Company Overview:

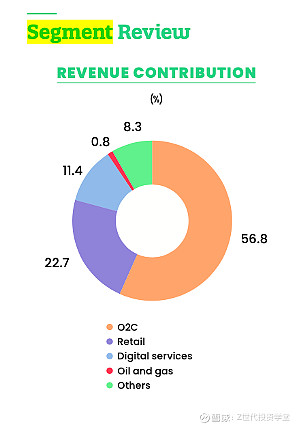

Reliance Industries Limited (RIL) is the largest Indian private sector company. It is a conglomerate with business segments in Oil to Chemicals (O2C), Retail, Digital Services, Oil and Gas, and Media and Entertainment. As of FY2022, it has 56.8% of revenues from O2C, 22.7% Retail, 11.4% Digital Services, 8.3% Media and Entertainment and 0.8% Oil and Gas exploration and production (E&P).

The O2C segment consists of plants and manufacturing assets in India and Malaysia, manufacturing and distributing transportation fuels, polymers and elastomers, intermediates and polyesters. As RIL has a 51% equity interest in a fuel retailing joint venture with bp– Reliance BP Mobility Limited (RBML) which operates under the brand Jio-bp, it launched its first Jio-bp branded Mobility Station in India which signals the start of its rebranding process for all 1460 fuel outlets RBML operates in India. These Mobility Stations bring together a range of services for consumers on the move – including additivised fuels, EV charging, refreshments & food, and plan to offer more low carbon solutions, e.g., battery swapping and hydrogen.

RIL's retail segment (Reliance Retail) comprises consumer electronics, fashion & lifestyle, groceries. Its end-to-end retail strategy consists of its e-commerce platform JioMart, digital commerce platforms connected to retail outlets and numerous other store concepts for different products. Its retail store count in FY2022 increased by over 2500 to 15196, and its retail area increased by 11.1 million sqft to 41.6 million sqft. Reliance Retail has been rapidly expanding, with merchant partners growing 3x YoY and digital commerce orders growing 2.5x YoY. The registered customer base was 193 million, a growth of 24% YoY. As of March 31, 2023, the retail segment has added 2844 retail stores and 24 million sqft of retail area since the end of FY2022, showing no signs of slowing down([1]). As a result, revenues and EBITDA for the retail segment have increased 26% YoY.

The Digital Services segment includes an ecosystem of products and services under Jio, India’s largest digital services platform with a total subscriber base of 410 million across mobility and fixed broadband as of March 2022. Jio has the largest single-country subscriber base and carries the highest volume of data traffic globally, excluding China, with over 7.5 billion GB of monthly data traffic in FY2022. Jio has a range of ecosystem platforms for connectivity and cloud (JioCloud, JioSwitch), retail (JioMart, JioPay) , media/gaming (JioGameslite, JioGamesCloud) and education (JioMeet, JioEducation). Revenue and EBITDA have grown 11% and 18% YoY respectively.

RIL's Media and Entertainment segment operates under Network18 Media & Investments, providing news and entertainment through TV, digital platforms (Network18 Digital) and cinema, with its business model generating revenue through advertising, subscriptions, content production and content syndication. Revenue and EBITDA has increased 25% and 36% respectively YoY.

RIL's Oil and Gas E&P segment is the smallest contributor to its revenue, at only 0.8%. RIL focuses on natural gas, with production levels in FY2022 at 0.2 MMBL of oil and 234.5 BCF natural gas.

Figure 1. RIL's revenue contribution by segments([2]).

Industry overview

The oil refinery and petrochemicals industry have been receiving tailwinds in the forms of the post Covid-19 rebound and Russia's invasion of Ukraine driving oil prices up. However, decarbonisation goals and regulations pose transition risks for the industry as companies and countries race to net zero. Based on current policies, the growth in world oil demand is set to slow significantly from 2022-2028 as the energy transition advances([3]). Overall oil consumption, however, will still grow ~5.5% to an estimated 105.7mb/d in 2028, from 99.8mb/d in 2022. Demand for oil is set to peak in 2030, and then slow down as alternative energy become more developed. Importantly, demand for oil from combustible fossil fuels is estimated to peak at 81.6mb/d in 2028, as the global energy crisis, decarbonisation policies and developments in EVs push the pivot to lower emission energy sources. In contrast, demand for petrochemical feedstocks will continue to grow as economies grow([4]). The major oil-derived petrochemical feedstocks are ethane, liquid petroleum gas (LPG), and naphtha, which are primarily used in the production of polymers for plastics, synthetic fibers, and other petrochemical intermediates.

