致伯克希尔哈撒韦公司股东:

Berkshire earned $4.0 billion in 2018 utilizing generally accepted accounting principles (commonly called “GAAP”). The components of that figure are $24.8 billion in operating earnings, a $3.0 billion non-cash loss from an impairment of intangible assets (arising almost entirely from our equity interest in Kraft Heinz), $2.8 billion in realized capital gains from the sale of investment securities and a $20.6 billion loss from a reduction in the amount of unrealized capital gains that existed in our investment holdings.

2018年伯克希尔利润为40亿美元(GAAP下)。包括24.8亿美元的运营利润、30亿美元的非现金形式的无形资产减记(主要来自卡夫亨氏)、28亿美元的资本利得(来自出售可投资证券)、206亿美元的亏损(来自投资组合的未实现资本损失)。

A new GAAP rule requires us to include that last item in earnings. As I emphasized in the 2017 annual report, neither Berkshire’s Vice Chairman, Charlie Munger, nor I believe that rule to be sensible. Rather, both of us have consistently thought that at Berkshire this mark-to-market change would produce what I described as “wild and capricious swings in our bottom line.”

GAAP新规要求将未实现的投资组合资本损益计入利润统计中。 正如我在2017年年度报告中强调的那样,我和伯克希尔副董事长芒格都表示反对。 相反,我们俩都一直认为,在伯克希尔,这种按市价计价的变化会令伯克希尔的利润发生狂野且反复无常的波动。

The accuracy of that prediction can be suggested by our quarterly results during 2018. In the first and fourth quarters, we reported GAAP losses of $1.1 billion and $25.4 billion respectively. In the second and third quarters, we reported profits of $12 billion and $18.5 billion. In complete contrast to these gyrations, the many businesses that Berkshire owns delivered consistent and satisfactory operating earnings in all quarters. For the year, those earnings exceeded their 2016 high of $17.6 billion by 41%.

2018年的季报证明了以这一点。第一和第四季度,我们分别录得11亿和254亿美元损失(GAAP下)。 而第二和第三季度,我们又录得120亿美元和185亿美元利润。 与此形成鲜明对比的是,伯克希尔旗下各家公司在去年所有季度都拥有持续且令人满意的营业利润,超过2016年利润高峰176亿美元的幅度高达41%。

Wide swings in our quarterly GAAP earnings will inevitably continue. That’s because our huge equity portfolio – valued at nearly $173 billion at the end of 2018 – will often experience one-day price fluctuations of $2 billion or more, all of which the new rule says must be dropped immediately to our bottom line. Indeed, in the fourth quarter, a period of high volatility in stock prices, we experienced several days with a “profit” or “loss” of more than $4 billion.

我们季度GAAP收益的大幅波动将不可避免地继续下去。 那是因为我们的巨额股权投资组合 - 在2018年底价值接近1730亿美元 - 通常会出现一天超过20亿美元的波动。而这些按照新的GAAP规则必须立即计入利润。 的确,在四季度,股价高位震荡的时期,我们经历了“盈利”或“亏损”超过40亿美元的几天。

Our advice? Focus on operating earnings, paying little attention to gains or losses of any variety. My saying that in no way diminishes the importance of our investments to Berkshire. Over time, Charlie and I expect them to deliver substantial gains, albeit with highly irregular timing.

我们的建议? 专注于营业利润,不要关注收益或损失。 但这并不意味这我们将削弱投资对伯克希尔投资的重要性。我和查理始终希望投资能为我们带来可观的收益,尽管它拥有高度不确定性。

