问题索引

民间集资诈骗的背景/土壤?

情歌爆发的的背景/土壤?

1993的房地产泡沫是海南地方性还是更大范围的?

分税制解决什么问题?国际经验?

人性本恶or人性本善?

巴菲特1991-1993对鞋3次投资的驱动因素?

股份支付的好坏?

如何识别投资标的是否有优秀管理层?

如何留住自己公司优秀管理层?

集中 VS 分散 持仓?

可口可乐 VS 百事可乐?

Detxter鞋业 VS 耐克?

衍生品风险大,那为何投资所罗门?灾害产生超额赔付也有风险,为何从事保险?

什么是super-cat?

查理·芒格

出售旗下存款业务

储贷与银行业务

“储贷行业仍将继续存在。有些储贷机构始终保持着良好的经营记录。

我们退出了储贷行业,并不代表所有储货机构都没前途了。我们的组织方式以及我们的思维方式不是特别适合从事储货行业,有的人却非常适合从事储贷行业。

……

“在我们完全退出储货行业之前,我们可能还会损失两三百万美元,都是因为我们在发放货款时出现了疏忽。我们做了很多傻事,我们活该亏钱,自己种的苦果自己尝。经营一家金融机构,总是要打起十二分精神,稍徽一放松警惕,损失就找上门来了。

有一次,我和一家大型储货机构的管理者聊天。我问他:“你用过贷款中介吗?惹没惹上麻烦?”听完我的问题,这位管理者如同一位 85 岁的老太太勝叨自己身体的小毛病一样,说起来一发不可收拾。他说:“我很清楚,货款中介不能用。可是那些年轻的经理,他们非要用。于是,我们公司用上了货款中介。结果好,他们说说、夸大其词,为了赚佣金,什么花招都使出来了。”

作为一个对比,最近比较推崇的是摩根大通(JPM)的Jamie Dimon。

对风险认知深刻。

保持谨慎乐观,甚至谨慎悲观(cautiously pessimistic)。

从而才能做出合理资本配置,做出对公司和股东有益的决策。

概率

“有的保险公司,因为概率很低的大灾难而陷入严重亏损,这证明它们承销保险业务的策略存在问题。举个例子。按理说,上一次地震过去的时间越长,下一次地震发生的风险越大。然而,有的保险公司在承销地震险的时候,距离上一次地震的时间越久,保费定得越低。”

裁员与负债

“裁员的遣散费是一大笔开支。如果你们从事证券分析工作,一定要小心这笔开支。

很奇怪,在欧洲,公司裁员付出的代价更高。欧洲各国对裁员有非常严格的规定。例如,你在法国开了一家只有40 个员工的小工厂,如果你决定关闭工厂,你就必须养着这 40 个员工,一直养到他们退休。”

沃伦·巴菲特

投票器VS称重器

长期称重器,短期投票器。 As Ben Graham said: "In the short-run, the market is a voting machine - reflecting a voter-registration test that requires only money, not intelligence or emotional stability - but in the long-run, the market is a weighing machine."

那年,伯克希尔股价涨了39%。

可口可乐和吉列,都曾存在市场涨幅低于利润涨幅。From 1991 to 1993, Coke and Gillette increased their annual operating earnings per share by 38% and 37% respectively, but their market prices moved up only 11% and 6%.

Detxter鞋业

当年,以股份支付(伯克希尔发行了25,203股,we issued 25,203 shares when we acquired Dexter Shoe)购买Dexter鞋业,生产传统鞋类(popular-priced men's and women's shoes)+高尔夫球鞋,还有77家的零售门市。

收购,一来是巴芒对公司评价很高(It is one of the best-managed companies Charlie and I have seen in our business lifetimes),甚至还是获奖企业(Last year both Nordstrom and J.C. Penney bestowed special awards upon Dexter for its performance as a supplier during 1992)。

二来是之前的鞋类收购的超预期表现( Again,results have surpassed our expectations )。在此之前的1991年,巴菲特并购了H. H. Brown(工作鞋、靴子和运动鞋work shoes, boots and other footwear),1992年又并购了Lowell Shoe罗威尔制鞋(女鞋与护士)。从收益上看,在1993年,三个鞋企的合并收益,比喜诗糖果还高,促成了1993年的收购。

因而,还给予很高的预期,利润明年翻倍(we expect Berkshire's shoe operations to have more than $550 million in sales, and we would not be surprised if the combined pre-tax earnings of these businesses topped $85 million)。

优秀的管理层,产品被市场的认可度,是选择收购的两个原因,股东会上提及。

至于其他领导品牌,耐克锐步,巴芒觉得不确定他们的长期竞争地位,特别是10-20年之后,他们比现在收购的品牌更复杂、更难以看透/预测,巴芒选择收购标的,因为那是简单的选择。带出两个错误的想法:

1.以为雇用一些有头衔的人,就能完成一些非常困难的工作(so many people think if they just hire somebody withthe appropriate labels, they can do something very difficult)——相反应该保持简单,不要为了exceptional成绩去做exceptional的事;

2.跳过7英尺高棚栏获得的彩带,比跨过1英尺高的栅栏的,更值钱——实际上,投资需要的是做平常事,做能理解的事。

最后证明,事实证明,Detxter鞋业是错误的。

也即,事实上,如果你能力跳过7英尺,认识到耐克或锐步的伟大,可以获得更多。

能为什么可口可乐能走向世界,茅台却很难,一个可能的原因是美国文化的输出,日本文化的的输入,也让美国和欧洲开始普及日料。

换股对获取股权方的好处

税务上便于不同的财务选择(varying financial paths,They incurred no tax on this exchange and now own a security that canbe easily used for charitable or personal gifts, or that can be converted to cash in amounts)

小企业多元化(private companies also often find it difficult to diversify outside their industries)

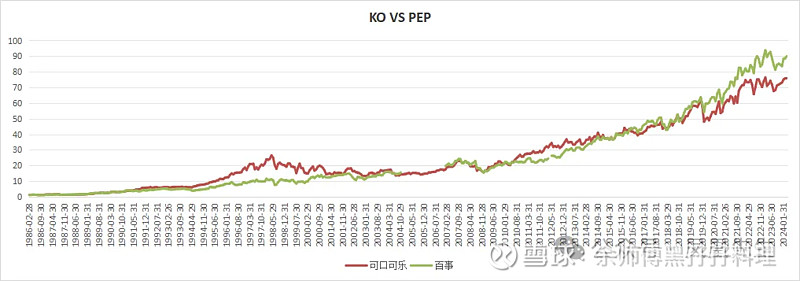

在普通股投资中(Common Stock Investments),花了很大篇幅讲了可口可乐。

可口可乐的独特在于,具有规模,产品单一,又持续增长,1938 Fortune story: "It would be hard to name any company comparable in size to Coca-Cola and selling, as Coca-Cola does, an unchanged product that can point to a ten-year record anything like Coca-Cola's."。

从1938到1993年,销售量从2.07亿,增长到了107亿,翻了50倍,it's worth noting that in 1938 The Coca-Cola Co. sold 207 million cases of soft drinks (if its gallonage then is converted into the 192-ounce cases used for measurement today) and in 1993 it sold about 10.7 billion cases, a 50-fold increase in physical volume from a company that in 1938 was already dominant in its very major industry,而且增长还在继续。

但在此之前的1920年,可口可乐就曾股价腰斩。By the end of 1920 the market, coldly reevaluating Coke's future prospects, had battered the stock down by more than 50%, to $19.50.

基于这个增长,1919年投资40美元在可口可乐股票的投资人(含将所收到的股利再投资)到1938年可获得3,277美元,若是在1938年以40美元投资可口可乐股票,至1993年底亦可以成长到25,000美元。

用choice前复权数据,1986年初是0.8145,1998年高点是20+,对应是76倍,百事对应是89倍。

为什么可口可乐能走向世界,茅台却很难,一个可能的原因是美国文化的输出,日本文化的的输入,也让美国和欧洲开始普及日料。

分散VS集中

如果找打了可口可乐这样的企业,集中似乎理所当然。

巴菲特和查理认为,要做出大量小的正确的决策太难(too hard to make hundreds of smart decisions),还不如做出少数,例如一年一次,的正确决策(a strategy that required our being smart - and not too smart at that - only a very few times. Indeed, we'll now settle for one good idea a year)。

分散投资(standard diversification dogma)并不能降低风险,能降低风险的是对投资标的的认知( thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it)。越熟悉,风险越小,把钱投资在自己排第20位的企业,不如集中到自己熟悉的、风险小的、利润潜力大的企业(It is apt simply to hurt your results and increase your risk. I cannot understand why an investor of that sort elects to put money into a business that is his 20th favorite rather than simply adding that money to his top choices - the businesses he understands best and that present the least risk, along with the greatest profit potential)。

常用估值模型中,不合理的地方在于风险的定义,专家喜欢以波动性来衡量风险(Academics, however, like to define investment "risk" differently, averring that it is the relative volatility of a stock or portfolio of stocks - that is, their volatility as compared to that of a large universe of stocks)。

因而衡量波动性的Beta值,不与企业的运营和竞争相关,而仅仅与股价相关(a beta purist will disdain examining what a company produces, what its competitors are doing, or how much borrowed money the business employs.……What he treasures is the price history of its stock),而投资人恰恰应该忽略短期的估计波动(即使未来一两年不能交易也不受影响,也不需要每日报价来确认企业健康,don't need a daily quote on our 100% position in See's or H. H. Brown to validate our well-being. )。