Competitor Analysis

RIL's main competitors are Oil and Natural Gas Corp Ltd, Bharat Petroleum Corp Ltd. These two companies have two operating segments: Refining and marketing of petroleum products, and exploration and production of hydrocarbons.

This places RIL in a unique position and outlines the economic moat of RIL. In light of the decarbonisation trends and shifting demands of oil products, RIL has diversified, generating almost half of their revenues (42.4%) from industries outside of Oil & Gas. This provides RIL a cushion to aid their transition to lower emission production in their O2C segment, and in the production of clean energy. Even in their retail and digital services segments, they are dominating in India. In these two segments, the threat of new entrants is low, given how established RIL has grown in India.

Investment Theses

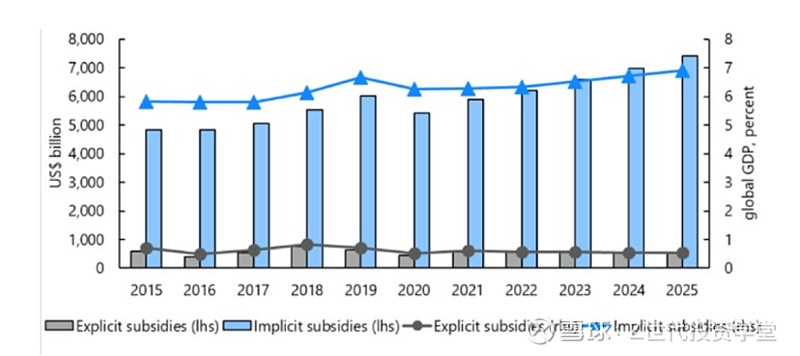

Investment Thesis 1: RIL is more well poised than others in the industry in tackling decarbonisation risks due to their diversification. With 42.4% of their revenues being generated outside of the Oil & Gas industry, this provides a safety net for RIL to decarbonise their operations in the industry. As carbon prices increase, Oil & Gas companies facing higher carbon costs will either need to absorb these new carbon costs, lowering profit margins, or pass the costs on to consumers, thereby increasing prices. Higher prices can incentivise consumers to shift to less carbon-intensive alternatives. This is a key driver for R&D in the industry for companies to decarbonise their operations, and to position their business models to shift away from traditional Oil & Gas. Public policy restrictions are also a key driver- e.g., G7 and G20 nations have released statements on ending subsidies for the Oil & Gas sector([5]). This would have significant impact on the industry, given the amount of subsidies provided currently (Fig. 2) The removal of subsidies in Saudi Arabia in 2016 led to petrochemical companies reporting profit reductions of between 6.5 and 44.1%. The transition risks are fully outlined in Table 1. RIL's strong diversification sets them apart from their competitors and provides a strong starting point for them to avoid these risks and even capitalise from them in their clean energy business (Investment Thesis 2).

Figure 2. Global fossil fuel subsidies from 2015 to 2025([6]).

Investment Thesis 2:

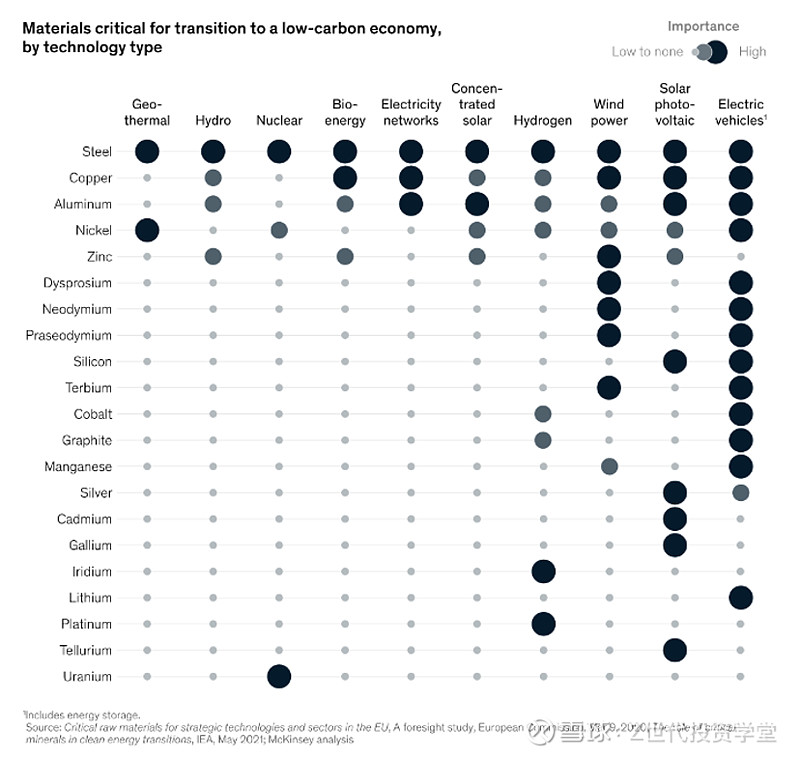

As the world moves toward net zero, the metals and mining sector will have to provide raw materials for new infrastructure as we transition from fossil fuels to wind, solar and alternative power generation, EVs and hydrogen production (Figure 3). As a result, the metals & mining sector is set to grow faster([7]).