**********

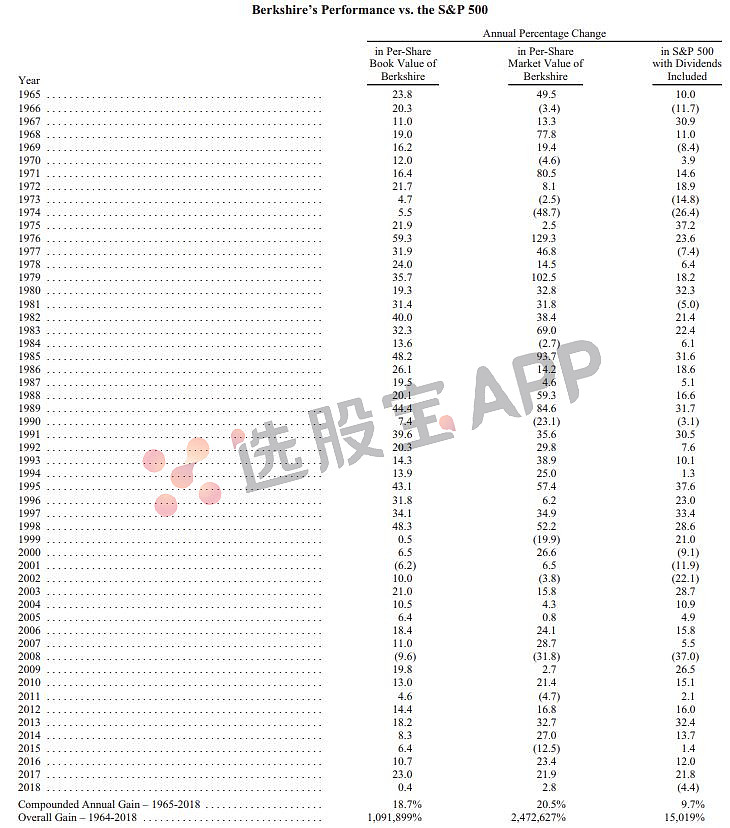

Long-time readers of our annual reports will have spotted the different way in which I opened this letter. For nearly three decades, the initial paragraph featured the percentage change in Berkshire’s per-share book value. It’s now time to abandon that practice.

我们的老读者会发现今年的股东信发生了变化。 过去三十年,我们总是会在开头提到伯克希尔每股账面价值的变化。现在是时候放弃这种做法了。

The fact is that the annual change in Berkshire’s book value – which makes its farewell appearance on page 2 – is a metric that has lost the relevance it once had. Three circumstances have made that so. First, Berkshire has gradually morphed from a company whose assets are concentrated in marketable stocks into one whose major value resides in operating businesses. Charlie and I expect that reshaping to continue in an irregular manner. Second, while our equity holdings are valued at market prices, accounting rules require our collection of operating companies to be included in book value at an amount far below their current value, a mismark that has grown in recent years. Third, it is likely that – over time – Berkshire will be a significant repurchaser of its shares, transactions that will take place at prices above book value but below our estimate of intrinsic value. The math of such purchases is simple: Each transaction makes per-share intrinsic value go up, while per-share book value goes down. That combination causes the book-value scorecard to become increasingly out of touch with economic reality.

事实上每股账面价值已经失去了相关性,有三大原因导致了这一现象。首先,伯克希尔逐渐从资产集中在可销售股票的公司,转变为主要价值在于经营业务的公司。其次,虽然我们持有的股权按市场价格计算,但会计规则要求我们用账面价值来记录我们旗下公司的价值,而这远低于当前市价。第三,未来伯克希尔很可能将回购股票,交易价格将高于账面价值、但低于我们估计的内生价值。回购将令每股内生价值上升、每股账面价值下降,将导致账面价值越来越与经济现实脱节。

In future tabulations of our financial results, we expect to focus on Berkshire’s market price. Markets can be extremely capricious: Just look at the 54-year history laid out on page 2. Over time, however, Berkshire’s stock price will provide the best measure of business performance.

在未来的财务业绩表中,我们期望关注伯克希尔的市场价格。 市场可以非常反复无常:只要看看第2页列出的54年历史。然而,随着时间的推移,伯克希尔的股价才是反应我们经营业绩的最佳指标。

**********

Before moving on, I want to give you some good news – really good news – that is not reflected in our financial statements. It concerns the management changes we made in early 2018, when Ajit Jain was put in charge of all insurance activities and Greg Abel was given authority over all other operations. These moves were overdue. Berkshire is now far better managed than when I alone was supervising operations. Ajit and Greg have rare talents, and Berkshire blood flows through their veins.

在继续之前,我想给你一些好消息 - 真正的好消息 - 这些都没有反映在我们的财报中。2018年初管理层发生变动,Ajit Jain负责保险业务,Greg Abel负责其他所有业务。事实证明这个变化早就应该推进了。伯克希尔现在的管理得比我独自管理时要好得多。 阿吉特和格雷格拥有难得的天赋,同时也拥有伯克希尔的基因和价值观。

Now let’s take a look at what you own.

现在让我们来看看你拥有的东西。

专注于森林 - 忘记树木

Investors who evaluate Berkshire sometimes obsess on the details of our many and diverse businesses – our economic “trees,” so to speak. Analysis of that type can be mind-numbing, given that we own a vast array of specimens, ranging from twigs to redwoods. A few of our trees are diseased and unlikely to be around a decade from now. Many others, though, are destined to grow in size and beauty.