另外,可口可乐和吉列,拥有很强的竞争力,但Beta值却和平庸公司相近(The competitive strengths of a Coke or Gillette are obvious to even the casual observer of business. Yet the beta of their stocks is similar to that of a great many run-of-the-mill companies who possess little or no competitive advantage)。

然后,列举了评估中的要点:

企业的长期竞争力 The certainty with which the long-term economic characteristics of the business can be evaluated;

管理层可靠 The certainty with which management can be evaluated, both as to its ability to realize the full potential of the business and to wisely employ its cash flows;

股东回报 The certainty with which management can be counted on to channel the rewards from the business to the shareholders rather than to itself;

购买价格 The purchase price of the business;

通胀率及税负 The levels of taxation and inflation that will be experienced and that will determine the degree by which an investor's purchasing-power return is reduced from his gross return.

这些信息无法从现存数据库中获取,所以很难获取精确的数字,但不精确不代表不重要,在这个估算中,宁要模糊的正确,不要精确的错误(It is better to be approximately right than precisely wrong)。

分散,在两种情况下是有利的:

单一交易的风险高(significant risk exists in a single transaction),但多个独立个案集合以后经过机率加权的净收益能让满意(believe that your gain, weighted for probabilities, considerably exceeds your loss, comparably weighted, and if you can commit to a number of similar, but unrelated opportunities),例如套利——类似的,还有保险业务(在股东会上被问及风险时再次阐释),可能在一个特定年份亏损,但不太可能在10年这个时间长度上亏损(We know we're going to lose money in some given day, that isfor certain, and and and we're extremely likely to lose money in a given year…… and we think the probability of losing money over a decade is low, so we feel that in terms of our horizon);

投资人并没有特别熟悉的产业或公司,但对整体产业前景/国家发展有信心(does not understand the economics of specific businesses nevertheless believes it in his interest to be a long-term owner of American industry),例如,定投指数基金(periodically investing in an index fund)

多次成功VS一次成功

这源于税负对投资收益影响的讨论,每次利得需要支付35%的税。

同样每年翻倍的税前收益率,对比频繁地交易与持续成长后再交易,10年后的差距是3倍多。

这是长期投资的优势(the penalty our corporate form imposes is mitigated - though far from eliminated - by our strategy of investing for the long term)。

这也是单一投资,对比系列投资,的优势(tax-paying investors will realize a far, far greater sum from a single investment that compounds internally at a given rate than from a succession of investments compounding at the same rate)。

关于管理层

如何识别优秀管理层:

与竞争对手对比,包括竞争对手的评价;

资本分配,如果对待股东,如果对待高管自己;

如何对待困境;

专注于公司业务,而不是会计规则(这是后面讨论,银行收购与回购股票时提到的);

以上这些,都要依靠数据/年报,不能道听途说(用后面谈论伯克希尔每股内在价值的说法,民意调查/别人说法不能使你赚钱,是你的研究判断能力让你赚钱);

优秀的管理层,也是巴芒保留所罗门头寸的原因,虽然这个生意杠杆率很高,甚至高达30倍,而利润率很低,股东会上,巴芒带领与会者给参会的所罗门管理者鼓掌(问及如何看待投行业务);

优秀的管理层,也是巴芒购买制鞋公司原因(问及如何看待制鞋业务)。

如何留住自己公司优秀管理层:

在这个层级,他们大都没有家庭经济压力;

合理的薪酬(当然作为生意,如果竞争者给了太高的薪酬,也没不会去匹配);

放权,包括在资金分配中给与合适的空间,不会干预每个决策(年终结果导向);

对董事会层面,有责任给予管理层合适的评价;

角色互换(我们希望怎样的对待,就怎样对待他们);

把工作变得有趣(巴菲特);

和喜欢的人一起工作,建立超越工作以外的关系(芒格)

super-cat

股东信和股东会都提到了霹雳猫业务(super-catastrophe insurance)

A simple example will illustrate the fallacy:Suppose there is an event that occurs 25 times in every century.If you annually give 5-for-1 odds against its occurrence that year,you will have many more winning years than losers. Indeed, you may go a straight six, seven or more years without loss. You also will eventually go broke.

At Berkshire, we naturally believe we are obtaining adequate premiums and giving more like 3 1/2-for-1 odds.

拔:

如果说1992,南巡讲话拆除了共和国成长的天花板,那么1993,则是开花的第一年,上证指数近前后十年的高位,固定资产投资增幅历史最高,恒生指数当年翻倍,第一次房地产泡沫,beyond高峰又跌落,《小芳》《唐伯虎点秋香》《霸王别姬》闪耀。

巴芒的选择和陈述,也给了我们很多的碰撞,yes集中持仓VSno分散,yes可口可乐VSno百事可乐,yesDetxter鞋业VSno耐克。

最后以股东大会巴菲特一个回答结束,什么是黄金人生,当然是活得最久的人生。