Figure 3. Materials critical for transition to a low-carbon economy, by technology type.

Electrification is a key part of the journey of decarbonisation. However, the low electricity energy density can pose challenges for heavy-duty operations like metals and mining due to a few reasons:

Power Demand: Heavy-duty operations such as mining require a significant amount of power to operate machinery and equipment. The limited energy density of electricity means that large amounts of power need to be delivered, and these high power requirements can strain electrical infrastructure if not adequately designed or supplied.

Transmission and Distribution: Electricity needs to be transmitted and distributed from power generation sources to the mining site. However, electricity transmission over long distances can lead to energy losses due to resistance in power lines. For remote mines, the infrastructure required to transmit electricity can be expensive and challenging to establish.

Storage Capacity: Mining operations often require a continuous and reliable power supply. However, intermittent power supply or disruptions can have significant impacts on mining operations, leading to downtime, decreased productivity, and potential safety issues. High energy density in storage solutions, such as batteries, is crucial to ensure sufficient power availability during peak demand periods or in cases of power outages.

Mobility and Flexibility: Some mining operations require mobility and flexibility in equipment and operations. Electric-powered heavy machinery may face limitations due to the energy density of batteries, which can impact their range, operational time, and the need for frequent recharging or battery replacements. In contrast, fossil fuel-powered equipment usually offer higher energy densities, allowing for longer operating times without refueling.

Although advancements in battery technology and the integration of renewable energy sources into mining operations are gradually addressing some of these challenges, the limitations of electricity energy density continue to influence the feasibility and efficiency of heavy-duty operations like mining.

As a result, hydrogen-powered operations are the way forward in the metals and mining industry, as acknowledged by many key players like Rio Tinto and Vale. These companies are investing in equipment and infrastructure to allow for the production of steel from iron ores using hydrogen, which results in zero carbon steel. However, current obstacles include storage, transport and price of green hydrogen. With respect to storage and transport, hydrogen shares similar challenges with electricity. However, technology is developing to improve their economics. Furthermore, hydrogen has a much greater energy density than electricity and does not rely on the grid for transmission, which would benefit remote mining operations. RIL intends to produce green hydrogen on a massive scale, aims to produce hydrogen at $1/kg by 2030([8]).

In terms of production costs, one ton of steel currently costs in the order of $490, which includes about $60 required for the coal used. Replacing this coal with hydrogen would require around $220 worth of hydrogen at current best prices ($4.4/kg), which would increase the total price of a ton of steel by about one third([9]). If the large-scale production of hydrogen drives down the price of hydrogen to $1/kg by 2030, steel produced with green hydrogen would be cheaper to produce than conventional steel.

In this context, RIL aims to build four Giga factories to manufacture and integrate critical components of the new energy ecosystem.

Solar Photovoltaic Giga Factory

Advanced Energy Storage Giga Factory

Electrolyser and Hydrogen value chain

In 2021, RIL's chairman announced plans to invest Rs 75,000 crore ($9.15Bn) in their end-to-end renewable energy ecosystem. With RIL's plans to build an entire green hydrogen ecosystem and with the resources it has, I believe RIL will be able to capture both India's green hydrogen market and globally.

Investment Thesis 3: India's growing consumer demand as a developing economy will drive growth in RIL's retail and digital services segments.

Digital Services: Jio’s network carried almost 10% of global mobile data traffic in CY2021. Jio remains the broadband network of choice with over 50% share of data traffic in India. Average data traffic per smartphone in the India region is the highest globally, together with GCC. It is projected to grow from 26 GB/month in 2022 to ~62 GB/month in 2028 at a CAGR of 16%. Total mobile data traffic is estimated to grow from 18 EB/month in 2022 to 58 EB/month in 2028, a 3.2x increase, growing at a CAGR of 22 percent. This is driven by high growth in the number of smartphone users and increased average usage per smartphone. Smartphone subscriptions in India as a percentage of total mobile subscriptions are expected to grow from 76 percent in 2022 to 93 percent in 2028. Jio’s device strategy and sustained investments in digital will be key to this enhanced data usage.