评估伯克希尔的投资者有时会对我们众多不同业务的细节——我们的“每一棵树”都仔细研究。考虑到我们拥有大量的投资标的,就如同在森林中有种类繁多的树种一样,这种分析的结果可能会让人头脑麻木。我们的一些树木会生病,但是病期不会超过十年。与此同时,还有大量其他树木在茁壮成长。

Fortunately, it’s not necessary to evaluate each tree individually to make a rough estimate of Berkshire’s intrinsic business value. That’s because our forest contains five “groves” of major importance, each of which can be appraised, with reasonable accuracy, in its entirety. Four of those groves are differentiated clusters of businesses and financial assets that are easy to understand. The fifth – our huge and diverse insurance operation – delivers great value to Berkshire in a less obvious manner, one I will explain later in this letter.

幸运的是,投资者没有必要单独评估每棵树,并以此来估算伯克希尔内在的商业价值。那是因为我们的森林包含五个重要的“小树林”,每个小树林都可以以合理的准确度进行评估。其中四个是易于理解的差异化企业和金融资产集群。第五个——我们庞大而多样化的保险业务——以不太明显的方式为伯克希尔提供了巨大的价值。

Before we look more closely at the first four groves, let me remind you of our prime goal in the deployment of your capital: to buy ably-managed businesses, in whole or part, that possess favorable and durable economic characteristics. We also need to make these purchases at sensible prices.

在我们更仔细地研究前四个树林之前,让我提醒一下您在资本配置中的首要目标:购买具有良好和持久发展特征公司的股票——全仓或者分散买都可以。当然,我们在购买这些股票的时候,还要以合理的价格来购买。

Sometimes we can buy control of companies that meet our tests. Far more often, we find the attributes we seek in publicly-traded businesses, in which we normally acquire a 5% to 10% interest. Our two-pronged approach to huge-scale capital allocation is rare in corporate America and, at times, gives us an important advantage.

有时我们可以买下符合条件公司的控制权,但是我们更通常的做法是,在公司公开交易的股份中,我们买下5%到10%的股份。我们这种双管齐下的投资策略在美国很少见,但这种策略也给我们带来了重要优势。

In recent years, the sensible course for us to follow has been clear: Many stocks have offered far more for our money than we could obtain by purchasing businesses in their entirety. That disparity led us to buy about $43 billion of marketable equities last year, while selling only $19 billion. Charlie and I believe the companies in which we invested offered excellent value, far exceeding that available in takeover transactions.

近年来,我们遵循的这一明智之路已经获得了很明确的收益:许多我们分散购买的股票为我们提供的利益比我们买下整个公司获得的利益要大得多。这种差异化的交易策略,让我们在去年买入了约430亿美元公开发售的股票,但是我们仅仅抛了190亿美元的股票。我们相信,我们投资的公司为我们提供了极好的价值,远远超过了收购这些公司带来的价值。

Despite our recent additions to marketable equities, the most valuable grove in Berkshire’s forest remains the many dozens of non-insurance businesses that Berkshire controls (usually with 100% ownership and never with less than 80%). Those subsidiaries earned $16.8 billion last year. When we say “earned,” moreover, we are describing what remains after all income taxes, interest payments, managerial compensation (whether cash or stock-based), restructuring expenses, depreciation, amortization and home-office overhead.

除了在股票投资上或以之外,伯克希尔森林体系中最有价值的一个小树林依然是数十个伯克希尔控股的非保险公司(我们在这些公司的股份通常是100%,没有低于80%的)。这些子公司在去年为我们贡献了168亿美元的净利润(在扣除各种税费之后)。

That brand of earnings is a far cry from that frequently touted by Wall Street bankers and corporate CEOs. Too often, their presentations feature “adjusted EBITDA,” a measure that redefines “earnings” to exclude a variety of all-too-real costs.

这一定义与华尔街银行家和一些CEO们常常兜售的概念相去甚远。他们通常会使用“调整后的EBITDA”,这种方法把一些应当计入的成本排除在外。

For example, managements sometimes assert that their company’s stock-based compensation shouldn’t be counted as an expense. (What else could it be – a gift from shareholders?) And restructuring expenses? Well, maybe

last year’s exact rearrangement won’t recur. But restructurings of one sort or another are common in business – Berkshire has gone down that road dozens of times, and our shareholders have always borne the costs of doing so.

