Vertical integration between wholesale and retail operations cushions out impacts of fluctuation in commodity prices

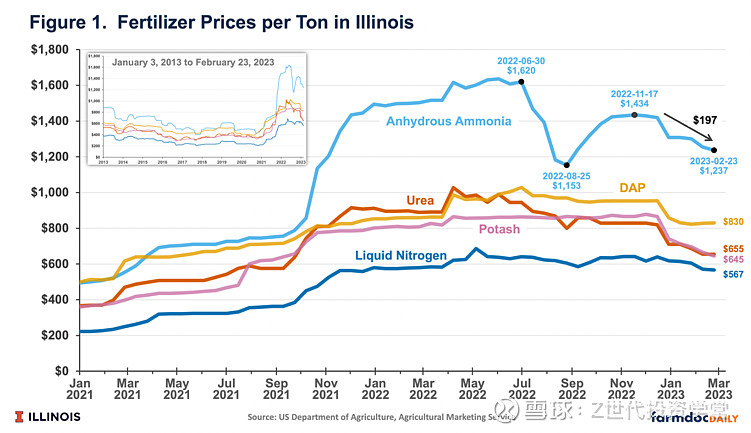

Fluctuations in commodity prices: As anhydrous ammonia is an efficient and widely used source of nitrogen fertilizer, we will be looking at the prices of anhydrous ammonia and potash prices. Overall, ammonia prices have exhibited significant volatility since the middle of 2021 as shown in figure 6 with that volatility continuing into the planning season for the 2023 crop. At the end of summer 2022, ammonia prices were $1,183 per ton, a low relative to the over $1,400 prices early in the year. For potash, potash prices were over $800 per ton for much of 2022, with an $866 per ton on December 15, 2022. Potash fell to $645 per ton on February 23, 2023. While fertilizer prices have declined in recent weeks, current prices are still high by historical standards. From 2016 to 2020, anhydrous ammonia prices averaged $518 per ton, $719 lower than the $1,237 price on February 23rd. Potash prices average $350 from 2016 to 2020, $295 lower than the $645 per ton current potash price.

Figure 6: Fertilizer prices per ton

Benefits of Nutrien’s vertical integration: Nutrien’s vertical integration has provided its ability to flex its production network so that they can adjust their production to changes market demands at a low and stable cost. This is important as they can influence different areas of the value chain, but also important in that they can create unique products based on needs.

Valuation

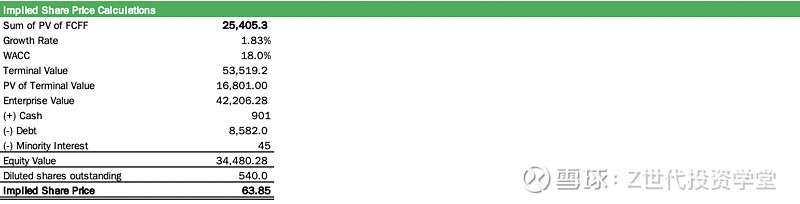

By doing a simple DCF analysis, we observed that the company is currently undervalued. Some assumptions taken in this analysis include:

WACC of 18%

Revenue projection based on the assumption that Nutrien can keep its market share amidst the growing Agriculture industry

Perpetuity growth of 1.83%

The analysis led us to the implied share price of US$ 63.85/share, which represents +8.48% of the current share price of US$ 58.87/share.

Prices for corn, soybeans, and wheat have recently declined as a result of seasonal pressure brought on by expectations of increased crop production in the US and Brazil. However, fresh crop futures are still around 15% above the 10-year average, and grower margins are still strong, giving farmers an incentive to make crop investments and increase production. Nutrien can expect increased global potash demand in the second half of 2023 as a result of lower expected inventories and improved grower affordability compared to 2022. Belarusian shipments will be down 25% to 40% this year and Russian shipments down 25% to 35% compared to 2021. These factors explains the lower performance for Nutrien in the near future.