Retail: India's retail industry is expected to continue to grow at 9-10% CAGR to reach approximately $2 Tn by 2032, from $836 Bn in 2022 and 81.5% contribution from traditional retail([10]). Indian shoppers from Tier II and Tier III cities comprise ~61% of the total market share in FY 2022 in comparison to 53.8 percent in FY 2021([11]). Tier II and III cities showed growth of 92.2 percent and 85.2 percent in e-commerce, respectively, growing more rapidly than Tier I cities (47.2%). In 2023, tier II and III cities dominance is likely to continue. RIL is capturing this market, with 75% of their new stores in Tier II and below cities, and 2.5x

growth in e-commerce sales in FY22. In fact, Reliance Retail is growing at a faster rate than the general Indian retail market, showing its effectiveness in capturing market share. With Reliance Retail showing continuous rapid growth, we can look forward to seeing its retail segment prosper.

Risks

A key risk for the company is if the production and utilisation of green hydrogen at scale cannot be achieved within this decade. Green hydrogen today is still at least 2.5-4.0x the price of oil, excluding the costs of transport. This would delay the company's plans to transition to low carbon operations which would have incur climate-related costs as highlighted in Table 1. However, I think that RIL has sufficient room for error in the form of its diversification in the retail and digital services segments, which allows it to expand further in those spaces should its new energy ecosystem take longer than expected to establish.

Table 1. Key climate risks for the oil & gas sector([12]).

Another key risk is regarding RIL's retail and digital services segments. Although RIL is dominating the Indian market, other players outside of India have already expanded outside of their domestic markets and have been capturing market share globally for years. Think Alibaba, Amazon, Tencent with similar ecosystems. It will be difficult for RIL to capture market share outside of India, with these players already established or establishing globally. However, RIL is still uniquely positioned in the Indian market, which is a rapidly growing market, so I believe that in the short to medium term, RIL will still maintain its competitive advantage.

ESG considerations

RIL has announced its targets to become a Net Carbon Zero company by 2035, and it has shown that it walks the talk. Its rapid diversification outside of oil & gas to contribute to a 'Digital India' has proven to be very successful and positions it well to cope with climate risks, as mentioned in section 5. Its expansion into new energy ecosystems is also part of its strategy to reach net zero and shows promise.

However, RIL's corporate governance poses some risk for the company. RIL is family-owned which although helps with stability for investors, there may be risks in terms of shareholder rights. The board also has multiple non-independent directors which means the management has strong influence within the board. The CEO and Chairman are held by the same individual- Mukesh D. Ambani, which further advances management's influence on the board. It would be to shareholders' benefit if RIL's board nominated more independent directors so as to prevent conflict of interests.

Valuation and Conclusion

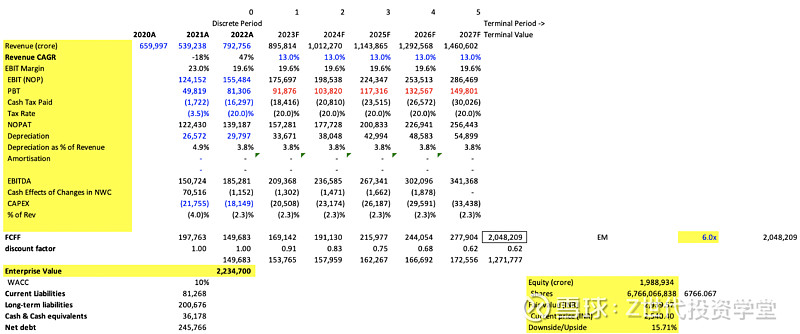

By conducting a DCF analysis, we can see RIL is currently slightly undervalued.

The assumptions in this analysis include:

WACC of 10%

CAGR of 13%

Enterprise Multiple of 6.0x

This DCF analysis implies a fair value of INR 2939.57/share, with an upside of 15.71% from the current share price of INR 2541.40.

Therefore, the current recommendation for RIL is BUY. Moving forward, we should monitor RIL closely for developments in its new energy ecosystem which will act as catalysts for the company. I believe that in the mid-long term, its new energy ecosystem will be a strong driver for RIL's growth. The CAGR of 13%, given that the future of its new energy ecosystem is still uncertain, is slightly conservative given the company's record growth. In the short term, its retail and digital services segment will continue to help the company grow.

([1]) 网页链接

([2]) 网页链接

([3]) 网页链接

([4]) 网页链接

([5]) 网页链接

([6]) 网页链接)%20continues%20to%20climb.

([7]) 网页链接

([8]) 网页链接

([9]) 网页链接(2020)641552_EN.pdf

([10]) 网页链接

([11]) 网页链接

([12]) 网页链接

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接