例如,管理层有时会断言他们的股票激励不应该算作费用。 (还能算做什么 -来自股东的 礼物 ?)重组费用? 也许去年的重组不会再发生。 但是,这各种重组非常常见 - 伯克希尔已经走了几十次这条路,我们的股东一直承担着这样做的代价。

Abraham Lincoln once posed the question: “If you call a dog’s tail a leg, how many legs does it have?” and then answered his own query: “Four, because calling a tail a leg doesn’t make it one.” Abe would have felt lonely on Wall Street.

亚伯拉罕·林肯(Abraham Lincoln)曾提出过这样一个问题:“如果你把狗的尾巴称为腿,它有多少条腿?”然后回答了他自己的疑问:“四条,因为把尾巴称为一条腿并不能使他真正成为一条腿。”

Charlie and I do contend that our acquisition-related amortization expenses of $1.4 billion (detailed on page K-84) are not a true economic cost. We add back such amortization “costs” to GAAP earnings when we are evaluating both private businesses and marketable stocks.

我们认为,伯克希尔与收购相关的14亿美元的摊销费用并不是真正的经济成本。当我们评估私营企业和公开发售股票时,我们将这部分摊销“成本”加回到GAAP下的收益中。

In contrast, Berkshire’s $8.4 billion depreciation charge understates our true economic cost. In fact, we need to spend more than this sum annually to simply remain competitive in our many operations. Beyond those “maintenance” capital expenditures, we spend large sums in pursuit of growth. Overall, Berkshire invested a record $14.5 billion last year in plant, equipment and other fixed assets, with 89% of that spent in America.

伯克希尔的84亿美元折旧费低估了我们的真实经济成本。事实上,我们需要每年花费超过这笔金额,以便在我们的许多业务中保持竞争力。除此之外“维护”资本支出,我们花费大量资金追求增长。总体而言,伯克希尔去年在工厂,设备和其他固定资产方面的投资达到创纪录的145亿美元,其中89%用于美国。

Berkshire’s runner-up grove by value is its collection of equities, typically involving a 5% to 10% ownership position in a very large company. As noted earlier, our equity investments were worth nearly $173 billion at yearend, an amount far above their cost. If the portfolio had been sold at its yearend valuation, federal income tax of about $14.7 billion would have been payable on the gain. In all likelihood, we will hold most of these stocks for a long time. Eventually, however, gains generate taxes at whatever rate prevails at the time of sale.

按价值计算,排在第二名的小树林是我们的股权投资,我们通常投在那些大公司5%至10%的股权。我们的股权投资在年底时价值接近1730亿美元,远高于其成本。如果我们将这些投资按照年底的估值售,那么将缴纳约147亿美元的联邦所得税。不过,我们很有可能将长时间持有其中大部分的股票。

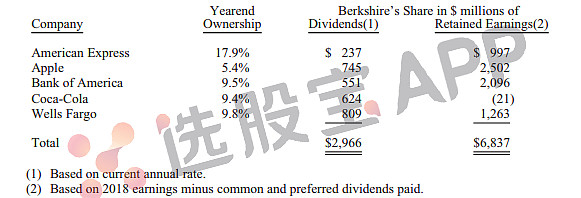

Our investees paid us dividends of $3.8 billion last year, a sum that will increase in 2019. Far more important than the dividends, though, are the huge earnings that are annually retained by these companies. Consider, as an

indicator, these figures that cover only our five largest holdings.

去年,我们还获得了这些投资标的38亿美元的分红,这笔款项将在2019年增加。我们在此公布我们从持有最多价值股票的五家公司获得的分红情况:

(1)根据目前的年率。

(2)基于2018年的收益减去已支付的普通和优先股息。

GAAP – which dictates the earnings we report – does not allow us to include the retained earnings of investees in our financial accounts. But those earnings are of enormous value to us: Over the years, earnings retained by our investees (viewed as a group) have eventually delivered capital gains to Berkshire that totaled more than one dollar for each dollar these companies reinvested for us.

GAAP - 它决定了我们报告的收益 - 不允许我们包括的留存收益投资对象在我们的财务账户中。 但这些收益对我们来说具有巨大价值:多年来,收益保持不变。我们的被投资者(被视为一个集团)最终为伯克希尔提供了不止一笔资金。这些公司为我们再投资的每一美元的美元。

All of our major holdings enjoy excellent economics, and most use a portion of their retained earnings to repurchase their shares. We very much like that: If Charlie and I think an investee’s stock is underpriced, we rejoice when management employs some of its earnings to increase Berkshire’s ownership percentage.

