别理德意志银行,这个消息也是JACK HU的:

Mindray (NYSE: MR) stock gained Thursday on rumors it was approached by private equity, including CITIC PE, who denied speculation. In the view of analyst Jack Hu of Deutsche Bank, privatization is unlikely.

"While such speculation for privatization is not new, we believe it is unlikely," said Hu. "Based on our communication with senior management during the past decade, we believe the founders are focusing on long term growth of the company instead of unlocking share value for the near term."

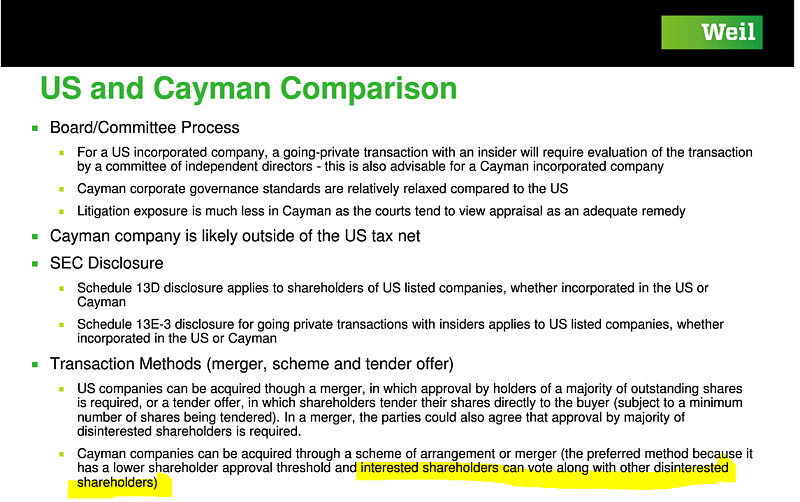

"Having been listed in the US since 2007, we do not think the story of Mindray has been misunderstood by global investors. It is hard to believe investors’ perception would dramatically change upon a change of the listing venue. Likewise, Mindray has sufficient cash for M&A. Therefore we believe privatization/re-listing may not be on the agenda for the management of Mindray," added the analyst. "That being said, we believe management continues to stay open for being acquired, the key issue is acquisition premium."

Deutsche Bank maintained a Buy rating on Mindray Medical with a price target of $34.

For an analyst ratings summary and ratings history on Mindray Medical click here. For more ratings news on Mindray Medical click here.

Shares of Mindray Medical closed at $ 30.71 yesterday.