Risks and Mitigation Strategies

Climate related risks (High): Physical risks from a changing climate can impact its operations, customers and supply chain. These include more intense weather events, longer droughts, rising sea levels, and changes in average temperature and precipitation patterns. Global decarbonization ambitions and the resulting energy transition are driving carbon regulations and informing capital allocation priorities of investors. Nutrien faces evolving transition risks related to potential regulatory changes, including carbon pricing.

Mitigating strategies:

Physical risks: Nutrien currently have its weather analytics system in place which uses atmospheric science to provide new perspectives for growers and crop consultants to better manage weather risks. Its whole-acre solutions and continued investment in technology have also helps improve s soil health, increase soil organic carbon sequestration, optimize nutrient-use efficiency, reduce GHG emissions, improve water quality and retain water while conserving and restoring biodiversity.

Transition risks: Minimisation of compliance costs through the implementation of various efficiency and emissions reduction projects, including cogeneration at Carseland, AB Nitrogen facility and at Cory, SK Potash mine and carbon capture, utilization and storage (“CCUS”). They supply CO2 from the Redwater, AB Nitrogen facility to the Alberta Carbon Trunk Line. They are currently also rolling out initiatives to N2O abatement technologies, energy efficiency improvements, expanding the use of CCUS technology, renewable energy options and low-carbon and clean ammonia development to reduce its scopes 1 and 2 operation emission intensity.

Volatility of the macroeconomic conditions: Trade tariffs, volatility in global markets, supply chain constraints, increased price competition, or a significant change in agriculture production or consumption trends could lead to a low crop price environment and reduced demand for our products or increased prices or decreased availability of raw materials used in making products. Geological and geopolitical events can result in disruptions to global supply, as was seen in 2022 with sanctions imposed on Belarus and Russia that limited the amount of potash shipments from these countries. In 2022, Nutrien estimated that Russian shipments were down approximately 30% and Belarussian shipments were down approximately 50% from 2021, constraining available supplies and resulting in shifting trade flow patterns.

Mitigating strategies: To cope with the potential supply shocks derived from the volatility of macroeconomic conditions, Nutrien’s low-cost, flexible operations are backed by a reliable supply chain. They are able to adjust their production plans by pulling forward some maintenance activities during downtimes which allowed them to preserve the flexibility to quickly ramp up production when demand re-emerge. The ability to respond timely to market demand at low cost is made possible through Nutrien’s flexible production capability. With that Nutrien has announced the ramping up of its annual operational capability to approximately 18 million tonnes in 2026.

ESG Assessment

In terms of its 2022 ESG ratings profile, Nutrien have outperformed its peer average across all esg ratings such as MSCI ESG ratings, S&P and Sustainalytics ESG risks ratings. Furthermore, as compared to its 2019 performance using the same metrics, they have improved across all ratings that have been considered which shows the improvement in its ESG efforts.

The company has announced to achieve at least a 30% reduction in its scopes 1 and 2 GHG emission intensity by 2023 from the baseline of 2018. In 2022, Nutrien’s scopes 1 and 2 emission intensity and absolute emissions have decreased in comparison with 2018 figures. Its scope 1 and 2 GHG intensity have reduced by 4% and 14% respectively. With regards to its scope 3 emissions, they have yet to conclude a reduction target but is currently working on its measurement with external advisors to establish a Scope 3 emissions data collection, quantification and reporting process.

According to its AR, its Nitrogen operating segment is the largest contributor to its overall GHG emissions. However, Nutrien is uniquely positioned well in the carbon space of the agriculture industry. They are vertically integrated from mine to farm which provided them with the ability to influence at different areas of the value chain. Given that they are one of the largest Nitrogen production company globally and the higher potency of nitrogen molecules, this calls for the need for Nutrien to manage its emissions effectively.

Conclusion

In the near future, the global agriculture commodities markets continue to be impacted by geopolitical and weather-related issues, such as Ukraine's considerable output and export reductions and Argentina's catastrophic drought conditions. Given Nutrien’s strategic and flexible production mine network, it can help them to cater to fluctuations in demand at a lower price which is more favourable as compared to its competitors. Increase in demand for potash over the years coupled with the reduced in supply of Potash suggests that Nutrien will be able to capture a larger market better than its peers.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接