Apple Inc. is likely to slash its projected iPhone 13 production targets for 2021 by as many as 10 million units as prolonged chip shortages hit its flagship product, according to people with knowledge of the matter.

The company had expected to produce 90 million new iPhone models in the last three months of the year, but it’s now telling manufacturing partners that the total will be lower because Broadcom Inc. and Texas Instruments Inc. are struggling to deliver enough components, said the people, who asked not to be identified because the situation is private.

The technology giant is one of the world’s largest chip buyers and sets the annual rhythm for the electronics supply chain. But even with strong buying power, Apple is grappling with the same supply disruptions that have wreaked havoc on industries around the world. Major chipmakers have warned that demand will continue to outpace supply throughout next year and potentially beyond.

Apple gets display parts from Texas Instruments, while Broadcom is its longtime supplier of wireless components. One TI chip in short supply for the latest iPhones is related to powering the OLED display. Apple also is facing component shortages from other suppliers.

Apple and TI representatives declined to comment. Broadcom didn’t respond to a request for comment.

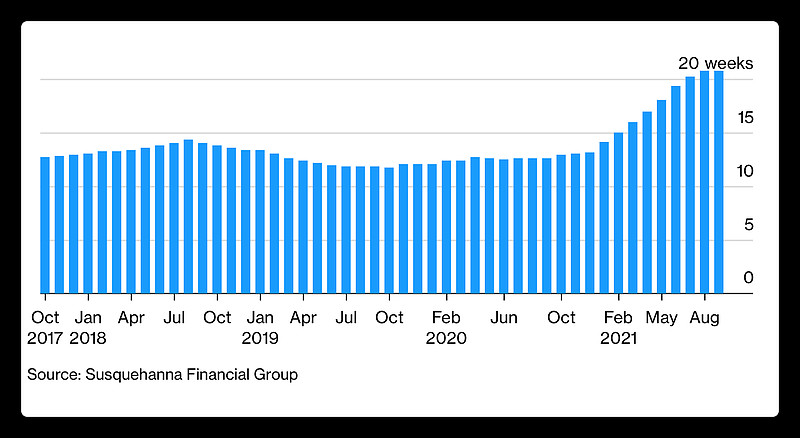

Waiting Game

The gap between ordering a chip and delivery hit a record 21.7 weeks

Source: Susquehanna Financial Group

Apple shares slipped as much as 1.6% to $139.27 in late trading after Bloomberg reported on the news. The stock was up 6.6% this year through Tuesday’s close. Broadcom and TI also dipped in after-hours trading.

The shortages have already weighed on Apple’s ability to ship new models to customers. The iPhone 13 Pro and iPhone 13 Pro Max went on sale in September, but orders won’t be delivered from Apple’s website for about a month. And the new devices are listed as “currently unavailable” for pickup at several of the company’s retail stores. Apple’s carrier partners are also seeing similar shipment delays.

Current orders are slated to ship around mid-November, so Apple could still get the new iPhones to consumers in time for the crucial holiday season. The year-end quarter is expected to be Apple’s biggest sales blitz yet, generating about $120 billion in revenue. That would be up about 7% from a year earlier -- and more money than Apple made in an entire year a decade ago.

Apple’s woes show that even the king of the tech world isn’t immune from global shortages made worse by the pandemic. In addition to facing tight iPhone availability, the company has struggled to make enough of the Apple Watch Series 7 and other products.

Earlier this year, Apple warned that it would face supply constraints of the iPhone and iPad during the quarter that ended in September. The Cupertino, California-based company cited the global chip shortages at the time. That period included about a week and a half of iPhone 13 revenue.

Broadcom doesn’t have major factories of its own and relies on contract chipmakers like Taiwan Semiconductor Manufacturing Co. to build its products. Texas Instruments makes some chips in-house, but also relies on outside manufacturing. That means they’re part of an increasingly challenging fight to secure production capacity at TSMC and other foundries. Apple is a TSMC client itself -- in fact, it’s the company’s largest. Apple uses the manufacturer to make its A-series processors, but they don’t appear to be under threat of shortages for now.

There are signs the chip crunch is getting worse. Lead times in the industry -- the gap between putting in a semiconductor order and taking delivery -- rose for the ninth month in a row to an average of 21.7 weeks in September, according to Susquehanna Financial Group.

To help untangle supply chain snarls, the U.S. Department of Commerce is asking global chipmakers to respond to a set of questionnaires by Nov. 8, but that effort is facing resistance from lawmakers and executives in Taiwan and South Korea.

U.S. Commerce Secretary Gina Raimondo tweeted earlier this week about a proposed $52 billion plan to support chip manufacturing in the U.S. Japanese Prime Minister Fumio Kishida also said he will work on establishing a chip production base in his country.

Separately, a protracted energy crisis in China may add to the iPhone maker’s headaches. Apple supplier TPK Holding Co. said last week that subsidiaries in the southeastern Chinese province of Fujian are modifying their production schedule due to local government power restrictions. That comes less than two weeks after iPhone assembler Pegatron Corp. adoptedenergy-saving measures amid government-imposed power curbs.

— With assistance by Mark Gurman, and Ian King

$立讯精密(SZ002475)$ $蓝思科技(SZ300433)$ $领益智造(SZ002600)$ 鹏鼎控股 东山精密 歌尔股份。。。。