我们投资的主要股票都有出色的经济收益,而且大部分公司都使用部分留存收益来回购股票。我们非常喜欢这样:如果我们认为被投资公司的股票价格被低估,那么当管理层将其部分收益用于增加伯克希尔的所有权比例时,我们感到高兴。

Here’s one example drawn from the table above: Berkshire’s holdings of American Express have remained unchanged over the past eight years. Meanwhile, our ownership increased from 12.6% to 17.9% because of repurchases made by the company. Last year, Berkshire’s portion of the $6.9 billion earned by American Express was $1.2 billion, about 96% of the $1.3 billion we paid for our stake in the company. When earnings increase and shares outstanding decrease, owners – over time – usually do well.

以上是从上表中得出的一个例子:伯克希尔持有的美国运通股份过去八年中没有变化。 同时,由于公司回购,我们的所有权从12.6%增加到17.9%。 去年,伯克希尔公司在美国运通公司获得12亿美元收益,约占我们为运通股权支付的13亿美元的96%。 当利润增加、在外流通股减少,这通常是件好事。

A third category of Berkshire’s business ownership is a quartet of companies in which we share control with other parties. Our portion of the after-tax operating earnings of these businesses – 26.7% of Kraft Heinz, 50% of Berkadia and Electric Transmission Texas, and 38.6% of Pilot Flying J – totaled about $1.3 billion in 2018.

第三类则是伯克希尔公司与其他方共享控制权的公司。我们在这些业务中的部分税后利润——包括卡夫亨氏的26.7%,Berkadia和德国电力传输的50%,以及Pilot Flying J的38.6%——在2018年总计约13亿美元。

In our fourth grove, Berkshire held $112 billion at yearend in U.S. Treasury bills and other cash equivalents, and another $20 billion in miscellaneous fixed-income instruments. We consider a portion of that stash to be untouchable, having pledged to always hold at least $20 billion in cash equivalents to guard against external calamities. We have also promised to avoid any activities that could threaten our maintaining that buffer.

在我们森林体系的第四部分,伯克希尔在年底持有1120亿美元的美国国库券和其他现金等价物,以及另外200亿美元的各类固定收益工具。我们认为这部分资金平时是不会轻易动的,我们承诺始终持有至少200亿美元的现金等价物以防范各类意外。

Berkshire will forever remain a financial fortress. In managing, I will make expensive mistakes of commission and will also miss many opportunities, some of which should have been obvious to me. At times, our stock will tumble as investors flee from equities. But I will never risk getting caught short of cash.

有时,随着投资者逃离股市,我们的股票将会下挫。但我永远不会冒现金短缺的风险。

In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own. The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects.

在未来几年,我们希望将大部分过剩流动资金转移到伯克希尔将永久拥有的业务中。然而,眼前可能并不是好的时机:那些拥有良好长期前景的企业股票价格现在是天价。

That disappointing reality means that 2019 will likely see us again expanding our holdings of marketable equities. We continue, nevertheless, to hope for an elephant-sized acquisition. Even at our ages of 88 and 95 – I’m the young one – that prospect is what causes my heart and Charlie’s to beat faster. (Just writing about the possibility of a huge purchase has caused my pulse rate to soar.)

这意味着,在2019年,我们将扩大公开市场交易股票投资的规模,但同时也会考虑对大公司的收购。

My expectation of more stock purchases is not a market call. Charlie and I have no idea as to how stocks will behave next week or next year. Predictions of that sort have never been a part of our activities. Our thinking, rather, is focused on calculating whether a portion of an attractive business is worth more than its market price.

我对更多投资股票的预期不是市场需求。我们并不知道下周或明年的股票表现会如何。我们也从未进行过这种预测。相反,我们的想法是专注于计算有吸引力的公司股票价格是否比市场价格更高。

**********

I believe Berkshire’s intrinsic value can be approximated by summing the values of our four asset-laden groves and then subtracting an appropriate amount for taxes eventually payable on the sale of marketable securities.

我相信伯克希尔的内在价值可以通过加总我们上述4个资产端的森林、减去税费得出。

You may ask whether an allowance should not also be made for the major tax costs Berkshire would incur if we were to sell certain of our wholly-owned businesses. Forget that thought: It would be foolish for us to sell any of our wonderful companies even if no tax would be payable on its sale. Truly good businesses are exceptionally hard to find. Selling any you are lucky enough to own makes no sense at all.

您可能会问,如果我们出售全资子公司时发生巨额税费支出,是不是应该进行补贴。 忘记这个想法:我们卖掉任何一个很棒的公司都是愚蠢的,即使不需要缴纳税款。 真正优秀的企业非常难找。 出售任何你有幸拥有的东西毫无意义。

The interest cost on all of our debt has been deducted as an expense in calculating the earnings at Berkshire’s non-insurance businesses. Beyond that, much of our ownership of the first four groves is financed by funds generated from Berkshire’s fifth grove – a collection of exceptional insurance companies. We call those funds “float,” a source of financing that we expect to be cost-free – or maybe even better than that – over time. We will explain the characteristics of float later in this letter.

我们在计算伯克希尔非保险业务的成本时,已将所有债务的利息成本扣除。 除此之外,我们对前四个树林的大部分所有权的资金,都来自伯克希尔的第五个小树林 - 一系列优秀的保险公司。 我们将这些资金称为“浮存金”,这是一种成本几乎为零、甚至拥有收益的资金来源。

Finally, a point of key and lasting importance: Berkshire’s value is maximized by our having assembled the five groves into a single entity. This arrangement allows us to seamlessly and objectively allocate major amounts of capital, eliminate enterprise risk, avoid insularity, fund assets at exceptionally low cost, occasionally take advantage of tax efficiencies, and minimize overhead.

最后,重要的一点:伯克希尔的价值最大化是由这五个小树林结合成一个有机整体。 这种安排使我们能够无缝地分配大量资金资本,消除企业风险,避免孤立,以极低的成本获取资金购买资产。

At Berkshire, the whole is greater – considerably greater – than the sum of the parts.

在伯克希尔,整体比部分的总和更大 - 相当大。

回购和报告

Earlier I mentioned that Berkshire will from time to time be repurchasing its own stock. Assuming that we buy at a discount to Berkshire’s intrinsic value – which certainly will be our intention – repurchases will benefit both those shareholders leaving the company and those who stay.

早些时候我提到伯克希尔将不时回购自己的股票。 假设我们回购的价格低于伯克希尔的内在价值 - 这当然是我们的意图 - 回购将使离开公司和留下来的股东都获得收益。

True, the upside from repurchases is very slight for those who are leaving. That’s because careful buying by us will minimize any impact on Berkshire’s stock price. Nevertheless, there is some benefit to sellers in having an extra buyer in the market.

诚然,回购的好处对于那些离开的股东来说非常轻微。 那是因为我们将谨慎回购,以尽量减少对伯克希尔股票价格的影响。 然而,这总归会吸引更多的买入者。

For continuing shareholders, the advantage is obvious: If the market prices a departing partner’s interest at, say, 90¢ on the dollar, continuing shareholders reap an increase in per-share intrinsic value with every repurchase by the company. Obviously, repurchases should be price-sensitive: Blindly buying an overpriced stock is valuedestructive, a fact lost on many promotional or ever-optimistic CEOs.

对于继续持有的股东而言,优点显而易见:如果市场价格发生扭曲,1美元价值只值90分,这时候如果公司回购,每股内在价值将会提升,继续持有的股东将会从中受益。 显然回购应该是对价格敏感的:在过高股价盲目买入是对股票价值的破坏,这一点被很多乐观的CEO们忽视了。

When a company says that it contemplates repurchases, it’s vital that all shareholder-partners be given the information they need to make an intelligent estimate of value. Providing that information is what Charlie and I try to do in this report. We do not want a partner to sell shares back to the company because he or she has been misled or inadequately informed.

重要的是,当一家公司表示它打算进行回购时,所有股东都应有权知晓其所需信息,以便对价值进行明智的估算。 提供这些信息是查理和我尝试的在这份报告中所做的。 我们不希望股东卖出股票,仅仅以为他被误导或并不充分知情。

Some sellers, however, may disagree with our calculation of value and others may have found investments that they consider more attractive than Berkshire shares. Some of that second group will be right: There are unquestionably many stocks that will deliver far greater gains than ours.

然而,一些卖家可能不同意我们的价值计算,而其他卖家可能已经找到了他们认为比伯克希尔股票更有吸引力的投资。 当然,的确有许多股票将比伯克希尔能带来更大的收益。

In addition, certain shareholders will simply decide it’s time for them or their families to become net consumers rather than continuing to build capital. Charlie and I have no current interest in joining that group. Perhaps we will become big spenders in our old age.

此外,某些股东认为是时候不需要再积累资本,而是可以成为一个纯消费者。 查理和我目前没有兴趣加入这个队伍。 当我们年老的时候可能需要非常大的开支。